“Only I didn’t say ‘Fudge.’ I said THE word … the big one … the queen mother of dirty words … the ‘F-dash-dash-dash’ word.” The “adult” Ralphie, A Christmas Story

Because of that “here-and-now” mindset, the Fed has become a four-letter word for investors.

And I don’t mean “Fhed.”

I’m talking about that OTHER four-letter word. The one Ralphie (Peter Billingsley) said to the Old Man (Darrin McGavin), as he “helped” his Dad change a flat in this classic holiday flick.

The one I can’t write here.

You know what I mean.

But there’s a reason we feel that way about the Fed – investor shorthand for the U.S. Federal Reserve.

As investors, we’ve become Fed-obsessed. We hang on Fed Chair Jerome Powell’s every word. We mark “Fed Meeting” on our calendars – right next to “Dr. Appt” … “Little League Game” … “Concert” … and more. We watch for – and then watch – every appearance by a central bank official.

The goal, of course, is to answer the question: “What’s next for interest rates?”

We even dig through Fed minutes, looking for “clues.”

Make no mistake, the news media flogs this …

But investors get suckered in – and this obsession transforms us from potential Wealth Builders to real Wealth Killers.

We’re doing it again now.

We’re playing a game that I’m calling “Rate-Cut Roulette.” And it’s just as risky and just as deadly as its “Russian” counterpart – the one where the players insert a bullet, spin the barrel, put the muzzle to their temple … and pull the trigger.

With Rate-Cut Roulette, an overly-short-term investment focus replaces the gun … a speculative willingness serves as the bullet … and doing options trades or other near-term/non-wealth-builders is, well, “pulling the trigger.”

I’ll talk about a strategy that’s the smartest strategy of all with Rate-Cut Roulette – not playing.

The Rate-Battleground Backdrop

Let’s start by talking about interest rates.

After all, how can you understand something if you don’t know the full story?

The COVID-19 Pandemic threatened to wreck the U.S. and global economies. Supply-chain disruptions led to shortages and fueled virulent inflation. Team Powell boosted the benchmark Fed Funds rate 11 times – taking it from a target of 0.25%/0.50% all the way to 5.25%/5.5%, where it’s been since late last July.

Inflation has cooled – from a peak above 9% to a higher-than-expected 3.5%, according to the most-recent report. But prices are still higher – much higher, in fact, than they were a four years ago.

Those higher prices – for insurance, groceries, utilities and rent, for instance – have created considerable consumer angst. And they’ve helped fuel the “Higher-For-Longer” storyline that keeps following the Fed.

In late 2023, on the doorstep of the New Year, many prognosticators were calling for as many as six rate cuts in 2024.

But as we sit here in mid-April of that New Year – following hotter-than-expected jobs and inflation reports – the Higher-For-Longer tagline could be a stand-in for inflation, prices or interest rates.

As of this writing (these “predictions” jump around a lot), there’s a 96.9% chance that the Fed stands pat at its next policymaking meeting in May, says the CME Group’s Fedwatch tool. There’s a 13.3% chance rates will still be at their current 5.25%/5.5% levels after the meeting in December – and virtually equal odds (33.1% and 33.6%) that the Fed Funds target rate will be at 4.75%/5.0% or 5.0%/5.25%, respectively.

In short, rates won’t fall much between now and the end of the year. And that’s increased investor interest in Rate-Cut Roulette.

And that’s why I assembled a “Do’s and Don’t” list.

Don’t: Speculate With Options

Stock-option volume exploded in 2020 – and trading in derivatives of all types has soared. Global trading volume reached 137.3 billion contracts last year – up a stunning 64% in 2023, says the Futures Industry Association (FIA). That’s the sixth-straight year of record-setting activity in the worldwide listed “derivatives” market, the FIA says.

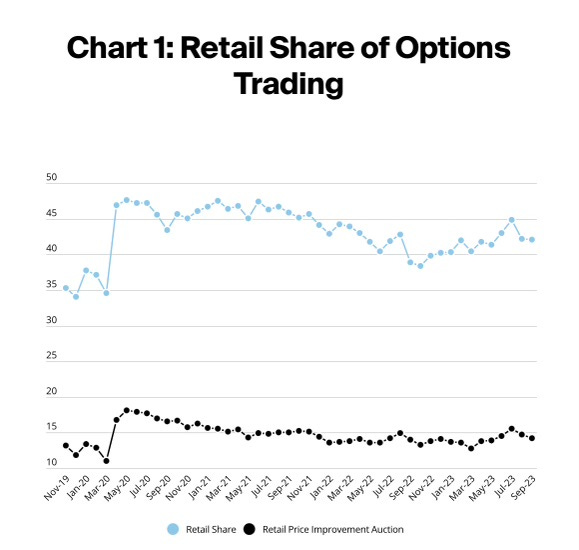

Retail investors have helped drive this. Retail options trading rose sharply during the pandemic, peaking at 48% of the market in July 2022, says the New York Stock Exchange. It wavered a bit before spiking again last summer – hitting 45%. And short-dated options (with five days or less to expiration) now accounts for 56% of all retail options trading.

Looked at from a dollar perspective, retail trading in options grew from $20 billion in 2010 to $240 billion in 2020, researchers from the Massachusetts Institute of Technology Sloan School of Business found in a research study.

Trouble is, retail investors are just bad at this, displaying “a trio of wealth-depleting behaviors,” the MIT researchers found. Retail investors overpaid for options, incurred massive big/ask spreads, and failed to respond when the “story” affecting their options changed.

Those investors lost $3 billion during that stretch.

And you know who made money on those trades?

Market makers … Wall Street.

It’s so one-sided, in fact, that a late-December Bloomberg report was headlined: “Options Trading is Rigged Against Average Investors,” noting that “payment for order flow allows brokerages and big traders to team up against the little guy.”

That’s so eloquent that I wish I’d said it.

A kind of “DraftKings Betting Mentality” has infected the stock market – and retailers have been badly afflicted. Sports wagering has exploded … and it’s an easy jump from baseball, football or basketball to stocks.

And the mistakes investors make buying stocks – playing catch-up or getting afflicted with “FOMO” – has followed them into options. Earlier this year, when AI Euphoria kicked in, options trading on AI chip stocks doubled .

I’m talking about an exceptionally cavalier view of money – akin to an “Oh Well” mindset when a trade that was a longshot to begin with doesn’t work out. It’s a bad habit to get into … and when you calculate the opportunity cost of the money that’s lost – and what it could’ve done for you when compounded over the long haul – it’s best avoided altogether.

Don’t: Use Options for Income

I know I’ll get some pushback on this. But this is a continuation of the arguments I just made. While some folks will tell you they do well with this, the truth is most retail investors lack the time, commitment, experience or knowledge to use these more-complex instruments.

And a number of studies bear this out.

Don’t take that as an insult … or some sort of “slight.”

Plain-vanilla strategies can really work to your advantage.

Do: Make Time Your Ally

As an aspiring Wealth Builder, you have one advantage that gives you a huge edge over the Wall Street players and institutional monoliths.

I’m talking about time.

Taking a long-term view – somewhere between “buy the dip” and “hold forever” – can give you a massive “edge.”

And I’ll tell you why.

I’ve been in this game for 40 years – 22 as a business journalist and 18 more here in financial publishing – so I’ve had a ringside seat to the three-ring circus Wall Street often turns into. Public company execs, retail fund managers and even private money managers must always measure themselves using a short-term yardstick. Their performance is viewed through a prism that presents only a quarter-to-quarter or year-over-year view.

But Wealth Builders like us can find the best storylines – leading to the best stocks – and then play those storylines for three, five, eight or even 10 years. It’s in the long run where the real wealth is made.

Do: Seek Income – But Real Income

Real income is a crucial element of the Wealth Builder process.

But not risky or “poser” income strategies like those dangled by options and options-based products.

I’m talking about income thought of from the vantage point of “cash flow” – what’s left over after taxes, market rates or inflation.

And these income streams can be built up over time – for instance, by finding the best storylines – leading to the best stocks – and then playing those storylines for three, five, eight or even 10 years. It’s in the long run where the real wealth is made.

Now, here are some tips to help you navigate it all.

Stock Picker’s Corner Tip No. 1: Markets have been gyrating here of late (the two-day, 2.6% drop the S&P 500 saw Friday and Monday was its biggest in more than a year). And after the hot streak that U.S. stocks had seen, this isn’t just expected … it’s healthy. And stocks could fall more. But here’s what you need to remember: Over the long haul, U.S. stocks go higher. So start assembling a list of stocks you don’t own – but want to – or stocks you own, but would like more of. Then figure out when you want to go shopping.

Stock Picker’s Corner Tip No. 2: One of he best storylines we’re following right now is the New Biotech. We’ve entered a window where potential huge blockbusters have been newly birthed – meaning you can ride the shares of the companies that made them for nearly the full duration of their patent-protected status. One example: The new class of GLP-1 weight-loss drugs being newly marketed by companies like Novo Nordisk NVO 0.00%↑ and Eli Lilly & Co. LLY 0.00%↑.

Stock Picker’s Corner Tip No. 3: One income play for the real income mentioned earlier that can do that for you is Annaly Capital Management Inc. NLY 0.00%↑, a New York-based mortgage REIT that’s got a track record of being well-managed. As a residential mortgage REIT, Annaly invests in the loans that finance the properties, versus the physical homes themselves. It has to pay out 90% of its taxable income to shareholders. At a recent share price of about $18.45, Annaly’s projected forward dividend of $2.60 a share equates to a yield of 14.2%.

The Fed’s going to do what the Fed’s going to do. You don’t need to waste the energy trying to anticipate the next move.

And you certainly don’t need to spin the barrel, look down the muzzle and play another game of “Rate-Cut Roulette.”

To heck with the “Fhed.”

Play the long term.

Be a Wealth Builder.

SPC is here to help you.

See you next time;