“There seems to be some perverse human characteristic that likes to make easy things difficult.” Warren Buffett

For retail investors like us, that snippet of Warren Buffett wisdom is more relevant today than it was when he shared it with Columbia Business School students way back in 1984.

It’s more relevant because of an outright explosion in so-called “investment products” and “investing tools.”

I’m talking about things that are pitched as “opportunities” … but are really “investing traps” that are better left alone.

Things like:

Easy-to-access options – including “zero-day options,” which are option contracts that expire on the same day someone trades them.

Private company investments.

Special-purpose acquisition companies (SPACs).

·Sketchy cryptocurrencies.

Algorithmic trading that uses computer codes to open and close trades for you.

And the potential for 24/7/365 trading on the New York Stock Exchange (NYSE).

There are more … but you get the idea.

When Options Aren’t “Optional”

Each of these are pitched as innovations that make life better, easier and more profitable for retail investors. But most of them just paint a bullseye on your back: They turn you into the proverbial “Greater Fool” – setting you up to take the “other end” (ie “losing end”) of some smart operator’s trade.

In short, they’re Wealth Killers.

And I can prove it.

Take options …

Between January 2010 and February 2021, retail investors lost $3 billion making options trades.

And zero-day options are inflicting daily damage: A study from Germany’s University of Muenster found that, since May 2022, day traders lost $358,000 each market day on zero-day options.

One longtime colleague of mine – I’m talking about someone who’s worked as a sell-side analyst on Wall Street, has run his own financial publications and who’s more recently moved into the dealmaking world – recently affirmed my view that options trading is like hemlock for everyday investors.

“You’re right, Bill,” my friend and colleague told me. “The vast majority of Mom-and-Pop investors – I’m talking about 99.7% – have absolutely no business going anywhere near options of any type. For retail investors, options are a rigged game … clear and simple.”

That brings us to the next Wealth Killer: “Margin trading” – the use of “leverage” (borrowed money) to boost returns on the actual cash invested. It’s a Wealth Killer, too.

In its report “The Financial Literacy and Overconfidence of Margin Traders,” The U.S. Securities and Exchange Commission (SEC) found that a mere 15% of margin traders could answer a basic question about trading on margin correctly. In short, they were guilty of an investing cardinal sin: They didn’t understand their investment.

And that lack of understanding of the risks may well lead to outright recklessness.

In a June 2023 study, Notre Dame researchers found that “retail investors’ decisions to lever up in stock trading despite the hefty borrowing cost is likely driven by overconfident beliefs and lottery preferences.”

As Shaggy used to say in Scooby-Doo: Zoinks!

To cap that off, the Big Board kicking off 24/7/365 trading would turn investing into more of a casino than it already is, with a “DraftKings gambling” mindset becoming even more of the status quo.

It Ain’t FOMO … It’s FOFS – You Heard it Here First

It becomes a battle of logic versus emotion.

Logically, most folks understand they shouldn’t invest in things – or in ways – they don’t really understand. But emotion too often trumps logic.

All it takes is one friend boasting about their “killer” options win they pulled off just that week (while neglecting to mention the string of losers that preceded it) to rev up that “lottery” mindset – or to trigger that Fear of Missing Out (FOMO) emotion.

There’s another emotion, one that doesn’t get talked about as much, but that’s just as damaging as FOMO – if not more so.

I call it FOFS (pronounced “Foe-Fuss”).

That’s the “Fear of Feeling Stupid.”

I see these financial newsletters/products/platforms – or streaming “shows” – that espouse the benefits of stock options. A group of attractive “commentators” breezily talk about all the great options trades – and the accompanying profits – that are there for the taking.

Viewers don’t want to “feel stupid” by questioning the veracity of this mass-streamed narrative.

So they attempt the trades themselves – and get creamed.

One lesson I learned early in my days as a reporter was that “the only stupid question is the one that’s never asked.”

If you don’t understand something, don’t feel comfortable with it, or feel those tendrils of fear taking hold deep in your gut … do the opposite of the Nike mantra.

Just … don’t … do it.

We’re Wealth Builders – So Join Us

The purveyors of this option-trading/SPAC-buying/margin-account/round-the-clock-investing “wisdom” will tell you it’s good for you.

As my Dad used to say …

Malarkey.

These folks (and their “make things easier and better” innovations) are Wealth Killers – pure and simple.

The good news is with an investing plan and the discipline to follow it, there’s an “antidote” to all of this – become a Wealth Builder.

Like us.

Wealth Builders:

1. Know who they are – Wealth Builders don’t invest in companies and assets or use “tools” that they don’t understand.

2. Know they need an “accumulation strategy” – Wealth Builders understand how to find the “right” stocks – and use that knowledge to consistently build meaningful stakes.

3. Know they won’t get rich overnight – Wealth Builders make time an ally, and leave options and margin trading to everyone else.

4. Know when to cut their losses – Wealth Builders understand that mistakes are inevitable. They know everyone makes bad investments. Instead of beating themselves up, they use it as a teaching moment. And they move onto the next opportunity.

5. Know their exit strategy – Wealth Builders have a pre-determined plan of when to cash out and walk away from an investment.

6. Know that the best storylines lead to the best stocks –Wealth Builders don’t chase short-term trends or market fads. And they don’t succumb to the “Malarkey-esque,” Wealth-Killing gambits I’ve outlined here.

If you’re reading this now, in our little investing corner of the world, the Stock Picker’s Corner (SPC), we’re all here as Wealth Builders, and I’m here as your guide for finding and following those powerful investing storylines.

Tomorrow, I’m going to share one of them.

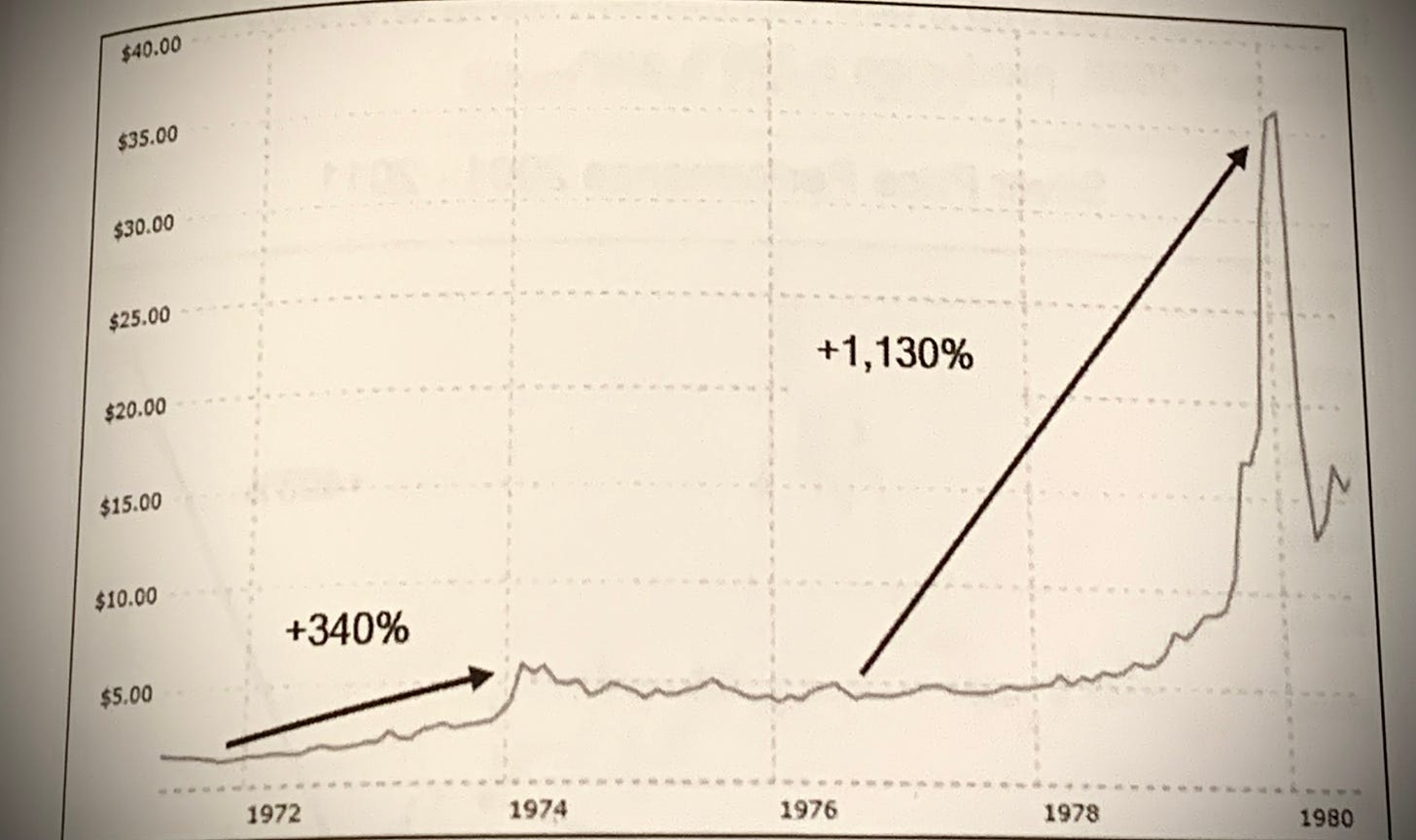

It’s a tale in one sector where previous bull markets saw prices shoot up 340% and 1,130%, respectively, creating massive windfalls for savvy investors.

It’s a story where demand is expected to hit record levels in 2024 … while the supply hits a deficit four years running – providing the rocket fuel for higher prices.

And it’s a story where a $27 price tag could turn into $300 … potentially in a matter of just a few years.

I’ll tell you all about it tomorrow.