I’m a stock picker, first and foremost.

That’s because stocks are the single-best “Wealth Builder” asset around.

And with how much prices have soared over the last four years, being a Wealth Builder is more important now than ever before.

Think about it: Since January 2021, car insurance is up 44% (including 20% in the last year alone). Gasoline has soared nearly 35%. Electricity has zoomed 28%. And it’s been more than 30 years since food chewed up this much of our paychecks.

During that four-year stretch, general prices are up 18%. But our wages have advanced only 15.4%.

When prices rise faster than our pay, that triggers worry.

And that worry is like a drumbeat that keeps building: By 2027, a quarter of all Americans are expected to have “side hustles” – just to make ends meet.

The “right” stocks can keep you out front.

And so can silver.

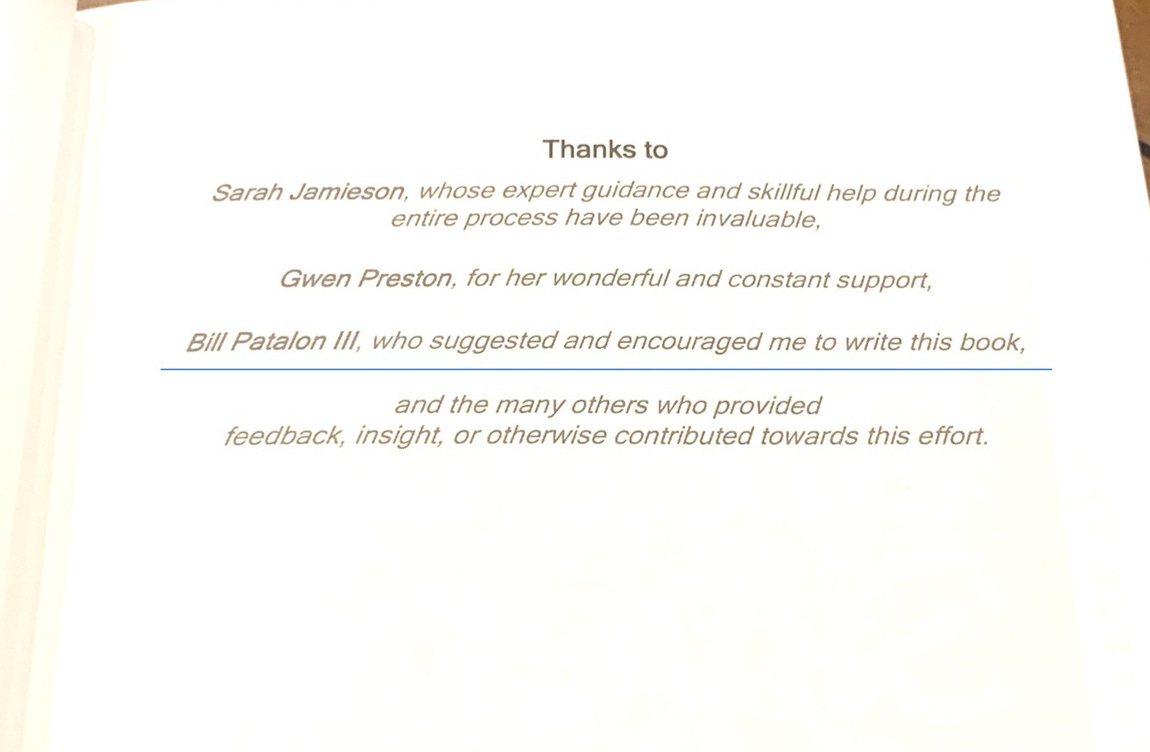

For the Wealth Builders looking to take back control, silver is like a coiled spring … and it’s going to get sprung, says longtime colleague Peter Krauth, author of “The Great Silver Bull,” which has been one of the top “commodities-and-trading” books on Amazon.

It’s a great book … something I know firsthand.

And Peter is one of the top experts on silver as an investment – and just a super person - something I also know firsthand.

That’s why I recently sat down with Peter, a metals-and-mining expert whose Canadian base has him operating in one of the most resource-rich markets in the world.

During that talk, Peter said we’re headed for $30 silver by the end of the year. With silver prices jumping 7.7% in the last month, that’s looking like a prescient call.

But it’s Peter’s long-term outlook – and his prediction of $300-an-ounce silver – that gives it the Wealth Builder impact I seek.

His impressive forecast – and it is impressive – wouldn’t do you folks much good without some context.

And our years of collaboration meant I knew precisely what questions to ask. The topics Peter and I covered include:

• Silver’s price affordability (aka its “stackability”).

• Its advantage over gold … thanks to its industrial and investment dual-demand triggers.

• The best ways to buy and own it.

• And, most important of all, why he sees the potential for a 12x gain in the “other precious metal.”

That interview is available, for free – here.

P.S. It’s been just over a month since Stock Picker’s Corner (SPC) launched, and our team is truly touched by all the early support. For folks who’ve asked in what ways they can help the publication, the best way right now is by liking and sharing our content for more people to find us. If you think this silver interview can add value to someone’s day, go ahead and hit the share button below – it’s truly appreciated.