Harley: Going Whole-Hog on This "Special-Situation" Stock

A turnaround, buybacks, and a takeover target ...

Back during my days as a business journalist, when I was covering Harley-Davidson Inc. HOG 0.00%↑, it was one of the coolest stories in Corporate America.

It was 1988, and I was working in York, Pa., where Harley had its biggest factory (and an amazing museum). And, after a tumultuous decade that nearly ended with the company’s collapse, Harley was once again riding high and revving up for even greater days to come.

But it was the journey that made Harley such a great story — for Washington, for America, for motorcycle buffs … and for writers like me. It’s a journey with twists and turns. And it continues today.

In fact, we’re going to ride it to the latest Wealth Builder opportunity … which is part of a special new project we just finished — just for our paid-up SPC Premium members.

It’s a deep-dive analysis of 10 “special-situation” stocks — the product of several months’ work by the SPC team.

With more to come …

And let me tell you: This is one of the coolest things we’ve done, yet: It includes biotech breakthroughs, quantum technology, spinoff deals — and perhaps a takeover or two.

And we’re going to give you a free peek today at a special-situation investment: Harley.

And I’ll start with my personal story …

THE HEAVYWEIGHT IN HEAVY BIKES

Going way back to the early 1970s, Harley-Davidson was a dominator. It actually owned — with a 100% market share — the heavyweight bike market (engine displacements of 1,000 cubic centimeters or greater).

Do you know how rare it is for a company — any company in any industry — to own a market?

It’s great when you have it. But it makes you a target for an attack — or even a full-on invasion.

For Harley Davidson, the so-called “Japanese Invasion” of the overall U.S. motorcycle market started with the Honda CB750, a bike that was innovative, powerful, cool, safe and super fun to ride. That ignited consumer interest in motorcycles in general — and triggered a flood of new models from Honda, Kawasaki, Yamaha and Suzuki. From dirt bikes to street bikes — in all displacements, including Harley’s heavy-bike segment — Japanese bikes set the standard, though other imports (like Germany’s BMW) benefitted, too.

That company that didn’t benefit was Harley. By the early 1980s, in fact, Harley was the sole remaining U.S. motorcycle producer. And its once “total” market share was under 15%. Sales plunged by about 45% in two years, the inventory of unsold bikes doubled and worker hours plummeted.

Harley-Davidson needed help. And it went to Washington to get it.

The Reagan Administration motorcycle tariff of 1983 was a tourniquet that eased the bleeding – as did an aggressive management overhaul of the company.

It worked.

In March 1987 – in an action described as “unprecedented” – Harley asked Washington to end the tariffs a year early.

Said Harley CEO Vaughn L. Beals Jr.: “We no longer need tariff relief to compete."

President Ronald Reagan acknowledged the victory with a visit to the York Harley plant, telling workers (and the voters) that: “You're the only major motorcycle manufacturer in the world to have increased production last year. Like America, Harley is back and standing tall."

THE GOOD YEARS

When I came to York and took over the Harley “beat” the next year, the company’s two-wheeled monsters — affectionately known as “Hogs” — had regained their brand panache and surged from “mode of transportation” to outright status symbol.

From 1987 to 1997, Harley’s sales grew at a compound annual rate of 162% — while profits boasted a CAGR of 29.2%. The 55,000 Hogs it sold globally in 1989 thundered to 118,000 in 1996 and more than 130,00 in the year after that.

Demand for the bikes — which could cost $15,000 — outstripped supply, meaning customers sometimes had to wait a year or two for delivery (and pay the $2,000 or more in additional money some dealers added to the sticker price).

The company created a strong community. Celebrities – like comedian Jay Leno — were publicly effusive in their love for their Harley Hogs. The company’s branded accessories were snapped up by folks who didn’t even own motorcycles.

For a guy like me, it was a really fun company to write about (even though I owned and rode my Kawasaki 175 Enduro — a bike that I still have). And though I left the York job years ago (and reporting altogether), I never stopped following the company, albeit sporadically and from afar.

I also never stopped being a “careful observer.” It’s what I am … not what I do.

SLINGSHOTTING INTO A NEW REALITY

Fast-forward 30 years. I’ve watched the motorcycle market change. Today it’s China that’s the new threat. The vehicle site TopSpeed recently wrote that “the global footprint of Chinese motorcycle companies is getting bigger with each passing day. While the industry still hasn’t made huge strides yet, some of its products are rather impressive.”

And that includes the MBP C650V cruiser, which TopSpeed says “makes popular cruisers like the Harley-Davidson Iron 883 and Kawasaki Vulcan 650 look unimpressive.”

I’ve also seen how the motorcycle market has changed. All those great Harley Hog fans? They’ve aged.

I’ve “observed” that — personally … thanks to two close friends.

The first is Keith Fitz-Gerald, principal at the Fitz-Gerald Group and operator of One Bar Ahead® for individual investors. The second is Harry Argentino, one of my two best friends from high school — and a guy who’s hands-down one of the best machinists in America.

A couple years back, Harry became an “early adopter” — buying a motorcycle alternative known as a Slingshot. Described as an “open-air trike” or “three-wheeled roadster,” the Slingshot is made by Harley rival Polaris Inc. PII 0.00%↑.

Forbes described it as “the most fun you can have on three wheels.” I’ve ridden in, driven and let my son Joey ride in Harry’s Slingshot, so I understand why they’ve caught on. With a Buick four-cylinder and a stick-shift transmission, that three-wheeled motorcycle/sports-car/hot-rod mashup is super cool.

I also understand why Keith is pondering one for himself. He’s not just an investment pro (indeed, he was a popular contestant in our “Desert Island Stocks Challenge” earlier this year). Keith’s also a hard-core touring bike guy who’s ridden thousands of miles on all kinds of bikes — from an antique BMW with a sidecar to the coolest-and-most-modern heavy bikes. Having reached that sixth decade, Keith is courageously candid in saying that motorcycles now seem heavier, traffic seems more frenetic and reaction times are more important than ever.

The upshot: Keith is now starting to consider the same motorcycle alternatives that Harry adopted.

“You know BP, long-distance touring and high-level investing are very similar animals,” Keith told me last week. “In either case, vigilance is critical. You have to anticipate what could happen — and not wait until something actually does. I’ve been a professional investor for nearly 45 years … so I understand the importance of adapting. The same holds true for riding. Here at nearly 60, I know I can’t ride the same way I did at 18. I’ve owned dozens of different motorcycles … of all makes and manufacturers … and have ridden everything with handlebars, motors and wheels … but I’ve always done it in a frame of reference that makes sense to me. Just like my approach to investing.”

AN END? OR A START?

Harley-Davidson — a company founded in 1903 — needs to do the same sort of soul-searching.

“If Harley wants to survive another hundred years, it needs to meet these new challenges,” Keith said. “It hasn’t developed a side-by-side offering … Polaris is kicking Harley’s butt there … Polaris grabbed that market with both hands … understanding that lots of Harley riders are getting older or aging out completely … and are looking for alternatives. Polaris and rivals are picking off those aging riders … and grabbing market share. And let’s not forget the China threat — which is much bigger than the one from Japan decades ago. As for the foray into electric motorcycles … well, the shine is off EVs for now … and especially for motorcycles. As I know from my own touring activities, much of America is an ‘electric desert.’ A guy like me — who rides a thousand miles at a time … the places I ride … we’re talking 180 to 200 miles between gas stations … let alone between charging stations — I see the electric motorcycle challenges as well as anyone."

There you have it. Harley-Davidson now faces:

An aging traditional customer base.

Competition — from new rivals like China, and new modes of transport like the Slingshot.

An obvious “hole” in its product line.

Wheezing sales … at least in the near-term outlook.

And, especially in the United States, a shift toward electric bikes.

So, is is game over?

Not at all.

Harley is making some interesting moves. And that means the stock is worth a closer look.

In short, Harley has made the journey from a “very special company” to a “special-situation stock.”

INTRIGUING TRIGGERS

What is a special situation?

Well, in simple terms, it’s a collection of catalyzing “triggers” that can provide a near-term price surge in a stock, sector or asset class.

We’re Wealth Builders at heart. And that often makes us Contrarians — at odds with the near-term “wisdom” of the masses. But we like storylines. And one of those storylines is the special situation. The reason: Those special situations are often very Contrarian in nature since we’re taking advantage in a near-term, out-of-whack window that the market is handing us.

Like Harley, where those “triggers” could include:

A rebound (albeit from lower levels).

A buyback push.

And, perhaps ultimately, a buyout of Harley.

Let’s start with the rebound.

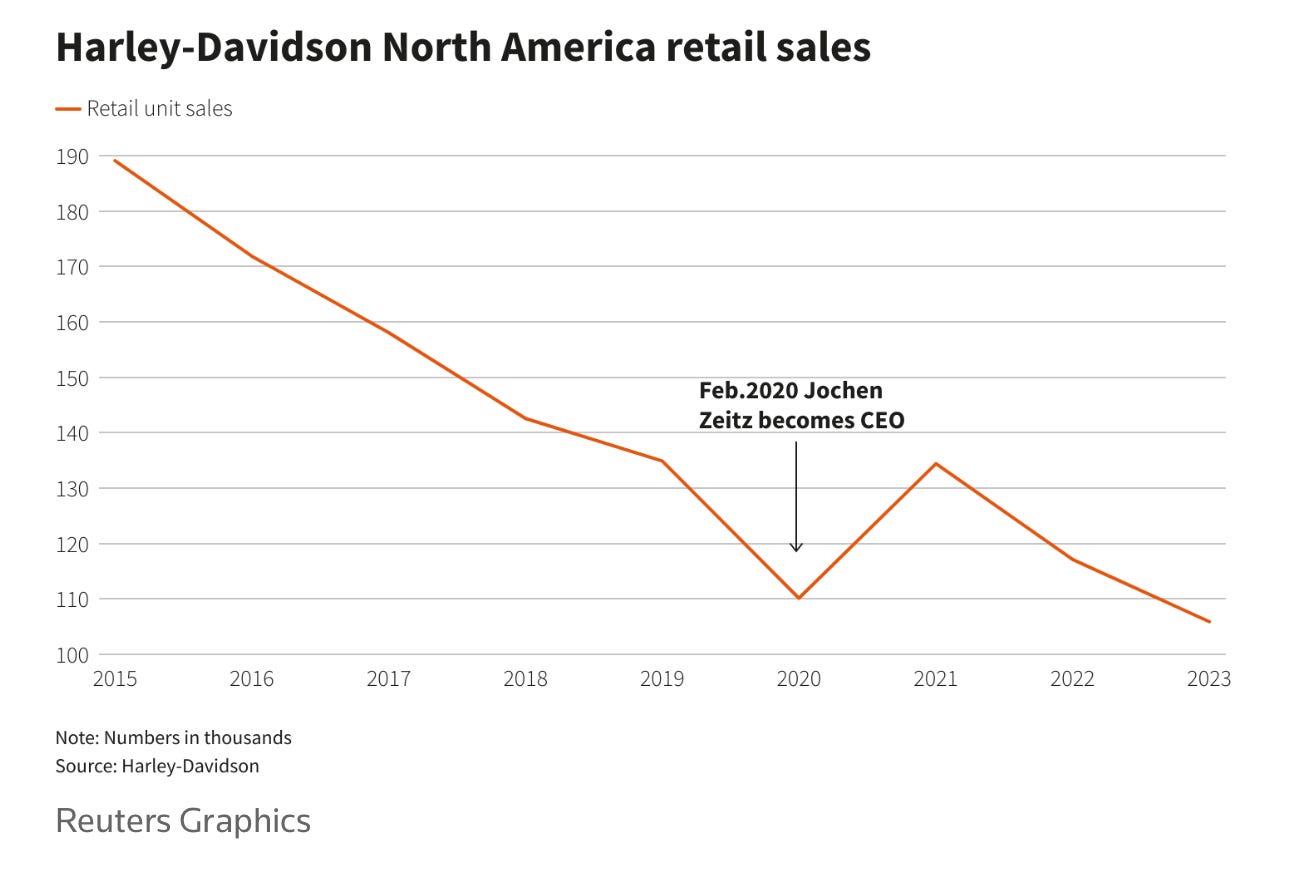

Go back 10 years — to 2014 — when global registrations of Harley bikes were at 345,203, says MotorcyclesData.com.

By 2020, those numbers were slashed by almost exactly half — to 177,078.

“After a one-shot recovery in 2021, sales started to decline again [and in 2023 hit] 169,931,” analysts at the motorcycle data site wrote. Then here, “in 2024, sales are growing again [at an 11% run rate]. This time we believe it is not a short-term recovery, but the start of a new era.”

In plain English, that’s a rebound. But a rebound from a low level — not one that gets the company back to those glory days of the 1980s, or those hefty sales of 2014 (check out the Reuters graphic below).

And that rebound isn’t assured: Harley-Davidson just blew away estimates with its second-quarter results, but it lowered full-year revenue guidance because of sluggish demand.

Then there’s the buyback. The company said it’ll buy back $1 billion of its own stock between now and 2026.

Lastly, there’s the potential for a buyout. Morgan Stanley MS 0.00%↑ recently put Harley on a roster of eight companies that could be takeover plays.

As a veteran stock picker, I can’t emphasize enough that you never buy a stock hoping for a takeover. You want to have to own it — should that deal never emerge.

Besides, with Harley, there has been takeover speculation about Harley since 2010.

So if you bought it hoping for a buyout, there’s only one conclusion: No deal.

That’s the essence of a special situation — a company I’ve watched for more than three decades. And this company in particular has a few “triggers” that make it worth watching.

But it’s not the only opportunity on this list we’ve created for SPC Premium members.

After months of analysis, a series of special conferences devoted just to this, and a series of “culling” reviews where we pared it down to our favorites … the best.

Corporate breakups … buyout candidates … turnarounds … massed buyouts … new products and breakthrough technologies - it has it all.

We’re excited … and I hope you found this look at Harley valuable;