Our Hottest Ideas — Please Share Them ...

Dear Readers: 'Six Moves' that'll make you the envy of all other investors ...

We’re only a tiny way into our journey here …

But I already see that we’re building something special at Stock Picker’s Corner (SPC) …

Really special.

You guys see it, too … which is why the SPC Family has grown so fast in such a short time. In fact, dozens of you folks (and by “dozens,” I mean dozens upon dozens) have shared stock picks, research reports, updates and Wealth Builder strategies with family members, friends and other folks in your personal networks.

I’m not only grateful. I’m inspired.

Inspired to reach out to each of you … because there are two important things I’d like to accomplish here today …

First, with the end of the year approaching, I want to inspire you — to have you consider your goals for 2025. So I’m sharing Six Moves — an easy-to-follow game plan for folks looking to jump-start their Wealth Building … or even get started anew.

Second, I was inspired to ask for your help. Look, we want to keep building the SPC Family. But we’ve chosen to avoid high-dollar marketing chicanery. And we’re avoiding the “bait-and-switch” clickbait tricks lots of newsletters use to build their lists. This is a community — not an “audience.” We stand on our real research — on the Wealth Building strategy we believe in and use ourselves — to build our community. And it looks like it’s working. Sixty-one people have already shared our work with family members, friends, colleagues and others in their personal “networks” — with absolutely zero incentive to do so

Today I’m asking you to help us keep that going: If there’s someone you know and care about, please share this story and ask them to join us.

With that said, let me share those six moves …

Move No. 1: Embrace the “Wealth Builder” Mindset

You’ll hear it here over and over again: Be a Wealth Builder … not a Wealth Killer.

Wealth Builders play the “long game” — riding narratives (and stocks) for three, five or seven years … or longer.

They tune out “The Noise.” They refuse to give in to emotion. They don’t obsess over headlines. The tune out the daily “wiggles” of the market indices.

And they understand the Wealth Killer miscues to avoid.

Move No. 2: Find the Best Storylines to Find the Best Stocks

I spent 20 years as a business journalist … and I was a pretty good one. I interviewed such heavy hitters as former U.S. President Richard Nixon, Amazon.com Inc. AMZN 0.00%↑ founder Jeff Bezos, General Electric Co. GE 0.00%↑ CEO John F. “Neutron Jack” Welch, magazine publisher and presidential candidate Steve Forbes (who gave me a great “Capitalist Tool” tie that I still have), and helicopter pioneer and leveraged-buyout specialist Stanley Hiller Jr.

And I told “stories.” Lots of stories. Important stories. Stories that help folks make important decisions – about elections, government initiatives, where and how to live, how to stay safe … and, for purposes of what we do here, how to invest.

So I think in terms of “storylines” … or what the Wall Street types refer to as “narratives.” Storylines are how I see the world. They help me frame the moneymaking opportunities I see and rank them so that we’re pursuing those with the longer time frames and (what I like to refer to as) the “biggest back-end bang.”

Many of the storylines we’re following right now are narratives that I’ve been following for years.

That’s right … years.

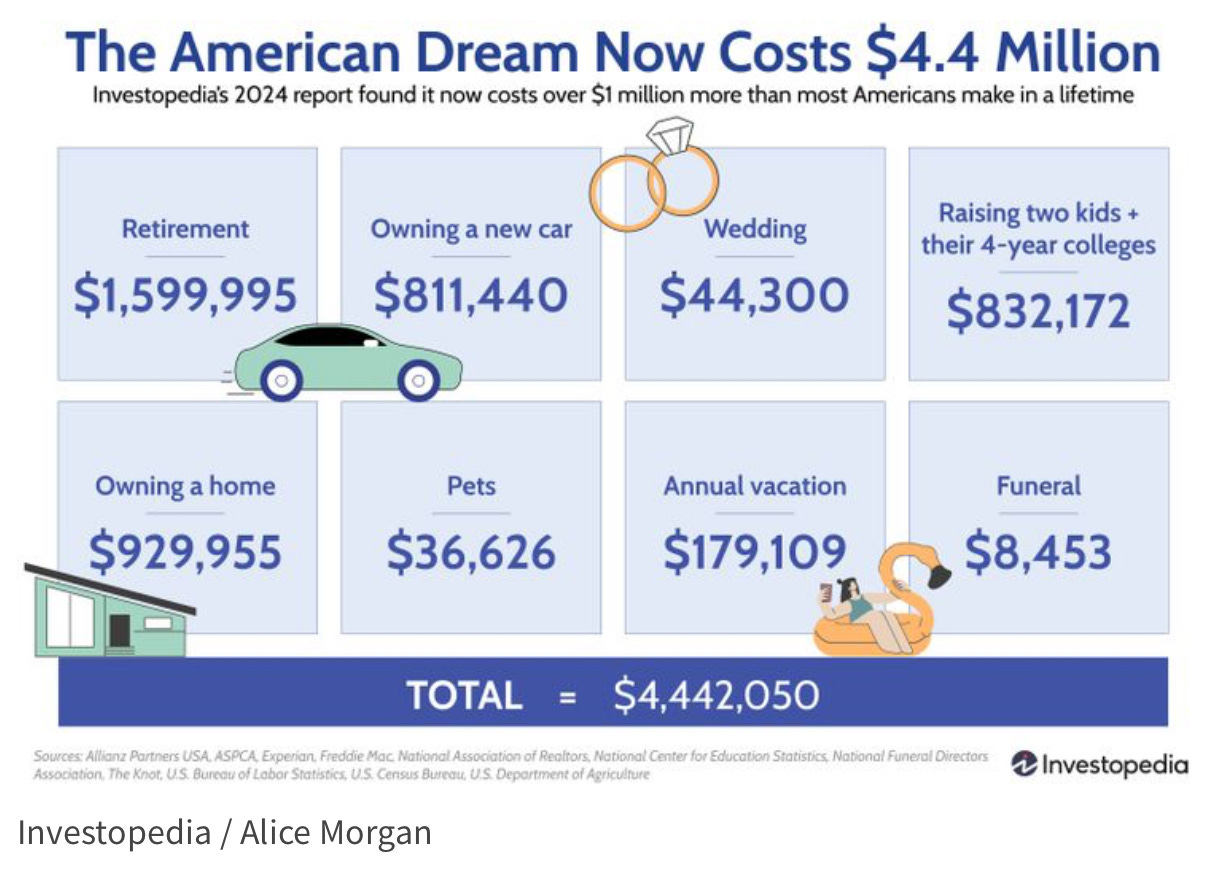

We just updated our storylines in a two-part report that ran this month. These are storylines that included (in Report No. 1) the Artificial Intelligence Era, the New Cold War, the New Biotech Blockbuster Window and the looming Commodities Supply Squeeze … and (in Report No. 2) the Private-Equity Tidal Wave, the Death of the American Dream and Inflation-Beating Income Plays.

If you learn those storylines, you’ll have “the drop” on 95% of the other investors out there. They’re flailing … grasping at hope. But powerful storylines run for years … and jump you to the front of the line when it comes to IDing companies that are the biggest beneficiaries … and potentially the best companies for Wealth Builders.

Move No. 3: Understand Today’s Realities

I’m a Contrarian Investor at heart (hence my co-authorship of the 1998 best-seller, Contrarian Investing: How to Buy and Sell When Others Won’t, And Make Money Doing It).

That means I often think “differently” than most folks … mostly at the points of change investors refer to as “inflection points.”

Because of my Contrarian mindset, I like to think I’m more objective than most investors. I’m able to take that “step back” … to stay free of short-term, knee-jerk, emotion-driven decisions.

And to steer clear of speculative frenzies, euphoric manias or the kind of “group think” that can lead investors astray. And one of the most-ruinous of all “group-think” traps is the “things are different this time” rationalization.

We saw this play out with the Dot-Com implosion, or with the credit-default-swap mess that kicked off the Great Financial Crisis. We’re talking about situations where investors rationalize that the “rules” that usually apply (like valuations, the need for sales and profits or other tangible metrics) don’t apply any longer.

(In fact, as my brand-new interview with financial historian Mark J. Higgins demonstrated, history shows us that these rules never really change.)

But changing rules shouldn’t be confused with changing backdrops.

Take inflation.

I lived through the inflation-ridden 1970s, and I watched how the relentless march of prices affected my family … and ground up families around us.

I saw inflation die after Fed Chair Paul A. Volcker raised rates into the 20% range. I saw it hibernate. And now — as an adult and a husband and a father myself – I’ve watched it return.

Americans are dodging their way through the “Whac-A-Mole Economy:” Though the inflation rate is supposedly easing, the political types are adroitly sidestepping the real issue — cumulative prices, which are 20%, 30%, 40% higher (or more) than they were four years ago.

And (as mentioned before) all of that has changed the reality of the so-called “American Dream.”

The “Single-Digit Millionaire” is dead. And so is the U.S. middle class.

Time was that a million bucks in savings meant something …

But $5 million is the “new” $1 million.

Move No. 4: Just Get Started

At Private Briefing, my newsletter before this one, I had a huge following. And (I’m grateful to say) a number of those folks have joined us here.

I mentioned that because one of the most-popular topics I wrote about at Private Briefing has also proved to be one of the most-popular ones I wrote about here at SPC.

It’s a column about financial education … about getting my son Joey started in stocks.

When I wrote about how I got Joey started in stocks – companies like Microsoft Corp.MSFT 0.00%↑, Netflix Inc. NFLX 0.00%↑, Berkshire-Hathaway (BRK.B), Apple Inc. AAPL 0.00%↑ and more — my readers went nuts. And, surprisingly enough, so did my colleagues.

I say “surprisingly,” because we were all working for a financial publisher … a company that specialized in stock-market research. But it took my column to shift those folks into that “here’s an easy way to get started” mode.

Fast-forward nearly six years — and Joey has hefty triple-digit gains on most of the stocks we bought for him.

And that story had the same effect here. Granted, I wrote about getting my son started in stocks. But this same approach will work with anyone …

And by “same approach” I mean: Just … Get … Started.

Move No. 5: Find “Income-Spigot” Stocks

We talk about Wealth Builders versus Wealth Killers – and recognizing the difference between the two.

One of the biggest Wealth Killers?

Scams.

I see them all the time. I’ve developed a personal radar that helps me spot them easily — and deconstruct them quickly.

And my years of experience have taught me that those scams gain effectiveness by keying on investor emotion — whether that emotion is greed or fear. And they also gain effectiveness by keying on “current events” — like inflation, the need for income and how uncertain consumers feel these days.

Want an example? Look at all the ads running these days for “passive income.” By definition, “passive” means “you don’t really have to do anything to get it.” But some of these ads are for “programs” or “side hustles” or “activities” … things you have to pay for … side jobs you have to take … moves you need to make.

Most of these are really designed to separate you from your money. They involve risk — and are payoff “long shots.” Even the best ones call for you to invest extra time.

In my book, that’s not “passive.”

And many of these also aren’t “income.”

If you know me, you’ll know that I take issue with how investors look at “income” these days. They look at a 4.5% certificate of deposit, look at their investing plan and say: “Income component — covered.”

(Game-buzzer sound) WRONG!

What folks really need to to is look at income as “cash flow” — what actually goes into your pocket after taxes, the prevailing market interest rate and the rate of inflation. I mean, are you actually ending up with anything in “real” terms?

That’s why I assembled a “Baker’s Half-Dozen” (which means seven, not six) list of income stocks – each with yields of better than 10%. That, my friends, is real “cash flow.”

And it really is “passive” – once you make the investment, you keep getting paid until you cash out.

Move No. 6: A “Shopping List” of Stocks

Stocks have been hot — white hot.

But stocks don’t go up forever. Eventually, we’ll have a correction … or a bear market … or a full-blown crash.

Yeah, I know it’s daunting to think about. But that’s the “Circle of (Stock-Market) Life.” And I don’t worry about it: Because a correction today is the foundation of the Next Bull Market tomorrow.

And a correction is also an opportunity – a chance to buy good stocks “on sale.”

That’s why I created this “shopping list” of stocks you’ll want to keep your eyes on — when that correction finally comes.

I call them “Pullback Plays.”

They’re good companies … and a market pullback would knock them down a bit in price — in effect, putting them “on sale.”

I offer that list here … as a bonus.

There you have it … six moves you can make … six strategies you can employ … to rev up what you’re doing … to get you started anew … or to share with someone you care about to help them achieve those same goals.

I hope it helped.

And if you can help us … share this with one … three … five folks …

I truly appreciate it.

See you next time;