Forecast 2025: Two Silver Stocks and a $40 Bullseye

Peter Krauth nailed his 2024 call — and still sees $300 silver ...

When I want to know about silver, there’s one name I think of immediately: Peter Krauth, Publisher of the Silver Stock Investor newsletter.

I’ve known, been friends and worked with Peter for 15 years.

When it comes to my network of experts, Peter is one of the inaugural financial-publishing members of my “Platinum Rolodex.”

Silver was a hot topic in 2024. And Peter was a true “thought leader.”

He told me in a March interview that silver would hit $30 an ounce by the end of 2024 … and $300 or more in the years to come – a scenario he detailed in his 2022 book “The Great Silver Bull.”

While it’s far too soon to assess his $300 prediction … Peter absolutely “nailed” that $30 prediction.

Silver was trading for less than $24 an ounce at the time of our talk. It soon after surged up over that $30 mark — peaking at $35 per ounce in October. What’s really key (to me) is the fact that silver stayed above Peter’s $30 prediction for most of the year.

But (as we know), investing is very much a “what comes next” reality.

And as we careen toward the end of the year, one of the debates investment pundits are having is how well gold will do, how well silver will do, and which of those two metals will outperform the other.

After he nailed it here in 2024, we’re back again … asking Peter “what comes next” for silver.

What does he “see” for the “other precious metal” in 2025?

We also have a silver poll at the end of the interview …

WPIII (Q): Peter, thanks for taking the time to chat today.

I want our members to have the lowdown on this developing opportunity.

So, for everyone here, including folks who may be new to metals, let’s start with the basics … the foundational question.

Why silver?

PK (A): Bill, as you know from our chats over the years, I’m a mining and metals guy. I live up here in Canada – one of the true mining meccas on the planet – so I know the players, know the history, and know the market. I regularly visit properties and mining sites and see the operations first-hand. And I’ve made silver my chief focus.

WPIII (Q): Because … ?

PK (A): Because … like its more-expensive counterpart … the so-called “yellow metal” (aka gold) … silver is viewed as a "store of value.” But, unlike gold, silver is an industrial metal, too.

Its use in solar panels has soared to 20% of the market. It’s also in automobiles, electronics like smartphones and tablets, medical applications, glass coatings in mirrors ... and that’s just a short-list of the “use cases.”

WPIII (Q): I know I’ve heard you say that “we’re within a few feet of silver nearly every second of the day.” If I also remember correctly from our many talks, about half of silver demand is driven by some of these industrial uses … or, at least, that was the case as recently as 2022.

PK (A): That’s right, Bill. In fact, based on 2023 data, it’s now about 60% going to industrial applications. And I’ve always found that fascinating … you know … that silver is both an industrial metal and a monetary metal.

Looking ahead, I believe silver will be a massive wealth generator, which I know is the type of “edge” your readers are looking for.

So the time to build your silver position is … now.

WPIII (Q): That’s good stuff.

So … let’s start with … a look back at 2024.

What did you get right? And were you correct for the reasons you expected?

What did you feel you missed? Or, perhaps, what surprised you about this year, vis a vis your area of expertise – silver?

PK (A): Well Bill, I said we’d see silver reach $35 in Q3, and we did in mid-October. I said that would happen as the market realized just how tight the silver market is. I believe that’s what happened. Of course, it didn’t hurt that gold ran to all-time highs of $2,750 at that time.

What surprised me was how physical silver investment has fallen back. It’s expected to be down about 13% over 2023. Bullion dealers are buying back a lot more silver than they are selling, which is confirming a weaker investment market.

WPIII (Q): What are you expecting for silver in 2025? Price target? Time frame? Trading pattern (will it rise quickly … meander along … peak and drop back down … peak and stay there?)?

PK (A): I think we’ll see silver back at $35 in the first quarter of 2025, and that we’ll see it reach $40 at some point before 2025 is over. The trading pattern is a tough question. But I think $35 will act as a price ceiling for a few months, maybe even into Q2 or Q3, before breaking through and running to $40.

WPIII (Q): What’s the “storyline” that will make this come true?

PK (A): I still believe a recession is in the cards before the end of the second quarter. Silver’s industrial uses may temper demand, or the expectation of it, since a weaker economic outlook would worry investors.

WPIII (Q): What “triggers” are you watching? Catalysts?

PK (A): As triggers I’m watching the gold price, which, if it hits a new all-time high, might pull silver along with it, but gold tends to offer more “stability” in a recession. For that reason, I’m watching for cracks in the economy. I have a close eye on reported inflation, which I believe will start to trend up by the second quarter. And government stimulus in reaction to recession or a black swan could be a huge catalyst as well.

WPIII (Q): What industries are key? Global factors? Economic factors?

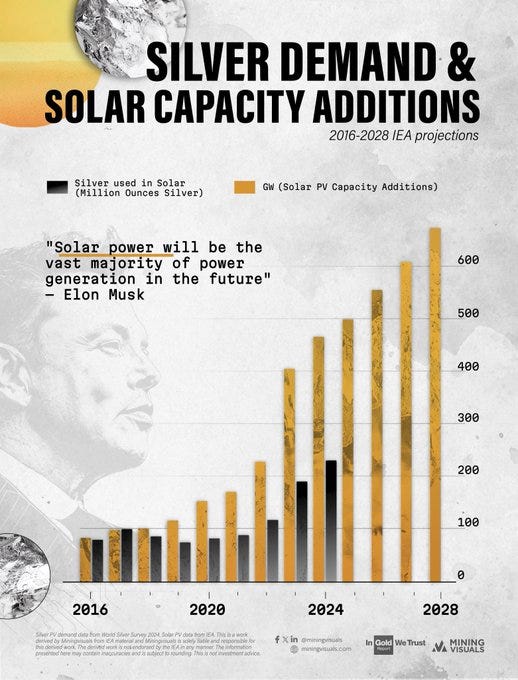

PK (A): Bill, there’s no question that solar demand, which is now 20% of the entire silver market, is the proverbial 800-pound gorilla in the silver room. That’s been growing at a breakneck pace.

This chart from Sprott Inc. really illustrates what I mean.

Consider that solar installations have grown at a 27% annualized rate since 2015. That’s just wild. Elon Musk said that “solar power will be the vast majority of power generation in the future.”

Add onto that silver’s indispensable role in electronics, electrification and medicine, and you have a kind of “perfect storm” since silver supply is projected to be flat for the next five years.

WPIII (Q): You’re right, Peter. That is wild.

Does the shift in leadership down in Washington — with President Trump’s return to the White House, meaning we’ve switched from Democrat to Republican — have an effect/play a role here?

PK (A): Well … some are worried that Trump might try to rescind unspent Inflation Reduction Act (IRA) funds, a lot of which will go to the green-energy transition — and by extension benefit silver. But I told my subscribers that 92% of the IRA’s investments have gone to Republican states, according to Benchmark. Besides, is he likely to do anything that would seriously hurt Musk (Tesla/Solar City), his new head of the Department of Government Efficiency (DOGE)?

WPIII (Q): A savvy question, Peter.

Okay … let’s look at this another way: How does this play out vis a vis gold … and the gold/silver ratio? How about the fact that the world’s central banks seem to be hoarding gold?

And what about silver’s growing connection with cryptocurrencies?

PK (A): All good questions to ask.

The gold-to-silver ratio is still at historically high levels, currently near 90. Over the last 40 years, it has averaged closer to 65. If gold stayed at its current price near $2,600, that would mean $40 silver.

You won’t be surprised to hear that I don’t expect gold to stay at $2,600, which is even more bullish for silver, considering its currently high ratio. I’ve been saying for over 15 years that I expect gold to head to $5,000. Silver will certainly follow along and outperform gold.

You raise an interesting point about gold and central banks. Retail investment as a whole has been weak for gold as well. Since only a little gold is consumed in industry, most of it is investment. Gold’s surge over the past three years is almost all about central bank buying.

The last two years have seen massive central bank buying. And I mean massive.

I believe that was triggered by the the United States weaponizing the U.S. dollar against Russia, and the realization that inflation is here to stay … with that latter point being something I know that the readers of SPC care about, too.

I think we will see more cryptocurrencies that are “silver-backed” gain attention and prominence, especially if/when we see another crypto debacle.

WPIII (Q): You talked about solar a minute ago. Let’s circle back to a broader topic — new technologies. How do such “new” technologies — solar power and AI, for instance — play into this? Especially since power and AI seem to be an offshoot of the general AI narrative.

PK (A): I’ve made my case for solar, but AI is going to be a big driver in two ways. The computer chips needed to supply this megatrend require silver. The data generated by AI means data centers are growing at a breakneck pace. The first, and biggest, are turning to nuclear for the power they need. But most will turn to solar as it’s cheap, clean, and fast to permit.

WPIII (Q): Let’s look longer term: Does your $300 price target still hold true?

Over what time frame?

What are the keys to watch there?

PK (A): Yes, I’m still expecting $300 silver. I think that can happen in the next five years or so. I expect at least two more big inflation waves. Retail investors will flock to gold. A much higher gold price will look inaccessible to many. So those investors will turn to silver, which will be much cheaper on a per ounce basis. FOMO will kick in and it will kick into a mania phase.

When we originally chatted, silver was trading around $24. It’s now over $30 … but back in 1980, silver traded for nearly $50 per ounce. That means silver prices are still roughly half of what they were at their peak, which was 44 years ago. That’s true for no other commodity I can think of.

In comparison, look at gold. In October — thanks to global uncertainty, geopolitical tensions and stepped-up buying from China — gold reached a peak price of $2,785.87 per ounce.

On a relative basis, that tells me silver prices have a lot higher to go.

WPIII (Q): What’s your preferred “investment vehicle” for silver? Are you a coin guy? And if so, what kind?

PK (A): For physical silver, my main choice is one-ounce coins. I know we’re both fans of U.S. Silver Eagles, and I think Canadian Maple Leafs are another great option, being that they are instantly recognizable. You will pay more for mint-issued coins, but you will also get more for them when you sell.

Some people may prefer bars, and if you go that route, I would go with the larger sizes of 10 oz, 100 oz, or 1 kilo.

I also find “junk silver” interesting, which is coins that have little value outside of the silver content within them.

Editor’s Note: For folks interested in physical silver but don’t want to store and secure it themselves, Peter is a fan of Money Metals Exchange, which offers monthly purchase plans and storage solutions for precious metals.

WPIII (Q): I love Silver Eagles. And, as I often tell folks, the Maple Leaf is a beautiful coin. I especially like Maple Leafs with added little “privies” – little added images of such alluring topics as the Titanic, Sasquatch, a WWI tank … and more. They’re super cool.

PK (A): As someone who lives in Canada, I couldn’t agree more.

WPIII (Q): With coins do you prefer between ungraded and graded? What are your parameters there?

PK (A): I’ll admit, Bill, that I’m not an expert on collectible coins.

That said, I’m quite sure for some that graded is preferred over ungraded, as it gives the owner an assurance of authenticity and the level of quality.

WPIII (Q): Okay, okay … so … for folks who really like physical silver — but maybe are worried about storage and security … or liquidity, for that matter — let’s talk about some other avenues to being a Wealth Builder using silver. Can you talk a little bit about miners and royalty plays?

PK (A): Absolutely, Bill … in fact, finding wealth plays of that kind are pretty much “Job No. 1" at The Silver Stock Investor.

I will talk about two for your folks here today.

The first is royalty play Wheaton Precious Metals Corp. (WPM).

The second is growing producer Aya Gold & Silver Inc. (AYASF).

Bill, I know you’ll remember Wheaton from our collaborations when you were doing Private Briefing.

WPIII (Q): I sure do …

PK (A): WPM is based in Vancouver, was founded in 2004, and used to be called Silver Wheaton. It changed its name to Wheaton Precious Metals in May 2017.

Wheaton is what’s known as a “precious metals streaming company,” which offers investors an intriguing way to invest in the mining sector. Traditional miners can have big appetites for upfront investment capital. Companies like Wheaton provide that money – which then buys them the right to purchase specified amounts of the metals mined at highly discounted rates. Streamers can turn around and sell that metal at the full market rate … and that “spread” more than makes up for the upfront cash they floated to the mining firms.

WPIII (Q): You say “highly” discounted. Break it down for the readers … using gold and silver.

PK (A): Absolutely.

Right now, we know that gold is trading around $2,600 and ounce … and silver at about $29.

For Wheaton, we could be talking about gold purchases as low as $440 … and silver at $5 ...

WPIII (Q): Five bucks an ounce … for silver. Now that’s a discount …

PK (A): Streamers are usually nicely diversified … and if I remember correctly, Wheaton has streams or royalties on 18 operating mines and 17 development projects. More than 90% are in the lowest quartile for production cost, and on average their assets have more than 30 years of “mine life.” There’s about 40% of organic growth coming over the next five years. That’s impressive for a $26 billion company.

And these royalty and streaming agreements include precious metals, as well as cobalt — a so-called “transition metal” that’s used in airbags, industrial tooling, rechargeable batteries, magnetic recording media … and more.

Silver represents about 45% of revenue, and silver together with gold is 97% of the revenue, so it’s a true precious metals royalty/streaming company. It’s also an income play. Wheaton pays the highest dividend as a percentage of revenue in the sector; about 1.3%.

WPIII: Really good stuff, Peter. Let’s talk Aya …

PK (A): Aya is based in my part of Canada … in Montreal. It was incorporated back in 2007 — and is a “mid-tier miner.”

With projects in the North African country of Morocco, the company primarily explores for gold, silver, zinc, lead, tungsten, molybdenum, uranium and copper deposits. Its flagship project is called the Zgounder Property, which is in the Anti-Atlas Mountain Range, and is one of the world’s largest high-grade, pure silver mines.

WPIII: You referred to this as a “mid-tier miner.” Tell our folks what that means … and then tell us why you like the company.

PK (A): Absolutely, Bill. Mid-tier miners usually have a market cap between $200 million and $2 billion. At a bit under $2 billion, Aya falls right in the higher end of that range. Mid-tiers often have one or a few producing assets, while advancing one or more other projects. The main difference from a large producer is that the growth projects have the potential to significantly increase the miner’s production output. And in a long-term bull market, like we have now, they provide heftier share price leverage as the market prices in greater future cash flows.

This company is interesting because its Zgounder mine currently produces about 1.8Moz of silver annually. However, the opportunity is highlighted by its current mine expansion program. Zgounder will ramp up production in the second quarter of 2024, quadrupling annual output to 8Moz silver at an all-in, life-of-mine sustaining cost of just $9.58 an ounce. This expansion boasts a 48% internal rate of return (IRR) and a payback of just 1.7 years. That’s outstanding in the mining industry.

In addition, Aya is exploring and expanding resources at Zgounder as well at its Boumadine polymetallic project, which itself has a (non-current) preliminary economic assessment with an IRR of 56% and a net present value (NPV) of $575 million.

One other thing of recent note …

In mid-January, Aya was included in the 2024 OTCQX Best 50, a list of top-performing stocks traded on the OTCQX Best Market last year. It made the list for the first time, based on its 2023 stock performance, ranking 12th out of 575 companies across a bunch of industries.

AYA shares pulled back in recent months. They hit a couple of one-time (nothing major) speedbumps in the expansion of Zgounder, but they also scaled back guidance for this year by about 40%. No matter, they are going to quadruple production. This past August my subscribers took a 100% gain on AYA when shares doubled. Now it’s looking like a bargain in my view.

WPIII: Peter … you never disappoint. That’s good stuff.

Let me shift gears a bit here … to a couple of interesting conversations we’ve had over the past few years … and circle back to something you said a moment ago about crypto.

Do you feel as if cryptocurrencies pose any issues for precious metals?

PK (A): I like to say gold and silver are “eternal metals.” They’ve been prized ever since they were discovered. Silver, especially, has numerous applications. Remember, it’s the most conductive and most reflective of all materials. That’s not easy to substitute, especially with the growing demand from advancing technologies.

Cryptocurrencies are very new as an asset class. But they’ve already had a huge impact, thanks particularly to the blockchain. We still can’t quantify … or mentally picture … all the possible applications – they’re limitless. The markets will decide which specific ones deserve to survive.

But I believe the asset class is here to stay. I’m particularly partial to those —like Bitcoin (BTC) — that have a finite supply … because they have the best chance to survive as a “store of value.” In my view, these are the few that offer limited competition to gold and silver as an inflationary hedge.

Of course, I don’t see precious metals and Bitcoin as an “either/or situation.” Investors should own both — according to their comfort levels.

I think the world is ultimately heading for a financial system “reset.” And I’ve thought for some time that the future of money will one day be a gold-backed and/or silver-backed cryptocurrency. You’ll have the best of both asset classes combined into one. As a side note, central banks will no doubt soon issue their own central bank digital currencies (CBDCs). But don’t be fooled. These are still unbacked with no intrinsic value … and will only make inflating the money supply easier.

Gold and silver have enjoyed millennia of acceptance, have an intrinsic worth, and offer great utility. Cryptocurrencies on an immutable, decentralized blockchain offer a high degree of security, convenience, and portability.

It’s an ideal combination.

WPIII (Q): That’s great, Peter. Thanks for joining us here. And here’s wishing you a happy, healthy and fruitful 2025.

And for you SPC folks … how do you all feel about silver?

What’s your take on that metal?