One afternoon early last week, this text string popped up on my iPhone.

I knew the sender. It was a friend.

The very best kind of friend.

A close friend.

One whose friendship goes back decades.

For purposes of today’s Stock Picker’s Corner (SPC) tale, we’ll call him Jake.

Jake’s an intelligent guy. An accomplished guy. And an entrepreneur with his own small firm. He’s what I would refer to as a “data miner.” And the stuff he’s worked on, and the companies he’s worked with, will leave you in awe. He’s amassed a decent nest egg. He’s also a few years younger than I am — meaning he’s got miles to go before he sleeps (i.e. retires).

So when his pair of texts popped up, I didn’t text back.

I called.

And the conversation went something like this:

Bill (Yours Truly … aka “Me”): Okay Jake, what are we doing here?

Jake (A): Well, the market looks overvalued to me. So I’m thinking about taking some money off the table. Not EVERYTHING, mind you. Just maybe $500,000 or so.

Me (Q): [Hesitating] Uh … ohhhh-kaaaay. So … like … lay it out for me. What are you trying to do here?

Jake (A): Well, I’m nervous. I think the S&P has topped out. So I’m going to take some money off the table.

Me (Q): OK … so … once you do that, what are you going to do with the cash?

Jake (A): I think I’ll park it in bonds … government bonds.

Me (Q): Until when?

Jake: (A): Until I feel better.

Me (Q): Which will be when … ?

Jake: (A): When the market is better.

Me (Q): Which will be when?

Jake: (A): When stocks start going back up.

I could keep going here. But you get the idea. I’ve shared the gist of where this talk was going.

And that “gist” is why I’m sharing this anecdote with you.

You see, there’s a “teaching moment” here.

And it relates to the core belief that SPC is built upon — that, as an investor, you’re either a Wealth Builder, or a Wealth Killer.

You’re one … or you’re the other.

There’s no middle ground.

And this text-string-turned-phone-call is a great case study that reminds us which is which.

Information, Affirmation - Stop That Call

Before we dig in, I need to be clear about a couple of things here.

First, I’m not denigrating my friend here — far from it, in fact.

My two Best Friends in the World are Harry the Machinist and Keith the Architect — friends you’ve already heard me talk about here. But Jake, here, is part of that small group of folks who I trust and have known for decades.

So know that there’s no “snark,” or sarcasm, or dismissiveness at play here.

Second, don’t perceive this as my having offered “investment advice” to my buddy.

In fact — and folks who know me understand this as part of “Bill’s Rules” — when someone you know calls you with a question like this, 90% of the time they’re not looking for information.

They’re looking for affirmation.

Or, as my wife likes to joke, it’s kinda like going to a restaurant with your family. Everyone’s sitting there chatting, perusing the menu, and Aunt Edie says: “I’m thinking of having the Lobster Thermidor.”

Aunt Edie isn’t seeking your opinion. She’s just affirming her inner decision to her outer self (and to all the other folks around the table … lol).

I understood that Jake was essentially doing the same thing. He’d already made his decision — (“Yeah, to heck with it: I’m taking that ‘half-a-mill’ off the table”) — and he was just affirming it … to himself. I was just his “sounding board” … I was the stand-in for “all the other folks around the table.”

So I knew that, in his own mind, he’d already “made the call” to take that 500 grand out of stocks. I knew I couldn’t stop it — and didn’t try.

In fact, when I made that very point to him, he laughed out loud.

Heck, he was downright agreeable (and even laughed again), as he replied: “You know, Bill — you’re absolutely right.”

There was more to our talk. And we’ll get into that — by breaking this conversation into its constituent “slices.”

So let’s talk … look … and learn.

Slice No. 1: Worrying About “The Stock Market”

VERDICT: Wealth Killer.

I’ve been writing about business, economics, stocks and the markets for 40 years and counting — 22 years as a business reporter and 19 and counting as a stock picker and financial writer. Whenever folks discover what I do for a living, the first question invariably is: “Hey Bill, what’s the stock market gonna do?”

My answer: “I don’t care.”

Okay, I’m being flippant. Exaggerating a bit for effect.

But in the proverbial big scheme of things, I don’t obsess over every little market wiggle, the overload of economic numbers, analyst upgrades and downgrades, influencers and podcasters, and all the other financial folderol that distracts investors from the real objective: Building Wealth.

Today’s stock market action is a data point; a date on a calendar. I don’t actually ignore what’s happening today or tomorrow or next week, next month or next quarter.

But I’m more interested in the opportunities to come.

To drive my point home — in the most simplistic way possible — I tell folks that I’m a “Next Bull Market Investor.” I don’t obsess about “today.” I make time my ally.

Like other Wealth Builders, I play the “long game.”

What counts as the “long game” varies with strategies and stocks. It can be three, five, seven years … or longer. Or it can be forever.

I still own some of the very first stock I ever bought — in the aftermath of the Crash of ‘87 (a story for another time). And one of my best investments ever was an innovative leader whose shares I snagged 25 years ago — and didn’t ever sell.

Morgan Housel, best-selling author of Same As Ever, has said that 10 years is a good holding period to target. And I agree that’s a timeline you can work up — or down — from.

You see, longer holding periods smooth out the stock-market’s gyrations. It lets us capitalize on the mistakers of others.

Worrying about where the S&P 500 or Dow Jones Industrial Average is right now, to me, is the wrong thing to focus on. It leads to errors of commission, and errors of omission — as we’ll see.

An error of commission is a decision you make, and an act you take — that's actually a mistake.

An error of omission is a “woulda/coulda/shoulda” catalyst for regret: It’s a decision you should have made, and an action you should have taken — but didn’t. And that “road not taken” proves to be a mistake.

Slice No. 2: Acting Emotionally

VERDICT: Wealth Killer

Folks who’ve followed me for years are very familiar with Bill’s Investing Rule No. 1: “Know Thyself.”

So I like that Jake is in touch with what he’s feeling. That’s okay. But responding in a knee-jerk manner to those emotions is a definite Wealth Killer move.

That’s not an opinion. It’s a data-backed fact.

Want proof? Check out this chart. That “voluntary investor behavior” is a $5 institutional-jargon phrase that means “a mistake.” And, over a 20-year stretch, it can translate into a 1.5%-a-year deficit to just the S&P 500, says market-researcher Dalbar.

And that’s just one “data point.” (Oh no, I used institutional jargon.)

Look, there’s no single “right way” to invest. By “Knowing Thyself,” you can create a strategy that meshes with your emotional makeup, financial goals and feelings about risk. Do that and you’re more likely to stick with your plan — to not veer away by reacting emotionally. That gets you into the long run — and gives your strategy time to work.

What Jake should have done — what Wealth Builders do — is to take their emotions into account when structuring their goals, strategy and investments in the first place. You do that and you squeeze the likelihood that you’ll cave in emotionally, and make this kind of “investing U-turn.”

In short, you’ll take knee-jerk, emotion-driven moves completely out of the equation.

Slice No. 3: Attempting to “Time” the Market

VERDICT: Wealth Killer

I didn’t invent this phrase, but I invoke it a lot: It’s not timing the market, it’s time in the market.

I’m not a “buy-and-hold-forever” guy. I believe that you find the best longer-term storylines and then dig down to find the best stocks — shares of the companies that are the biggest beneficiaries. I’m talking about big storylines like:

Inflation and Income, which also includes this special interview about silver.

The “New Cold War” (Special Report No. 1 and Special Report No. 2).

The “Next Blockbuster Era” in biotech.

And, of course, the AI Revolution.

And I’m working on others, too.

Our game plan as Wealth Builders is to identify the very best “Stock Picker’s Market” opportunities, and “accumulate” our way into desired positions. Unlike Jake, we don’t fear market selloffs — we welcome them.

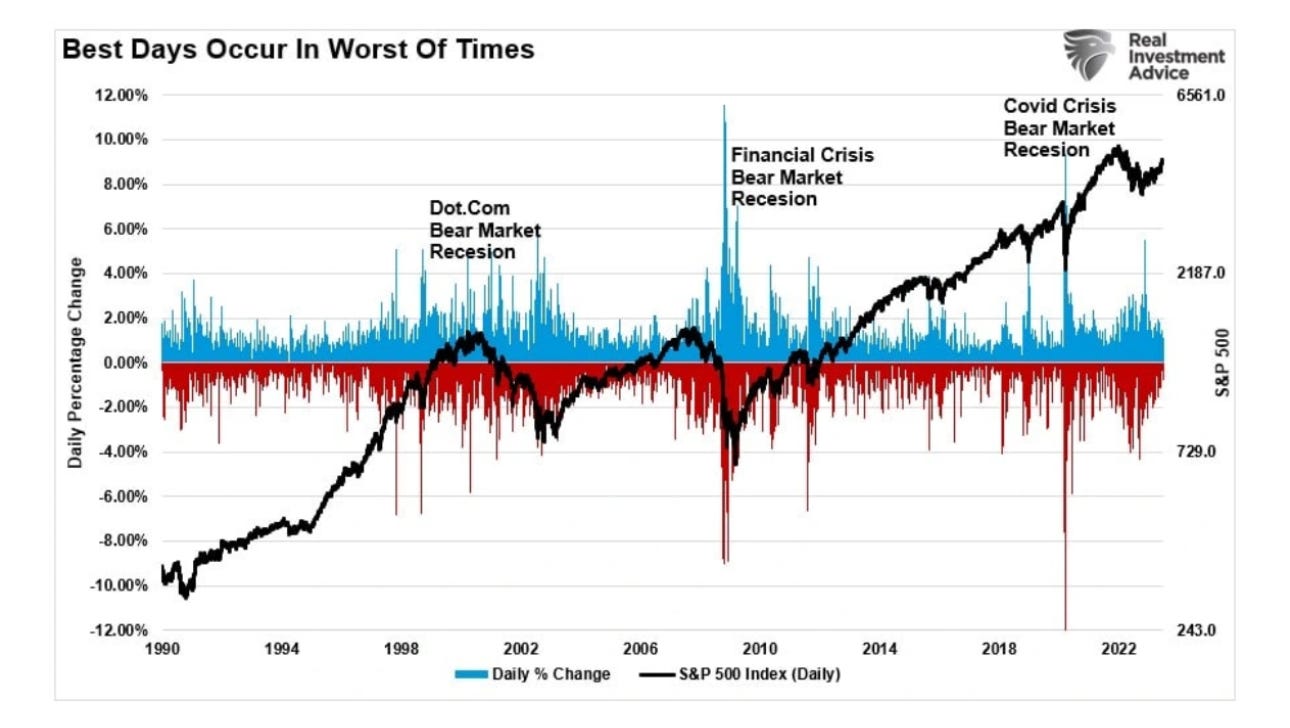

The reality is that — over the long haul — stocks go up. And if you miss the market’s “best days” — which often come during what feels like the “worst times” — you get left behind.

And nobody wants that.

Those “best days” are worth a look … so let’s do that — in a chart, and a table.

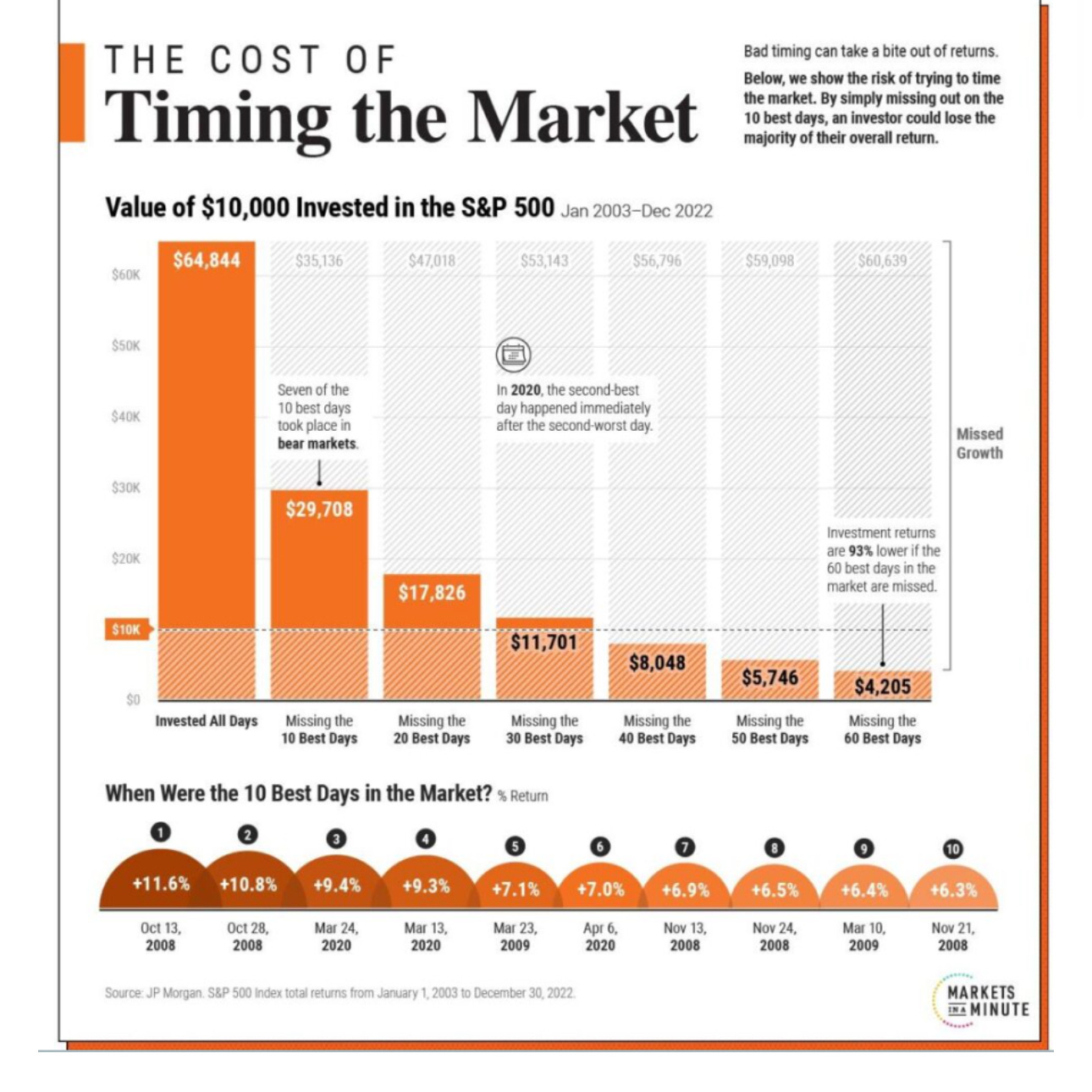

In this table from The Visual Capitalist, check out what happens if you start with $10,000 — and invested it in the plain-vanilla S&P 500 over a two-decade stretch. Forget about lagging the market: If you miss enough of those “best days,” you actually lose money.

Slice No. 4: Not Following Through

VERDICT: Wealth Killer.

I grant you: This is an extension of “No. 3” (market timing) and, in essence, the flip side of “No. 2” (acting on emotion).

As I asked Jake: “Okay, so how will you know when to get back in?”

As we saw, missing those “best days” is a definite Wealth Killer. And the odds are strong that he’ll miss those days because he’ll act emotionally — which is a natural (albeit destructive) thing to do.

Every investor knows the investing maxim of “Buy Low, Sell High.”

But very few people actually do that.

They know this maxim logically … intellectually. But they act emotionally. So if the S&P 500 does get hammered as Jake expects — into a 10% correction or a 20% crash — will he actually buy back in?

It would make sense: That’s the point in time where the opportunity to “Buy Low” is there for the taking: Prices (valuations) will be lower, making the companies cheaper to snag.

But here’s where that “flip side” I mentioned potentially comes into play: Will the same emotional override that made Jake sell out keep him from buying back in? In other words, will that “inner voice” warn him to steer clear, whispering something like: “Jake … DUDE … this is UGLY, man! Let’s wait until things are ‘better’.”

Another question: How will he know when “things are better?” How will he decide where the “bottom” actually is?

That’s why Wealth Builders flip the script. They look forward to selloffs. They keep shopping lists (the hot-button SEO term these days is “Watch Lists”) of stocks they want to buy for the first time, or holdings they want to add to. And they do so on pullbacks, or when they get more cash.

That’s the essence of an “Accumulate” strategy.

And it helps prevent scenarios like the one I’ve described here.

A Quick Review

Be a Wealth Builder. Not a Wealth Killer. Embrace an approach that works for you — and that structures you for success. A good starting point:

Identify good storylines.

Identify the biggest beneficiaries.

Establish foundational positions.

Accumulate as you go.

And play the long game.

Check out our free reports. Subscribe to our work here. And check out SPC Premium, which includes a Model Portfolio and a Farm Team of other promising companies.

And be sure to stop back next time;