SPC Premium: A New Model Portfolio Stock

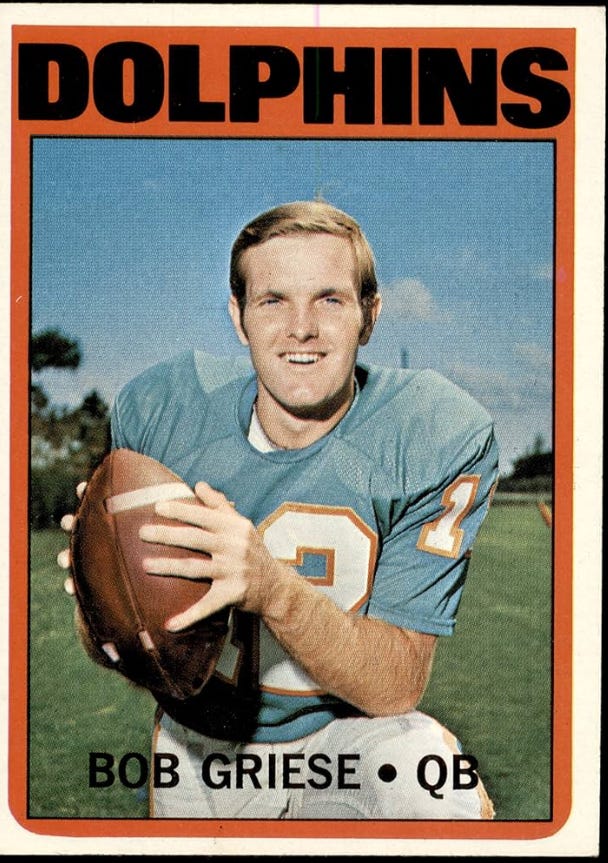

Three beneficiary stocks from the NFL Dolphins deal ...

Miami Dolphins owner Stephen Ross is in "advanced talks" to sell a slice of his NFL team to a private-equity firm, Bloomberg reported this week.

Dolphins execs back in May said the team wasn’t for sale — so the reports of the deal came as a big surprise to many.

But not to us here at Stock Picker’s Corner (SPC).

Not really.

A core belief here is “find the best storylines and you’ll find the best stocks.”

The “Private Equity Tidal Wave” is one of those “best storylines.” And though we only launched SPC Premium early this year, it’s already delivering those “best stocks.”

Take the rumored Dolphins deal, which will:

Directly benefit one of the companies already in the Model Portfolio.

Indirectly benefit one of the “Super 10” companies in the Special-Situation Portfolio we just delivered to you.

And here today has us “promoting” one of the SPC Farm Team companies into that premium Model Portfolio.

That’s the benefit of being ahead of “the crowd.” Especially with a storyline as powerful as the “Private Equity Tidal Wave.”

Trillions With a ‘T’

When I talk about private equity, or PE, I’m referring to investment partnerships that controlled $8.2 trillion last year, says consultant McKinsey & Co. For context, that’s what you’d have if you combined the economies of Japan ($4.2 trillion) and Germany ($4.01 trillion).

And it’s more than just dollars: I’m also talking about a true “paradigm shift” in how money is —and will be — invested.

Companies are staying “private” longer — and many aren’t going public at all. In fact, as JPMorgan Chase & Co. JPM -1.21%↓ CEO Jamie Dimon told his bank’s shareholders earlier this year, the number of U.S. companies trading on the key exchanges has been slashed by almost half in the last few decades. And the number of investment-grade stocks will likely be halved again in the two decades to come.

The billionaire PE dealmakers are major players here. Their economic footprint just keeps growing.

Just after we launched SPC, we showed you that one PE heavyweight was emerging as “AI’s Landlord”— thanks to its plan to finance (and even own) AI data centers. Just last week, this company confirmed a $17.2 billion investment for an AI data center in Northeast England. It’ll be Britain’s biggest.

Private equity is influencing our lives in stunning — and unexpected — ways.

In early September, I told you that these guys have figured out how to squeeze millions out of your kid’s Little League team.

And then – just a few weeks back – I said some complicated rule changes cleared the way for these billionaire PE dealmakers to start taking stakes in America’s top pro football league.

Talk about prescience and great timing – part of what we want to deliver.

I also want to educate you.

For instance, go back to that decline in available stocks.

Even as the number of public companies dropped by almost half, the number of private firms has zoomed nearly sixfold — from 1,900 to 11,200.

“There are good reasons for private markets,” JPMorgan’s Dimon told shareholders. “Companies can stay private longer if they wish and raise more and different types of capital without going to the public markets. However, taking a wider view, I fear we may be driving companies from the public markets. The reasons are complex and may include factors such as … costly regulations, cookie-cutter board governance, shareholder activism, less compensation flexibility, less capital flexibility, heightened public scrutiny and the relentless pressure of quarterly earnings.”

That means you need to think differently … and look for “alternate” opportunities – like direct investments in the shares of publicly traded PE firms.

You may also need to get access to the “smoke-filled rooms” where these private-company investments are made — a $13 trillion market most investors know nothing about.

That’s why I invited friend and private-investing expert Sean Levine to join us here last month. Sean walked us through “Private Investing 101” in a video interview that’s generated some nice feedback.

But there are “here-and-now” moves we can make. So I’ll spotlight four stocks for you, our SPC Premium family — including a new member of our Model Portfolio.