As the New Cold War Gets Nasty, This Technology Gives America That "Edge"

Here are the details ...

Find the best storylines and you’ll find the best stocks.

That simple-but-powerful concept fuels the mission here at Stock Picker’s Corner (SPC).

That story-based mindset was solidified during the 22 years I spent as a reporter, a career that earned me national recognition for my award-winning coverage of big public companies, Wall Street, the economy and sectors like defense, biotech and finance.

The storylines I chronicled traveled in all sorts of directions — and took all sorts of forms: They spotlighted winners and losers, featured heroes and villains, and captured happiness and grief.

They also unveiled threats … and opportunities.

For folks like you and me, seeing and understanding those storylines is investing gold.

Find the threats … and you avoid the losses.

Find the opportunities … and you’ve found some of the best places to build wealth.

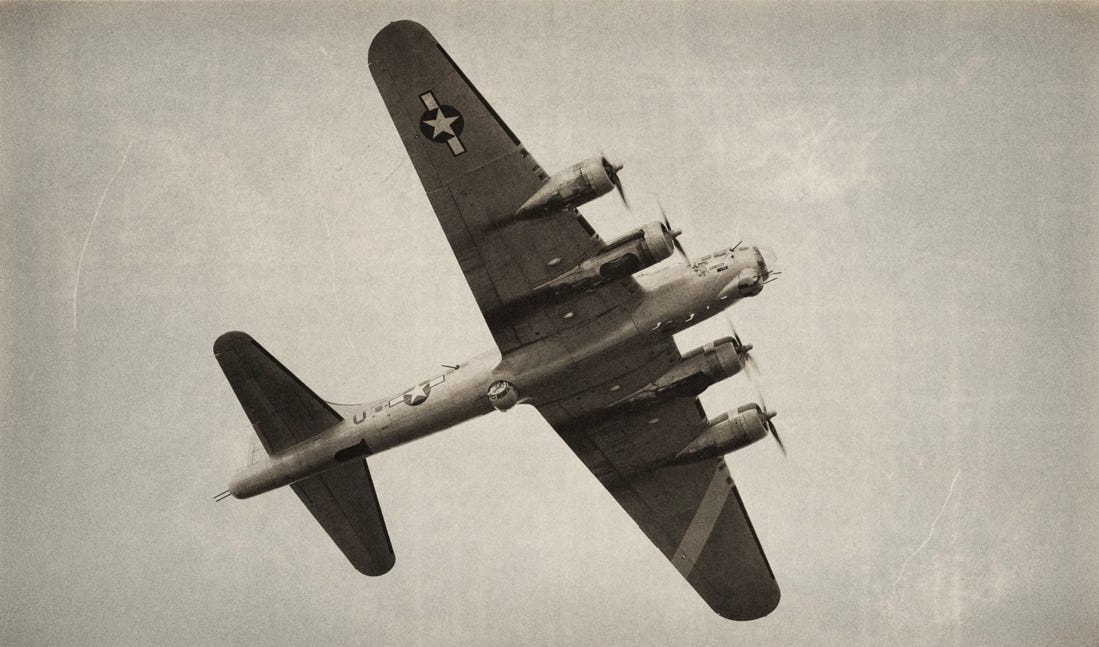

And one of those storylines is the “New Cold War.”

I lived through and partly worked through Cold War No. 1, which lasted from 1947 to 1991. So I can tell you with confidence that this tense new standoff feels like a bit of a “sequel.”

The “cast of characters” contains some similar names: China and Russia are back in the fold. Nuke programs in North Korea, dangerous military regimes in the Sahel Region of Africa and proxy armies like the Houthi Movement creates new threats.

And new technologies are expanding the fields of battle into cyberspace and outer space.

It’s a story I’ve outlined in great detail in our two-part series: Part 1 is available here and Part 2 is available here.

It’s also a storyline I’ve been keeping track of since the launch of SPC:

April - Congressional Targets: First It Was the TikTok Ban, Now Drones

May – Russia’s Targeting Our Satellites, Hackers Are After Our Drinking Water

I’ve also shared a few opportunities for your research starting point, which include:

✅Boeing Co. BA 0.00%↑ and its unmanned drones in the sea and air. Its Wave Glider (used for intelligence, surveillance, reconnaissance) sits on the ocean’s surface while its Echo Voyager submarine drone fed into the U.S. Navy’s Orca undersea program. In the air, Boeing is developing the MQ-25 Stingray, a flying tanker aircraft that can give U.S. carrier groups an edge in case of military operations in the South China Sea. It’s also shown versions with “hardpoints” under the wings that would let the Stingray carry AGM-158C Long-Range Anti-Ship Missiles (LRASMs). The flying tanker, which I wrote about at my previous newsletter, Private Briefing, way back in 2018, is targeted for operational status by 2026. Boeing is also developing the MQ-28 Ghost Bat, which will serve as an uncrewed “loyal wingman” to manned fighter jets.

✅AeroVironment Inc. AVAV 0.00%↑ provides unmanned vehicles to the U.S. government and more than 55 countries, but it also has additional cash-flow sources outside of weaponry. It’s developing a solar-powered drone to provide broadband access and partnered with NASA to launch the first drone on Mars in 2021.

✅The Broad Specialist: I always believe the biggest gains are made through owning individual stocks, but ETFs can serve as a “starter” investment or even as a diversifying foundational play for the individual companies you want to own. You can profit from an ETF through a certain storyline – like the New Cold War – while using the collection of companies held by the fund as a way of limiting your downside a bit. One such ETF to consider is the iShares U.S. Aerospace & Defense ETF ITA 0.00%↑, with Boeing and AeroVironment both included in its 34 total holdings (as of June 6).

I’ve also shared some insight on RTX Corp. RTX 0.00%↑ (formerly Raytheon), Lockheed Martin Corp. LMT 0.00%↑ and the ETFs Cybersecurity ETF CIBR 0.00%↑ and Global X Artificial Intelligence & Technology ETF AIQ 0.00%↑:

But my favorite company in the New Cold War era is in the SPC Premium Model Portfolio.

It has a market cap that’s just 2% of Boeing’s. And most people have probably never heard of it.

But its next-generation unmanned aerial vehicles (UAVs), satellites and microwave electronics (not for heating your burrito – it’s for electronic warfare systems) are gaining attention.

In fact, at the end of May, JPM Securities started covering the company, giving it a “outperform rating.” That’s Wall Street jargon that a company’s stock price is expected to do better than the average market return.

The analyst’s price target is roughly 32% higher than where it’s trading right now.

That’s not bad.

But as Wealth Builders, we play the long game, knowing that we should be comfortable with the idea of holding any stock for at least 10 years, as can be seen from Morgan Housel’s research in Same as Ever:

Over just the next six years, I could see the stock price doubling; that’s a conservative projection.

Now, this is a high-risk/high-reward opportunity, and my No. 1 rule in investing is “Know Thyself. “

In other words, we’re all different. We all have different financial goals. Different time frames. Different risk tolerances.

You want to be comfortable with AND fully understand any investment you make. That means there’s no “one-size-fits-all” portfolio.

And that’s okay.

So I’ve created a Model Portfolio that you can use as a superb starting point for your research. Choose the stocks and other investments you like and understand – and adapt them to your goals. And pass on any ideas you’re not comfortable with.

That report for SPC Premium members is ready:

If you’re already a member, you can access it directly by clicking the image above or by clicking here.

If you’ve enjoyed what you’ve been reading and would like access to our Model Portfolio, Dossiers (like the one just released), Farm Team and SPC Premium Issues, feel free to learn more here.