The fine art of winning investing is all about the “What’s Next.”

You can keep building wealth today — with the stocks you already own and are “accumulating” right now.

You can position yourself for that “What’s Next” by researching and listing the next round of stocks that you’d buy if you came into more cash …

Or if we experienced a pullback in stocks.

Our Best Ideas are already in the Stock Picker’s Corner Model Portfolio. And are based on our core strategies — like our “Magic Seven” rules for Wealth Builders.

And still other companies I’m watching are rostered on the “Farm Team.” (Indeed, one of those stocks just called “promoted” to the Model Portfolio.)

But in our “look ahead” story early this week, I promised I’d circle back with some other candidates for your Watch List.

I always do my best to keep my promises. And today I’m keeping the promise I made Monday.

I’ve researched and listed five companies — five stocks — that are worth a closer look.

And make no mistake: While these aren’t in that Model Portfolio, they’re still damned good ideas.

I wouldn’t share them here — wouldn’t waste your time — if they weren’t.

So … without further ado … let’s rock and roll, folks …

Watchlist Stock No. 1: Apple Inc. AAPL 0.00%↑

I loved how the iDevice King handled its AI announcement back in June — and how it masterfully shifted the narrative about itself from “Apple is way behind” to “Apple is a brilliant leader.” (In fact, you’re looking at Apple, you need to check out our “Apple’s Next Act Trilogy.”)

But perception is one thing — and execution and valuation (the stock surged after that) is another. The company still faces challenges: Regulators are after it, it’s dealing with a patent spat, it has China worries and year-over-year revenue has dropped for five straight quarters. Earnings growth projections are still on the low side, too, versus other companies I’m watching.

Although I dug Apple’s AI messaging, I want to see more substance — since it’ll take time for that strategy to turn into top-and-bottom line cash.

But Apple is a scrapper.

And we’re Wealth Builders with patience and a longer horizon. With a little progress on the revenue front — and a share price kicked lower by a broader correction — we’ll absolutely take a bite from that …. apple.

Watchlist Stock No. 2: Blackstone Inc. BX 2.19%↑

We’ve talked with you about Blackstone as an “AI’s Landlord” — because of the massive data center strategy that it already seems to be executing superbly.

These data centers are a lynchpin of the Artificial Intelligence (AI) Era.

We’re already seeing an explosion of digital data that must be stored, organized and managed so that AI, driverless vehicles, cryptocurrencies, digital payments, e-commerce, drug discovery, personalized medicine, cybersecurity and cyberwarfare, virtual working and virtual learning — and scads of other key pieces of our modern digital lives — can evolve and advance without disruption.

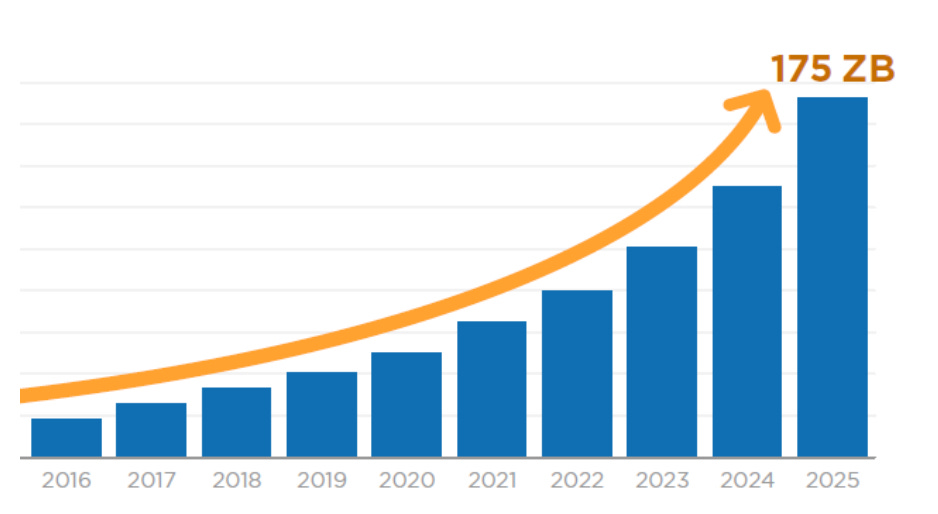

From 2020 to 2025, IDC Research projected a yearly data-creation rate of 23% — leading to 175 zettabytes of data by 2025.

The “data universe” will explode during this decade, grow more than tenfold from 2020 to 2030, when it’ll reach 660 zettabytes, says UBS Wealth Management.

That’s the equivalent of every person in the world having 610 iPhones — each with 128 gigabytes of storage.

But the “AI Landlord” narrative is just one of Blackstone’s “storylines.”

With more than $1 trillion (that’s “trillion” … with a “T”) in assets under management, Blackstone is the world's largest alternative asset manager.

Despite its size, the company is nimble — and opportunistic: For instance, it snapped up distressed houses during the Great Financial Crisis — and made at least $7 billion when it sold them off when real estate rebounded.

In short, Blackstone knows how to make money.

Lots of money.

Earnings are already projected to grow at an average annual rate of 23.5% over the next five years.

That means earnings will double in 3.1 years. And since we know that share prices tend to follow earnings, we know this bodes well for Blackstone’s long-haul share price.

With a forward dividend of $3.39 a share, we’re talking about a yield of 2.4% at current levels.

I actually like this stock here and now — and at the lower prices that accompany a correction, it’s a stock for Wealth Builders we can build on.

Watch List Stock No. 3: Broadcom Inc. AVGO 0.00%↑

Our mantra here at SPC is “find the best storylines, and you’ll find the best stocks.”

And when multiple storylines intersect, you’ve got an especially powerful narrative.

That’s exactly what we’ve got with Broadcom, which is benefitting from the intersections of the New Cold War, Deglobalization, the Resurgence of America and the AI Era.

The company makes semiconductors and creates “infrastructure” software for cloud computing, cybersecurity, mobile devices, digital storage, data centers, wireless-and-broadband networks and industrial enterprises.

It’s a company that I’ve followed for a number of years, so I know its backstory and its potential.

Indeed, with a share-price gain of better than 1,980%, Broadcom was one the best-performing stocks of the 2010s.

Broadcom recently completed a 10-for-1 stock split, and the shares are near the top of their 52-week range. But it has a perfect 99 Composite Score from Investor’s Business Daily. And it’s projected to grow earnings at an average annual rate of 17.8% over the next five years, meaning profits will double in just over four.

Some pundits are talking it up as a rival to Nvidia Corp. NVDA 0.00%↑. It doesn’t need that “label.” It’s impressive enough to stand on its own storyline.

Watch List Stock No. 4: Goldman Sachs Group GS 0.00%↑

It’s hard to bet against an investment bank that came out on the “right side” of the subprime mortgage crisis. (And by “right,” I mean “solvent and profitable,” not “pious and just.” In other words, not up on “Boot Hill” with Lehman Bros. and Bear Stearns.)

In the old Rust Belt days of America, I would have labeled Goldman as the “Cadillac” of investment banking. Today, I guess it’s the “Mercedes.”

By any name, it’s a winner.

Indeed, it’s an alluring SPC Watch List Stock, with my own brand of “Trump Trade” kicker — meaning it’s got the longer-term, Wealth Builder power we want.

Two of Goldman’s core businesses are wealth management and dealmaking. And many of the “triggers” I’m watching will feed into both.

Two potential examples:

An expected near-term drop in interest rates is in the offing — which is good for stocks and wealth creation.

And a Trump White House is likely to lead to a regulatory easing that will favor corporate dealmaking.

Goldman itself says investors should favor stocks over bonds — at least until 2030 — which tells us it believes worldwide wealth will surge. I agree, and the forecasts back us up: Indeed, global assets under management (AUM) will grow from $126.99 trillion in 2023 to $205.6 trillion in 2032, projects Credence Research.

Expect dealmaking to accelerate, too, as industries consolidate, new companies go public, and startups and private firms seek financing. Dealmaking is a key element of Goldman’s investment-banking business — and would generate lucrative fees.

The forward dividend of $12 a share represents a 2.5% yield at current prices. And that yield goes up as the share price goes down.

Even now, Goldman Sachs is projected to grow profits at an average annual pace of 25.7% for the next five years – meaning earnings will double in less than three. A correction gets us in at a lower share price.

Watch List Stock No. 5: Hallador Energy Co. HNRG 0.00%↑

We like “special-situation” plays, and I’m using this last company to round out our “Five Stocks in Five Minutes” segment. It’s a misunderstood company, is higher risk, and is one you’d absolutely want to see a pullback on before you buy. The company is based in Terre Haute, Ind. (a city that’s been on my radar ever since it was named over and over in the Season 7 Law & Order episode “I.D.”).

The company’s name is a Spanish term for “one who leads the way,” and it’s been involved in the energy markets since 1951. It started out as an oil-and-gas explorer, evolved into a coal firm and is undergoing another makeover — shifting this time into renewables and actual power production.

I’m intentionally oversimplifying this, but call it “a utility in the making.” (And, no, I don’t know the Spanish term for that.)

As part of a push to reduce overall debt, Hallador recently cleaned up its balance sheet by converting some convertible debt to stock. It posted a first-quarter loss of $1.7 million — and conceded that the 816,000 megawatt-hours of power it generated fell short of its 1.5 million target — but also noted that revenue from its electricity operations surpassed those from coal for the first time.

With a market value of about $325 million, this is definitely a small-cap play. With a pullback, it could be playing “micro-cap limbo” — dancing under the $300 million micro/nano threshold — so I’m going with that label here.

And I’d label the risk level as high.

Hallador rates as a “special situation” in my book because of a “six-pack” of factors: 1.) It’s changing its business model, 2.) dealmaking could accelerate that transformation, 3.) the shift away from “carbon” fuels won’t be as quick or as easy as most folks think, 4.) we have the chance to do this before retail investors catch on, 5.) it’ll be aided in the near-term by falling interest rates, and 6.) aided in the long-term by rising energy demand.

Indeed, on that last point, the U.S. Energy Information Administration (EIA) says global electricity demand could surge by 33% to 75% by 2050, when as much as two-thirds of the world’s electricity production could come from nuclear and renewables. Both the “stickiness” of carbon fuels (check out our report on coal here) and the shift toward renewables will benefit Hallador.

Sound interesting? Watch for a pullback down into the low $6 range — but one driven by a broader market decline … and not miscues by the company.

There you have it. Five “Watch List” stocks. And if it took you more than five minutes to read … well, I hope it was because we really pulled you in.

If any or all of these grabbed your interest, be sure to do your own “due diligence” — making sure one or all fit your personal wealth plan.

Check out some of the other SPC stories I linked to.

And if you don’t subscribe to our free issues — or SPC Premium — I’ve added the links for you just below.

See you next time …

I like that you highlighted Hallador Energy. We also find the company interesting.

Here's our "breakout" report on Hallador ...

https://stockpickerscorner.substack.com/p/we-said-wed-grab-this-stock-at-6