It’s a fact: When interest rates fall, investors “reach” for income.

And with interest rates high (but expected to fall) … consumer pessimism still rampant … a boatload of uncertainty fueling that funk … and a record $6 trillion sitting on the sidelines in cash … you’ve got the ingredients for one hell of an investing mess.

And we’re going to detail it here for you today

In fact, I’d call it a “trap.”

An investing-income trap where all those reaching-for-yield retail investors:

Stuff their cash into the usual “income” investments — money markets, CDs, bonds or other interest-bearing investments — without considering such crucial “context” elements as taxes, the inflation rate or interest-rate trends.

Grab a big block of a super-high-yielding dividend stock — without first making sure that payout is sustainable … and safe.

Chase the high returns promised by “income products” — or “income strategies” like options —without really understanding how they work … or the higher risks that accompany those higher advertised flows of cash.

Or get suckered into “passive-income” alternatives that are increasingly being “pitched” (marketed) everywhere — schemes that demand lots of extra effort (which means, despite the claim, they aren’t “passive” at all).

I “see” the catalysts for these income-investing miscues.

Rates are still high. But the U.S. Federal Reserve will launch its rate-cutting campaign sometime this year. So payouts on the top-yielding deposit accounts will fall – from about 5.35% now to a projected 4.45% by the end of the year, says Bankrate.com.

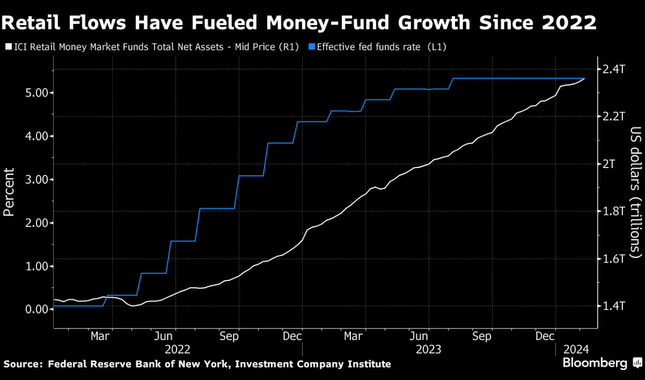

With the mountain of cash currently sitting on the sidelines, we’ll all feel the ripples – especially retail investors. Of the $1.198 trillion in cash that’s poured into money funds since the start of 2022, a full 80% came from retail investors, Bloomberg says.

And money from all sources — from individuals, institutions and companies — keeps flowing into cash investments, adding to the $6 trillion that’s already there.

So I understand why retail investors are feeling this income-investing imperative.

But I also understand the income-investing paradox — where the greater their appetite for yield, the more likely folks are to make the mistakes I detailed above.

Here at Stock Picker’s Corner (SPC), our team wants to help with that — by delivering the strategies and opportunities that will avoid those traps and deliver the income you seek. That’s why income investing is one of the storylines we’re following here.

And we’re going to drill into its depths here today.

Let’s start at the very beginning — by looking at the single-biggest “trigger” that sends income hunters down the wrong path.

And that trigger is “fear.”

Once you understand it, you can beat it.

The Death of Retirement

Once upon a time in America, “retirement” was more than a dream. More than a goal, even.

For most U.S. workers, it was just the way things were done.

You started your working life at 18 or 21, and worked for 40 years or more (often ending your career with the same company you started with). Once you hit 65, you had a fat company pension waiting for you (and probably some cash or savings bonds stuffed away, too). You traveled, fished, spoiled your grandkids or maybe bought a cottage somewhere.

And you didn’t worry.

Old-time pensions were great, and lasted as long as you did – so you didn’t fear outliving our money.

And you didn’t work.

If we go back about four decades, to 1987, only 11% of Americans were working when they were 65 or older.

Fast forward to the present, to 2023, that share of post-65 workers had nearly doubled to 19%:

And we’re never going back.

Because of something the pundits are referring to as “The Great Disconnect,” I believe the number of “un-retirees” will keep climbing in the years ahead.

That “disconnect” is due, in part, to a kind of “perception gap” that exists right now.

The stock market is screaming like a stock car at Daytona.

Washington and all those official reports tell us the U.S. economy remains strong.

But millions of the American consumer/worker/investor just aren’t buying the “all is well” narrative.

They’re all skeptical. And the main thing fueling all that “regular folks” skepticism is Inflation.

Or, more accurately, prices.

Don’t Tarnish Those “Golden Years”

In a recent poll conducted by The Atlantic, folks were asked which factors most influenced their feeling about how “the economy” is doing.

Grocery prices topped the list, and 60% placed it in their Top Three — more, even, than the percentage of folks who chose “inflation.”

Heck, back in 2023, even as inflation dropped sharply, food prices zoomed 6%.

As UBS Global Wealth Management Chief Economist Paul Donovan told The Atlantic: “You won’t convince any consumer that inflation is low when prices are rising that fast.”

Unfortunately, there’s a “stickiness” to that kind of pessimism. That’s partly why a recent IPSOS.com survey found that only 34% of consumers expect their personal financial situation to be stronger six months from now, down 10 points from January 2020.

That dour outlook extends well into the future. And it reaches across multiple age groups.

In a July 2023 survey, the Virginia-based news venture Axios found that 29% of workers younger than 55 don’t expect to retire. And three-quarters of the folks in that group say they can’t afford to stop working – and will never reach the point where they can.

Indeed, according to a May 2023 GOBankingRates survey of 1,045 respondents who ran the gamut from Baby Boomers to Gen Xers to Millennials to Gen-Zers, the No. 1 fear was … outliving their savings.

That’s not just scary. It’s terrifying.

And, after a lifetime of work, it’s downright tragic.

Let me be clear: There is nothing wrong with working past 65.

Heck, I plan to keep working. And not because I have to.

It’s because I want to.

I still have lots to offer – and plenty left in the tank to do so. I continue to mentor some of the younger-than-me colleagues I’ve worked with through the years.

And I wanted to launch SPC — and hopefully help you folks. I’ve got a terrific, younger collaborator here to help me.

I’m sure lots of you reading this feel that same “fire.” And kudos to those of you who do.

Working gives us a sense of purpose, keeps us sharp and creative, and enriches our lives through the social interactions we have on the job.

But working because you want to — and working because you have to — are two very different animals.

You want to be the former … and you don’t want to be the latter.

Income strategies … and an income portfolio that throws off consistent cash … can help you avoid that “work-because-you-have-to” fate.

For instance:

Understand when income investing is right — and when it’s not: As Simple Wealth, Inevitable Wealth author Nick Murray writes: “People greatly overestimate the long-term risk of owning stocks [and] seriously underestimate the long-term risk of not owning stocks.” Sometimes stocks trump income. But income cash flows can be used to buy stocks. (Want proof? Just look at some of the strategies Warren Buffett used to build the juggernaut we know as Berkshire Hathaway Inc. (BRK.A, BRK.B.)

Understand the “full picture” with your income plays: Factors like time frames, market rates, inflation rates and taxes need to be part of your “income-investing math,” meaning you need to think in terms of “real return,” “cash flow,” “sustainability” and “yield on cost.” That full picture will give you a full understanding of the income investments you make.

Know thyself: It’s a mantra of mine – one I share with you. Don’t get into “income” plays that aren’t what they seem, that you don’t understand, or that sit far outside your personal comfort zone.

I’ve given you a full overview. Now we’ll put those insights to work.

An Income Play to Research

If you’re researching income investments, one starting point is a company like Ares Capital Corp. (ARCC).

The Los Angeles-based Ares is a “business-development company,” or BDC. BDCs are a type of closed-end investment firm that provides debt-and-equity financing to small- and mid-market companies. In fact, BDCs operate a lot like private-equity (PE) or venture-capital (VC) firms. But while PE and VC firms mostly accept investments only from wealthy folks, BDC shares are publicly traded, meaning anyone can invest if they want to.

BDCs are required by law to invest at least 70% of their assets in private U.S. companies with market values of less than $250 million. And they’re required to pay at least 90% of their income out to shareholders as dividends.

The yield, liquidity offered by publicly traded shares, availability to all investors and diversified asset base are the strengths of a BDC firm. The weaknesses are that you must monitor the credit quality of what they hold (especially in a slowing or stalling economy), and you want to be cautious when interest rates spike.

Ares specializes in lending to mid-market companies. Its current market value is $11.7 billion. As of December 31, it was the largest BDC by market cap.

Ares’ current yield is 9.5%. Over the last five years, it’s had a minimum yield of 7.17% and a median yield of 8.87%, according to YCharts.com.

That track record as a high-yielding opportunity is why Ares is worth putting on your personal list of income investments to consider. Remember what I said about risk? The high yield — and the business model that drives it — makes for higher risk. So do your homework: Make sure this fits within your “know thyself” parameters.

Income investing in general is one of the “Wealth-Building Storylines” I’m following for you folks here at SPC.

We detailed the Artificial Intelligence (AI) storyline in our introductory SPC report. Over the next few weeks, I’ll be sharing another – a fascinating investing storyline I refer to as “The New Cold War.”

See you then …