SPC Weekender: Satellites, Engineered Cures, and Gaming to Win

AI's new profit paths — and a take-two look at an expert's favorite ...

In this issue of Stock Picker’s Corner (SPC):

1️⃣ The new age of medicine that Project Stargate will unlock.

2️⃣ Satellites are out of sight, but they shouldn’t be out of mind for investors.

3️⃣ And it’s “game on” for shares of this iconic video game maker.

No. 1: Stargate

In January, Chief Stock Picker Bill Patalon shared “cliff notes” on Project Stargate, a $500 billion venture between OpenAI, SoftBank Group Corp. (SFTBY), Oracle Corp. ORCL 0.00%↑, and a few other players, aimed at improving infrastructure to keep the United States a leader in the artificial intelligence (AI) race.

While most of the announcement was centered around the size of the investment and the 10 data centers under construction in Texas, there was a brief but fascinating tidbit one of our Substack neighbors, The Investor’s Guide to Biotech, highlighted from the announcement.

“Larry Ellison made a particularly intriguing statement (towards the end of the video). He discussed the possibility of developing personalized cancer vaccines based on data from early detection cancer blood tests. A simple blood test could identify the type and location of cancer, after which the DNA would be sequenced. Within 48 hours, an individualized cancer vaccine could be developed. Each step in this process would leverage AI to enhance health outcomes across the U.S.”

It was less than two minutes (around the 10:50 mark), but this is a profound AI use case — faster drug discovery.

It can take more than a decade to develop a new drug, with no guarantees it’ll be brought to market; 90% of drug candidates that actually make it into clinical trials fail to make it through the three-stage U.S. Food and Drug Administration process for market approval.

But we’re already seeing the power of what Ellison was talking about in action, with Insilico Medicine. It advanced an AI designed anti-fibrotic drug candidate from novel target discovery to the start of Stage 1 trials in 30 months.

As a part of investing in the Artificial Intelligence Era and Biotech Blockbusters, we’ll be keeping a close eye on this space for the best opportunities.

🛰️No. 2: Satellites

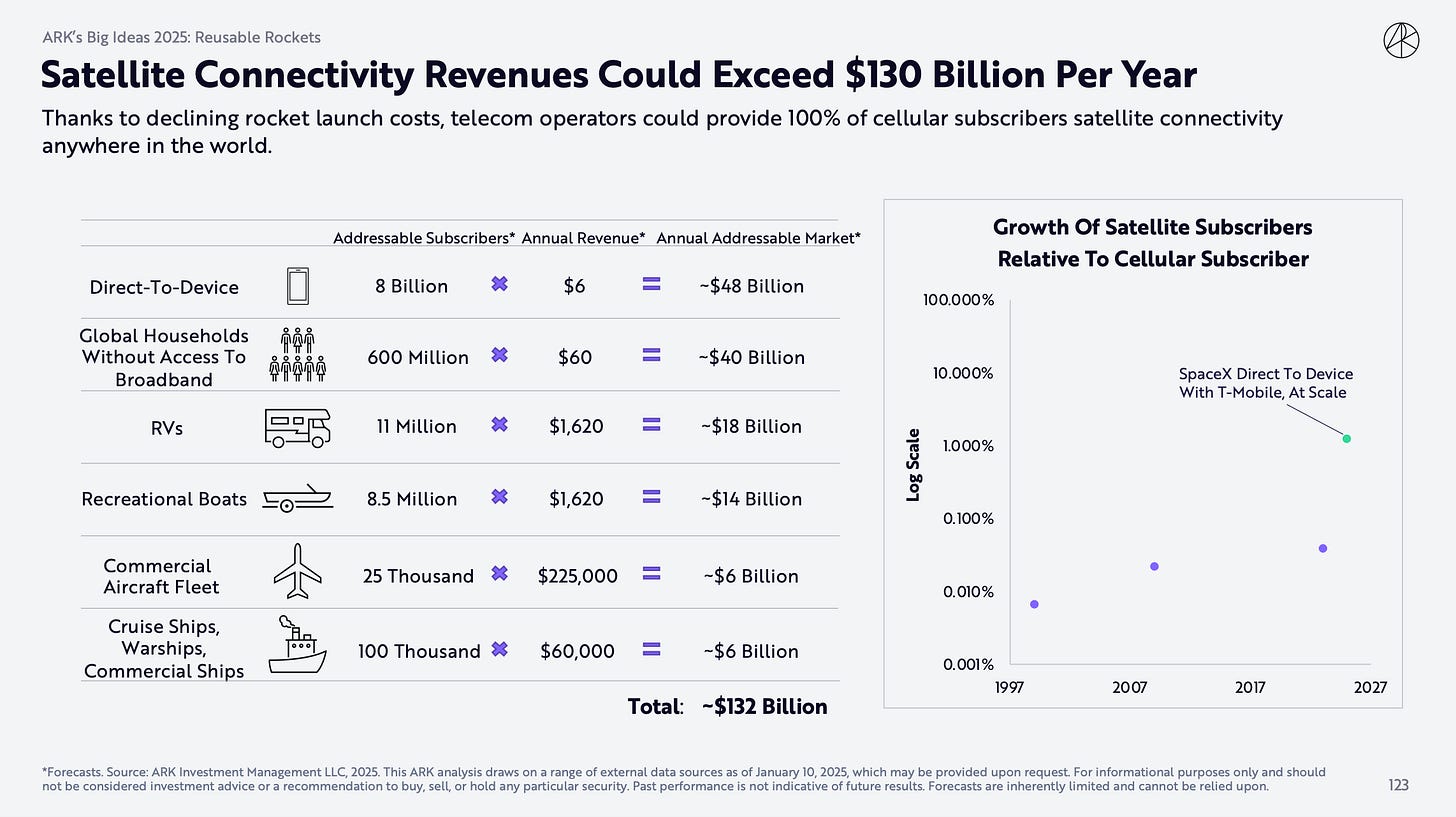

In Ark Invest’s 2025 “Big Idea” presentation, one of its “bullish bets” is on reusable rockets, which should drive down costs for space launches.

As those costs go down, one of the benefactors will be a market we’ve been watching closely: the satellite connectivity market.

It’s a market that intersects once again between two of Bill’s storylines: The Artificial Intelligence Era and the New Cold War.

Those satellites provide internet connectivity so things like John Deere tractors can autonomously navigate corn fields and self-driving cars “see” what’s in front of them on roadways. Government and military agencies need them for real-time intel, secure communications, navigation, and missile detection.

And in the satellite investing guide we created in October, we said Iridium Communications Inc. IRDM 0.00%↑ was the least flashy companies on our investable opportunities list but one of the better starting points for your own research.

The reasons:

✅Iridium had a massive projected five-year annual earnings growth rate of nearly 140%.

✅Iridium offers stability through major customers like Caterpillar Inc. CAT 0.00%↑ , Honeywell International Inc. HON 0.00%↑, and Garmin Ltd. GRMN 0.00%↑.

✅Albeit on the smaller side, it paid a dividend at the time of 56 cents (yield of 1.91%) for income generation.

✅And it had announced an additional $500 million buyback.

More recently, in its Feb.13 earnings report, Iridium beat on both consensus earnings per share (EPS) and revenue expectations, sending the stock up 15% in 24 hours.

This market is still in the early stages of what it can be, as the global internet satellite market and global mobile satellite markets were collectively valued at about $11 billion in 2023. But with the growing need for secure satellites, as you saw earlier from Ark’s projection, that number could touch over $130 billion.

You can see the full details on our outlook, as well as more on Iridium and three other satellite stocks, in the report below.

🎮No. 3: Game on for Take-Two Shares

Revisiting our 2025 Forecast series, Danny Brody (The Net Worth Club) selected Take-Two Interactive Software Inc. TTWO 0.00%↑ as one of his top picks for the year.

One of the reasons was the expected release of its popular Grand Theft Auto series, which as you can see in the image below, has been a massive hit for the company.

Take-Two confirmed in its Feb. 7 earnings report the latest offering, “GTA 6,” will be released in the fall. Since Feb. 6, shares are up 16%.

Danny said a key to all this is positioning yourself ahead of the launch, and you can hear more about Take-Two in the minute-long clip below:

And you can see Danny’s other high-conviction picks in the full interview.

That’s it for today.

Enjoy your weekend,