If you find the best storylines, you’ll find the best stocks.

And one of those “best storylines” is still the Artificial Intelligence (AI) Era — despite a new bout of “AI Fatigue” … and a “Great Rotation” where rate-cut hopes have money flowing out of big-cap tech firms and into their small-cap counterparts.

Those investors are playing the short game — using a putter for a tee shot when a driver is what they really need. They may grab some near-term profits. But we’re investing for long-term wealth — because the AI story hasn’t changed.

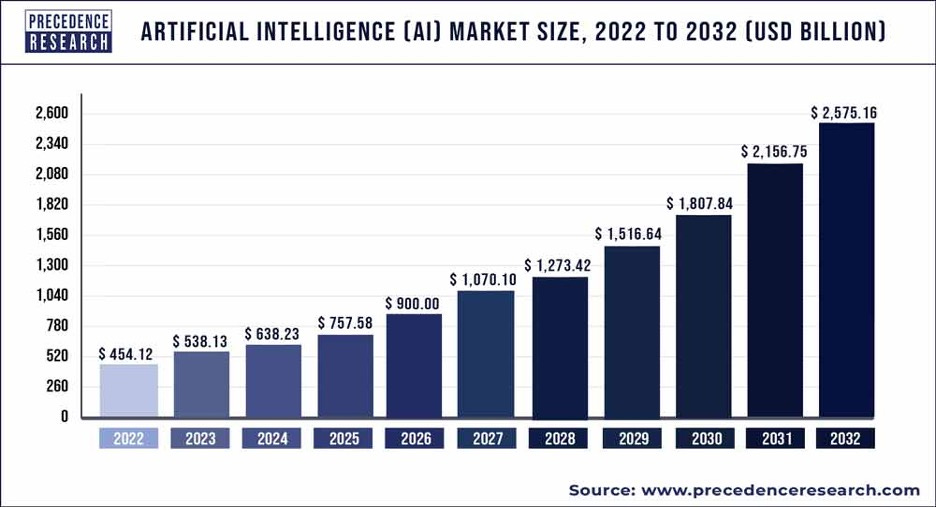

Precedence Research forecasts the global AI market will surge from an estimated $454.1 billion in 2022 to a projected $2.5 trillion by 2032, with growth of 19% annually from 2023 forward.

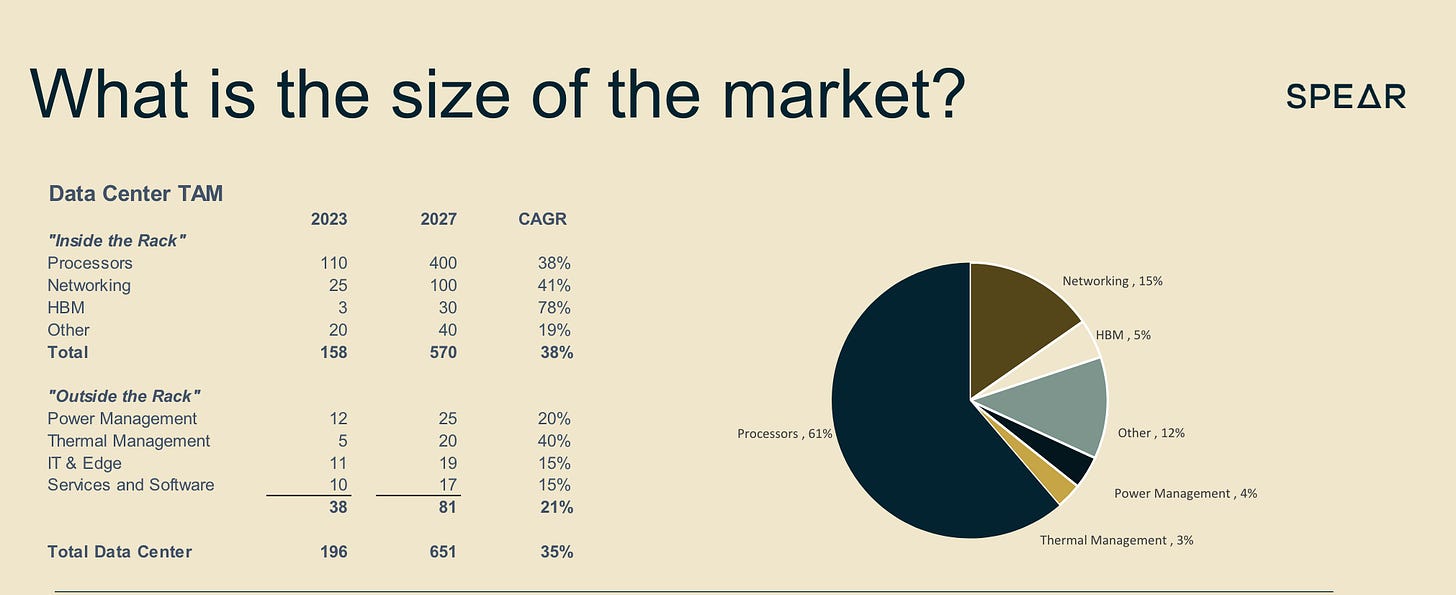

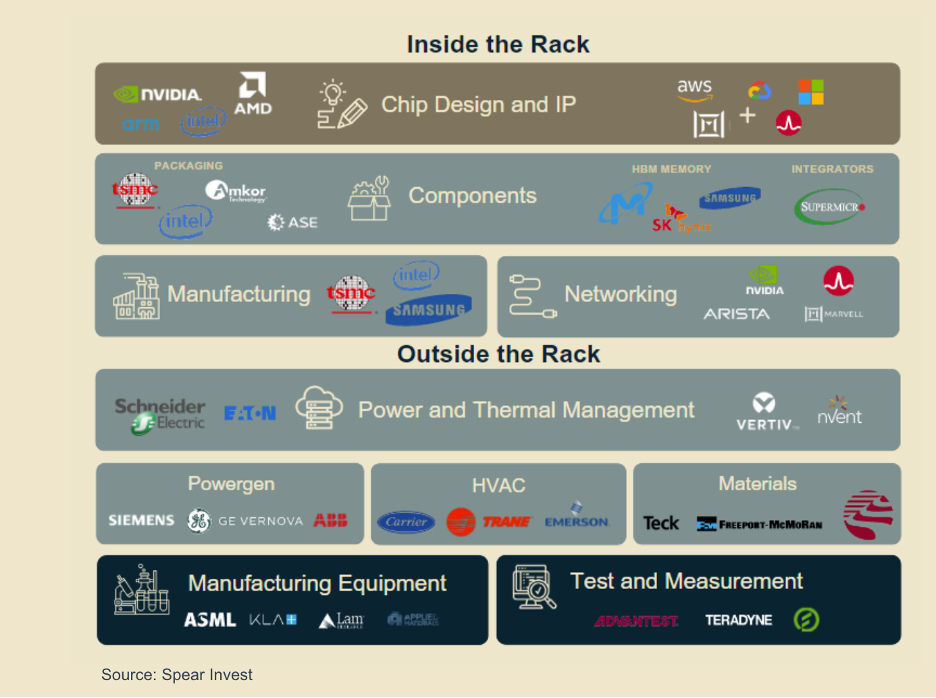

And here are two other exhibits from a recent Spear Invest webinar — which talked about the “Data Center Value Chain” … and the pieces that bring it all together.

It’s a strategy that makes sense to me:

Spear categorized the opportunities that are Inside the Rack and Outside the Rack.

I’m talking about data-center opportunities like:

Applied Materials Inc. AMAT 0.00%↑ , whose equipment makes the semiconductors that serve as their brains.

Amkor Technology Inc. AMKR 0.00%↑ , which tests and packages those microchips.

Carrier Global Corp. CARR 0.00%↑, whose air-conditioning systems keep data centers cool.

And Vertiv Holdings Co. VRT 0.00%↑, which markets pre-fab versions of data centers.

To “put a name with a face” — since some of these companies are OTC or foreign-listed — I assembled a “cheat sheet” based on the Spear chart.

Editor’s Note: Some of these companies are already in our SPC Premium service — either in the Model Portfolio or on our Farm Team (a full list of stocks we’re watching that could get “called up” to the Model Portfolio).

It’s an opportunity so massive that we’ll be following it for you for years to come.

And we’ll have a special report on “AI Energy” in the weeks ahead.

Inside the Rack

Chip Design and IP

Nvidia Corp. NVDA 0.00%↑

Arm Holdings ARM 0.00%↑

Intel Corp. INTC 0.00%↑

Advanced Micro Devices Inc. AMD 0.00%↑

Amazon.com Inc. AMZN 0.00%↑

Marvell Technology Inc. MRVL 0.00%↑

Alphabet Inc. GOOG 0.00%↑

Broadcom Inc. AVGO 0.00%↑

Components (Packaging)

Taiwan Semiconductor TSM 0.00%↑

Intel Corp. INTC 0.00%↑

Amkor Technology Inc. AMKR 0.00%↑

ASE Technology Holding Co. Ltd. ASX 0.00%↑

Components (HBM Memory)

Micron Technology MU 0.00%↑

SK Hynix Inc.

Samsung Electronics Co.

Components (HBM Memory)

· Super Micro Computer Inc. SMCI 0.00%↑

Manufacturing

Taiwan Semiconductor TSM 0.00%↑

Intel Corp. INTC 0.00%↑

Samsung Electronics Co.

Networking

Nvidia Corp. NVDA 0.00%↑

Arista Networks Inc. ANET 0.00%↑

Marvell Technology Inc. MRVL 0.00%↑

Broadcom Inc. AVGO 0.00%↑

Outside the Rack

Power & Thermal Management

Schenider Electric (SBGSY)

Eaton Corp. ETN 0.00%↑

Vertiv Holdings Co. VRT 0.00%↑

nVent Electric NVT 0.00%↑

Powergen

Siemens AG (SIEGY)

GE Veranova Inc. GEV 0.00%↑

ABB Ltd. (ABBNY)

HVAC

Carrier Global Corp. CARR 0.00%↑

Trane Technologies TT 0.00%↑

Emerson Electric Co. EMR 0.00%↑

Materials

Teck Resources Ltd. TECK 0.00%↑

Freeport-McMoran Inc. FCX 0.00%↑

Southern Copper Corp. (SCCO)

Manufacturing & Equipment

ASML Holding ASML 0.00%↑

KLA Corp. KLAC 0.00%↑

Lam Research Corp. LRCX 0.00%↑

Applied Materials Inc. AMAT 0.00%↑

Test and Measurement

Advantest Corp. (ATEYY)

Treadyne Inc. TER 0.00%↑

Fortive Corp. FTV 0.00%↑

Keep watching;

P.S. Get a head start here with our free report on data-center heavyweight Blackstone Inc. BX 0.00%↑— which CEO Stephen Schwarzman recently said “is positioning itself to be the largest financial investor in AI infrastructure in the world.”