These “Biotech Rules” Delivered an 818% Winner

And those same rules just spotlighted this stock ...

Let me tell you folks a story …

Back in 2012, a tiny biotech firm called Pharmacyclics created a new blood cancer drug – just as a slew of Big Pharma players were losing key patents.

I knew this drug – called Imbruvica – was a blockbuster in the making. I knew we’d be getting in early. And with so many Big Pharma firms careening toward the so-called “patent cliff,” I knew an outright buyout was more than possible.

In short, I knew there were two ways to win: We’d either let the blockbuster storyline playout – or we’d be richly rewarded with a takeover.

Either Imbruvica’s blockbuster revenue would rocket Pharmacyclics’ stock into the stratosphere, or a big drug company – desperate to restock its patent-cliff-drained pipeline – would achieve the same result by buying the company outright.

So I recommended Pharmacyclics shares to my Private Briefing subscribers.

I even predicted the company would end up as a buyout play.

I was right.

And we scored.

In March 2015 – so a mere three years later –Pharmacyclics was sold to AbbVie Inc. ABBV 0.00%↑ for $21 billion. And the Private Briefing subscribers who followed my reports pocketed gains of as much 818%.

I can hear you now: “Okay, Bill, we dig the story … but why are you telling it here?”

I’m glad you asked.

Because I’m now going to share another story – a tale for Wealth Builders that I call: “The Hunt For the Next Blockbuster.”

And here’s a “spoiler alert:” This second story has an even better ending than the first one.

I’ve found that “Next Blockbuster.” I’ll tell you what the company is. I’ll show you the “clues” that led me to it. And I’ll show you some brand-new early “proof points” that say I’m right.

Again.

Breadcrumbs That Lead to Winners

Let’s start by defining the term: A blockbuster is a drug that generates sales of at least $1 billion a year for the company that sells it.

The “First Blockbuster” was the antacid drug Tagamet, which hit $1 billion in sales in 1986. The two biggest of late (besides the COVID-19 vaccines) are the AbbVie arthritis-battler Humira, with peak yearly sales of about $22 billion, and the Merck & Co. MRK 0.00%↑ anti-cancer drug Keytruda, which rings the register at about $21 billion a year.

There obviously has been many others, too.

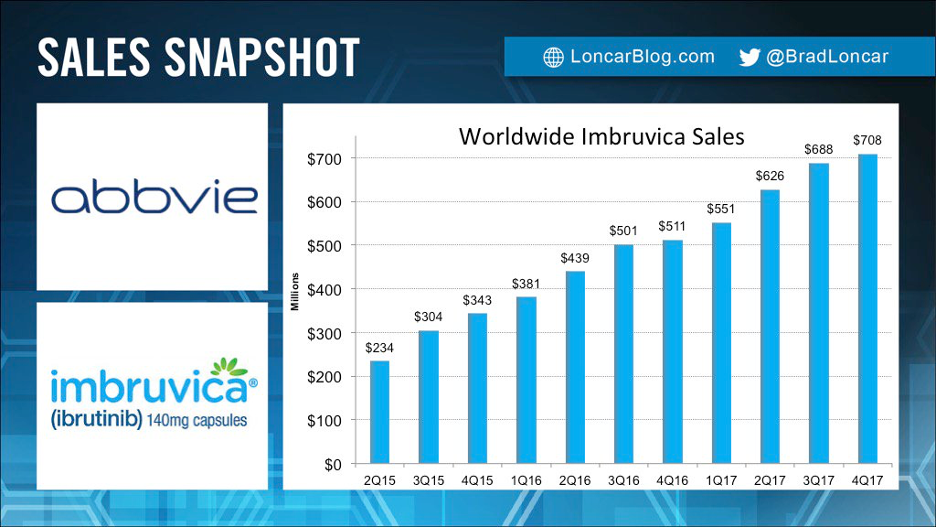

Just look at how Imbruvica has done:

And the formula that led me to that drug – and the windfall stock play I found and recommended as a result – is being put to use again here … for you.

The formula is really a three-step checklist. And here it is:

Step No. 1: Identify that “Next Blockbuster” – Find a new drug that’s going to get to $1 billion a year in sales … and rise from there.

Step No. 2: Identify It Early – If you find the drug early, and grab the company’s shares, you can ride that baby during years of patent-protected growth. And the revenue can be magnified via so-called “label expansions” – when the drug’s creator finds additional uses or maladies it can effectively treat.

Step No. 3: “Accumulate” Your Way to Wealth – You build a “foundational stake” in the stock, and during the early-going add to your holdings on pullbacks.

It’s a simple formula. And a powerful one, too.

I used it with Pharmacyclics and Imbruvica. And I’m going to use it again here – with Eli Lilly & Co. LLY 0.00%↑, and its weight-loss-related drugs Mounjaro and Zepbound.

Twin Wealth Builders

Here in 2024’s early going, we declared this to be the “Year of Weight-Loss Drug Stocks.”

Eli Lilly jumped into the weight-loss game. It generated $5 billion last year with its own diabetes drug — Mounjaro, which has weight-loss benefits — and won approval for a weight-loss version, Zepbound, in December 2023.

Danish drug firm Novo Nordisk NVO 0.00%↑ is a player, too – even getting the early drop with “Ozempic.” Sales of that drug nearly doubled from $4.76 billion in 2021 to $8.44 billion in 2022. In 2023, Ozempic sales topped $13.9 billion. Once the “Ozempic” secret was out last year, patients had trouble getting orders filled.

Make no mistake: This “Next Blockbuster” story is a Wealth Builder Tale.

Goldman Sachs recently predicted the market for weight-loss drugs would zoom from about $19 billion last year to $100 billion by 2030.

I predicted that sales would begin their jet-trail-emitting surge here in 2024, as the percentage of U.S. employer health plans covering weight-loss drugs jumps from 25% to a projected 43%.

With the additional health-plan coverage and boosted consumer awareness, Novo and Lilly will need the extra capacity. And when you have supply ramping up to meet pent-up demand for a hit product that’s zooming toward “blockbuster status,” you’re looking at a massive potential stock-price trigger for both Novo and Lilly.

But let’s focus on Lilly …

Boosted Guidance Sends a Signal

Eli Lilly’s just-released first-quarter earnings report shows us it’s time to make your move.

The Quick Recap

Earnings per share (EPS) of $2.58, beating expectations of $2.48.

Revenue of $8.77 billion, falling short of the $8.94 billion forecast. But there’s a quirk at play here: The revenue shortfall was due to the supply of one of its weight-loss drugs not keeping up with demand – more on that in a second.

Gross margin improved to 80.9% – up from 76.6% at the same time last year.

Eli Lilly’ boosted its full-year guidance – from a previous $41.44 billion to a range between $42.4 billion to $43.6 billion.

Boosting “guidance” is bullish – and was due to surging demand for its weight-loss drug Zepbound, as well as its off-label weight-loss drug Mounjaro.

Zepbound – which just won Food and Drug Administration approval in December – racked up sales of $517.4 million, thrashing estimates of $418.20 million.

Mounjaro’s sales of $1.81 billion were short of analyst’s expectations of $2.08 billion, but that was largely due to supply not keeping up with demand – and Eli Lilly is working on solutions to meet that demand.

The company will have a North Carolina facility producing Zepbound and Mounjaro up and running by the end of the year. It just broke ground on a manufacturing site in Germany. And it plans to acquire Nexus Pharmaceuticals to produce injectable medicines.

This still gives you time to move – now.

Blockbuster drugs are the ‘Holy Grail’ for biotech firms and biotech investors alike. And, for investors, getting in at the very start of a Next Blockbuster ramp up is a true Wealth Building move.

That’s us … we’re Wealth Builders.

And we’re playing the long game here. The long game smooths out near-term bumps like this. Because we see the opportunity … we see the upside … and it’s huge.

See you next time.