Nvidia Fatigue? Check Out This AI Landlord Stock Instead

Dollars are flowing to data centers ...

If there’s a “face” to the Artificial Intelligence (AI) Era, it’s chipmaker Nvidia Corp. NVDA 0.00%↑.

With a market share up around 80% for AI chips, Nvidia is the proverbial 800-pound gorilla – but with a Steve Jobs brain. With different forecasts handicapping the AI’s market value hitting between $500 billion and $900 billion in the next two years, little wonder that AI is the hottest investing storyline going.

And little wonder investors see Nvidia as the “must-have” stock to ride the AI rocket to the sky.

Here at Stock Picker’s Corner (SPC), we believe that “if you find the best stories, you’ll find the best stocks.” And the AI Era is absolutely on our “best stories” shortlist. But for the aspiring Wealth Builders following our work, we’re going to show you that Nvidia isn’t the only “best stock” to play.

Especially if the huge run-up Nvidia has experienced in recent months has you worried – or perhaps just feeling some “Nvidia Fatigue.”

Meet the Data City

There’s a subplot in the AI story. And it’s a page-turning Wealth Builder with years to play out.

I’m talking about the explosion of digital data that somehow has to be stored, organized and managed so that AI, driverless vehicles, cryptocurrencies, digital payments, e-commerce, drug discovery and personalized medicine, cybersecurity and cyberwarfare, virtual working and virtual learning – and scads of other key pieces of our modern digital lives – can evolve and advance without disruptions.

The enabling linchpin of everything I just described here is sprawling, campus-like villages where zettabytes of data – not human beings – make up the citizenry.

They’re called data centers. And the humans that work in them serve the data stored there – so that the rest of us can live our lives – blissfully unaware of the cost and complexity of these innovative places.

Data-center campuses include massive buildings that house rows of networked computers, routers, switches, software, cables, power systems and more. Their massive storage capacity, and speedy operation, enable you to have Zoom meetings with colleagues on other continents, binge-watch the latest movies or old TV shows, use ChatGPT to ask for a “Keto” chocolate-chip cookie recipe (and have it in a second), order that Mother’s Day gift from Amazon Prime … and, well, you get the idea.

The need for data storage is massive – and massively underestimated.

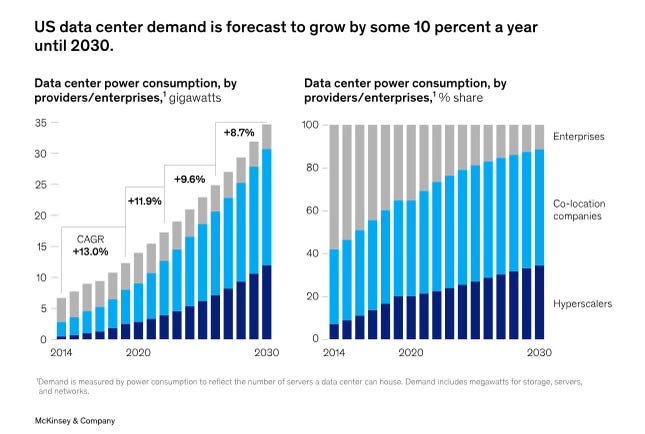

Consultant McKinsey & Co. says power consumption is a good proxy for data center growth here in the U.S. market, which accounts for about 40% of the global market. That power consumption, which reflects the number of computer servers a data center can house, is projected to grow from 17 gigawatts (GW) in 2022 to 35 GW in 2030. Data centers will grow at 10% a year during that stretch.

A forecast by ResearchandMarkets is even more bullish. Data center hardware demand is projected to grow 12.4% annually on a global basis from 2023 to 2030. Here in the U.S. market, that yearly growth rate will be even higher – averaging 14.2% a year.

The individual projects will be massive.

Amazon.com Inc. AMZN 0.00%↑ – whose 31% of the global cloud-storage business makes it the market share leader – plans to spend $150 billion over the next 15 years on data centers to meet demand driven by AI adoption.

As companies push to offer better, faster and more advanced AI products and services, they’ll need data centers to handle the bandwidth.

That brings us to Blackstone Inc. BX 0.00%↑.

Founded in 1985 and based right on Park Avenue in New York City, Blackstone has $1 trillion in assets under management (AUM) – which makes it the world’s largest manager of “alternative” assets.

Those “alternatives” include more than 230 companies and 12,500 real estate assets.

And Blackstone’s folks are smart.

Very smart.

One of the strategies in Blackstone’s real-estate playbook is to identify areas of rising demand, where there’s a looming shortage of supply, and to swoop in as the landlord – ideally, grabbing those assets (and building hefty market share) before prices explode.

Blackstone’s already pulled this off with housing. And now it’s applied this winning strategy to (you guessed it) AI — and data centers.

A Gridiron-Sized Project

In 2021, Blackstone acquired QTS Realty Trust for $10 billion – the largest data center transaction at the time.

QTS has data centers across North America and Europe. And with Blackstone’s investment and guiding hand, QTS signed more leases in 2023 than in the 17 years prior to the acquisition.

But Blackstone is just getting started. It’s now ramping up QTS with a project on a Phoenix, Arizona, tract that Bloomberg describes as a “stretch of land larger than 60 football fields.” And 30 miles from that site, there’s another under-development complex on 400 acres (or about half the area of Central Park in New York City).

Blacktone’s Phoenix campus was fully leased before it was completed, with Microsoft Corp. MSFT 0.00%↑ as a tenant.

In addition to QTS, Blackstone has a $7 billion partnership with Digital Realty Trust Inc. DLR 0.00%↑ to develop data centers in:

Paris, France.

Frankfurt, Germany.

And Northern Virginia.

In theory, any company with an appetite for growth could pursue the same strategy as Blackstone – you know, buy the land, outfit some massive data centers and lease out space for AI-focused tech companies.

Like I said … in theory.

But Blackstone has a stealthy “moat” that gives it the kind of “edge” I seek when hunting for longer-term, understandable-risk wealth plays for my readers.

Because the “shopping list” for data centers contains a lot of high-dollar hardware, software and construction material, Blackstone’s vision is a big-budget strategy. And it doesn’t stop there: Building a data center requires a large amount of money, land, energy access, political influence, potential customer connections and the “know-how” to see a project this massive all the way through to its finish.

Blackstone has the resources and “know-how” to make this happen.

Chipmakers will command a lot of investor attention – and that’s understandable: They’re sexy investments – especially compared with real estate, or warehouse-sized rooms filled with tech equipment.

But Blackstone’s blueprint is the kind of wealth play I look for – especially since it’s one most investors just won’t seek.

But that’s okay: It’s on your radar now.

And it’s a Wealth Builder play you can add today – and plan to hold for years to come.