Visualizing the AI Boom: A "Power Play" for Profit

The companies that feed AI data centers ...

When we released our “Visualizing the AI Boom” issue on August 2, at the time, the growing narrative was that investors were ditching AI stocks and flooding into small-cap plays.

A so-called “Great Rotation.”

But we told you to tune out that short-term noise; the long-term AI Era storyline is far too compelling to ignore.

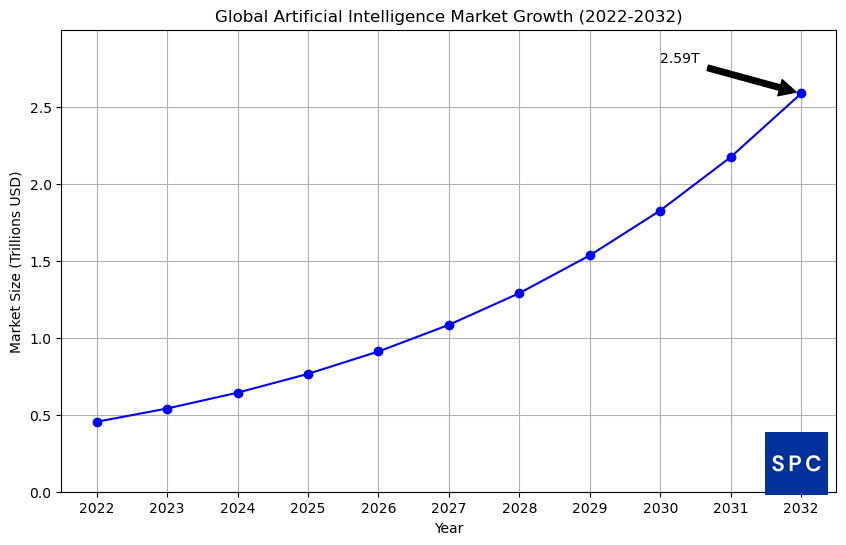

Precedence Research forecasts the global artificial intelligence market will surge from an estimated $454.1 billion in 2022 to a projected $2.5 trillion by 2032, with growth of 19% annually from 2023 forward.

The takeaway: We’re in the early innings of the AI Era — meaning we’ve got lots of time to establish foundational positions and accumulate our way to wealth in the leading companies.

Some of those leaders are energy firms, as someone has to keep those energy-hungry data centers fed.

As a recent “proof point,” Microsoft Corp. MSFT 0.00%↑ signed a 20-year agreement with Constellation Energy Corp. CEG 0.00%↑ to restart the infamous Three Mile Island nuclear plant for its data centers, with Constellation aiming to have it operational by 2028.

Morgan Stanley MS 0.00%↑ gave us additional fodder, saying power demand for generative AI (used to create text, images, video, and audio) will skyrocket 70% each year through 2027. By the end of that span, the power demand for generative AI could equal the electricity used by Spain in 2022.

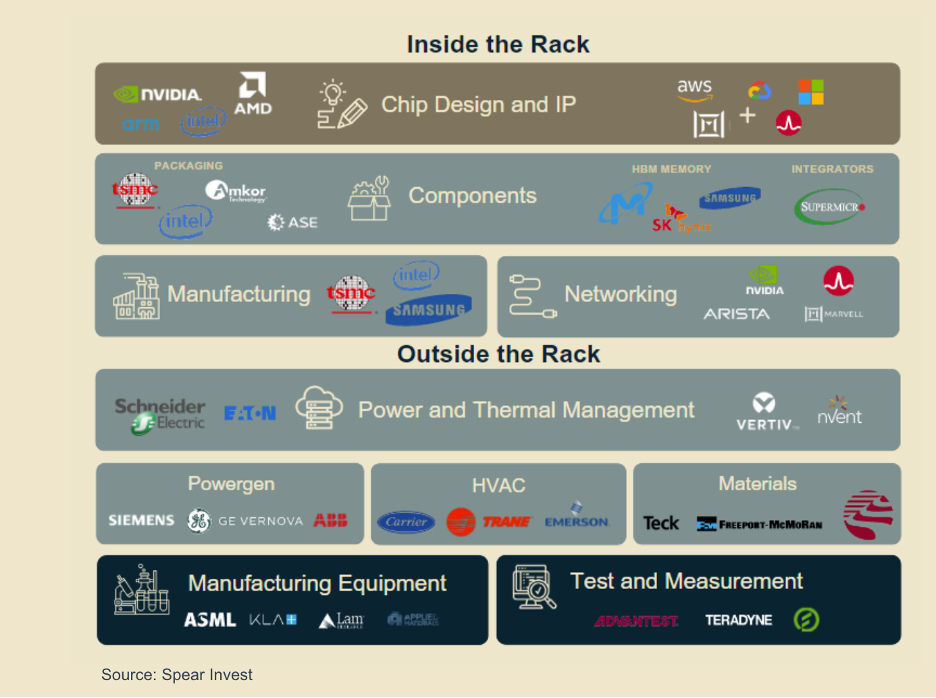

The global data center build-out will trigger a wave of energy investments, and that will open up all sorts of new ways to invest in AI as tech asset manager Spear Invest shows us below:

Today, we’re going to dive deeper into those “Outside the Rack” opportunities that include “Power and Thermal Management” and “Powergen.”

This is an introductory overview and the companies we are about to look at run the gamut in terms of products and services, with some of their offerings overlapping. So we’ll focus on what the companies see as their core businesses or strengths.

Power and Thermal Management

Schneider Electric (SBGSY)

Quick Briefing: With its Uninterruptible Power Supplies (UPS) systems, Schneider keeps data centers running even during power outages. Its Data Center Infrastructure Management (DCIM) software provides remote monitoring of efficiency and power use. And it offers cooling systems — a big deal given all the heat data centers create.

Eaton Corp. ETN 0.00%↑

Quick Briefing: With UPS and cooling-system offerings, there’s some of that mentioned overlap between this company and Schneider. But Eaton has a bigger presence in North America and focuses more on the maximization of electricity availability and quality, while Schneider focuses more on improving energy usage — or reducing it outright.

Vertiv Holdings Co VRT 0.00%↑

Quick Briefing: From design to continued maintenance, Vertiv offers something for every stage of a data center’s lifecycle. Its modular offerings allow companies to expand capacity quickly. It also markets cooling solutions and management and monitoring tools.

nVent Electric NVT 0.00%↑

Quick Briefing: nVent’s advanced liquid-cooling solution is the company’s big selling point since it’s pitched as an improvement over traditional air-cooling methods. It also has hybrid cooling systems, which lets data centers prepare for new advances to avoid the stop-and-restart costs of total overhauls.

Powergen

Siemens AG (SIEGY)

Quick Briefing: Siemens provides power distribution systems, meters, and monitoring products. It also has a unique offering via its Siemens Energy Consulting Service, which is for contract negotiations and utility bill management.

ABB LTD. (ABBNY)

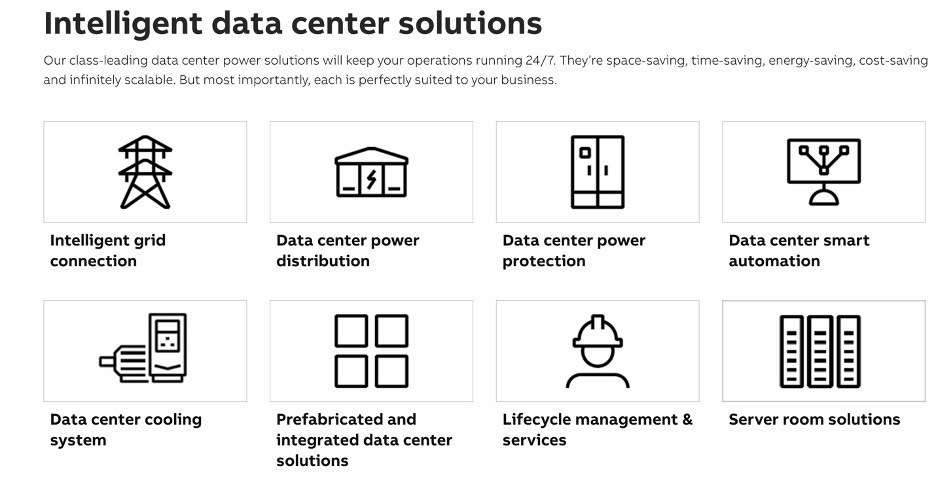

Quick Briefing: ABB (known for years as Asea Brown Boveri) is “energy-sector royalty,” with a heritage that dates back to the late 1800s. Its global reach (operating in 100 countries) exceeds almost any company on this list, and as the chart below shows, it also has a diverse roster of offerings.

GE Vernova Inc. GEV 0.00%↑

Quick Briefing: GE Vernova is a General Electric Co. GE 0.00%↑ spinoff that first traded in April. So there isn’t a dividend history or an abundant earnings forecast to look at. The spinoff offers backup power solutions that run on alternative fuels, as well as energy storage for data centers. Shares are on a tear this year, climbing 87%.

Final Thoughts

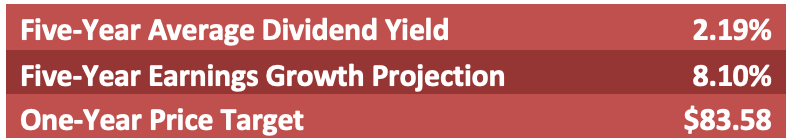

There are a lot of metrics to judge a company on, but if you’re seeking both stock price appreciation and dividend income, Eaton fills the bill.

Earnings are projected to grow at an average annual pace of 15.17% over the next five years, meaning earnings will increase by nearly 50% within three years. Stock prices tend to follow earnings, which bodes well for Eaton’s shares. Its current dividend payout ($3.76 per share, 1.14% yield) is lower than its five-year average yield (2.15%). But it boosted its payout 9% back in March and has boosted dividends at an average annual pace of 7.78% over the past 10 years.

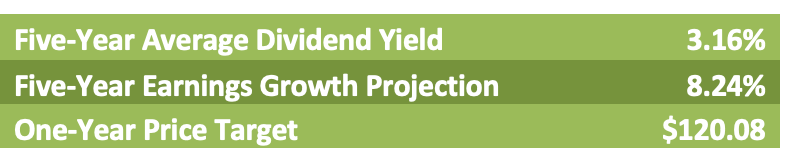

If you’re focusing primarily on potential stock price growth, Vertiv is a winner in terms of earnings growth projections. But keep in mind — in the near term — that the stock price has already skyrocketed 84% this year.

GE Vernova might also be worth a look.

As Chief Stock Picker Bill Patalon counsels with other stocks, our strategy at Stock Picker’s Corner (SPC) is based on finding good storylines like this one, grabbing foundational stakes of companies with strong long-term outlooks — and then buying more on pullbacks.

We’ll be diving deeper to find if any of these firms are worthy of potential inclusion on our Farm Team or in our Model Portfolio in our SPC Premium publication.

Take care,