Growing Acclaim for Stock Picker's Corner

Some big names are honoring the work we are doing for you ...

Here at Stock Picker’s Corner (SPC), we’re not in this for recognition, either.

We’re in this to help people.

Specifically, people like you – the retail investors who’ve been dumped on, scammed, misled and (as a result) left behind.

Our goal is to show you “The Way.” To put you on the Wealth-Builder path. To catapult you back into the lead. And keep you there.

So we’re not looking for recognition. But when we get it … we take it as a proof point that we’re hitting the bullseye …

Delivering value and helping our readers.

And we’ve gotten a lot of recognition here as of late.

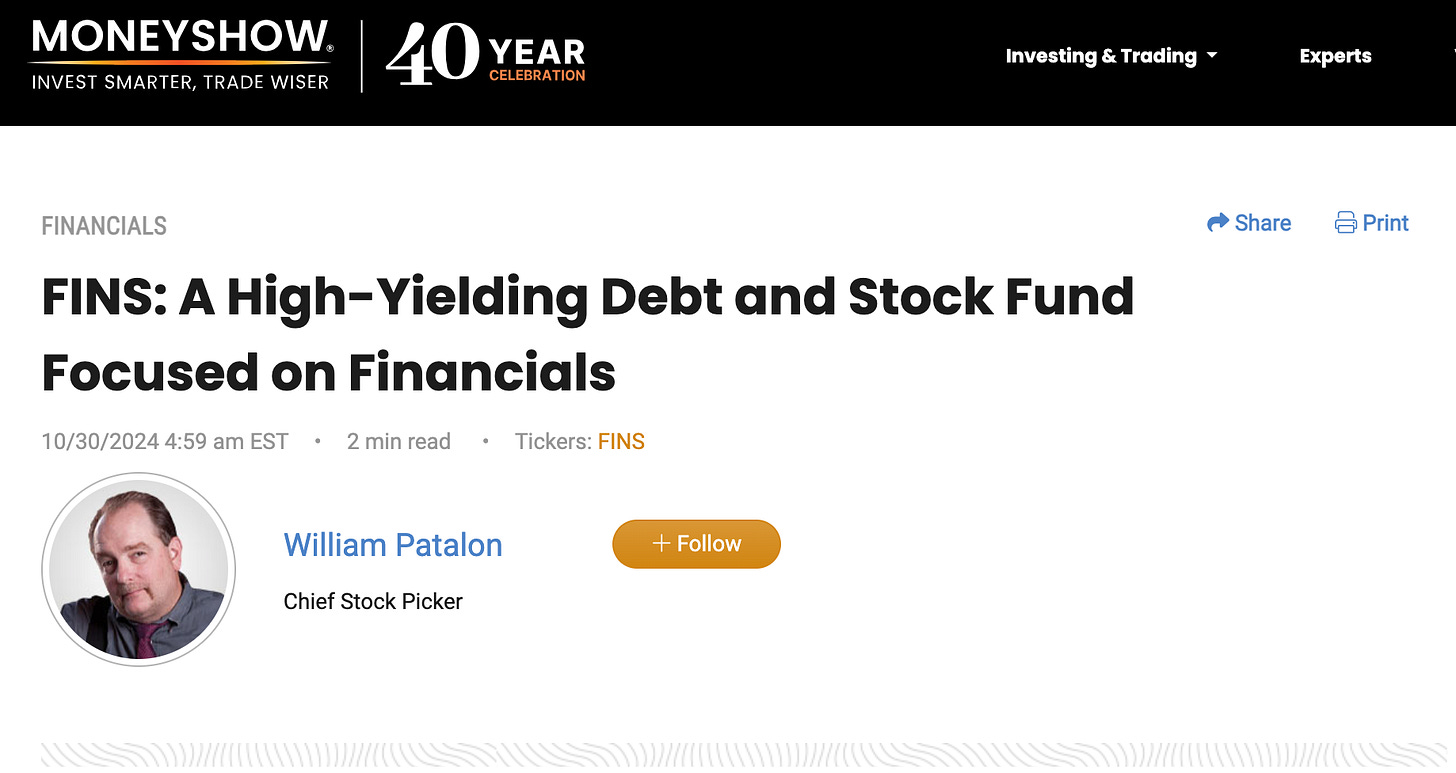

FINS: AN INCOME SHARK

The folks at the iconic Money Show last week embraced our Wealth Builder/Wealth Killers message – and repeated our warning about the “passive-income” scams that are rampant these days.

Passive income means … you don’t have to do anything (like drop-shipping, or a side job, or taking costly classes to “qualify” for passive-income opportunities).

They detailed our case for income-spigot play Angel Oak Financial Strategies Income Term Trust FINS 0.00%↑.

Angel Oak was recently trading at about $13 and is currently paying out $1.31 a share — as monthly 11-cent dividends. That equates to a yield of around 10%.

Check out their shout out here.

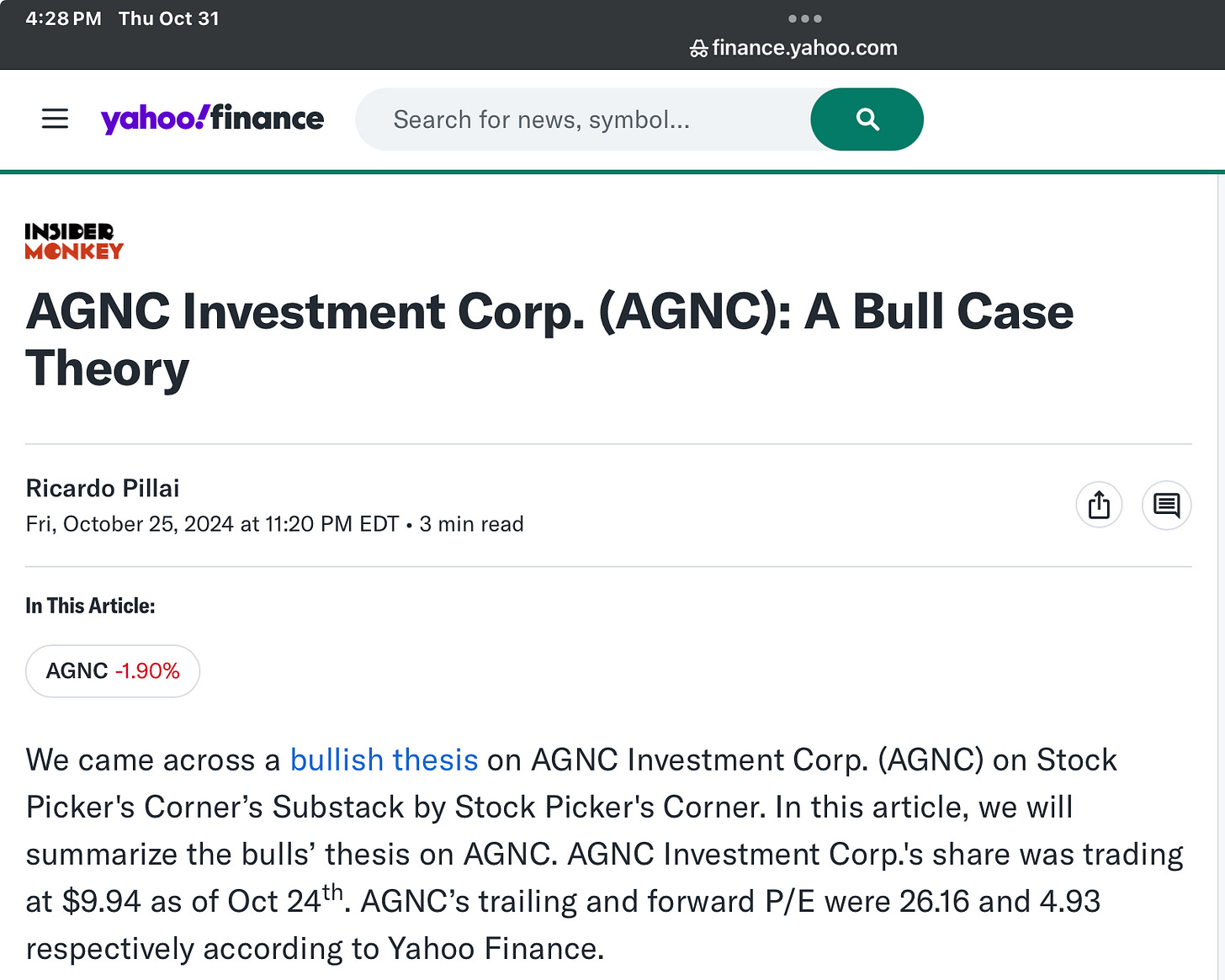

SPC ON THE BIG STAGE

Staying with our “income-spigot” strategy, we next turn to the shoutout we received on no less than Yahoo! Finance, where Insider Monkey said “we came across a bullish thesis on AGNC Investment Corp. AGNC 0.00%↑ on Stock Picker’s Corner’s Substack.”

Writer Ricardo Pillai drilled down from there.

The analysis of AGNC was detailed in the report: “This $12.5 Trillion "Reinvestment Tsunami" Hits in Two Weeks.”

AGNC is a mortgage REIT, which was recently trading at $9.31 a share; its forward dividend of $1.44 a share gives it a yield of 15.47%.

Unlike you and me and the community here at SPC, most folks really don’t get income investing.

And I mean … don’t get it at all.

Most folks look at “income” the wrong way. They look at the “nominal” yield — not the real return … the flow of cash that ends up in their brokerage account … or their pocket … after taxes, inflation or other “afterthought” costs are backed out.

I’m oversimplifying this, but it’s kind of like taking out a mortgage and looking at the stated interest rate, but never considering the payments, closing costs, property taxes and insurance.

With rates dropping – U.S. Federal Reserve policymakers are expected to cut the benchmark rate again Thursday – finding “yield” will increase in importance.

Our reports can help.

A BIG COMPLIMENT

Speaking of the Fed … you’ll want to watch for my “take” on this week’s policy meeting.

Why am I saying that?

Because fellow Substacker DualEdge Invest had this to say about my “take” after the last Fed meeting.

That’s right … the “best take” … on all of Substack.

HIGH QUALITY/HIGH POWER

And, finally, to wrap up the “appreciation tour,” let’s spotlight the mutually appreciative rapport I’ve enjoyed with Giles Capital, a Substack that does a very nice “roundup” of the stock research published across the platform.

Over the last few weeks, Giles has spotlighted several of our research reports – including the work I did on “Pet Biotech” Zoetis Inc. ZTS 0.00%↑ and the “AI Stock in Disguise” Corning Inc. GLW 0.00%↑.

Giles said the Zoetis report “perfectly illustrates what we love about quality research – deep analysis with a personal angle.”

Wow, talk about hitting the bullseye: That’s how I’ve always approached my work. I find the best storylines, find the best stocks and then deliver it with personal anecdotes that put retail investors out front.

See you folks next time;

You are crushing it! Keep those hits coming!