Back in 2012, when I was running a stock picking newsletter at another company, I saw that Big Pharma was careening toward a “patent cliff,” a tight window when a swath of important drugs lose their patent protections – all at the same time.

You see, I’d spent years covering biotech – first as a business reporter and then as an analyst and stock picker. So I already knew how that patent-cliff “story” would end: Lots of deep-pocketed Big Pharma players would go on shopping sprees – looking to restock their all-important drug pipelines.

So I put together a special report “The Biotech Buyout Binge” – and assembled a list of up-and-coming innovators with promising drugs.

My reasoning: These were companies that had standalone promise — and at least a couple were almost certain to end up as buyout targets.

One of those companies was blood-cancer biotech Pharmacyclics. My early call on Pharmacyclics handed my Private Briefing subscribers an 818% windfall when that company was bought out by AbbVie Inc. ABBV 0.00%↑ a few years later.

You can see where I’m going here: Find the best stories … and you’ll find the best stocks.

Find the best stocks … and you’ll really cash in.

And right now, biotech is one of the best stories going.

And there’s one biotech story that ranks above all.

And I’m calling this Wealth-Builder tale: “The Hunt For the Next Blockbuster.”

And one blockbuster in particular.

The “New Math” — Biotech Style

The ‘First Blockbuster” was the antacid drug Tagamet, which hit $1 billion in sales in 1986. The two biggest of late (besides the COVID-19 vaccines) are the AbbVie arthritis-battler Humira, with peak yearly sales of about $22 billion, and the Merck & Co. MRK 0.00%↑ anti-cancer drug Keytruda, which rings the register at about $21 billion a year.

“While this list [of top-selling drugs] is generally fairly static from year to year, just three of the current Top 10 drugs will remain among the highest sellers by 2028,” Daniel Chancellor, thought leadership director for Citeline, predicted during an interview with PharmaVoice at the close of 2023.

As I know from my decades of work, finding that “Next Blockbuster” isn’t easy. Blockbusters are long shots for companies to create. And an even longer shot for investors to handicap.

One lesson that can help you is one I learned early. I call it “Biotech Math.”

And it consists of these five simple points:

1. It takes more than a decade and as much as $2.6 billion to develop a new drug.

2. On average, only about 250 drug candidates out of 5,000 to 10,000 make it from the researcher’s bench to preclinical testing – and only one or two make it to market approval.

3. Fully 90% of drug candidates that actually make it into clinical trials fail to make it through the three-stage U.S. Food and Drug Administration process for market approval.

4. Once a drug achieves approval, gross margins can exceed 90% – albeit not forever.

5. These pharma creators only have 20 years of patent protection for a drug – half or more of it gets eaten up by development and approval. (After which generic contenders can drain away 90% of sales.)

Here’s the thing: We have an early glimpse of what malady that “Next Blockbuster” window will focus on.

I’m talking “weight loss.”

Goldman Sachs recently predicted the market for weight-loss drugs would zoom from about $19 billion last year to $100 billion by 2030.

You’ll see those sales start ramping up here in 2024, as the percentage of U.S. employer health plans covering weight-loss drugs jumps from 25% to a projected 43%.

Big Pharma and biotech companies have a vested interest in maximizing the revenue from all their new discoveries.

In a strategy known as “label expansion,” these companies develop a drug to treat one malady — but have a massive incentive to uncover new uses for each new drug they get approved.

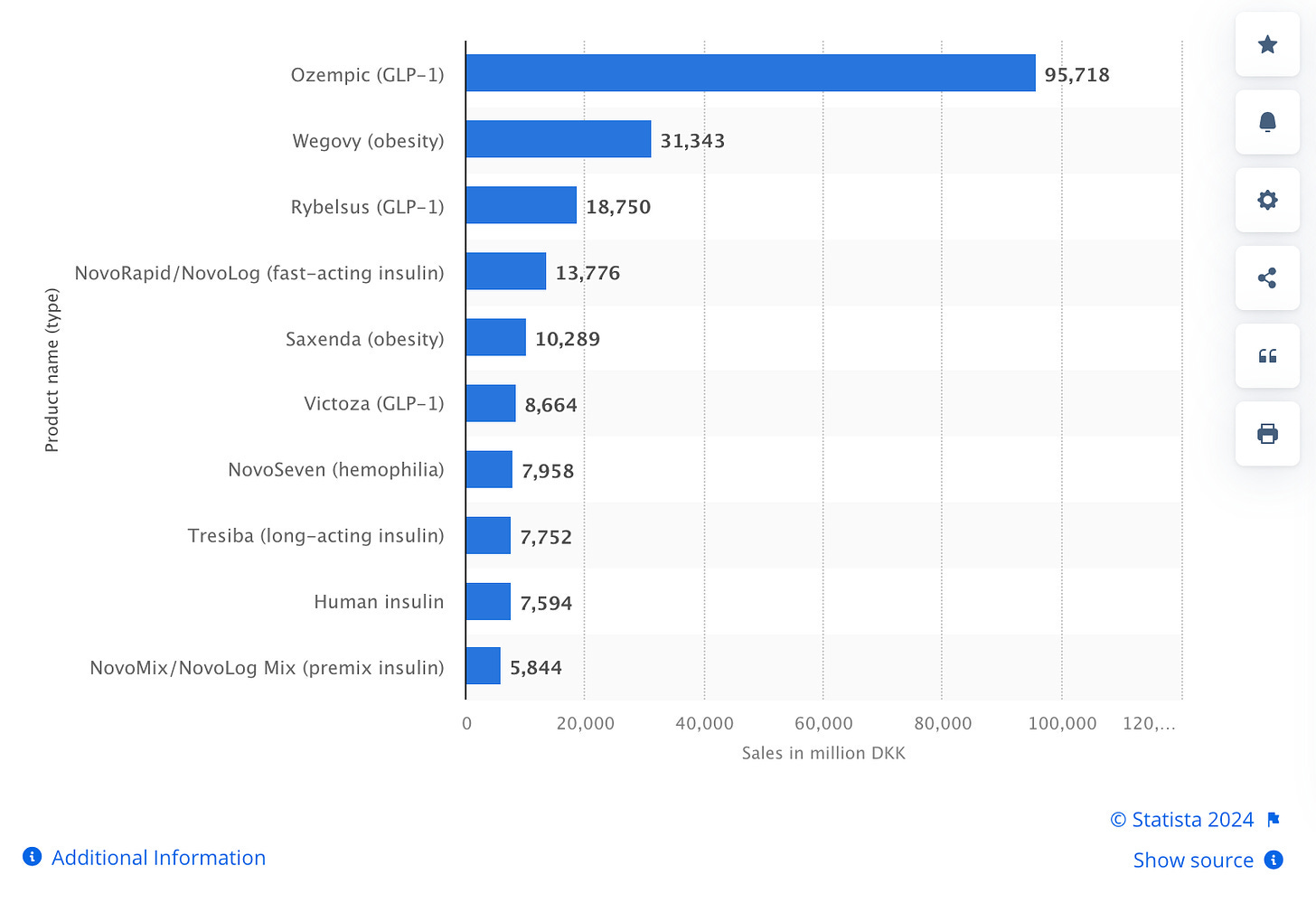

We’re seeing it now with the Novo Nordisk NVO 0.00%↑ drug Ozempic.

The Ozempic Effect

While originally developed for people with Type 2 diabetes, Ozempic demonstrated a potentially beneficial side effect: Weight loss.

One study found that, on average, patients on Ozempic lost 5.9% of their body weight in three months. In six months, people lost 10.9% of their body weight.

Now sales for Ozempic are booming.

Those sales nearly doubled from $4.76 billion in 2021 to $8.44 billion in 2022. In 2023, Ozempic sales topped $13.9 billion.

Early follower Eli Lilly & Co. LLY 0.00%↑ has also jumped into the game. It generated $5 billion last year with its own diabetes drug — Monjouro — and won approval for a weight-loss version, Zepbound, in December 2023.

Once the “Ozempic” secret was out last year, patients had trouble getting orders filled. Both Novo and Eli Lilly say they’re ramping up capacity, with Lilly specifically investing $4 billion to build two new plants in North Carolina. And Novo just announced plans to buy New Jersey contract manufacturer Catalent, a $16.5 billion deal that will give the Danish Pharma giant more production capacity.

With the additional health-plan coverage and boosted consumer awareness, Novo and Lilly will need the extra capacity. And when you have supply ramping up to meet pent-up demand for a hit product that’s zooming toward “blockbuster status,” you’re looking at a massive potential stock-price trigger.

We’re still in the early chapters of this storyline. And the plot will thicken – thanks to that “Biotech Math” I mentioned a moment ago.

I know how rare an opportunity it is for retail investors to invest in the earliest stage of a runaway “blockbuster” drug like this one. That’s the power of our “storyline” strategy … you find the best storylines, you’ll find the best opportunities — and the best stocks.

And this “Next Blockbuster” narrative is one of those stories we’re following.

We’ll keep you posted here in Stock Picker’s Corner (SPC).

See you next time …