In last week’s Stock Picker’s Corner (SPC) report on central bank moves and the second half of the year, I made you folks a promise: I said we’d follow up with a “game plan” to help you navigate whatever the markets throw our way.

Today I’m keeping that promise.

Folks talk about the “Magnificent Seven” stocks that are the big market drivers.

Well, today I’m bringing you the “Magic Seven” – the seven rules that can transform an investor from Wealth Killer to Wealth Builder … and keep Wealth Builder rules pointed to that wealthy “promised land.”

Follow these … and you’ve got all that you need.

I’ve even thrown in a “bonus” rule …

And a quick “review” you can keep as a crib-sheet reminder … to keep you focused.

With that overview … let’s get started.

Wealth Builder Rule No. 1: Know Thyself

During the "Dot-Com" boom, lots of folks who were normally conservative, “risk-averse” investors were infected with the most-catastrophic of all money maladies: Fear Of Missing Out (which our media friends refer to as FOMO) – which is fear, greed and recklessness all rolled into one. You see, those methodical investors watched as “everyone else” (including friends and family) was getting rich on the biggest stock-market “gusher” of their lifetime. The cautious investors wanted a piece for themselves. So they dumped their blue-chip shares, dividend aristocrat stocks, utility shares, mutual funds, bonds and bank CDs – all the “comfort-zone” investments that made sense – and greedily shoved all that cash to the center of the table. Then they stuffed all those Greedy Greenbacks into Internet investments they hadn’t studied, didn’t understand and should’ve known were overvalued and hyper-risky. They believed – truly believed (or maybe hoped) - that this orgy of speculative capitalism would have a long, long run. And they believed they’d know when it was time to “exit stage right.”

It wasn’t to be, of course. When that dot-com boom turned into the "dot-bomb" bust, those same folks suffered a total pasting. I watched two friends themselves with Internet-stock forays. One, the father of a friend in his 60s, invested his entire retirement in a dot-com “fund” with hefty front-end and back-end loads. The other, a health-challenged physical therapist in his late 50s, went heavy on AOL and several of its brethren. The physical therapist was so badly stung that he couldn’t retire; he worked into his 70s, even as his mobility and vision ebbed – and is in tough straights today. My friend’s Dad had a massive heart attack and died – after years of stewing about the “bad advice” that eviscerated his savings.

Don’t let that happen to you. And if you “Know Thyself,” it probably won’t.

Reexamine your financial plan. Reassess your tolerance for risk. And be honest about both. What do you hope to accomplish? By when? How much will it cost to get there? With what you’re saving and what you’ll need, are those goals realistic? Are your goals and the amount of risk you’re taking reasonable given your age, savings, goals and experience with stocks, funds, ETFs, income plays and other investments? In short, what adjustments do you need to make? Make them now.

Wealth Builder Rule No. 2: Don’t Be a Wealth Killer

I like to keep things simple. With good reason: By helping you strikingly boost your odds of success.

So in that vein … let me give you some simple advice.

As an investor, you’re either a Wealth Builder, or a Wealth Killer.

You’re one … or you’re the other.

There’s no middle ground.

Wealth Builders follow our blueprint.

They don’t succumb to pessimism – they just look for opportunities.

They make time their ally.

They understand that, over time, stock values move higher.

And they identify the very best narratives: As I say, “find the best storylines, and you’ll find the best stocks.”

So when stocks go up, we make money.

When stocks go down, we look at our long-term storylines, and “accumulate” more of the stocks we already own. Or we create “foundational” positions in the shares of other “winners to be” – other storyline beneficiaries that are already on our target lists.

Wealth Killers ignore these simple winning strategies.

They don’t invest – they trade. They try to “time” the market. They dabble with “meme stocks” like GameStop Corp. GME 0.00%↑. Even worse, they speculate – with options.

They believe they can “outsmart” the market – but only outsmart themselves.

In short – with apologies to the 1983 Tom Cruise sports drama featuring the opposite title – Wealth Killers are making “all the wrong moves.”

I know which investing group I want to be in. I want you to be with us – as Wealth Builders.

Wealth Builder Rule No. 3: Find the Best Storylines and You’ll Find the Best Stocks

I truly believe that it’s always a “stock picker’s market.” And by following the best storylines, you’ll find the best stocks.

That’s how we intend to operate in our “corner” of the investing world. And it’s why we created SPC.

Powerful storylines – in its jargon-speak, Wall Street calls them “narratives” – are big trends that coalesce into the biggest wealth windows around. You’ve got such supercharged storylines as:

The AI Era.

Special Situations, which include spinoffs, “financial engineering,” activist investors and alternative-asset opportunities like silver and coal.

The New Cold War, which is intersecting with AI, and which is helping drive deglobalization, and which will drive hefty opportunities in drones, cybersecurity, defensive weaponry and new battlegrounds like space.

The New Biotech, which will be defined by the Next Blockbusters, personalized medicine, AI and data and consolidation.

Real Income, where we talk about income investments more like cash flow.

Even better: They help you spotlight the most promising companies – the businesses that can ride these waves for years … sometimes even decades. These are just a few of those storylines I’m following … and I’ll soon have more to add.

Wealth Builder Rule No. 4: Stocks Go Up Over Time (AKA It Pays to Think About the Long-Term Picture)

I’ve been writing about business, economics, stocks and the markets for more than 40 years — 22 as a business reporter and 19 and counting as a stock picker and financial writer. Whenever folks discover what I do for a living, the first question invariably is: “Hey Bill, what’s the stock market gonna do?”

My usual answer: “I don’t care.”

Granted, that’s an intentional exaggeration … a tongue-in-cheek comment … and I always say it with a smile.

But as a Wealth Builder, I don’t obsess over every little market wiggle. Or the numbing overload of economic numbers, analyst upgrades-and-downgrades or headline du jour. And I tune out most of the influencers and podcasters, and all the other financial folderol that distracts investors from the real objective: Building Wealth.

I don’t outright ignore what’s happening today or tomorrow – or next week, next month or next quarter. The information can add to – and refine – my long-term view.

But when you drill down to the essence, all that stuff – including whatever stocks happen to do today – is just a data point matched with a calendar date.

The reality is that it pays to “be long” – if you invest long-term.

With stocks, “being on the side of the angels” means “being on the side of the bulls” – as long as you’re a long-term Wealth Builder.

In other words, stocks tend to go up most of the time – and over time.

Check this out …

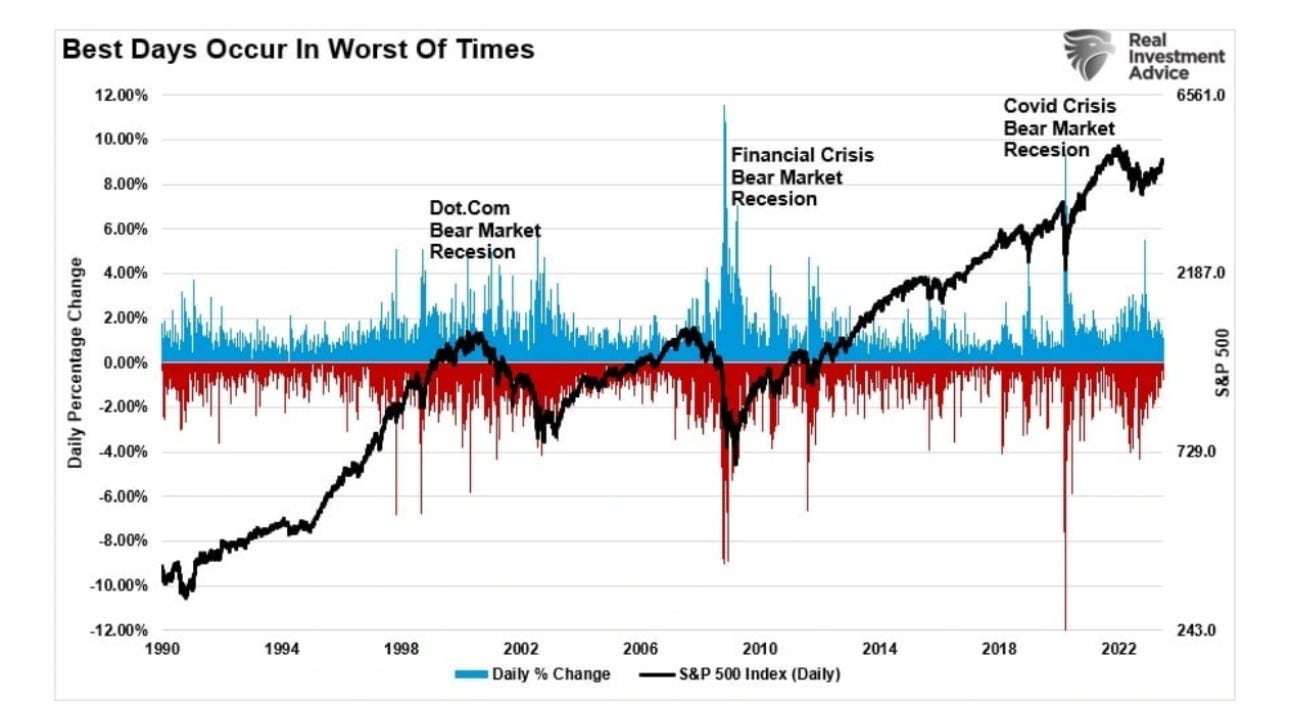

Wealth Builders understand that stocks – as a group – have a bullish personality. Wealth Killers haven’t had this “investing epiphany.” That makes them vulnerable – to all the data points, market wiggles and “competing voices” that Wealth Builders have learned to tune out.

That’s why Wealth Killers get shaken out during “scary moments,” and lose out – since some of the market’s best moments occur against some of the worst backdrops. (More on that in a moment.)

What the chart above really shows us is that longer holding periods smooth out the stock-market’s gyrations. It allows Wealth Builders like us to capitalize on Wealth Killer mistakes.

We play the long game.

What constitutes the “long game” varies with the strategies and stocks in question. It can be three, five, seven years … or longer.

It can even be forever – which, in stock-market time, takes an investment from one generation to another.

Maybe it’s my Contrarian nature (I actually co-authored a book on that topic), but my interest in stocks was triggered by the Crash of ‘87 (a story for another time). I bought my first shares a month or so later – and I still own part of that stake. And one of my best investments ever was a tech leader whose shares I snagged 25 years ago — and never sold.

Morgan Housel, best-selling author of Same As Ever, has said that 10 years or more is a good holding period to target.

And I agree that’s a timeline you can work up from – or down from.

Wealth Builder Rule No. 5: Invest … Don’t Trade

Consider this a follow-on to Rule No. 4.

Worrying about where the S&P 500 or Dow Jones Industrial Average is right now, to me, is a waste of time … and a waste of energy. It leads to errors of commission, and errors of omission — as we’ll see.

An error of commission is a decision you make, and an act you take — but ends up as a huge mistake.

An error of omission is a “woulda/coulda/shoulda” catalyst for regret: It’s a decision you should have made, and an action you should have taken — but didn’t. And that “road not taken” proves to be a mistake.

Investors are lousy at predicting short-term market trends.

And I mean … lousy.

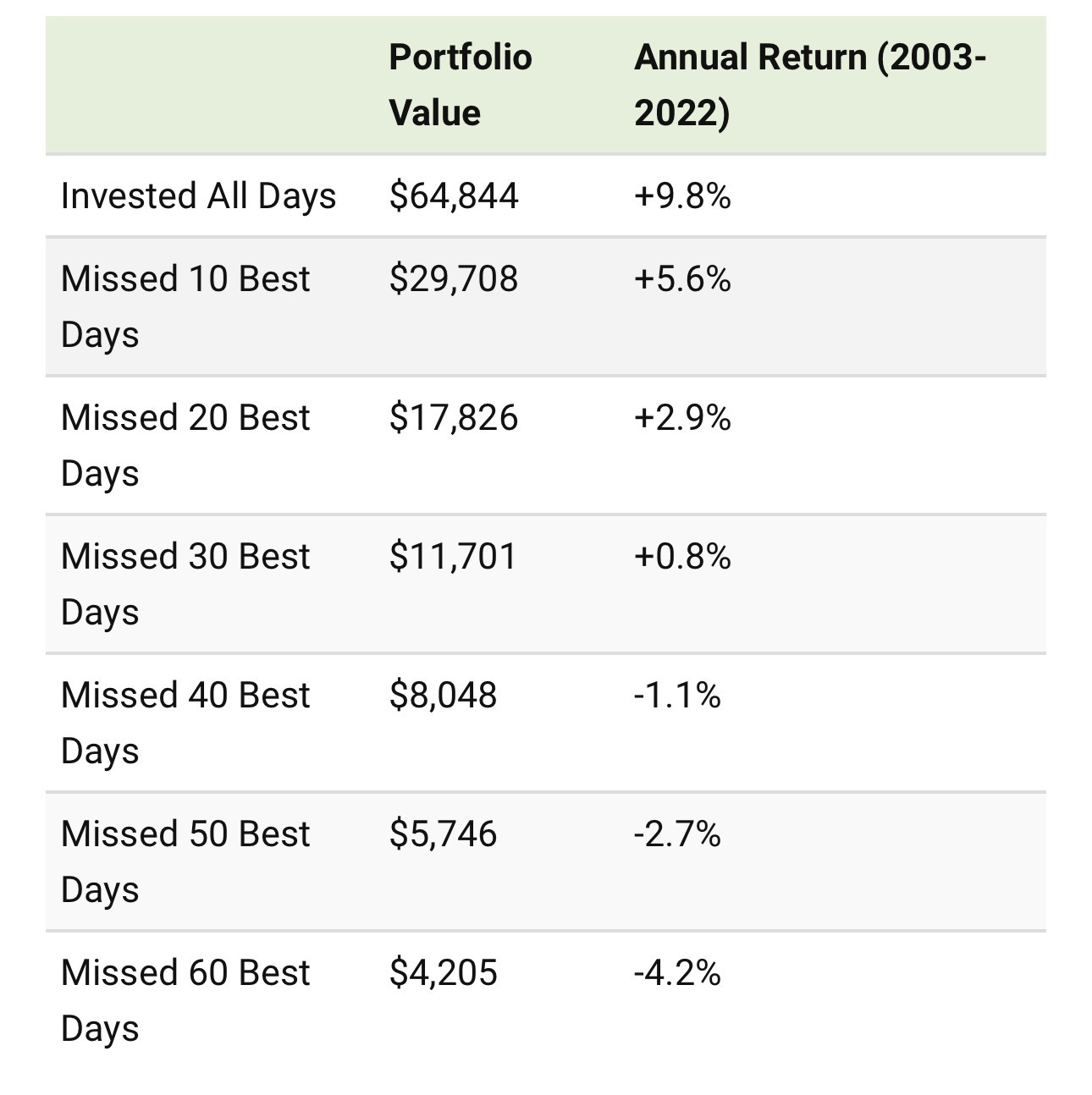

In this table from The Visual Capitalist, check out what happens if you start with $10,000 — and invested it in the plain-vanilla S&P 500 over a two-decade stretch. Forget about lagging the market: If you miss enough of those “best days,” you actually lose money.

With our next rule, I’ll show you how to turn this Wealth Killer mess to a Wealth Builder advantage.

Wealth Builder Rule No. 6: Be a “Next Bull Market” Accumulator

As we saw in Rule No. 5, missing those “best days” is a definite Wealth Killer move.

Maybe they sold out when stocks started “trading ugly.” Or maybe they’ve been sitting on a pile of cash – and are waiting for that “right moment” to invest. In either case, they’re not “in the market” on those “best days.”

Both are Wealth Killers … missed opportunities – in essence, destructive “non-moves” dictated by emotion.

Every investor knows the investing maxim of “Buy Low, Sell High.”

But very few people actually follow it.

They know this maxim logically … intellectually. But they act emotionally.

Bull markets tend to last about four years. But the average correction (a decline of 10% to 19%) lasts 138 days. And the average bear market (20% or more) persists for less than 18 months.

In short, we know that any bearish market we fall into will eventually turn around. And since we know (and have already demonstrated here) that it pays to be “long” if you’re a long-term investor, we also know that buying the shares of the best “Best Storyline Companies” during these darkest stretches will magnify your wealth when the “new dawn” eventually comes.

To say it another way: If the S&P 500 takes a 10% spill (a correction) or a 20% freefall (a bear market or even a crash), doesn’t it make sense to view it as a “Buy Low” opportunity?

I mean … that’s the point in time where that “Buy Low” opportunity that we all know to be correct is being handed to us: Prices (valuations) will be lower, making the companies cheaper to snag.

It’s not the case for Wealth Killers: They succumb to emotion; they wait until “things look better” – and miss those “best days.”

Wealth Builders see and understand this “Buy Low” dynamic. And they act. That’s how Wealth Builders win: They rely on logic … and they control their emotions.

That’s why Wealth Builders flip the script. They look forward to selloffs. They keep shopping lists of stocks they want to buy for the first time, or holdings they want to add to. (The hot-button SEO term these days is “Watch Lists.”)

And they do so on pullbacks, or when they get more cash.

They buy low … and buy low again … and buy low again — and cash in on the long-term-bull-market nature that stocks possess.

Think about it … if you know that stocks tend to go up in the long run … the odds are strong that if you invest in a good company today, the stock price today will be less than the stock price next year, in five years or a decade from now.

So don’t obsess over today’s prices: Focus on the “Next Bull Market” – the bull market that comes next year … or five years after that.

That’s the essence of an “Accumulate” strategy.

And it’s not the same as “market timing.” You’re not looking to trade in and out at the perfect moment.

Instead of “best days,” you’re focused on the “best stocks” from those “best storylines.” You’re looking to “lean into” long-term plays. You’re looking to amass a position over the long haul … for the long haul.

You’re looking to build wealth. And have “checked another box” in the Wealth Builder checklist.

Remember, the stock market is a “what-comes-next” apparatus. And I’m more interested in the opportunities to come.

So I don’t obsess about “today.” I make time my ally. Like other Wealth Builders, I play the “long game.” I “accumulate” my way to wealth.

Or, as I like to tell folks, I’m a “Next Bull Market Investor.”

Wealth Builder Rule No. 7: Avoid Options - At All Costs

A new gambling affliction – I’ve dubbed it the “DraftKings Mindset” (like any malady, I discovered it, so I get to name it) – has infected the retail “investing” markets.

And I do mean infected – with Wealth Killer consequences.

Investing newsletters, financial publishers, so-called “master classes” and other “organizations” have come up with all sorts of odiferous “investments” or “products” – most of them targeting the most-vulnerable groups of retail investors. I’m talking about things like:

Private company investments.

Special-purpose acquisition companies (SPACs).

Sketchy cryptocurrencies.

So-called algorithmic trading — or any trading, for that matter.

The potential for 24/7/365 trading on the New York Stock Exchange (NYSE).

So-called “income” strategies that are really relabeled options products.

And easy-to-access options — including “zero-day options,” which are option contracts that expire on the same day someone trades them.

Each of these are pitched as innovations that make life better, easier and more profitable for retail investors. But most of them just paint a bullseye on your back: They turn you into the proverbial “Greater Fool” – and just set you up to take the “other (losing) end” of some smart operator’s moneymaking trade.

In short, they’re Wealth Killers.

All of them.

But the options stuff is the absolute worst.

So if anybody comes to you with a pitch for an options-trading “product” or “service” or “strategy,” be sure to look down while they’re talking – to see if they have their hand in your pocket.

Because you can bet that they do.

For most retail investors (and by “most,” I mean 99%), options trading is a Wealth Killer … not a Wealth Builder – and I don’t care what Malarkey-filled pitch any of those “Derivatives Devotees” are giving you.

Still want to make a wager?

Here’s your best bet …

If you see an options contract, run in the other direction – as fast as you can.

That’s your best move: And I can prove it.

Between January 2010 and February 2021, retail investors lost $3 billion making options trades.

And zero-day options are inflicting daily damage: A study from Germany’s University of Muenster found that, since May 2022, day traders lost $358,000 each market day on zero-day options.

One longtime colleague of mine – I’m talking about someone who’s worked as a sell-side analyst on Wall Street, has run his own financial publications and who’s more recently moved into the dealmaking world – recently affirmed my view that options trading is akin to hemlock for everyday investors.

“You’re right, Bill,” my friend and colleague told me. “The vast majority of Mom-and-Pop investors – I’m talking about 99.7% – have absolutely no business going anywhere near options of any type. For retail investors, options are a rigged game … clear and simple.”

That brings us to another Wealth Killer: “Margin trading” – the use of “leverage” (borrowed money) to boost returns on the actual cash invested. It’s a Wealth Killer, too.

In its report “The Financial Literacy and Overconfidence of Margin Traders,” The U.S. Securities and Exchange Commission (SEC) found that a mere 15% of margin traders could answer a basic question about trading on margin correctly. In short, they were guilty of an investing cardinal sin: They didn’t understand their investment.

And that lack of understanding of the risks likely leads to destruction.

In a June 2023 study, Notre Dame researchers found that “retail investors’ decisions to lever up in stock trading despite the hefty borrowing cost is likely driven by overconfident beliefs and lottery preferences.”

Yeah … “lottery preferences.” As in … “DraftKings Mentality.”

To cap that off, a Big Board move to crypto-like 24/7 trading would turn investing into even more of a casino than it already is, with a “DraftKings gambling” mindset becoming even more of the status quo.

It’s yet another battle pitting logic against emotion. And, with Wealth Killers, that destroyer we call emotion usually wins.

Logically, most folks understand they shouldn’t risk money on “investments” – or “strategies” – that they really understand. But emotion – greed over the potential for a quick buck or promised super-high return – is too strong to resist.

All it takes is one friend boasting about their “killer” options win they pulled off just that week (while neglecting to mention the string of losers that preceded it) to rev up that “lottery” mindset – or to trigger that old friend “FOMO.”

One lesson I learned early in my days as a reporter was that “the only stupid question is the one that’s never asked.”

If you don’t understand something, don’t feel comfortable with it, or feel those tendrils of fear taking hold deep in your gut … adopt the “anti-Nike” mantra.

Just … don’t … do it.

Wealth Builder Bonus Rule: Forgive Yourself

If you’ve perused today’s report … and you realize: “Holy Smokes, I’m a Weath Killer!”

Forgive yourself.

And move on.

I don’t know about you, but I don’t bite the erasers off my pencils. People make mistakes (“To err is human”). And today is a New Day.

Even if you’re reviewing your past practices and current holdings and realize: Yikes, this is ugly, man.

Hit the reset button — and do it right this time around.

These rules will set you up for long-term wealth … and will help you navigate whatever “messes” or “disasters” come our way.

A Quick Review for the 2024 Second Half

If you’re a Wealth Builder, the “milestones” that most investors obsess over – first quarter, second quarter, midpoint, year-end – are largely just dates on a calendar … artificial constructs. But a “milestone” like the middle – or end – of the year can be a good time to reassess – to examine what you’re doing and to make sure you’re on the right path.

Be a Wealth Builder. Not a Wealth Killer. Embrace an approach that works for you — and that structures you for success. A good starting point:

Identify the best storylines.

Identify the biggest beneficiaries.

Establish foundational positions.

Accumulate as you go.

Play the long game.

Don’t trade.

And don’t be tempted by the “get-rich-quick” Malarkey … like options.

Check out our free reports. Subscribe to our work here. And check out SPC Premium, which includes a Model Portfolio and a Farm Team of other promising companies.

And be sure to stop back next time;

An insightful summary. I love the clarity of the rules. They remind me of the following maxim: simplicity beats complexity. Thanks for sharing.

Regarding options, I would like to add some color. Zero-day options and similar strategies are 100% crap. However, there are wealth-building strategies with options like LEAPS. They represent the opposite of short-term thinking approaches.

A properly selected LEAPS call (underlying asset's price well below strike price, implied vol below 40%, high open interest/volume, and at least 12 months to expiration) offers massive asymmetry skewed in investors' favor. For example, when the stock moves 40% to 60%, the call may move beyond 500%.

I have been using LEAPS calls to exploit strong impulse trends with 12-18 month durations. Of course, I am not saying options are easy to use; neither is it the only way to gain Alpha.

It is quite the opposite; options (even simple plays such as LEAPS calls) require experience and knowledge. Moreover, LEAPS are just another tool in the box of industrious investors. As a reminder, there are no all-round tools. The hummer does not screw bolts, nor does the screwdriver punch nails.