Win the Inflation/Debt Bomb Tug-of-War — While Everyone Else Loses

With silver, select stocks and the right storylines, you'll stay out of that "muddy hole."

Think of it as a super-high-stakes tug-of-war.

On one end of the rope is the near-term inflation outlook — which suddenly looks to be getting worse.

On the other: America’s massive long-term debt bomb — $36 trillion and ticking.

In the middle is that nasty mudhole that the contestants get dragged through — back-and-forth … back-and-forth — and where the “losers” eventually get dumped.

I want to help you stay out of that mudhole.

I want to make sure that list of losers doesn’t include you.

DEBT-BOMB FALLOUT

In our Wednesday’s issue, financial historian and bestselling author Mark J. Higgins detailed the massive debt bomb — 123% of GDP and ticking toward a disastrous end.

“Federal deficits have exploded since the COVID-19 pandemic,” Mark told me in our interview. “What is most concerning is that interest payments on the debt now constitute a rather large percentage of the fiscal deficit. In 2025, the interest payment is expected to be $952 billion — which is more than defense spending … My biggest concern is that the U.S. has made itself vulnerable to encountering an unexpected catastrophic event, and it will lack the debt capacity to respond effectively.”

He's right: That massive debt load — and the huge interest payments it creates — poses a massive risk for our country … today, tomorrow and in the distant future.

And during the 40 years I’ve spent as a business reporter, financial columnist, analyst and stock-picker, I’ve written about dozens of those scenarios, including:

A Drag on the Economy:

A Risk to America’s Credit Rating.

A Potential “Crowding-Out Effect” For Private Borrowers.

Reducing Washington’s “Prime-the-Pump” Options with Emergencies or Recessions.

Inevitable (And Growth-Thwarting) Tax Increases.

An Invitation to Relentless Inflation.

A Dent in the Value of the Greenback.

And more …

Then there’s inflation – a narrative that looked to get worse this week.

THAT REBOUND RELATIONSHIP — INFLATION

The U.S. consumer price index (CPI) — a bellwether inflation metric that tracks prices and help guides public policy — surged more than expected in January, adding muscle to the U.S. Federal Reserve’s wait-and-see stance on additional interest-rate cuts.

According to a U.S. Labor Department report released Wednesday, the CPI jumped a much-higher-than-expected 0.5% last month following a 0.4% advance in December. That works out to a 3% annual rate through January after a 2.9% move in December.

Economists were looking for a monthly surge of only 0.3% for January and a 2.9% increase for the previous 12 months, Reuters reported.

Before the CPI report, analysts were expecting a quarter-point central bank cut in June. Now they don’t see a rate reduction until September — at the earliest.

Here’s where that “tug-of-war” I talked about starts to take shape …

I’m intentionally oversimplifying this … and using some “back-of-the-envelope” math.

Given the current U.S. national debt of approximately $36.22 trillion — and the prevailing interest rates — the government spends about $1.2 trillion a year in interest payments alone.

For every 1% interest rates go down, Washington saves about $361 billion in interest payments.

So a rate cut would be good for stocks, good for corporate profits and good (from this standpoint) for our massive debt load.

But … (there’s always a “but” isn’t there?) … rate reductions are inflationary.

And few of us have forgotten the inflationary surge of 2022 — or the 9.1% rate peak in June of that year.

We haven’t forgotten it because — thanks to cumulative inflation, which I explained in this report — prices today are 15% higher (on average) than they were five years ago.

Some items have increased even more.

For instance, car repairs surged 17% in 2023 — and another 7.4% last year. Car insurance rates have more than doubled over the last five years — punctuated by a 17.75% jump last year alone.

And let’s not forget food — which fills our stomachs … and causes acid reflux … often at the same time.

Meat, poultry, fish and eggs increased by an aggregate 12.6% in 2023.

And, if you’re watching the headlines, you know that eggs are the l'ennui du jour …

Remember when eggs were two bucks a dozen?

Nationwide, in December, U.S. stores charged an average of $4.15 for a dozen of the large, Grade-A eggs — a jump of 65% from a year earlier and 132% from the good-old (pre-influenza) days of December 2021, says the U.S. Bureau of Labor Statistics.

Waffle House just instituted an “egg surcharge” — of 50 cents each. My son Joey and I love the “triple hashbrowns.” But that just added a buck and a half to the price of the three-egg tomato-and-cheese omelettes that I order when I get breakfast.

MORE PAIN, YOU GAIN

Look, I’ve been around long enough to know how insidious inflation can be. I remember how it took hold in the 1970s — and wouldn’t go away.

The “cure” was almost as painful — but it was a cure.

Then-U.S. Fed Chair Paul Volcker squeezed the U.S. money supply by jacking up rates — taking the benchmark Fed Funds Rate to a peak of more than 20% in June 1981.

This triggered the “double-dip recession” of the early 1980s. The first lasted from January to July 1980. The second one ran from July 1981 to November 1982. This gave us a “W-shaped” economic chart — with the middle part of the W representing the brief recovery between the two downturns.

Inflation dropped from its 15% peak in 1980 to roughly 3% by 1983.

However, it took until 1986 for borrowing costs to get back down to a more-normalized 5%.

That’s what happens when you let inflation into your house.

And it brings us back to the “tug-of-war” challenge that Washington, the Fed and investors like you and I now face:

Washington must tackle the country’s massive debt load.

The Federal Reserve has to balance the growing inflationary threat against the pressures it’s going to face from politicos who want lower rates for consumers and for interest-payment relief on the nation’s gigantic “credit card.”

And you and I must navigate the near-term threats and the very real long-term risks.

One of the biggest risks you and I face is uncertainty.

Most economists now say any rate cuts will come much, much later than they were forecasting as recently as a few months.

Heck, Interactive Brokers Senior Economist José Torres is taking a downright Contrarian stance: As he told Yahoo! Finance this week, if inflation accelerates to 3.5%, he believes the central bank may have to reverse course and start raising rates.

Although he sees only a 25% chance this will happen, the fact that he’s talking about it at all underscores that the risk is real.

As is the debt threat.

So here’s what we do …

“SILVER AND GOLD”

My good friend Peter Krauth, publisher of the Silver Stock Investor newsletter, has been warning folks about the U.S. debt bomb for years: In fact, it’s a key storyline in his 2022 book “The Great Silver Bull.”

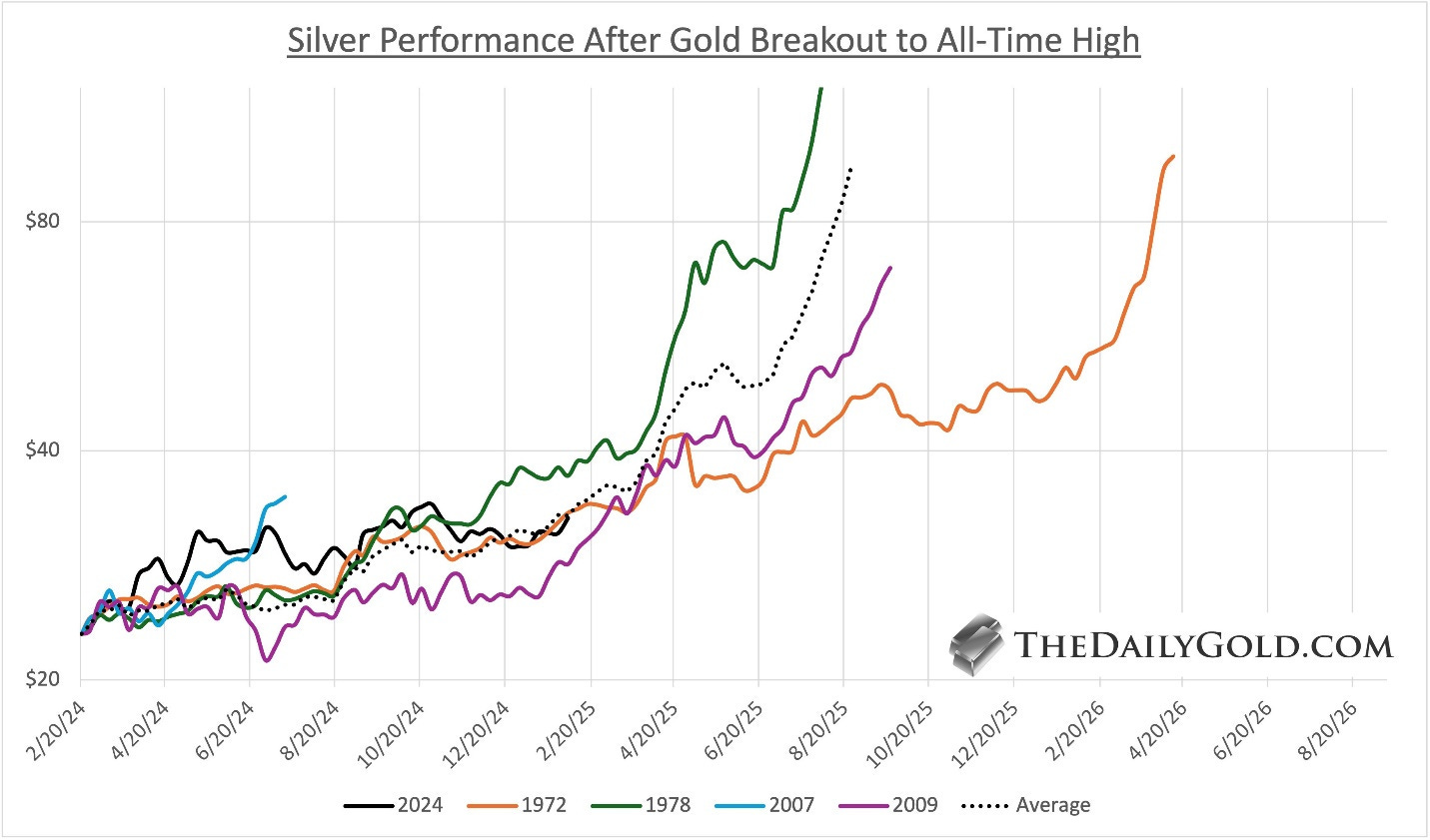

Going back to last March, when silver was trading at just under $24 an ounce, Peter told me in an interview that silver would hit $30 an ounce by the end of 2024 … and $300 or more in the years to come.

As we now know, he “nailed” that $30 prediction: That “other” precious metal rose to nearly $35 in October. And he boosted his near-term target to $40 in this SPC interview in December.

But the debt problem remains, Peter told me this week.

“This is a very big deal, Bill,” he said. “Have a look at this chart. Says it all. The U.S. is in the worst shape as it pays the most interest relative to GDP for developed nations.”

I asked him what we need to watch going forward. And I asked him to detail how that will affect the price of silver.

“I think the U.S. dollar has peaked,” he said. “We know President Trump wants a weaker dollar and will do everything he can to get it. This is great for silver, Bill. And the fact is that the investing public is catching on, with expectation of five-year inflation at new two-year highs. That’s why gold is at an all-time high … silver follows, and still has a lot of catching up to do, heading to my $300 target.”

It’s not a coincidence that gold prices have soared over the last five years — as Washington packed on all that debt.

OTHER STOCKS, OTHER STRATEGIES

But metals aren’t the only piece of your Stock Pickers Corner (SPC) “Tug-Of-War Protection Plan.”

In addition to the Premium Dossiers for our Model Portfolio, we’ve created our Super 10: Special-Situation Portfolio for our SPC Premium family members.

And here in recent weeks, for the daily readers of our free research, we’ve also published:

The Trump 2.0 Investment Blueprint: We believe that if you find the best storylines, you’ll find the best socks. And many of the narratives we most believe in have only been supercharged by what we’ve seen here in the first part of U.S. President Donald Trump’s second tour of White House duty. This has been an immensely popular research report. If you haven’t read it yet, you can read it for free right here.

Gunfight at the Tariff Corral: How to Win No Matter What Happens: A “subset” of the Trump blueprint — and a report that’s reflective of the fast-changing nature of the administration’s trade policies — this research shows that the sequel can be more popular than the original. And it includes my very favorite “trading” strategy.

And Don’t Forget Silver: If you want a “cheat sheet” for Peter’s thinking on that metal for 2025, we gave readers this short-but-powerful summary just a few weeks back.

There you go, folks.

Everyone else can play tug-of-war — yanking this way over debt fears one day … and that way over inflation worries the next — a no-win struggle that leads to rope-burned hands, sprained shoulders and badly twisted knees … and an eventual plunge into a muddy hole whose stench doesn’t wash off.

Say “No” to the tug-of-war.

And play a different game.

A wiser game.

A winning game.

And one that keeps you out of that muddy hole.

That’s our game … make it yours’.

See you next time;

The Tariff/Trade War gunfight ...

https://open.substack.com/pub/stockpickerscorner/p/gunfight-at-the-tariff-corral-how?r=3ftiph&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false

Be sure to check out Part 1 of this two-part report -- our full interview with author and financial historian Mark J. Higgins, who details the looming threat of an American Debt Debacle.

https://stockpickerscorner.substack.com/p/americas-debt-debacle-tick-tick-tick