The SPC Mid-Year Review Part II: Some Super-Special "Special Situations"

Surprising Key Ingredients For America's Future Fortunes

We have an interesting dynamic here in the Patalon household. Joey’s a vegetarian. My wife, “RK,” is a vegan. I eat everything (though I will admit I’m striving to eat healthier here of late).

That obviously creates some challenges when it comes to meals at home, trips to a restaurant, dinner parties with friends or trips the three of us take together.

But we find ways to navigate.

For instance, when my wife bakes a cake (back when I was still eating cake), she scratched the milk and eggs as ingredients — and replaced them … with apple sauce.

You’d never know it. Her cakes always taste great.

But as she and I talked about as I was writing this, there are just some ingredients — without which — you just aren’t baking a cake.

Like flour.

No flour … no cake.

Or as Hummingbird Bakery said (and I love this): Without flour, “our fluffy little cupcakes would be flat, sloppy puddles and our beloved bakeries would be turning out omelettes.”

For stock pickers like us, it’s an important point.

You see, flour is to cake what commodities are to the powerful American economy — and to such huge new opportunities as the Artificial Intelligence Era.

You want Blackstone Inc. BX 0.00%↑ to keep building the massive data centers that are like the “brains” of AI? You need steel for the building’s framework, and coking coal is to steel what flour is to cakes.

And don’t forget silver — which Barron’s just last week anointed as “a hot AI play” … and copper.

For both those metals, and for other key commodities, demand will keep growing, but costs, in-the-ground reserves, related constraints (like water), and sure-to-tighten regulatory issues will lead to long-term “supply gaps” — as this graph from an academic paper shows us.

Take note of the phrase “long term.” That’s a core element of the Stock Picker’s Corner (SPC) philosophy.

We’re stock pickers here. But more than that, we’re opportunists — long-term opportunists.

We’re Wealth Builders.

We look for wealth wherever we find it.

That also includes “special-situation investments.”

We’re also “critical thinkers.” We look at big storylines — and we analyze the “ingredients” and we look at the “finished product” … the finished “cake.”

And right now, all of this includes the commodities story.

Like flour, commodities are a crucial ingredient for just about everything we make, sell and do. Or, as I like to say, they’re a “window into the economy.”

But right now, the commodities story is not — as a couple folks have asked — a simple “supply-and-demand” tale. There are special-situation Wealth Builder opportunities here — in the companies that bring us those “ingredients” and in the beneficiaries of the long-term storylines that these commodities feed into.

Mix that all together … leave it in your oven for a few years … and in concert with all the other story-fueled stocks we bring you … you’ll bake yourself one hell of a cake.

That’s why — here in Part II of our inaugural SPC Mid-Year Review (and our Desert Island Stocks Challenge that will be shared starting tomorrow) — we’re going to give you a rundown on commodities … and related special situations.

The Crypto Market Grows Up

Overview: The two big events in crypto this year were the Bitcoin (BTC) halving and the approval of Bitcoin ETFs.

Bitcoin YTD Return: 42%

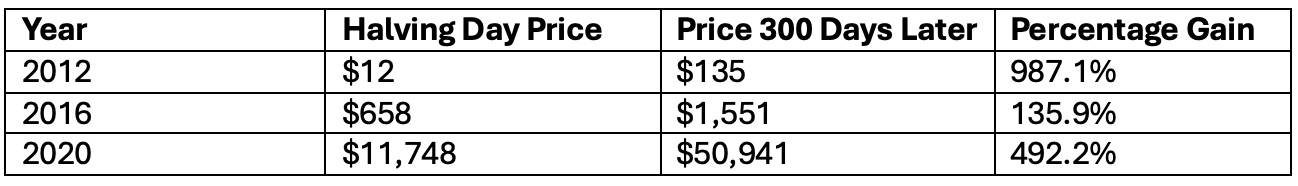

Bitcoin ETFs are the magnet that’s drawing a whole new group of folks into the crypto world — easy to see from the reported $13.9 billion that flowed into SEC-approved ETFs in their first week of trading. And while “The Halving” is over, we know from the past that it takes less than a year for prices to soar in the aftermath. (Check out this chart.)

What to Watch Next: My “Platinum Rolodex” is a pipeline to the most innovative Wealth Builders I’ve met during my four decades writing about companies, stocks, the economy, defense, finance and special situations — folks like David Zeiler. I’ve known Dave for years (I respected him so much I even hired him so we could work together at one point). And through those years, I’ve watched as he became a pioneering solo Bitcoin miner — and as his crypto predictions hit the bullseye year after year after year (and I mean that literally). You’ll hear more from Dave next week. And you can follow him on his recently launched Substack for more coverage on crypto. But here’s his quick run-down for the rest of the year.

“When it comes to broad trends, Bitcoin tends to follow a similar pattern every four years. So the sideways price action we’ve seen since the halving in April is exactly what you would expect. In fact, I expect it to continue for the next several months, until September or October. That’s when we should see a breakout to the upside. How high Bitcoin goes before December 31 is hard to say. If FOMO kicks in, it could go as high as $100,000, but I think it will most likely end the year trading in the $90,000 range.”

Gold and Silver Hold Their Own

Overview: Gold and silver prices keep climbing as a lot of uncertainty ahead of the 2024 Presidential Election unfolds and as folks distrust the S&P 500 and the Nasdaq surging to new peaks seemingly day after day.

Gold YTD Return: 13.01%

For Wealth Builders, I see a bigger opportunity in silver than gold. (I’ve always been more of a “Silver Bug.”) But I do own gold and understand what the “yellow metal” can do for us. If you’re looking for opportunities in gold, Danny Brody of The Net Worth Club released a compelling report about the VanEck Junior Gold Miners ETF GDX 0.00%↑.

Silver YTD Return: 23.32%

When it comes to gold, I watch the gold/silver ratio (GSR) because it shows you how much silver it takes to buy an ounce of gold — making it a great metric for relative value. The historical average over the last 40 years has been 60. But the ratio right now is around 80– which is 33% above the norm. That means it takes more silver than usual to buy gold – lots more, in fact. Viewed another way: Silver is cheap. My friend Peter Krauth, publisher of the Silver Stock Investor newsletter, believes that once the Federal Reserve cuts rates, gold prices will rise. But silver will rise faster, bringing that ratio down. He believes that the ratio could eventually drop below 30 and could reach 15, like in 1980 at “peak” silver. So with gold at $5,000 an ounce, and a gold/silver ratio of 15, you’re looking at $333 silver – which is just slightly above his $300 target.

Remember to follow Peter at the Silver Stock Investor for more coverage on silver.

What to Watch Next: Debates about federal deficits and debt (at $28 trillion), the expectation for a single Fed rate cut before New Year’s Eve, stock market investors tapping out and geopolitical land mines around the world should offer favorable backdrops for gold to keep moving higher. With a growing appetite thanks to electronics, autos and the AI Era (and a silver-deficit surge of 17%), look for silver to keep climbing. And with the right economic “ingredients,” Peter’s $300 price target could end up not looking aggressive after all.

Coal & Copper

I’m releasing a new interview with Danny Brody tomorrow. Danny was his typical, enthusiastic self — which made our talk fun. We hit on a wide array of topics — and his “Desert Island” stock pick was surprising since he’s an “old friend” of mine. Until then, check out my original interview with Danny, where he first told us about that looming copper shortfall — and where he shared four stocks that’ll serve as a great starting point for your own investing research.

You can also find more coverage on copper, energy and a variety of topics from Danny at The Net Worth Club.

I’ll also have a new interview with Matt Warder — which I’ll release next week (he gave me an interesting rundown on what to look for — as well as his “Desert Island” stock. Until then, see our recent chat about the coal market’s future and the companies Matt is watching closest.

For more coverage on coal, follow Matt’s The Coal Trader.

I’ll see you tomorrow.