At Private Briefing, the newsletter I ran for more than a decade before coming here to launch Stock Picker’s Corner (SPC), I had a cadre of ardent readers who wrote in pretty regularly.

Those readers would ask for “folos,” my slang for “follow-ups,” on earlier stories. They’d ask about my wife, son or Dad — who were frequent subjects of my research reports. They’d tell me how my columns struck a personal chord. They’d share their own victory tales — testimonials spotlighting how my research led to their own successes. And several times — when I’d taken a vacation, or had uncharacteristic gaps between missives because of a family emergency — they’d even write in (or call customer service) to make sure I was okay.

As a writer whose entire career has been focused on helping people, these notes were gratifying — heck, were downright heartwarming …

My bosses took to calling these “Hey Bill Notes,” because that’s the greeting these letters, e-mails and calls to customer service often opened with. At first, my bosses used that label in a “tongue-in-cheek” manner. But as the years rolled by and those notes rolled in, the “Hey Bill” sobriquet shifted to one of respect: My bosses finally understood — as I’d understood from the very start — that these were special readers … whose respect and engagement we were lucky to earn (and that I worked hard to keep).

Substack offers that same engagement potential. That’s why I came here. That’s why I co-launched SPC. And (I believe) that’s why the “Hey Bill Notes” are starting to emerge.

Like this one — on Monday — from longtime reader L.W.

“Hey Bill: Most of our cash investments are in stocks. I am concerned about the dockworkers strike disrupting the supply chain and forcing inflation to rise. Should I stay where we are with stocks, invest in government bonds or do you have a suggestion? We have rental properties in a low-key tourist town. Those are our largest investments. Thank you for your time and suggestions.”

It's a great question. And a timely one …

I obviously can’t offer individualized investment counsel — I can’t “see into” a person’s portfolio, don’t know their financial plan or goals and am not an expert on their tax situation. But I do have good, sound foundational strategies to share — insights that apply to any Wealth Builders out there.

So let’s get started … with the basics … and the near-term outlook.

Dry-Docked … Or ColdCocked?

This is the first dockworkers strike in nearly 50 years. It affects about 45,000 workers across 36 ports from Maine to Texas. Those ports account for about half of U.S. container trade. And as this strike takes hold, it could cost the U.S. economy $5 billion a day.

I live and work less than an hour from the Port of Baltimore, which only recently reopened after the March collapse of the Francis Scott Key Bridge. And I worked for years as a business reporter for The Baltimore Sun, so I understand the port’s importance to the regional economy. I’ve covered shipping and logistics from trucking to warehouses to railroads to container terminals to global trade — so I also “see” the very real U.S. fallout potential.

I’ve also seen this from both sides. I’ve been a union member myself: For a hefty swath of my 22 years as a business reporter, I was a member of The Newspaper Guild (now the NewsGuild) and worked in one market under an expired contract that was at six years and counting when I left for another job — and took years after that to settle.

But here today — taking a step back and viewing this as an analyst and stock picker — the possible supply-chain mess is far too easy to visualize. Here today, we’re only four years removed from the economic SNAFU known as COVID-19 — a case of “economic lockjaw” that cleared store shelves, introduced millions to the term “hand sanitizer,” created the “arms-length economy” and inspired corporate logistical experts to prepare for “next time.”

And that “next time” may be now.

If this strike gets really messy — you know, if it gums up America’s supply chain, creates holiday shortages, supercharges inflation and spools up into a major election issue — the near-term costs could be hefty.

It’s especially thorny since we’re already dealing with the fallout from Hurricane Helene … guesses about what the Federal Reserve will do next … the New Cold War threats posed by Russia and China … the “hotter” (and wider) threats posed by Israel, Iran, Hamas, Hezbollah and Lebanon … “hacking” threats from everywhere and whatever else is “lurking” out there (known and unknown).

The takeaway: The near-term situation could be messy, indeed. And the longer the strike lasts, the bigger the mess.

Any preparations companies made (they saw this coming, stocked their supply chains and gave themselves a month or so of “cushion”) will be eviscerated. The Walmarts and Home Depots will watch as their shelves get lean … that “stuff” you want to get your kids for Christmas won’t be there … and whatever is available is likely to cost more — maybe a lot more.

Want some context? Me, too. So I dug into my Platinum Rolodex — and turned to several of my fellow Substack neighbors, including Mihail Stoyanov, who runs The Old Economy service here.

According to Mihail, the dockworkers strike absolutely “has the potential to unlock another round of cyclical inflation, considering that we have the right ingredients: Rising liquidity [courtesy of the Fed and the brand-new stimulus from the People’s Bank of China] and constrained supply chains (Red Sea blockade). We are approaching the holiday season, so the timing is perfect.”

Shipping is one of Mihail’s areas of special focus, so he speaks as a true expert in telling us that the longer the strike goes, the higher the port congestion.

“In simple terms, Bill, the vessels will stay for extended periods in port waters without being offloaded, resulting in longer contracts and fewer ships available for new employment,” he told me. “The result is rising day rates and, eventually, higher consumer prices. If the strike is held for more than a week, port congestion will become inevitable. Conversely, if the strike is resolved within a week, its effect will be relatively limited. Let's see how it plays out.”

Let’s see, indeed.

As Mihail and other experts candidly tell us: We just don’t really know what the near-term situation holds.

Which brings me back to that “Hey Bill” question: What to do.

It’s Buy Stocks - Not “Goodbye” Stocks

Between the tug-of-war between “bullish” factors like Fed rate cuts and China stimulus infusions … and bearish factors like the dockworkers strike, the mess in the Middle East and “Whac-A-Mole Inflation” that could be supercharged by what’s happening now … there’s a lot to handle already.

And we know there’s more good and bad to come – meaning more whipsawing – and that’s before “new uncertainties” emerge from the dark corners of the global economy.

Could that lead to a correction before year-end? Absolutely.

Is it a certainty? Not at all.

Here’s where retail investors — all investors, really … but especially the folks we write to here — need to embrace the one competitive advantage they have.

Time.

Otherwise known as the “long view.”

If inflation re-accelerates, stocks are the No. 1 investment vehicle that will keep you out front. Invest in good companies — ventures whose businesses (and revenue and profits) will keep growing.

If you try to deal with every single near-term challenge that comes along, you’ll (first) drive yourself nuts. But (second) you’ll fall behind, sell when you should be buying — or find yourself on the sidelines (in cash) watching as the “Next Bull Market” ignites … and leaves you behind.

It’s tough, I know, to have a lot of cash in stocks — and watch as the entire market “gets a haircut.”

But it pays to be “long” on stocks — since stocks tend to go up most of the time — and over time. And buying during bad stretches gives you an advantage over folks who chase the bull.

Check this out …

Wealth Builders & Wealth Killers

Wealth Builders understand that stocks — as a group — have a bullish propensity. Wealth Killers haven’t had this “investing epiphany.” That makes them vulnerable — to all the data points, market wiggles and “competing voices” that Wealth Builders have learned to tune out.

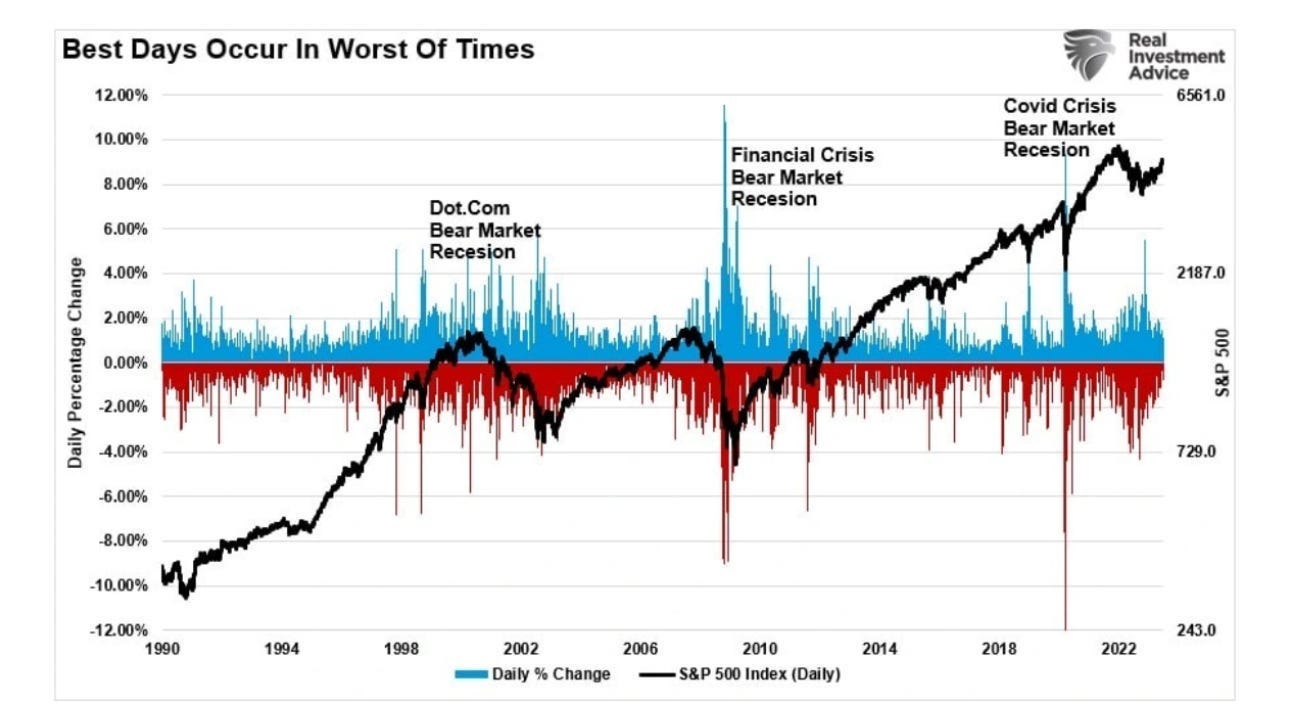

That’s why Wealth Killers get shaken out during “scary moments,” and lose out — since some of the market’s best moments occur against some of the worst backdrops.

Wealth Builders also know that pullbacks, corrections and bear markets aren’t just inevitable … they’re downright healthy for the stock market.

A drop in stock prices shakes out all the “weak hands” — the speculators, the ill-informed and the “I’m not that committed to this stock/rally/bull-market” crowd.

That means the smart folks — the “strong hand” Wealth Builders like you and me — are still in the game.

It’s like a pub that bounces the riff-raff. Or a forest fire that burns up all the branches, dried leaves and rotted trees to rejuvenate the soil, clearing the surrounding ground for new growth and creating spaces in the forest “canopy” to let in a lot more nurturing sunlight.

A sell-off in stocks performs that same healthy function.

And, with a “Next Bull Market Mindset,” it sets us up for the next move – a strategy that’s the true differentiator … and one that really creates the wealthy elite.

I call it the “Accumulate Strategy.”

And it’s a key to building wealth.

Buy Low, Buy Low and Buy Low Again

Every investor knows the investing maxim of “Buy Low, Sell High.”

But very few people actually do it.

They know this maxim logically … intellectually. But they act emotionally.

Bull markets tend to last about four years. But the average correction (a decline of 10% to 19%) lasts 138 days. And the average bear market (20% or more) persists for less than 18 months.

In short, we know that a bear market today is a table-setter for a bull market tomorrow.

And since, as I’ve already shown you, it pays to be “long” if you’re a long-term investor, we also know that buying the shares of the companies with the best storylines during these darkest stretches will magnify your wealth when that Next Bull Market inevitably comes.

To say it another way: If the S&P 500 takes a 10% spill (a correction) or a 20% freefall (a bear market or even a crash), doesn’t it make sense to view it as a “Buy Low” opportunity?

I mean … that’s the point in time where that “Buy Low” opportunity that we all know to be correct is being handed to us: Prices (valuations) will be lower, making those great companies cheaper to snag.

Want a checklist of what to consider? Here you go.

Look at the stocks you own now: Which ones would you like to own more of? Look to “Accumulate” additional shares on any pullbacks, or as you get more cash.

Look at stocks you don’t own now – but would like to. Create a “foundational stake” now – and then shift into “Accumulate” mode.

Or create a “Watch List” (like this one) and wait for a pullback to make that first purchase.

Once you’ve done that: Go long.

The Simple Secret to Making Money

Whenever a new investment is added to the SPC Premium Model Portfolio, I also give folks a specific “holding period” — ranging from three to 10 years.

The holding periods do vary — based on the specifics of the stock, fund or asset.

But that longer-holding-period philosophy is based on two key pieces of hard data.

The first isn’t all that surprising: Generally speaking, the longer you hold a stock, the more likely you are to reap a positive return.

The second (and you can see it here): The shorter the holding period, the more likely you are to take a loss.

Giving yourself an investment horizon of just one month puts the probability of a loss at 38%. But if you hold a stock for five years, that probability plummets to just 10%.

And look at this: If you hold that stock for just one day, your probability of a loss is 46%.

So … it’s basically a coin flip — almost a “heads I make money, tails I lose.”

But give yourself 10 years, and the probability of a negative return is a mere 6%.

That’s my response to this “Hey Bill” note.

Again, it’s not individual advice — but rather is the kind of broad analysis I share with all our readers here at SPC.

And I’ve got one other bit of analysis related to the dockworkers strike — a long-term wealth play I’ll share if this labor standoff seems to take hold.

Keep those notes coming … I appreciate them.