There were plenty of investing “gems” shared during our “Desert Island Stock Challenge” — certainly fitting given that some of the recommendations were commodities-related.

So perhaps it’s not surprising that the clear favorite in our reader poll was Natural Resource Partners LP NRP 0.00%↑.

But from that challenge, we wanted to circle back to a bold prediction from Danny Brody, a successful venture capitalist who also publishes The Net Worth Club.

Danny’s Prediction: SoFi Technologies Inc. SOFI 0.00%↑ will trade for $10 by the end of 2024.

✅SoFi Closing Price Day of the Published Interview (July 3): $6.52

✅Potential Total Gain from Prediction Price: 53.37%

We haven’t covered SoFi at Stock Picker’s Corner (SPC) before. And it’s not on our Farm Team or in our Model Portfolio for SPC Premium members.

But one of our missions here is to bring you ideas … opportunities … and starting points for your own investing research. And as I write this, the stock price is already on a nice run since Danny’s prediction - up 15%.

So here’s a rundown on SoFi.

Quick Overview: SoFi is an online bank that offers student loans, mortgages, and other financial products. Its online-only nature — SoFi doesn't have physical bank branches — is a massive cost-saver. So it’s able to charge lower fees and offer higher interest rates.

One “dark cloud” narrative that’s loomed large has been SoFi’s over-reliance on student loan revenue. SoFi claimed it lost $300 million to $400 million in refinancing revenue and $150 million to $200 million in profits between March 2020 and March 2023 because of student loan forgiveness.

The company has also continuously lost money since going public in 2021; it recorded its first profitable quarter at the end of 2023.

Shares are down 22% on the year.

Of course, it’s the “what comes next” that matters most.

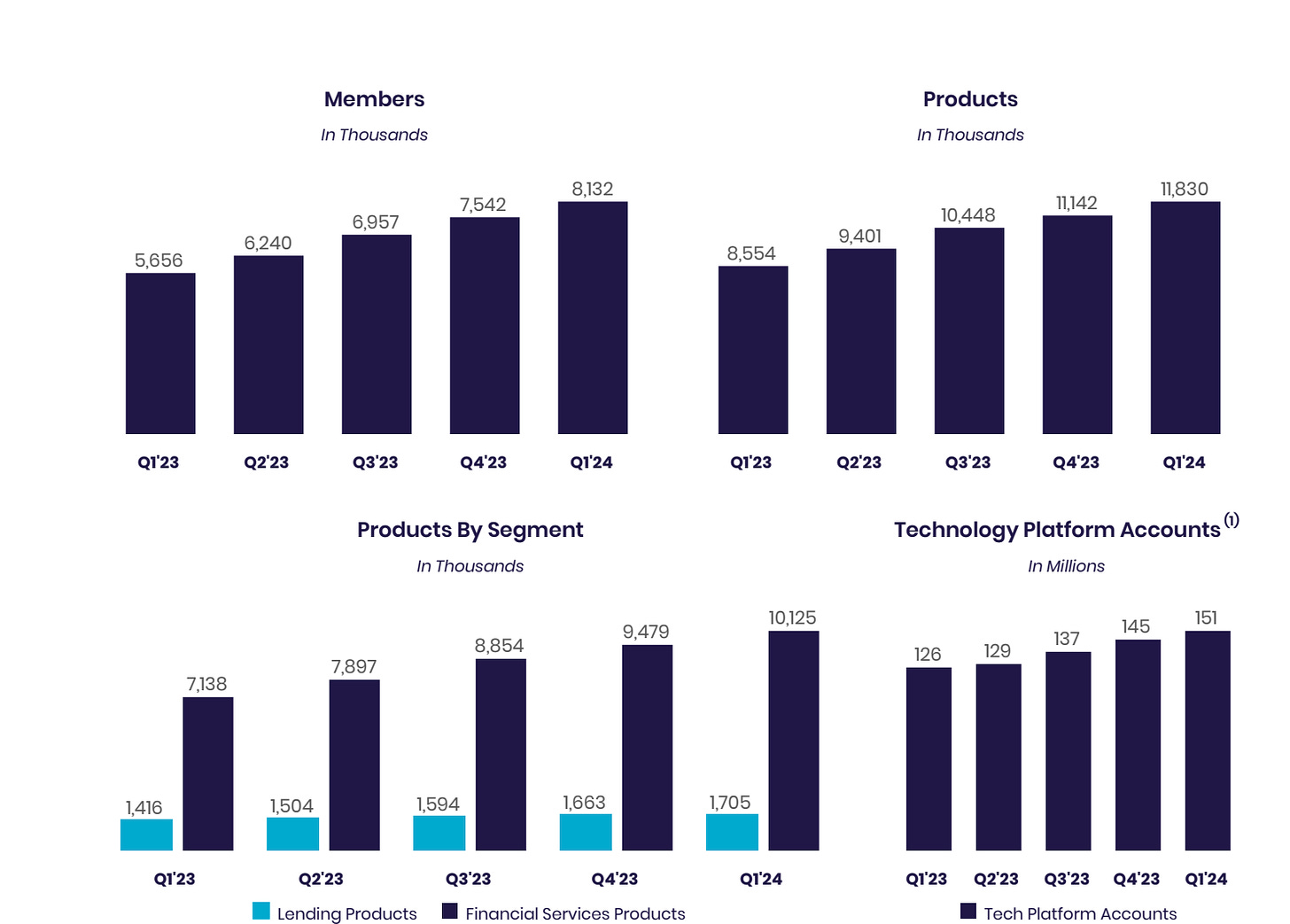

💡As part of SoFi’s first-quarter-earnings report, Noto said the company is becoming more diversified — and is pursuing larger, more sustainable revenue sources. As proof, he pointed to the company’s “Tech Platform” segment: It provides cloud-based infrastructure for other “neobanks” (financial services companies without physical locations) and fintech ventures. The Tech Platform’s revenue climbed 21%, with the number of accounts increasing 20% to 151 million.

As you can see in the charts below, members, products offered, and accounts are also steadily growing across the board:

Looking at what could be ahead, Chief Stock Picker Bill Patalon likes to use earnings growth as a “gauge” for stock price appreciation, as surging earnings tend to lead to higher stock prices. SoFi’s earnings are projected to grow at an average annual rate of 51% a year over the next five years.

That brings us back to Danny.

In less than two minutes in the clip below, he shares why he likes SoFi. And he’ll also tell you his biggest predictions for the rest of 2024.

Take care,