It’s the “First AI War” – And It's Silently Supercharging the “AI Era”

Find the best storylines and you’ll find the best stocks. And AI is a storyline all by itself ...

They were known as “forward air controllers” – or FACs, for short. And they flew low and slow over the jungles of Vietnam, directing air strikes for fast jets whose bombing runs protected American troops on the ground.

We’re talking about gutsy pilots flying some of the most crucial – and deadliest – missions of the Vietnam War.

Guys like Peter Condon, a Royal Australian Air Force (RAAF) fighter pilot who directed air strikes from a USAF Cessna 0-1A Bird Dog – a lumbering, single-engine plane known as the “jeep with wings” whose cousins are hangered at local air strips even today.

Droning low over Vietnam’s thick jungle canopies, ACs like Condon targeted the enemy with white phosphorous rockets – despite withering gunfire. FAC airplanes – the ones that came back – were hit by as many as 50 rounds during a single mission.

"There were about 230 forward air controllers killed in the Vietnam War,” Condon recalled in a video interview for the Australia’s Department of Veteran’s Affairs. “I would say it was probably the most dangerous occupation in Vietnam – in the air anyway."

That’s how you targeted the enemy back in 1968. But artificial intelligence (AI) technology has changed the game in warfare, just as it’s revolutionizing so many other parts of our lives.

In this report, I’ll show you the changes … the opportunities AI is creating for investors … and some of the key “Wealth Builder” moves to make right now.

I’ll do all that. But let me tell you about another conflict – one some experts are referring to as “The First AI War.”

World War – From the Other Side of the World

Let’s fast-forward nearly six decades …

From the war in Vietnam (and Laos) to the conflict between Russia and The Ukraine.

From low-and-slow flying Bird Dogs to high-and-fast flying satellites.

From those low-tech white smoke rockets to high-tech (and full-colored) computer screens.

And from human FACs to digital (artificial) “stand-ins.”

Just think about what I’m really saying here. In Vietnam, a guy like Peter Condon had to put himself in harm’s way, willingly (and courageously) putting himself right over the action to find those “targets” – and, because of it, acting as a target himself.

But with the advancements in AI, the “FACs” of today can be anywhere … they can pick out targets on a Ukrainian battlefield while starting at a computer screen and sipping coffee in an air-conditioned office in Kyiv … or London … or Nevada.

That’s right … instead of forcing gutsy aviators in tiny planes through fusillades of groundfire to identify enemy targets … tech specialists sitting in offices on one side of the world are taking data from field sensors, reconnaissance drones and satellites, parsing it through AI algorithms, and hitting enemy targets on the other side.

And a stealthy AI company called Palantir Technologies Inc. PLTR 0.00%↑ is doing exactly that in the Russia/Ukraine War, journalist Bruno Macaes wrote in a recent Time magazine story, “How Palantir is Shaping the Future of Warfare.”

“Increasingly, the real battle will take place not on the ground and not in space but inside computer code,” wrote Macaes, who also authored the book Geopolitics for the End Time.

“The target coordination cycle: find, track, target, and prosecute. As we enter the algorithmic age, time is compressed. From the moment the algorithms set to work detecting their targets until these targets are prosecuted — a term of art in the field — no more than two or three minutes elapse.”

I’ve opened this report with a comparative anecdote about how AI is changing warfare – and for good reason: It’s not a story most folks know about … yet.

But don’t think for a minute that this this weapons-and-wartime storyline is the be-all/end-all for AI’s impact.

It’s not.

Our mantra here at SPC is simple and powerful: Find the best storylines and you’ll find the best stocks. And AI is a storyline all by itself.

One that will deliver some of the best “Wealth Builder” windfalls of our time.

It's Not Paradigm Shift … It’s Paradigm Shock

Welcome to the “Artificial Intelligence Era” – where we’re likely to see the biggest changes of our lifetimes … and the greatest wealth creation.

But it won’t come all at once. It’s likely to ebb and flow. And that means it’ll be a bumpy ride.

But years from now – once we look back and see how far we’ve traveled – we’ll understand that the changes were massive in scope.

The experts refer to change of this magnitude as a “paradigm shift.” And AI’s “shift” is sure to be a shocker.

AI isn’t an incremental technology. It’s downright disruptive – meaning we’re in for a lot of changes. Whether those changes are good or bad will probably depend on where you’re sitting – and how they impact your life.

At one time or another, you’re likely to experience both extremes.

For some companies, some professions and even some individual consumers or workers, AI could be a “Wealth Killer” as it upends – or obliterates – the status quo.

However, as former General Electric Co. GE 0.00%↑ CEO Jack Welch once said: “When there’s change, there’s opportunity.”

And for folks like you and me, that kind of “opportunity” means AI will be a true “Wealth Builder.”

Big Numbers = Big Opportunity

Different forecasts put different dollar values and different growth rates on the AI market.

But they agree on two things:

It’ll grow fast.

And it’ll get big.

Here’s a sampling.

Researcher Market Growth Reports says the worldwide AI market will grow from about $67.4 billion in 2022 to a forecasted $501.8 billion by 2026, a compound annual growth rate (CAGR) of 39.73% during that short run.

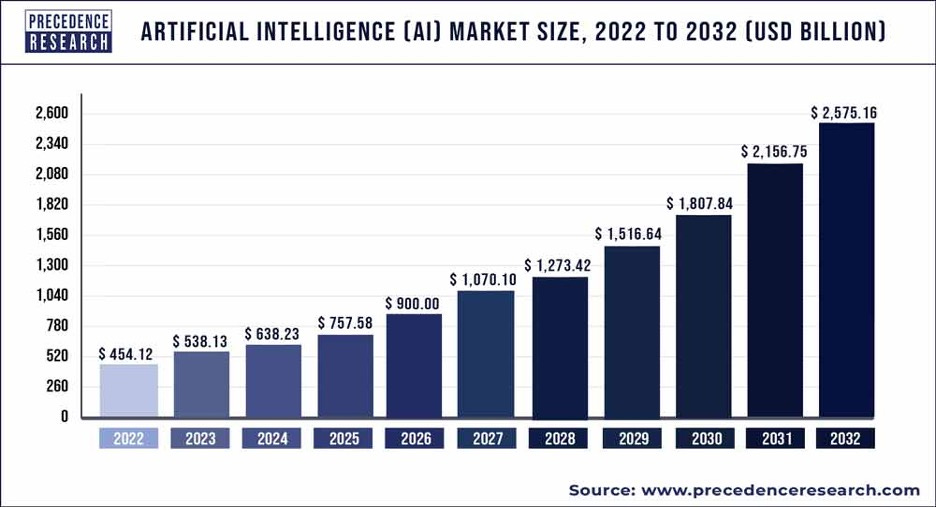

Precedence Research projects a bigger upside, with a slightly slower growth rate.

According to Precedence, the global AI market will surge from an estimated $454.1 billion in 2022 to a projected $2.5 trillion by 2032, with a CAGR burst of 19% from 2023 forward.

The U.S. slice of that market will surge from $103.7 billion to a forecasted $594 billion during that same 10-year stretch — also a CAGR of about 19%, Precedence says.

With an estimated value of about $167.3 billion, North America accounted for 36.84% of that AI market in 2022. And if you wanted to break the global AI market into pieces, the two biggest pieces were “deep learning” (36.36%) and services (39.64%), the Precedence researchers said.

Here’s a candid caveat: Forecasting anything a decade into the future with any degree of exactitude is a fool’s errand.

But that’s okay.

While I guarantee you these projections will change over time … the magnitude of these forecasts show us what’s headed our way.

And that shows us that AI is a massive “Wealth Builder” — an opportunity for anyone who picks the right stocks and who gets started now.

There’s Nothing Artificial About This Intelligence

Artificial intelligence is one of those rare things whose name really describes what it is.

Granted, I’m vastly (and intentionally) oversimplifying this. But we’re essentially talking about using super-high-powered computers to simulate human thinking.

You’ll hear more and more about such innovations as machine learning, machine vision, speech recognition, generative AI and natural-language processing. AI systems are fed massive amounts of data, looking for patterns or correlations to “learn” how to do work usually done by people.

AI will help limit mundane tasks (things like data entry), identify threats and implement home-security measures. It’ll put self-driving vehicles on the roads, in the air and on and under the global seas, to list a couple of examples. The future uses will boggle the mind – limited only by the inventiveness of creators around the world.

And the spinoff benefits created will be equally mind-boggling.

Take “generative AI” – the flavor of artificial intelligence that can create images and text replies on command. Just that slice of the AI market has direct and indirect economic benefits of $6.1 trillion to $7.9 trillion a year, says consultant McKinsey & Co. With those numbers, if generative AI was a country, it would’ve been the world’s third-largest economy in 2022, trailing only the United States and China, according to the reference website Worldometer.

But every innovation is accompanied by a whole lot of “noise.”

Take the dot.com/dot.bomb boom-and-bust. For every prospect like Amazon.com Inc. AMZN 0.00%↑ , there are even more suspects like Pets.com (which Amazon ironically invested in) which raised $82.5 million in its February 2000 IPO, but filed for bankruptcy nine months later.

We’ll see the same with AI.

For AI profit opportunities, I’m cutting through the noise and focusing on the innovations that can supercharge a company’s products and services, increasing productivity and cutting costs.

An integral part of the “Artificial Intelligence Era” is data. If you can organize it better and analyze it faster, you can make better decisions and dynamically improve your company.

Two examples that may surprise you are McDonald’s Corp. MCD 0.00%↑ and Wingstop Inc. WING 0.00%↑.

Back in December, McDonald’s announced a partnership with Alphabet Inc. GOOG 0.00%↑, GOOGL 0.00%↑ that’ll let Mickey D’s use the Google Cloud to track things like food freshness and equipment outages. And it’s likely integral to the Golden Arches’ move to automate with new kiosks and food-delivery robots.

In March 2023, chicken-wing chain Wingstop tested a pilot program where an AI voice assistant took phoned-in orders — and even make recommendations. While this was pitched as a time-saver — it let Wingstop employees focus on order filling — it’s actually also a data play: Wingstop can harvest the data to identify trends — like the menu items that are selling best — and create revenue-boosting “upsell” opportunities.

With their proprietary apps and the data they gleam from them, McDonald’s and Wingstop can boost their respective businesses: They can nurture repeat buying, recommend menu items and judge which products to promote and which to ditch. And they can tailor all of them to different markets and different times of the year.

Taking Stock(s)

Now, as the name of our Substack makes clear, I’m a stock picker at heart.

And I will be with AI, too.

Make no mistake: As we saw with the Internet (another paradigm-shifting era I analyzed, wrote about and invested through), AI investing will be volatile. AI stocks are sure to get “overheated” during different parts of our journey – meaning the prices of what we own will get whipsawed.

If you want to benefit from AI’s Wealth Builder potential – while smoothing out that volatility a bit – consider starting with an ETF. You can still invest in individual companies. Just think of the ETF as a “great foundation” on which you can build a great house.

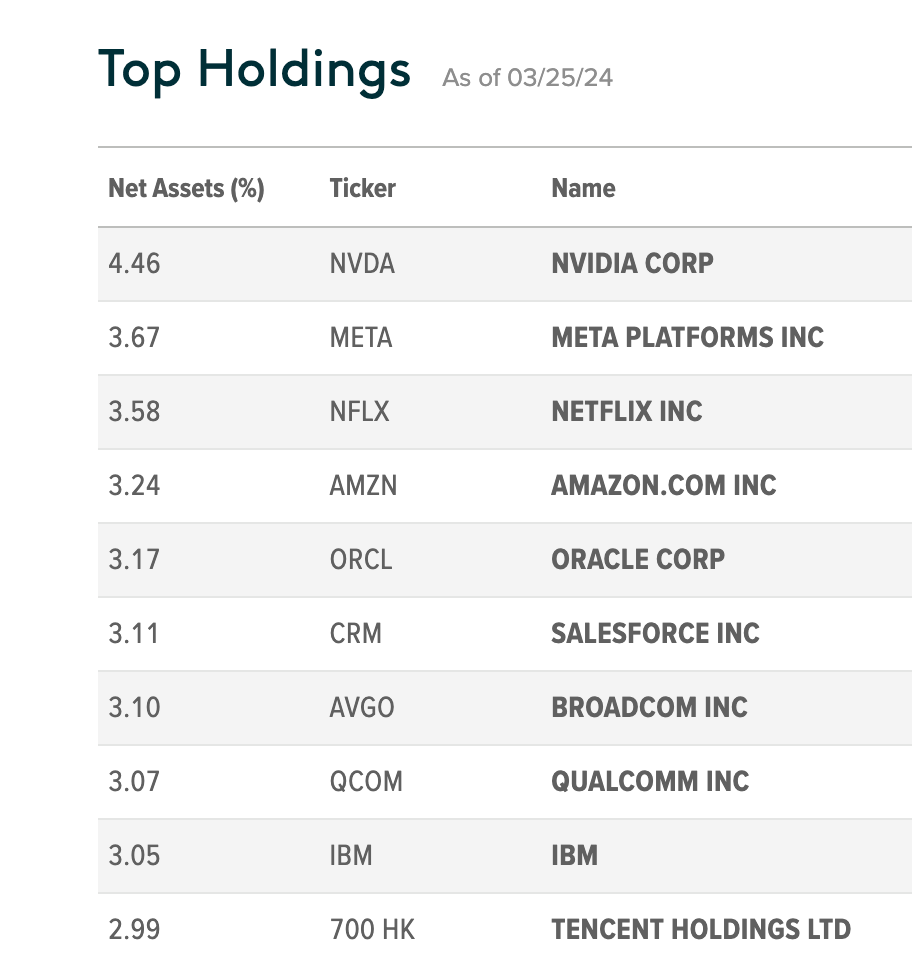

One that’s worth a look is the Global X Artificial Intelligence and Technology ETF AIQ 0.00%↑.

Its top holdings include familiar names like Nvidia Corp. NVDA 0.00%↑, Broadcom Inc. AVGO 0.00%↑ and IBM IBM 0.00%↑:

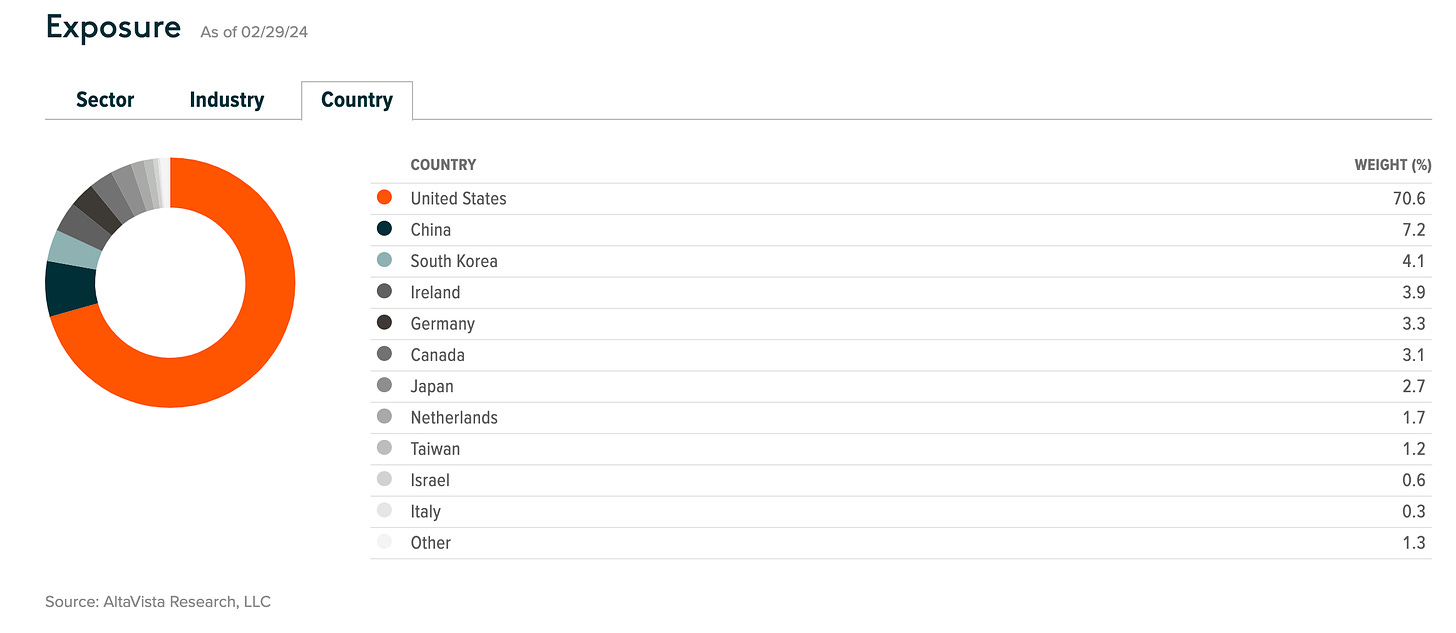

But it also has overseas holdings for “global” AI investment exposure to broaden the moneymaking opportunities.

Over the last year, Global X has also handily outperformed the S&P 500.

That’s just for starters, of course.

The bottom line: Given our mantra that if you “find the best storylines, you’ll find the best stocks, we strongly view AI as a major “Wealth Builder” storyline.

And it’s one of several that we’ll be following here – including three that we’ve already talked about. Check out our reports on “Wealth-Building” opportunities in:

Inflation and Income, which also includes this special interview about silver.

The “New Cold War” (Special Report No. 1 and Special Report No. 2).

And the “Next Blockbuster Era” in biotech.

As a guy who’s been making his living with words for four decades, I’ve constantly hunted for those great stories … meaning stories that make a difference for the folks in my audience.

And I’ve got plenty left in the tank.

For SPC followers and subscribers like you, I want to share the stories that matter, tell you which ones to tune out, and help you achieve the greatest of goals: Control over your own future.

Hope you keep coming back … to visit our little “corner” of the world.

See you next time;

Thank you for these insights Stocker Picker's Corner.

One reality of the New Cold War is that we're adding to the potential "theaters of operation."

Think of it as the potential battlefields of the future (i.e. the new places to fight).

The military skirmishes of the future will include outer space ... and cyberspace ...

And this Stock Picker's Corner report spotlights both -- as well as one of the biggest potential beneficiaries we're watching right now.

https://stockpickerscorner.substack.com/p/russias-targeting-our-satellites