One of the many things that I’ve learned in my years as a financial reporter, columnist, stock picker and newsletter editor is this:

When it comes to stocks (and even investing in general), there are “special situations” … and there are “special opportunities.”

And sometimes those two are one and the same.

Keeping it super simple (as I like to do), I’d explain this like so …

A “special situation” is a stock, or financial asset that’s poised to benefit from a specific (identifiable), catalyzing “trigger” – like a buyback, corporate breakup, a transaction like a buyout/merger, changes forced by an activist investor, some sort of a dividend change, a radical shift in the supply/demand dynamic … and more.

A ”special opportunity” is a unique and limited window to grab an asset or a stock when its price is temporarily out of whack.

Through the years – as a guy who does this for a living, and as an investor myself — I’ve seen plenty of both.

Take Nvidia Corp. NVDA 0.00%↑, the chipmaker that’s soared this year thanks to an artificial intelligence (AI) “tailwind” that’s been more like an outright AI “tail gale.”

Nvidia is a company that I’ve followed for more than a decade; at Private Briefing, the newsletter I ran at another publisher from August 2011 to December 2021, I first recommended Nvidia to my subscribers back on June 7, 2013.

The “adjusted” closing price on June 6 of that year – the day before my recommendation: 36 cents a share.

My Wealth-Builder strategy there was the same as here: “Accumulate” shares of the best companies on pullbacks, or through consistent purchases.

And that’s what I told my subscribers to do. I chronicled major strategic moves — and covered Nvidia’s share-price surge.

I also chronicled the pullbacks – spotlighting those interludes as “special opportunities” to build their Nvidia stakes.

I’m sharing this bit of “Bill Nvidia History” for a reason.

In the words of the late, great Yogi Berra, with the latest developments involving Nvidia — a drop in its share because of “disappointing” second-quarter financial results — I’m experiencing “déjà vu all over again.”

I’ve seen this before …

I see a potential “special opportunity” — one magnified by a “special situation.”

And that gale-force tailwind could resume before 2024 comes to an end.

DISAPPOINTING RESULTS … YEAH, RIGHT

The company last week achieved what I like to call an “earnings-report trifecta” –beating estimates for revenue … beating estimates for profits … and boosting its forward guidance.

And, yet, Nvidia’s shares skidded 8% in after-hours trading.

To explain how this translates into a “special opportunity” — for those who missed it (it was, after all, the last week of the summer), let’s review the basics.

Nvidia delivered:

Earnings per share of 68 cents (adjusted) versus 64 cents expected.

Revenue of $30.04 billion vs. $28.7 billion expected.

And projected revenue of about $32.5 billion for the current quarter, versus earlier forecasts of $31.7 billion — a year-over-year increase of 80%.

So why the sell-off?

Simple. Reported revenue for the quarter was up 122% — following three-straight quarters with year-over-year top-line growth in excess of 200%.

It seems that (among the sell-sider set) there were worries about the company’s gross margins – a metric the execs and analysts can use to assess its efficiency. Nvidia said that number slipped from 78.4% in the first quarter to 75.1% in the second (though those analysts seem to ignore the fact that both of those numbers are up from a gross margin of 70.1% a year ago).

Then Nvidia execs said they see full-year gross margins to be in the “mid-70% range” — below analyst forecasts of 76.4%, says StreetAccount.

A lot of minutiae, to be sure – more minutiae than I typically get into here at Stock Picker’s Corner (SPC).

But I’m detailing it because it’s near-term minutiae.

And we’re long-term players.

And, over the long term, I continue to like the Nvidia story.

So this near-term wobble creates an opening … a “special opportunity” that’s supercharged by a “special situation.”

WHEN EMOTION ERODES REASON

The more Nvidia CEO Jensen Huang talked about the earnings and the sell-off in the interviews that followed that second-quarter report, the more annoyed he seemed to get.

The company’s shares had soared more than 150% this year. And that’s after a 240% zoom last year.

But that’s pushed the stock into a realm where investors are prone to be less forgiving over any “cracks” that show up in the Nvidia storyline.

Some “slowing” revenue growth (from more than 200% to a “mere” 122%), and “eroding” or “disappointing” margins … well, to some folks, those are troubling signs.

For instance, as Bloomberg Intelligence analysts Kunjan Sobhani and Oscar Hernandez Tejada wrote in a research note: “It was up against lofty and unsustainable expectations.”

Fair enough: But the real questions now are these:

Now that Nvidia “disappointed” investors, have those folks hit the “reset button” on those expectations?

·Or, did they actually hit the “overreact button” — meaning Nvidia has become a “special opportunity” that’s worth grabbing?

For folks like us, either one of the two is just fine. We believe that “if you find the best storylines, you’ll find the best stocks.” And we believe some fascinating chapters are being written for the Nvidia story.

The bottom line: For Wealth Builders like us, Nvidia is right now a “special opportunity” fueled by “special-situation triggers,” including:

Special-Situation Trigger No. 1: New Chips/Old Chips – Remember when I said that temporary supply/demand imbalances can create windows? We have one here. Some customers delayed purchases now in favor of “Blackwell” - Nvidia’s next-generation AI chip. The company shipped samples of Blackwell during the quarter and used feedback to improve its manufacturability. It now expects to ship “several billion dollars” worth of Blackwell chips in the fourth quarter, said CFO Colette Kress. In fact, Blackwell demand is “incredible,” the company said. That’s great. Also great: It’s current AI chip – called “Hopper” – won’t see the decline that usually accompanies a changeover. Indeed, it expects shipments to increase over the next two quarters. In short, the AI “tailwind” isn’t ebbing … it just took a break … and will spool up anew later this year.

Special-Situation Trigger No. 2: The Buybacks Continue – Nvidia also said it approved $50 billion in additional share buybacks. That’s being tacked on to a buyback plan that has $7.5 billion remaining. This, too, invokes the supply/demand dynamic shift that I like to find. If the surge in Nvidia’s stock price that we’ve seen the last few years is a “proxy” for increasing demand – and if buybacks represent a reduction in the “supply” of Nvidia’s stock – then you’re talking about having fewer shares available to buy over the next few years as the investor appetite is increasing. And, yes, I’m oversimplifying this. But that, my friends, is a key ingredient for a continued surge in the price of Nvidia’s shares.

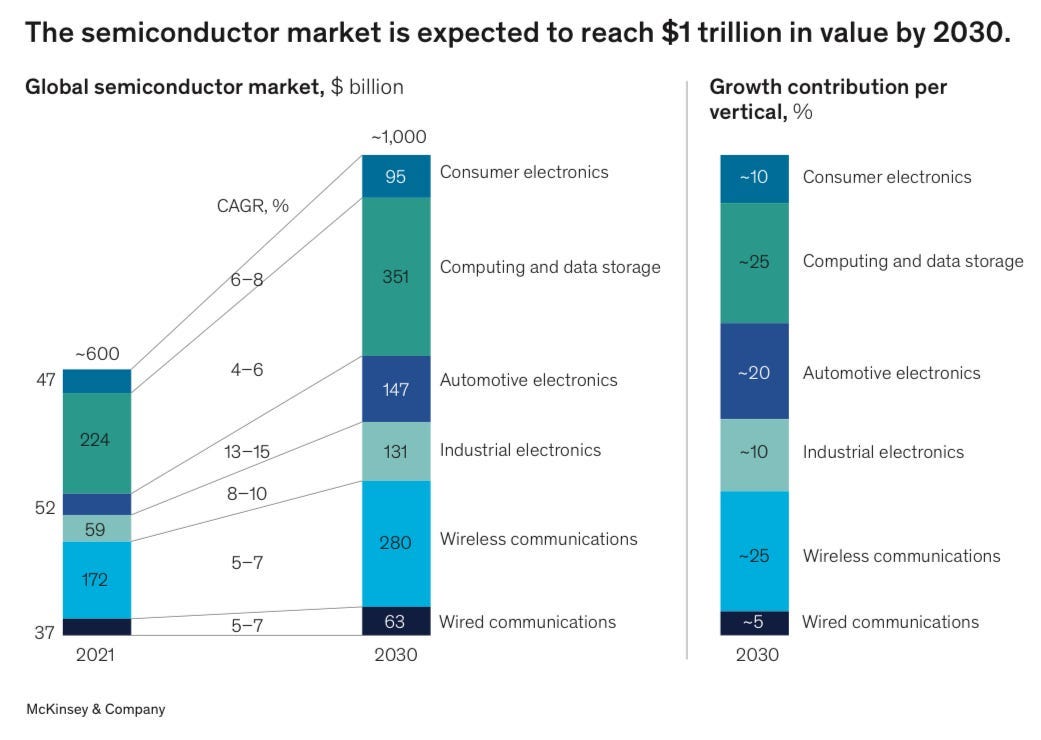

And Special-Situation Trigger No. 3: That Exciting Long View – There’s a lot of sizzle in that long-term AI story. Researcher Gartner says Nvidia will have sales of more than $84 billion this year – up from a forecast of $71 billion (as recently as May). Consultant McKinsey & Co. forecasts global chip sales to surge from about $600 billion in 2021 to $1 trillion by 2030 (check out the chart below). AI and data storage will be a big driver, surging from an estimated $224 billion in 2021 to $351 billion by the decade’s end – figures that could well be outdated already.

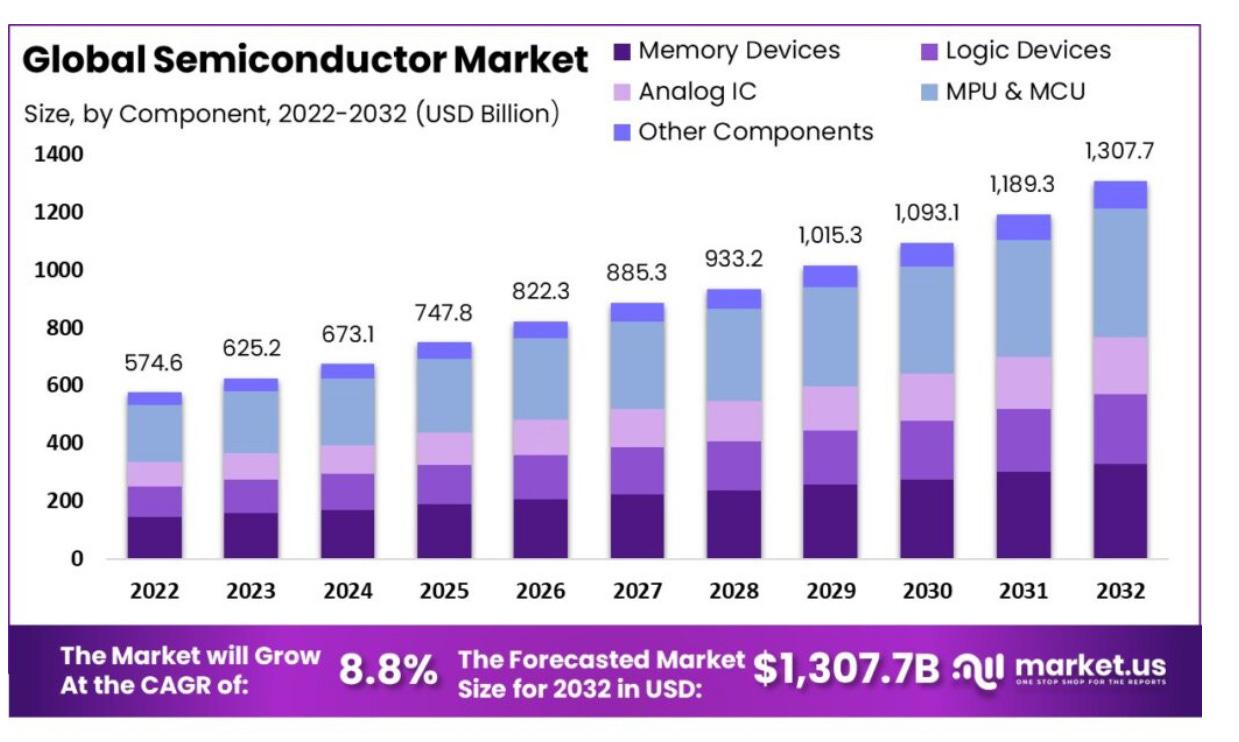

A forecast by Market.us Scoop, a researcher specializing in tech-market data, is even more upbeat. From a lower starting point ($574.6 billion) a year later (2022), it says worldwide chip sales will hit $1.09 trillion in 2030 and $1.31 trillion in 2032.

The fact is that semiconductors – microchips – are the brains of innovation and economic advancement. And Nvidia is one of the very best players. We’ve been handed a nice little window where investors have overreacted and aren’t seeing or playing the long game, meaning we’ve got the chance to step in.

As long as you’re playing the long game, understand this will be a volatile journey and are willing to follow the “Accumulate” strategy, this could be a pretty good time to add to your stake.

See you next time …