Our Favorite Storylines (Part I)

Powerful storylines that have already delivered hefty gains ...

Since launching Stock Picker’s Corner (SPC) in February, we’ve added like-minded thinkers to our community at an accelerating pace, launched a paid service called SPC Premium and expanded our network of specialized experts.

We’ll soon be celebrating an entire year of publishing on Substack.

If you’ve been with us from the start (or joined us soon after), you know that Chief Stock Picker Bill Patalon's strategy starts with finding the best storylines since that leads to the best stocks.

With 2024’s “finish line” up ahead, we wanted to revisit those key storylines — the ones we started with and others that we’ve added along the way.

View it as a refresher … or as an introduction.

Whatever the label, we don’t want you to miss anything.

So let’s get started.

The Artificial Intelligence (AI) Era

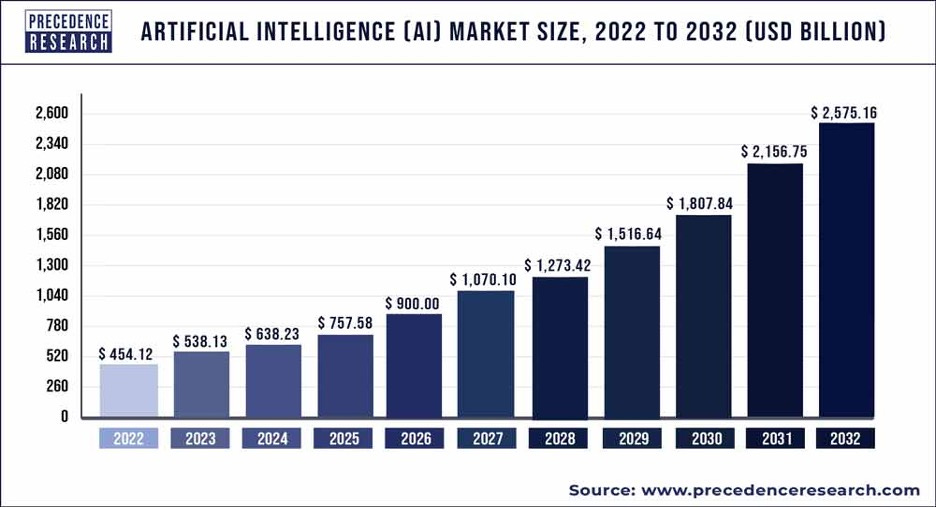

We’re not worried about short-term market fluctuations or the “noise” about bubbles. Because the long-term storyline — that AI is a generational opportunity — hasn't changed: The global AI market is projected to grow from $454.1 billion in 2022 to $2.5 trillion by 2032.

Resources

🔵Visualizing the AI Boom: We’re still fans of Nvidia Corp. NVDA 0.00%↑ — as you’ll see in a minute — but the AI Era doesn’t rise and fall solely with chipmakers. From semiconductor equipment firms to microchip packagers to data center fabricators, we have a full list of companies that’ll serve as a starting point for your research.

🔵Visualizing the AI Boom: A “Power Play” for Profit: AI will drive significant energy investments, as seen in the agreement between Microsoft Corp. MSFT 0.00%↑and Constellation Energy Corp. CEG 0.00%↑ to restart the Three Mile Island nuclear plant for data centers. Companies like Schneider Electric (SBGSY), Eaton Corp. ETN 0.00%↑, Vertiv Holdings Co. VRT 0.00%↑ and nVent Electric NVT 0.00%↑ (just to name a few) are positioned to benefit from the increasing demand for power and thermal management solutions in data centers.

🔵It’s the “First AI War” – And It's Silently Supercharging the AI Era: Bill always says when multiple storylines intersect, you've got an especially powerful narrative. And one of those “intersections” is the AI Era and The New Cold War. AI’s impact on warfare is exemplified by the role of Palantir Technologies Inc. PLTR 0.00%↑in the Russia-Ukraine conflict, and Bill has more on what Time dubbed “The First AI War,” as well as a few theme-focused ETFs for those who have yet to dip their toes into the “AI waters.”

The New Cold War

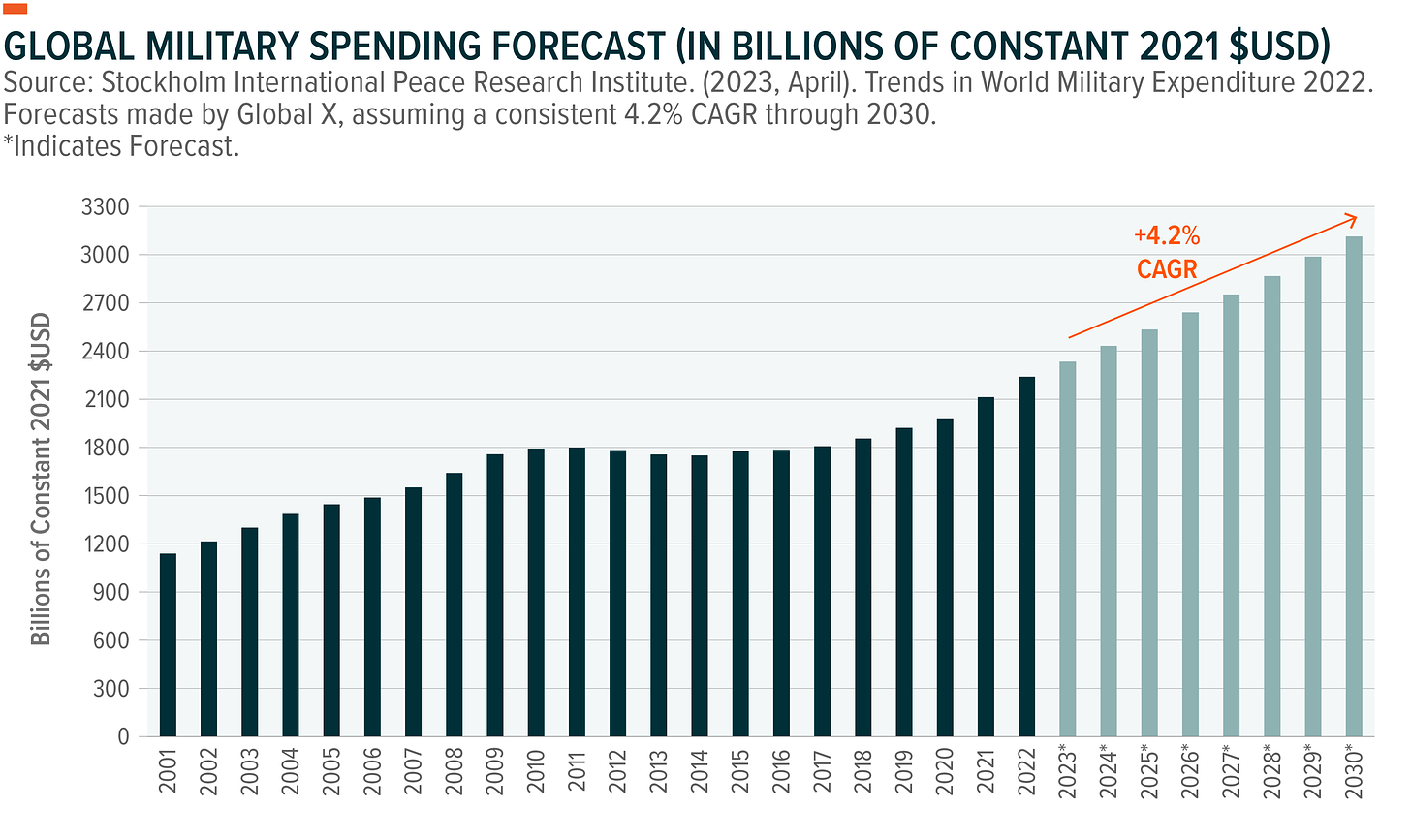

The New Cold War is one of our core storylines, and the latest headlines underscore why the money continues to flow into defense and security initiatives. Global military spending jumped 3.7% in 2022 to hit a record $2.24 trillion, according to the independent think tank Stockholm International Peace Research Institute (SIPRI). And spending will continue to grow — approaching $3.3 trillion by decade’s end.

Resources

🔴Welcome to the New Cold War (Part 1): While there are some similarities between the last “Cold War” and this “New Cold War,” this isn’t just history repeating itself; there are fresh threats and new opportunities. In this two-part series, Bill equips our readers with insights to make informed decisions in a world that’s only getting more complex.

🔴Welcome the New Cold War (Part 2): Once you have the context of the “New Cold War” from Part 1, you’ll see a handful of opportunities to consider when starting your own investing research in Part 2.

🔴Russia's Targeting Our Satellites, Hackers Are After Our Drinking Water: As mentioned earlier, there are plenty of new threats to consider, ranging from the development of anti-satellite weaponry to the U.S. water infrastructure being attacked. Knowing these new-school threats helps crystalize the importance of defense companies.

Biotech Blockbusters

Blockbusters — drugs that generate $1 billion or more a year — are the Holy Grail of biotech firms. But those breakout drugs are long shots to achieve, which makes it tough for investors to ID biotech-blockbuster stocks. But when you can, the windfalls are massive and will keep getting bigger as the value of the biotech market jumps higher.

🟢The "Next Blockbuster" Drug Will Be a Scorcher: If AI wasn’t nabbing all the headlines right now, companies with weight-loss drugs may have been one of the “hottest” investments over the last two years. There will be several companies that create “Blockbusters” in this segment, and Bill shares two of the early winners.

🟢These “Biotech Rules” Delivered an 818% Winner: In March 2012, Bill knew from his years of covering the biotech sector that Pharmacyclics and its blood cancer drug Imbruvica was going to be a “Blockbuster.” Turns out, so did AbbVie Inc. ABBV 0.00%↑ when it bought Pharmacyclics for $21 billion. Bill’s readers at his previous newsletter who followed his reports pocketed gains of as much 818%. But that isn’t being shared as a victory lap — it’s being shared because the three-step checklist he used to identify Pharmacyclics as a winner that can still be used for any biotech investment.

🟢The No. 1 Pet Biotech: Biotech innovations and medicine extend beyond humans, as the animal biotech market is expected to also climb in value from $8.9 billion in 2023 to $57.9 billion by 2032, a respectable compound annual growth rate (CAGR) of 8.9% during that time. One of the top stocks Bill has identified in that market is Zoetis Inc. ZTS 0.00%↑.

Commodities (More Than a Supercycle)

Massive “supply deficits” loom across the commodity sector, which follows the “Econ 101” math that if demand continually exceeds supply, you’ll have a sustained period of higher prices.

Normally, commodities don’t receive a lot of mainstream news coverage, are highly cyclical, and require a trading mindset. That’s enough for retail investors to avoid the market and the opportunities that exist there.

But Bill’s Platinum Rolodex is filled with an array of experts who can help make commodities feel more approachable.

⚪Silver's Surge: $30 Soon ... $300 By 2030?: This was one of the first interviews shared on SPC. And it demonstrates the value of our network, our research, and our prescient thinking. At the time, silver was trading for around $25. Peter Krauth, publisher of The Silver Stock Investor newsletter, believed silver would hit $30 an ounce by the end of 2024. Right now, silver is up to about $32.40. Investing is a “what-comes-next” venture, and we now turn our attention to the second half of Peter’s prediction — that silver will reach $300 in the next six years.

⚪For Wealth Builders, Coal Is Now a Black Diamond: Understandably, most investors hear “coal” and immediately think it’s a dying industry. But Bill took the time to chat with Matt Warder of the Coal Trader to eradicate that misconception about coal, get an “Econ 101” overview of the different types of coal, and get a look ahead of what to expect for the industry.

⚪4 Copper Stocks to Zero in on ... Before Copper Prices Double (Or More): It’s not every day you can hear from someone buying a copper mine, but that’s the type of access we bring to our readers. Oro Capital CEO Danny Brody — a successful VC who’s also the publisher of the Net Worth Club — not only shares his boots-on-the-ground copper insights but also lists his top copper stocks for retail investors: Hudbay Minerals Inc. HBM 0.00%↑, Lundin Mining Corp. (LUNMF), Capstone Copper Co. (CSCCF), and Abitibi Metals Corp. (AMQFF).

Special-Situation Investing

The holding periods for the investments in our SPC Premium Model Portfolio are typically between three to 10 years, as the data shows that the probability of making a profit increases if you hang on to a company for 10 years or longer.

But special-situation investing catalysts, or what Bill calls “triggers,” unspool in a condensed time frame that might be as quick as a few years to just a matter of months.

🟠Harley: Going Whole-Hog on This "Special-Situation" Stock: There’s a potential “turnaround” afoot with sales rebounding, Harley buying back $1 billion worth of its own stock, and Morgan Stanley MS -0.28%↓ recently adding the “hog” producer to its list of eight companies that could be takeover targets.

🟠The Surprising "Special-Situation" Stock: Nvidia: As shares have skyrocketed 2,500% over the last five years, this may seem like too obvious of an investment … or that all the money has been made … or anyone who wants to own Nvidia already does. But when stellar earnings were “punished” by impatient investors last quarter, Bill said any pullback in price offered a buying opportunity, as they were missing the point that a delayed rollout of its most advanced chips just meant revenue was not lost … just pushed back a few months. Plus, Nvidia approved an additional $50 billion in stock buybacks.

🟠This $6 Stock Delivered a 64% Gain in Five Weeks: Hallador Energy Co. HNRG 0.41%↑It started out as an oil-and-gas explorer, evolved into a coal company and is undergoing another makeover — shifting this time into renewables and actual power production. This “transformation” and being “misunderstood” created a special-situation opportunity, one that has already allowed some of our readers who acted to nab a 64% profit in five weeks. This is definitely a high-risk investment, and shares will be prone to wobble, but Bill outlined why he likes the long-term outlook for Hallador.

There are also three other major storylines (Real Income, the Single-Digit Millionaire, and the Private-Equity Tidal Wave) that we’ll cover in Part 2 of this series, but we wanted to start with those first five as an “introduction” for anyone who recently joined us or as a “refresher” for anyone who has been with us since the beginning.

Thanks for being here.

Take care,