We like to keep things simple here at Stock Picker’s Corner (SPC).

And we’ll do it again here.

When it comes to investing “types,” there are really only two …

You’re either a “Wealth Builder” …

Or you’re a “Wealth Killer.”

It’s as simple as that.

And it’s crucial to understand.

Here in our little corner of the investing world, what’s masquerading as “investing” these days – speculative options – are hand grenades in disguise.

Hand grenades with their pins already pulled.

For the majority of retail investors, speculating with options is akin to a prop DraftKings wager where you’re guessing how many yards a quarterback will amass on Sunday … while actually expecting to be rich Monday morning.

For those folks, there’s a better way.

Become a “Wealth Builder.”

Chart your own course. Understand the “big picture” – including the investing storylines we’re chronicling here. Take the long view. And accept that you may occasionally be “uncomfortable” in the near term.

Like with electric-vehicle (EV) innovator Tesla Inc. TSLA 0.00%↑ .

Will the Real Tesla, Please Stand Up?

Back in October, Tesla’s impresario founder Elon Musk warned that consumer demand could slow – a reality the company confirmed in January. Indeed, Tesla said the rate of growth would be “notably lower” in 2024.

If you view Tesla as “just” a car company – which many folks do – that’s something to worry about. And worry they did – “taking Tesla to the woodshed,” as it were.

If you look, you’ll see that:

The stock has slumped 35% year-to-date.

Musk has been vacuumed into a distracting compensation battle where the lawyers representing Tesla shareholders are seeking $5.6 billion in Tesla stock as their attorney fees.

And in a research note to clients, a Wells Fargo analyst bashed Tesla as a “growth company with no growth.”

Each of those points are true … as “facts.”

But they fall short when it comes to “meaning.”

And when it comes to Tesla, that “meaning” tells us that it’s more than an EV car company.

Much more.

Tesla is an “ecosystem” play – like Apple Inc. AAPL 0.00%↑ – where the company in its entirety is greater than the sum of the individual parts.

With Tesla, the ecosystem story is the real story.

✅ It’s a technology story: Thanks to Tesla’s innovative know-how – like Full-Self Driving (FSD) and the next-generation Roadster built with SpaceX technology – we’re talking about technology so advanced that it makes people buy that car.

✅ It’s an energy story: Electric-vehicle “range” – the EV equivalent of how far you can drive a regular car before you run out of gas – has become a real concern with consumers, who worry they won’t find a charging station when they need one. Even here – with something called “range anxiety” – Tesla is superior. Tesla has the largest global network (50,000+) of Superchargers, with roughly 2,000 across the United States.

The Official Tesla “User’s Manual”

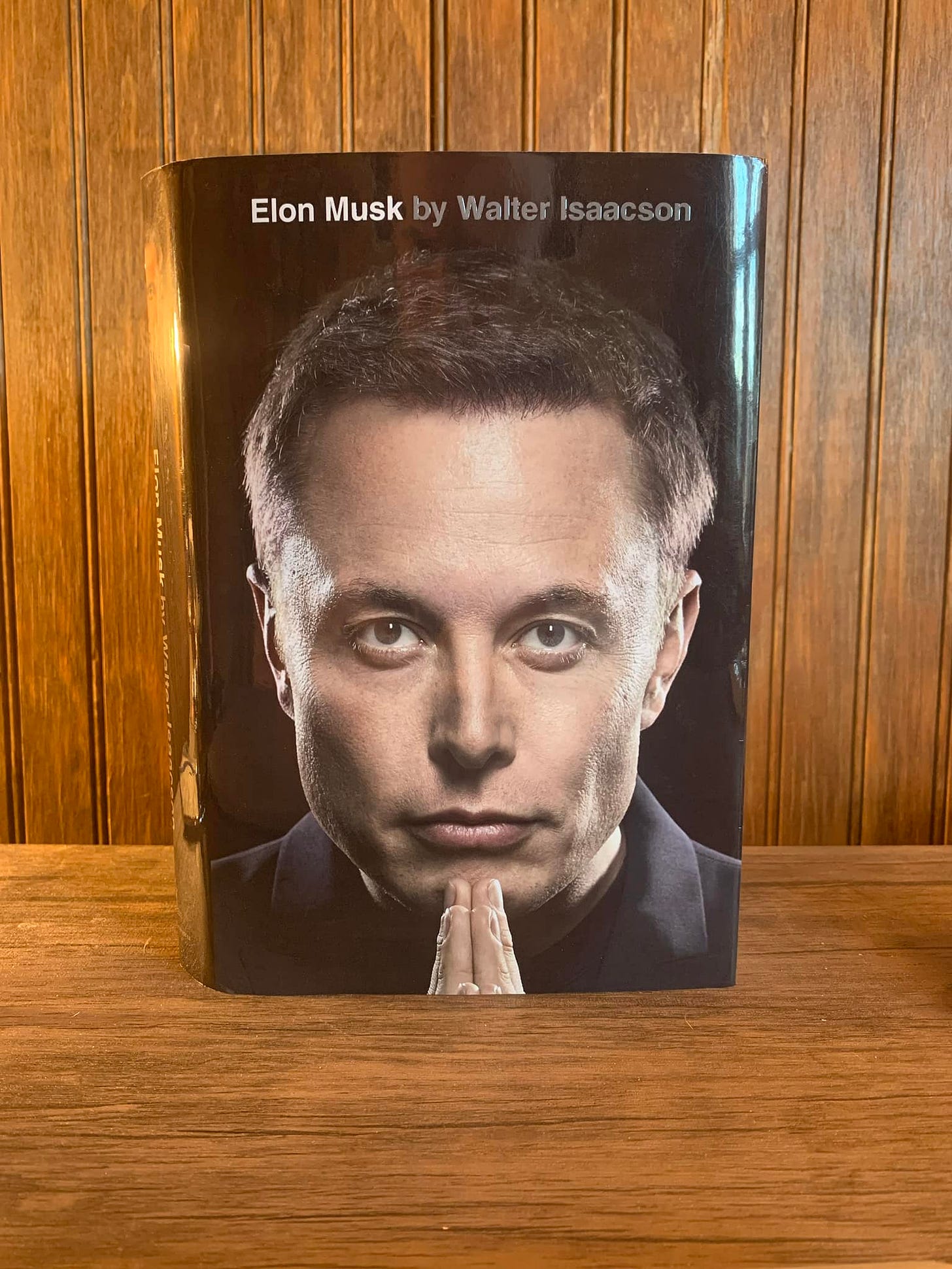

If you want a kind of “secret decoder ring” that helps you understand the Tesla ecosystem at work, check out the authorized biography Elon Musk , by American author, journalist, and professor Walter Isaacson.

Like an “embedded journalist” on the front lines of a battle, Isaacson spent two years following Musk everywhere – from Tesla to the factories of SpaceX.

This is about as close as you’ll get to being an actual Musk “insider” – seeing how he thinks, talks and operates … as well as the experiences that shaped him as he grew up.

I’ve selected three passages that reinforce the idea of understanding the world around you … understanding Tesla … and understanding why it’s a wealth-building investment.

Inside Musk’s Mind, Inside the Ecosystem

With the following passages, you’ll see even Musk jumps around with different descriptors of Tesla. But as I’ve been saying, these disparate pieces combine to form that ecosystem. They also illustrate Tesla’s ability to constantly evolve – so that it doesn’t end up as “just a car company.”

Every piece of Tesla – from the technology to energy infrastructure – makes it greater than the sum of its parts.

With Tesla’s vehicles gathering real-world data, it will end up with a bigger digital view of the world than any rival carmaker out there … and perhaps, eventually more than any company in the world.

While X, formerly Twitter, is its own company, it’s still part of the Musk ecosystem where he can leverage the knowledge, know-how, and data at one of his companies for another.

“He also realized that success in the field of artificial intelligence would come from having access to huge amounts of real-world data that the bots could learn from. One such gold mine, he realized at the time, was Tesla, which collected millions of frames of video each day of drivers handling different situations. ‘Probably Tesla will have more real-world data than any other company in the world,’ he said. Another trove of data, he would later come to realize, was Twitter, which by 2023 was processing 500 million posts per day from humans.” Page 243

Isaacson acknowledges Musk for not hamstringing Tesla with an overly narrow value proposition – meaning it can evolve in lockstep (or ahead of) the world it operates in.

Isaacson pointed that out when relating a story about Tesla’s battery factory.

“After opening its Nevada battery factory, Tesla had begun making a refrigerator-size battery for the home, called the Powerwall. It could be connected to solar panels, such as those installed by SolarCity. The concept helped Musk avoid the mistake made by many corporate leaders of defining their business too narrowly. ‘Tesla is not just an automotive company,’ he said when the Powerwall was announced in April 2015. ‘It’s an energy innovation company.’” Page 253

To round out the ecosystem concept, Isaacson puts it all together – from the vehicles to energy to the tech to AI.

“In the future, he realized, Tesla was going to be not just a car company and not just a clean-energy company. With Full-Self Driving and the Optimus robot and the Dojo machine-learning supercomputer, it was going to be an artificial intelligence company – one that operated not only in the virtual world of chatbots but also in the physical real world of factories and roads.” Page 594

As a fellow “Wealth Builder” – and someone who’s now part of our SPC family – what I really want you to see is how the Tesla ecosystem functions, adapts and grows.

Tesla shareholders will feel uncomfortable over the next year or so. And other investors will avoid the stock completely.

But avoiding Tesla is a “Wealth Killer” move.

There’s a bigger story here … and we have a pretty good idea how it ends.

Be there for the payoff when that happens.