After penning the “Robotaxi Checklist” report for you folks last week, I made sure I tuned in to watch Elon Musk’s “We Robot” cybercab event (courtesy of the “watch party” hosted by Benzinga).

The Thursday night unveiling started “fashionably late” (about 57 minutes after it was scheduled). It lasted less than 40 minutes. And I left with two takeaways — one more powerful than the other:

As I detailed in the checklist, Wall Street was looking for certain key things from Tesla Inc. TSLA 0.00%↑; on that, the event didn’t deliver.

But there was a “visionary” aspect to it all — a big-picture “view-of-the-future” that Musk did deliver; and that was my dominant takeaway, leaving me with an “Yes, I can see it” epiphany that was downright inspiring.

Let’s talk about both these takeaways … starting with Wall Street’s dour (and short-sighted) “morning-after” view.

BIG MONEY MYOPIA

I said this in the “checklist” report: Big-money investors came into that event looking for specifics.

And they didn’t get them.

At a 20-acre to 30-acre cityscape-type movie set on the Warner Bros Discovery Inc. WBD 0.00%↑ studio lot in Burbank, Tesla had 20 robotaxis and 30 fully autonomous Model Y cars circling and offering rides — creating a “feel” for what Musk’s future “reality” would look like.

The robotaxi — which Musk referred to as a “cybercab” — is super cool. It seats two, lacks pedals or a steering wheel and will sell for less than $30,000. He said they’ll go into production in late 2026 or (more likely) early 2027. And he vowed they’ll be 10 times safer than conventional autos.

Tesla also shared a prototype for a 20-person, autonomous “Robovan” (which Musk pronounced “Ro-BO-venn”). And it detailed updated models of its humanoid robot: Optimus.

Big challenges remain. Musk said fully autonomous driving (known as Full Self-Driving, or FSD) is supposed to be available in California and Texas next year. But Tesla is dealing with investigations — and actual lawsuits – related to its autopilot and FSD systems. The company’s defense: Inattentive drivers.

There’s also a controversy about the technological approach. To keep FSD affordable, Tesla has (and I’m intentionally oversimplifying this here) gone with a camera-based system — though many engineers say that a sensor-based system is the only path to truly safe FSD.

WALL STREET’S RUTHLESS CALLED IT “TOOTHLESS”

The fact that Tesla shares plunged 9% Friday — scything a good $60 billion off the company’s market value — pretty much says it all about how investors felt about the performance the night before.

In a (harsh) note sent to clients Friday morning, Jefferies Financial Group Inc. JEF 0.00%↑ analysts referred to the cybercab as a “toothless taxi,” grousing that Tesla set “ambitious targets” but offered “little evidence of feasibility.”

On a podcast hosted by David Papadopoulos, Bloomberg Editor Craig Trudell said he felt like the event came up short.

“In terms of when these are actually going to be ready … how many they’re going to make any sort of technical indications of real progress here and sort of hard-and-fast retails … there was nothing,” Trudell said. “We got through his presentation and, honestly, my reaction to it was ‘Is that it? That’s all we got?’”

UBS analysts were a bit more even-handed.

“Tesla continues to control the narrative on autonomous driving,” analysts wrote. “But we don't believe much new was learned as details were light. When this future occurs remains unclear, and we believe further out than indicated."

Is that all there is? Is that truly the bottom line?

No.

I think there’s more.

THE “GREATEST SHOWMAN”

I spent 22 years as a business reporter — covering big national business stories. And I’ve interviewed heavy hitters … and visionary folks … through the years.

CEOs like Amazon.com Inc. AMZN 0.00%↑ founder Jeff Bezos and General Electric Co. GE 0.00%↑ impresario CEO John F. “Neutron Jack” Welch, helicopter pioneer and LBO specialist Stanley Hiller Jr., former U.S. President Richard Nixon and more.

As an investor, I’m a Wealth Builder — and I play the long game. But I’m a Contrarian at the “inflection points” – where you’ll often find big buying opportunities … or “great escape” exit points for the inevitable occasional mistakes or for storylines that have inexplicably changed.

So with events like Musk’s “robotaxi moment” Thursday night, I’m usually able to step back … and take the long view.

Like here.

Lots of folks say they’ve heard Elon’s “spiel” before.

But I really dug it.

Musk was the Greatest Showman … in his element … at ease … a Chautauqua Revival speaker in a leather jacket. He was inspirational — the “spool-folks-up” visionary who repeatedly elicited “oohs” … “ahhs” … and laughter from his audience.

Far too many folks these days can’t play the long game. When it comes to stocks and investing, they succumb to the quarter-to-quarter, have-to-have-it-now mindset. If it doesn’t pay off now, they aren’t interested. And that’s why their “investing” morphs into “trading.” And it’s why they abandon stocks … for options.

That leads to misteps … mistakes … and a Wealth Killer prison sentence without the possibility of parole.

Here’s something else … which I learned from studying history … and from decades of my own talks with innovative thinkers at all levels: We need folks like Elon Musk. We need folks to eschew the status quo … to “move the chains.”

Without those folks, we’d have no cars to drive, airplanes to fly in, computers to help us, drugs to keep us safe, or Internet to bring our world closer together.

I thought about all of that as I listened. What others dismissed as his “spiel,” I found inspiring.

Like his rejection of a dystopian future — the dismal “tomorrow” depicted by Sci-Fi flicks like BladeRunner.

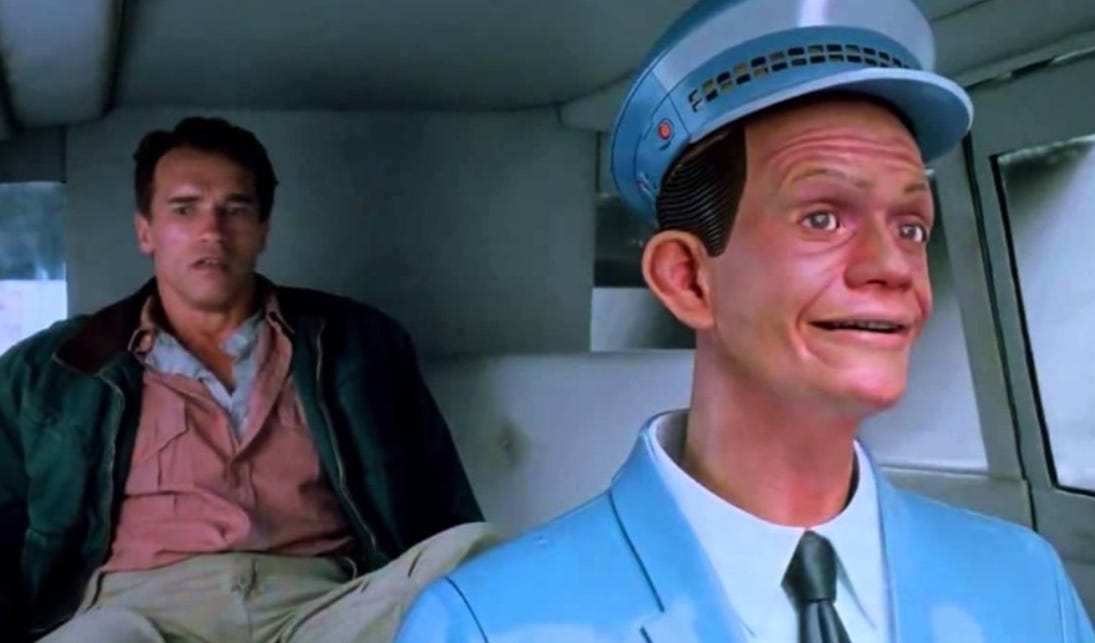

Or (as I thought as he talked) the “cringy” and off-putting elements of tomorrow — like the creepy-as-heck “Johnny Cab” in the 1990 “Ah-Nold” starring movie Total Recall.

THE “TESLA KEIRETSU”

Musk’s view of tomorrow is an upbeat one.

“We want to have a fun, exciting future that, if you could look in a crystal ball and see the future, you'd be like: ‘Yes, I wish I could be there now’,” he told the crowd. “That's what we want” for our future.

A future where autonomous vehicles slash the need for a paved-over earth — so acres of macadam parking lots can be returned to nature … and green … as parks to be enjoyed.

A future with more free time. For intellectual and wealth-creating pursuits.

And a future where Tesla wins — big.

That’s a future that most analysts are incapable of seeing: Their quarter-to-quarter myopia won’t let them.

And they don’t understand what some experts refer to as the Elon Musk Unified Field Theory. But having spent time in Japan during my reporting years, I’ve nicknamed it (and you heard it here first) the “Tesla Keiretsu.”

Musk has X/Twitter, SpaceX, Tesla, Tesla Energy, The Boring Co., xAI, Neuralink and probably a few more ventures in there. And they all work together — in the short-term and the long-term.

In Japan, a “keiretsu” is an interconnected family of companies, that operate for the good of themselves, the good of each other and the good of the group.

That’s essentially Musk’s management philosophy. And in the era of data creation, automation, AI and quantum computing, the digital “scale” his group of companies can achieve is a massive long-term competitive advantage. It’s “leverage” — using the research and components from one place to benefit another.

That’s the stumbling block that’s keeping analysts from really “modeling” Tesla. Their short-term, hyper-focused mindset just won’t let them see it.

And Musk hinted at that leverage potential once again Thursday night.

THIS TIME LEVERAGE IS POWER

In Elon Musk’s visionary tapestry, everything fits together.

And one piece leverages another.

Take the AI5 computer for the cybercab, which Musk says is “over-spec’d.” Because cars aren’t driven constantly, there’s a ton of surplus computing power – which can be redistributed in a way that leads to a roving network of AI-driven computing power – available whenever needed.

It “will be somewhat over-spec'd because I think there's also an opportunity, sort of like an Amazon Web Services,” Musk told his audience. An opportunity “where if the car is driving for 50 hours a week, there's still over 100 hours left and there's a potential there to have a massive amount of distributed inference compute, where if you've got like a fleet of 100 million vehicles and a kilowatt of efficient inference compute, you have 100 gigawatts of compute, which is really quite substantial.”

Substantial, indeed: According to Microsoft Copilot, that’s equal to 4,000 data centers.

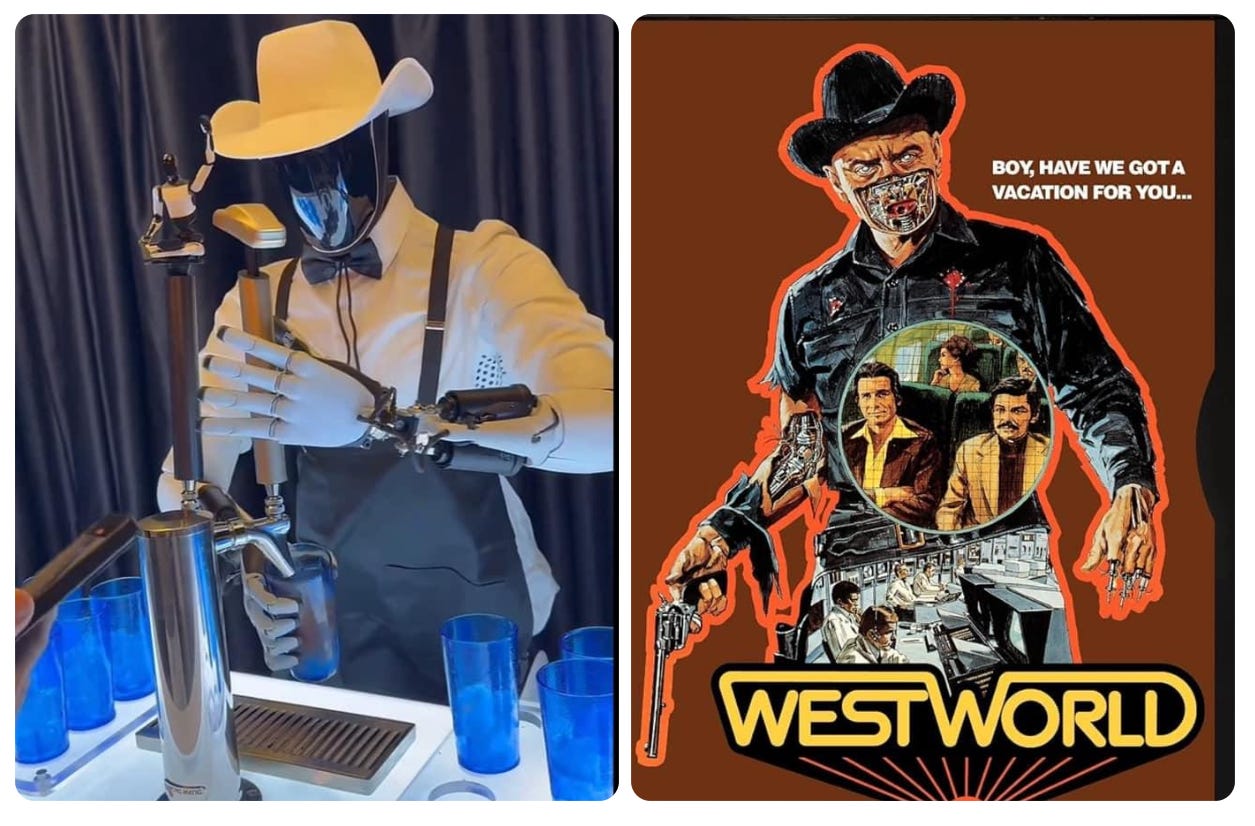

Then there’s the Optimus humanoid robot – examples of which were dancing, interacting, and even tending bar at the event. One bartending robot exuded a Western flavor – topped by a nifty Stetson. (It made me think of the Yul Brenner killer robot in the 1973 flick Westworld; seems even I’m guilty of slipping into that dystopian brain lock. But I also recognize – and can break free of it.)

As Musk said: “It’s a wild experience just to have humanoid robots and they're there, just in front of you.”

I buy his vision … in more ways than one.

With a comparison of cars and robots, Musk hit on the “leverage” his “keiretsu” can deliver.

“Speaking of robots: Everything we've developed for our cars – the batteries, power electronics, the advanced motors, gearboxes, the software, the AI inference computer — it all actually applies to a humanoid robot,” he said. “The same techniques: It's just a robot with arms and legs instead of a robot with wheels. We've made a lot of progress with Optimus. And as you can see, we started up with someone in a robot suit. And then, we've progressed dramatically, year after year. So, if you extrapolate this, you're really going to have something spectacular, something that anyone could own. So, you can have your own personal R2-D2/C3PO.”

That leverage keeps costs down. Robots will cost less than a car — $20,000 to $30,000, once we hit that “long term.”

“And what can it do? It'll basically do anything you want,” he said. “It can be a teacher or babysit your kids, it can walk your dog, mow your lawn, get the groceries, just be your friend, serve drinks whatever you can think of, it will do. And, yeah, it's going to be awesome. I think this will be the biggest product ever of any kind, because I think everyone of the 8 billion people of Earth, I think everyone's going to want their Optimus buddy.”

What’s the end game here?

For Musk, it’s a future where “the cost of products and services will decline dramatically. And basically, anyone will be able to have any products and services they want. It will be an age of abundance the likes of which people have not, almost no one has envisioned. It will be something special.”

And that, my friends, is the power of the “leverage” of that Tesla Keiretsu.

Is it long-term?

Yes. Absolutely.

But long-term is what Wealth Builders like us focus on. It’s what we live for. It’s where we cash in.

So while he didn’t deliver the near-term details most folks were seeking, he did deliver the long-game view I dig.

But most folks missed the latter … by obsessing over the former.

We’ll keep watching this.

See you next time;

Here's our original "Tesla Robotaxi Checklist."

https://stockpickerscorner.substack.com/p/the-tesla-robotaxi-checklist