Our Favorite Storylines (Part II)

If you're serious about Wealth, these storylines will accelerate your journey ...

Find the best storylines … and you’ll find the best stocks. That’s our mantra … and our “methodology” … here at Stock Picker’s Corner (SPC).

It’s an approach that:

Focuses on big-picture narratives, which plays to our longer-term approach, since these are the storylines most likely to “have legs.”

Helps us tune out the near-term “noise” — the bullish-today/bearish-tomorrow whipsawing that causes investors to make mistakes by falling prey to emotion.

Separates “prospects” from “suspects” — so we can zero in on opportunities for building wealth.

And steers us clear of risky short-term windows — and risky instruments like options.

We keep a core list of storylines we’re following — and we add to them over time. And as we zoom in on the end of our first year here on Substack — to embrace the new readers who join us daily and to look at a few of the new narratives we’ve added, we're doing a quick review of all those we’re following.

In Part I of this report, we talked about the Artificial Intelligence (AI) Era, the New Cold War, Biotech Blockbusters, the supply shortfall of Commodities and Special-Situation Investing.

But we aren’t done — not by a long shot.

So here in Part II, we’ll bring you the rest of these storylines … and some wealth plays they bring.

Real Income

One of the storylines Chief Stock Picker Bill Patalon shared since the start of SPC is “Real Income,” saying it’s “imperative” to start an income-generation strategy now — as a source of cash for new investments today and as a stream of cash for when you retire tomorrow.

They’re actually connected.

Want proof?

Since March 2022, 1.5 million Americans have “unretired.” And this dark Forbes headline from September poses the obvious question:

If retirees are going back to work to feel useful, learn a new skill or two, make some new friends or earn a little pocket money to spoil the grandkids, that’s probably a good thing. But if we’re talking about a “back-to-the-wall” scenario — they can’t afford food or medicine, are falling behind on the mortgage or are getting creditor calls because they didn’t save enough to retire — that’s a disaster in the making.

Still not convinced about this “income imperative?” In this list of the seven common reasons people “unretire,” check out how many times Forbes invokes the word “income:”

Reason No. 1: “You need more current income👀 to pay for your living expenses.”

Reason No. 2: “Medical insurance is too expensive because you retired before age 65, the eligibility age for Medicare.”

Reason No. 3: “You realize that you need to increase your retirement income👀, so you take steps to boost your eventual retirement resources (more on this topic later).”

Reason No. 4: “You’re bored with retirement as a full-time vacation and want to find more purpose, meaning, and mental stimulation.”

Reason No. 5: “You miss the social interaction that comes with work.”

Reason No. 6: “If you’re married, you aren’t ready for the constant companionship of full retirement, as indicated by a common lament—Now I have twice the husband and half the income👀.”

Reason No. 7: “A life disruption could result in a need for more income👀, such as a spouse, parent, or dependent needing expensive medical or long-term care. Another example is an unexpected setback in your financial security, such as a substantial increase in your living expenses or a reduction in your retirement income👀, possibly due to a stock market crash.”

And “income” should be listed in Reason No. 2, as well: It’s the “unspoken” solution to the problem of (a.) not being able to afford medical insurance, and/or (b.) not being able to afford the doctor visits or medicines, either as a co-pay or in lieu of insurance.

So acknowledging the need for an income plan is the first step.

The next step is to make sure you understand factors like market rates, inflation rates and taxes to know the “real income” you’re generating.

Bill has seven income-generation opportunities that range in risk levels for you to consider as a part of your own investing research.

Income Play No. 1: Angel Oak Financial Strategies Income Term Trust FINS 0.00%↑, a Big Board-listed closed-end fund that invests primarily in financial-sector debt — including structured debt and mortgage-backed securities. It aims to keep at least 50% of its holdings invested in investment-grade debt. And it also buys financial-sector stocks — both common and preferred. FINS currently trades at about $13.10 — putting it up near the top of its 52-week range of $11.66 to $13.24. Its current payout of $1.31 a share — doled out as monthly 11-cent dividends — equates to a yield of 10.57%.

Income Play No. 2: The Carlyle Credit Income Fund CCIF 0.48%↑, a closed-end fund that invests in “collateralized loan obligations,” or CLOs. Once a “niche” market, CLOs have exploded into a $1.2 trillion financing venue that fills about 70% of the demand for U.S. corporate loans. Carlyle is an interesting income play because — in July — it changed its name from the Vertical Capital Income Fund to CCIF. The reason: Carlyle Global Credit Investment Management LLC took over as the fund’s advisor. CCIF invests in both debt and equity “tranches” of CLOs. The shares were recently trading at about $8.50 — near the top of the 52-week range of $7.43 to $8.80. The net asset value (NAV) per share at the year’s midpoint was $7.68. At CCIF’s current trading price, the $1.19 yearly payout translates to a yield of 15.41%. Dividends are paid monthly.

Income Play No. 3: AGNC Investment Corp. AGNC 0.00%↑, a real estate investment trust (REIT) that invests in residential mortgage securities. It’s based in Bethesda, Md., a little under two hours from my home office. At a recent price of $10.64, the $1.44 in yearly dividends translates into a yield of 13.66%. Dividends are paid monthly. The company has been aggressive with buybacks in the past, and there’s an existing buyback program that’s still to be finished.

Income Play No. 4: New Mountain Finance Corp. NMFC -0.55%↓, a business-development company (BDC) that specializes in private-equity investments, lending and buyouts involving middle-market companies in energy, chemical, materials, engineering, tech and distribution companies. As rates fall, dealmaking volume will climb. And private-equity deal-making, in particular, is surging — as we’ve been reporting. At a recent price of $12 a share, the $1.36 annual dividend gives investors a yield of 11.3%.

Income Play No. 5: Ellington Financial Inc. EFC -0.56%↓, another REIT that specializes in residential mortgage-backed securities (RMBS). At a recent price of $13.15 a share, the $1.56-a-share dividend works out to a yield of 11.77%. Like some of the other income plays, dividends are paid monthly.

Income Play No. 6: OFS Credit Co. Inc. OCCI 0.27%↑, a closed-end management investment company that invests in debt-and-equity collateralized loan obligations (CLOs). Consider this high risk. But at a recent trading price of $7.65, the $1.38 dividend translates to a yield of 18.05%.

Income Play No. 7: Oxford Lane Capital Corp. OXLC 0.28%↑ , a publicly-traded closed-end management investment company that invests in debt-and-equity tranches of CLOs. At a recent price of $5.20, the $1.08-a-share dividend translates to a yield of 20.77%.

The Single-Digit Millionaire

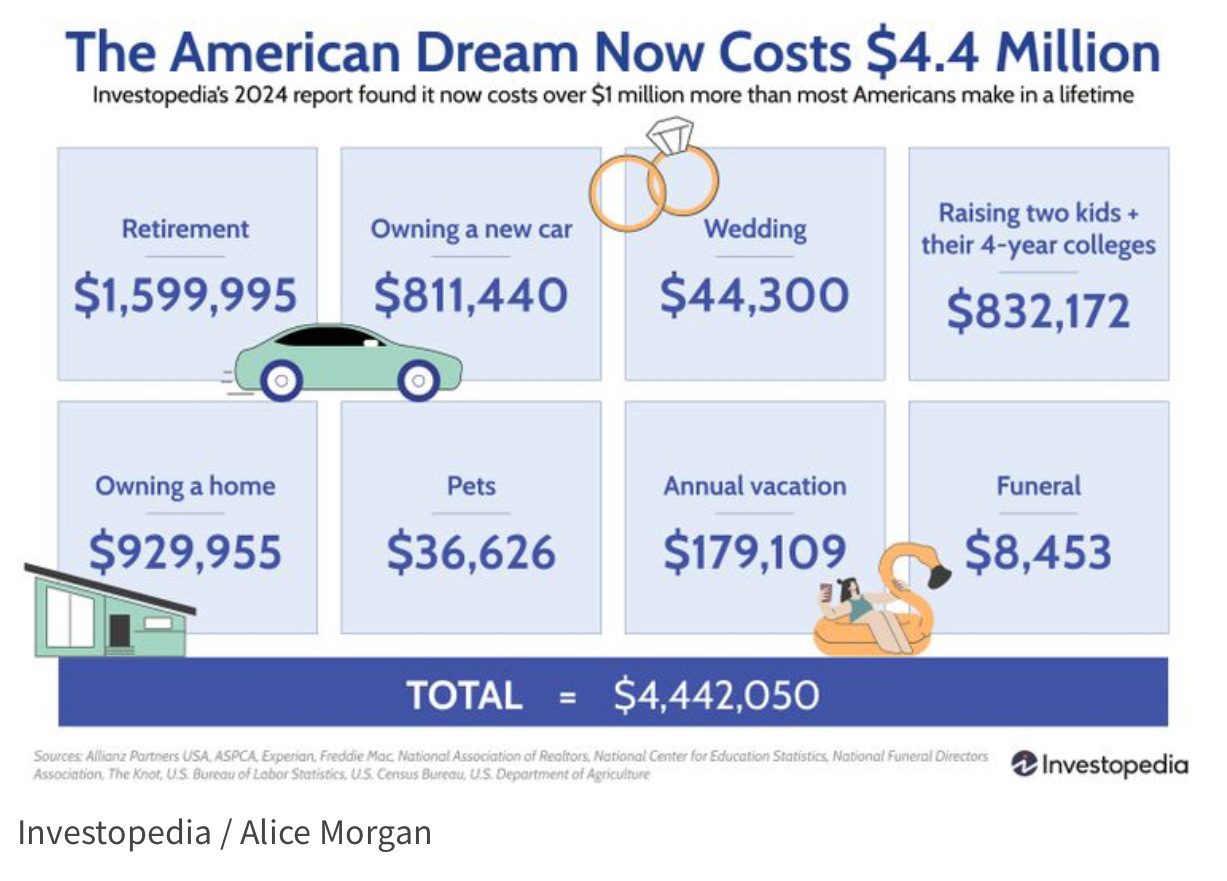

Every year, the folks over at Investopedia calculate the cost of the “American Dream:”

In this year’s study — released a few weeks back — that cost skyrocketed to $4.4 million.

Bill says at a time when $10 million is the “new $1 million,” it’s important to aim higher, and you can do so with three steps.

Step 1: Just Get Started

For 2024, a Forbes Health/Onepoll survey found that the second-most common “New Year’s Resolution” was “improved finances.”

But you don’t have to wait until a new year to get started to improve your finances, and the sooner you start, the better.

Step 2: Focus on “Money Doublers”

With a consistent and disciplined plan, the math behind building your nest egg isn’t as intimidating as many might first think.

Stocks have delivered an average return of 11% annually over the past 10 years, which means it would take 6.55 years for your nest egg to double.

And Bill says that anything you can do to accelerate that a bit will help.

For instance:

At 12%, your money will double in six years.

At 15%, it’ll double in 4.8.

At 20%, it’ll double in 3.6.

To find some of those “money doublers,” you can check out Part 1 of these storylines.

Step 3: Invest Long-Term

In his book, “Same As Ever: A Guide to What Never Changes,” author Morgan Housel tells us that a holding period of 10+ years is the “ideal” holding period.

Private-Equity Tidal Wave

It’s a fact: We’re seeing more growth and dealmaking in companies that don’t trade on public exchanges. And private equity — an $8.2 trillion global pool of capital available for wheeling and dealing — is “big-footing” just about every business you can think of. A month or so ago, Bloomberg reported that PE firms are “muscling into the world of life insurance and retirement savings and shaking up the business.” PE is also flooding into the AI market — signaling the vast profit potential there, too.

As we’ve been reporting, PE dealmakers are big sports fans — both for games that play out on the field and the profits those games pour into their pockets. In a two-part report for our SPC Premium members, Bill talked about how private equity firms are grabbing sports businesses “from Little League to the NFL.” Just weeks later, we shared how private equity is circling the Miami Dolphins.

Here’s where it might appear tricky. “Private” means private — as in, “outsiders aren’t welcome.” You can’t afford to be deterred here, though, since the investment playing field is shifting.

The number of U.S. companies trading on the key exchanges peaked at 7,300 back in 1996. That number has been cut by nearly half — to about 4,300. And it’s expected to be halved again in the next two decades to come.

At the same time, the number of private firms has zoomed nearly sixfold — from 1,900 to 11,200.

Companies are staying private longer — or aren’t “going public” at all. It used to be that entrepreneurs would launch a venture, go through several “rounds” of private-equity fundraising, and then “monetize” their investment by selling a slice of the company in an initial public offering, or IPO.

Oftentimes now, however, founders are selling out directly — avoiding IPOs and the regulatory scrutiny that accompanies running a public firm. As one CEO told Bill years ago: “If I had to do this all over, I’d never run a public company again.”

You can’t ignore this shift. And you don’t have to.

By reaching into Bill’s Platinum Rolodex — the SPC network of experts — we gave you an introduction to private-company investing with our interview of expert Sean Levine.

And there are ways to invest alongside PE players — by investing in PE firms. One leader: Dealmaker Apollo Global Management Inc. APO 0.77%↑, which is one of the firms approved to make NFL investments.

The narratives we brought you here — as well as in Part I — are a veritable blueprint for wealth-building success. They’ll help you make money … but, just as key, they’ll keep you away from the mistakes that can set you back.

That’s a killer one-two punch … for winners.