At the end of last year, the “watchers” of the U.S. Federal Reserve were expecting as many as six central bank rate cuts throughout 2024.

What a difference six months can make.

As we close in on the 2024 halfway point, that same group of central-bank watchers is looking for (perhaps) a single interest-rate reduction from policymakers at the Fed.

That shows you how the so-called “investing narrative” can change over time.

And change it has.

But the stock market is a “what-comes-next” mechanism. And while a number of indicators point to a promising second half of the year, the risks are stacking up, too.

That sounds complicated. Too complicated.

Especially since we believe in keeping things simple.

As you’ve heard me say here over and over again, there are only two types of stock-market investors: Wealth Builders and Wealth Killers.

If you’re not one, you’re the other.

Wealth Killers obsess over the next economic report, the next data point or the next (near-term) market move.

They try to anticipate the “what comes next” – believing they can jump in ahead of rallies or jump out ahead of market stumbles. By definition, that makes them short-term investors – or just plain-old “traders.”

These in-and-out forays magnify risks and multiply mistakes. And some of those folks make the biggest Wealth Killer mistake of all: They trade options.

You don’t have to make those same mistakes.

You can turn this murky midpoint of 2024 to your advantage.

If you’re a Wealth Killer, you can use this “halfway pole” to “hit the reset button” and put yourself on the winning path.

If you’re already a Wealth Builder (and kudos to you), you can use this as an “affirming moment” – to congratulate yourself for what you’ve done … and to remind yourself to stay on that path.

Here today, I’m going to help you do exactly that.

I’m going to show you some of the institutional tomfoolery at play. I’ll serve up some of the crosscurrents to consider. And I’ll help you get your mind right for the six-month stretch that’ll take you to the end of 2024 — and beyond.

Mea Culpa Moment

Stocks have had a smoking first half. The tech-focused Nasdaq Composite Index is the leader of the pack: It’s up 19% this year and a sizzling 32.4% over the last 12 months. But a handful of stocks have a big influence on that performance.

Then there’s the S&P 500 — the favorite broad benchmark of the institutional crowd. It’s up 15% year-to-date (through June 20) and 25% over the last 12 months.

Last (and least) is the blue-chip Dow Jones Industrial Average — the index that is “The Stock Market” to most retail investors. And the Dow has been left in the dust: Though it’s up a solid 14.6% over the past 12 months, it’s advanced only 3% here in 2024.

That tomfoolery I mentioned? As we get to the year’s midpoint, the big investment banks are racing to remind folks of their relevance. Like that annoying teacher’s pet you remember from high school (or maybe even college) – they’re raising their hands, speaking loudly and showing their “smarts” by boosting their stock-market target prices for the rest of the year.

But you have to look where those new targets were boosted … from.

Late last month, Morgan Stanley MS 0.00%↑ Chief U.S. Equity Strategist Mike Wilson – one of the last remaining bears on Wall Street – finally capitulated and turned bullish on stocks. He boosted his S&P 500 target from 4,500 to 5,400 – an upside of only 2% from where that index was trading. (The S&P has already punched through that: It’s at 5,497.60 as I put this story together.)

In more recent days, several big-name analysts have boosted their own targets for the S&P — citing a still-strong economy and the relentless power of generative artificial intelligence.

Late last week, Goldman Sachs Group GS 0.00%↑ boosted its year-end target from 5,200 to 5,600.

Citigroup Inc. C 0.00%↑ strategists on Monday boosted their year-end target from 5,100 to 5,600. It accompanied that note with the mea culpa that its target would’ve been right had it not been for the outsized impact of big tech.

At the start of this week, Evercore ISI strategist Julian Emanuel ramped his year-end target from 4,750 to a Wall Street high of 6,000 – saying the “AI revolution is in the early innings.”

“Analysts are scrambling to keep up with the market, with a top bear even turning bullish,” Fortune writer Michael W. Santiago wrote this week. “But while this epic first-half market surge and increasingly lofty valuations have led some to fear a correction could be on the way, Bank of America Corp. BAC 0.00%↑ doesn’t yet see enough of the 10 classic signs of a bull-market peak.”

I’ll admit it: Forecasting anything is tough. There are too many variables … too many unknowns.

But that’s kind of the point, right? Why “bet” your money — your future — on something you know (as we’ve shown) will probably end up being … wrong.

Given those considerations, betting is exactly what you’re doing.

What’s interesting here is that most of these target-price increases were accompanied by notes of caution — notes that are warranted.

Analyze This

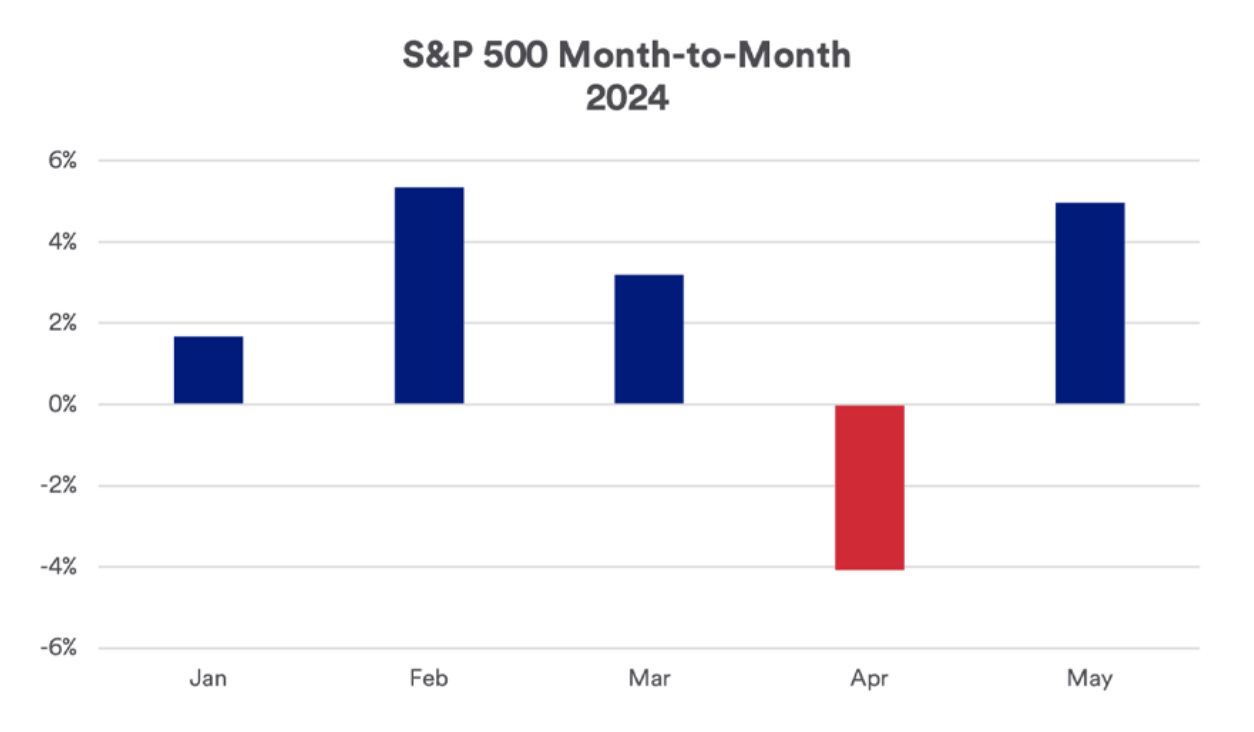

There’s more than a week still to go in June. But stocks gained in May after losing ground in April.

Stocks could easily go higher from here. But there’s more to think about than ever before.

The last “correction” — if you want to call it that — was in February, with a pullback of more than 10% from market highs. Corrections — and bear markets — are a normal part of a market cycle. Indeed, they’re healthy.

That’s a consideration. And there are many more.

Let’s go back to the monetary policies of the Federal Reserve — the topic I led off with here today.

One of the levers central bankers can pull in their effort to manage the economy is the Fed Funds rate, which helps set the “price” of money for consumers, investors and companies.

To battle inflationary pressures that spooled up at their most virulent levels in 40 years, Fed policymakers raised that benchmark rate 11 times between March 2022 and July 2023 — taking it to a range of 5.25% to 5.5%, where it’s remained ever since.

That’s the highest the Fed Funds rate has been in almost a quarter century: It was at 6% in January 2001 (following a half-point cut) after the speculative mania for Internet stocks imploded.

Other than “what are stocks doing?” … the Fed is the No. 1 hot button investors obsess over.

CME FedWatch puts the odds of a quarter-point cut at the Fed’s September meeting at just under 60%. Then there’s the November meeting, which comes right after the U.S. Presidential Election, where the odds of rates going as low as 4.75% to 5% are about 25%.

Look, I understand how challenging the modern investing landscape can be for today’s investors. There’s a lot to be happy about at this juncture. But there’s also an overload of available data — some relevant, most not.

So let’s get back to keeping it simple.

Here at Stock Picker’s Corner (SPC), we’re all about Wealth Building, and all about finding the very best storylines.

And there are some terrific storylines at play now – like the AI Era and the New Biotech – that offer years of Wealth-Building potential.

Earnings remain strong – with profit margins expanding and many companies beating forecasts. Dividends are still increasing. And statistics say consumers – who account for 70% of the American economy – remain upbeat: While economists polled by Reuters saw the Conference Board’s consumer confidence index falling from 97 to 95.9, it instead rose from a revised 97.5 in April to 102 in May.

And yet, there’s an underlying angst — academics and journalists have dubbed it “The Great Disconnect” … I called it “The Whac-A-Mole Economy” — in which consumers remain angry about the impact “cumulative inflation” has had on their wallets and are distrustful about the social and political schisms that are increasingly dividing America. It’s a just-below-the-surface angst that could trigger a fast reversal in sentiment if the wrong “buttons” get pushed.

In short, it’s a risk.

There are also some crosscurrents emerging in the jobs market, Investor’s Business Daily just reported. By that I mean:

The May JOLTS (Job Openings and Labor Turnover Survey) report said the number of open spots per job seeker fell for the third straight month – hitting its lowest point since February 2021.

The job quits rate, which peaked above 3% in 2021 and 2022, is now down to 2.2%, below its levels of 2018 and 2019 – which tells us the openings that do exist are at their least appealing level in years.

Wages grew 4.1% in May on a year-over-year basis – exceeding predictions. But the unemployment rate for May was 4% — up from 3.9% in April.

And there are all sorts of other wildcards — some are bearish … but others are downright bullish. There are some that I’m “sorta/kinda watching,” and there are still others that no one can anticipate — that’ll come out of nowhere, like a smack across the back of the head.

The takeaway here: Don’t obsess over all this near-term minutiae. Don’t let “Wall Street” lead you around by the nose. Don’t let others do your thinking for you. And don’t play the “short game.”

If you do that, by definition, it means you’re being “reactive.” It means you’re chasing the market. It means you’re a trader; not an investor.

It means you’ve become a Wealth Killer.

I don’t want that for you.

I want you to be a thinker … a controller of your own destiny … a winner.

A Wealth Builder.

Stop back next week, and I’ll give you a “Wealth Builder Blueprint” that you can put in place immediately …

And when July 1 rings in the “second half of the year” and most investors are casting about for the “right way” to go … you’ll already be steaming toward victory.

That’s what I want … for you.

See you next time.

Fantastic read!