Forecast 2025: Six Hot Storylines — And 11 Potential Winners

Here's your "launch code" for a Wealth Building New Year ...

I don’t make predictions.

At least … not the kind of “predictions” that Wall Streeters and other so-called “experts” have conditioned us to expect.

Those invest a lot of time and energy predicting where slivers of the economy, a specific commodity, specific stocks or the broad market indices will trade next week, next month or next year.

As a Wealth Builder, I have zero interest in that. And neither should you.

It’s a waste of all that time and energy I mentioned.

It’s a total Wealth Killer move.

And we don’t make those …

So here at the start of the year — while JPMorgan Chase and Goldman Sachs and others place their wagers on how the S&P 500 and U.S. GDP will perform here in 2025 — the Stock Picker’s Corner (SPC) team is investing in something far more productive: The storylines that will make us money … this year, next year and for years to come.

Because … as I’ve told you time after time here: If you find the best storylines, you’ll find the best stocks. You’ll find the top beneficiaries – the very best opportunities. You’ll get there before the Big Money does — and you’ll be able to ride these stocks for years.

That’s how you win …

So as we wade into the New Year — and round out our Forecast 2025 investing series (which has been a huge hit), here are some of the key storylines we’ve identified and some intriguing ways to profit.

No. 1: Deglobalization and the New Cold War

I talked about this all last year and the headlines kept proving me right (right up to the end of the year) and the new administration in the White House will supercharge it all. This war will be fought on all fronts — “in the air, on land and sea” (as The Marines’ Hymn tells us) — and now in outer space and cyberspace. As 2024 wound to a close, China stunned the global aerospace community by unveiling two new tailless jets. The U.S. Treasury Department disclosed that its unit that administers economic sanctions was hit by hackers that enjoy Beijing’s backing. And China sanctioned five U.S. defense contractors in response to U.S. arms sales to Taiwan. That’s just a tiny slice, of course. But you factor in the Trump administration’s professed preference for tariffs over sanctions, and you can bet the New Cold War will spool into a whole new gear.

As will deglobalization — the “globalization reversal” that will fracture the world economy back into trading blocs. We’ll see a “New Arms Race” in such areas as air, land and seagoing drones, hypersonics, area-denial weapons, defense technologies, artificial intelligence (AI) and quantum computing, and cybersecurity. Some of these you’ll hear again, here, since these storylines tend to intersect — creating powerful “profit circles.” But deglobalization will drive construction of new semiconductor “fabs” here in America, benefitting production-equipment-maker Applied Materials Inc. (AMAT). And systems-focused defense spending will benefit the Delaware-based Leidos Inc. (LDOS), which specializes in data analytics, cybersecurity, sensor technology and digital-systems modernization.

No 2: Uncertainty (With a Side of)“What-a-Mess” Potential

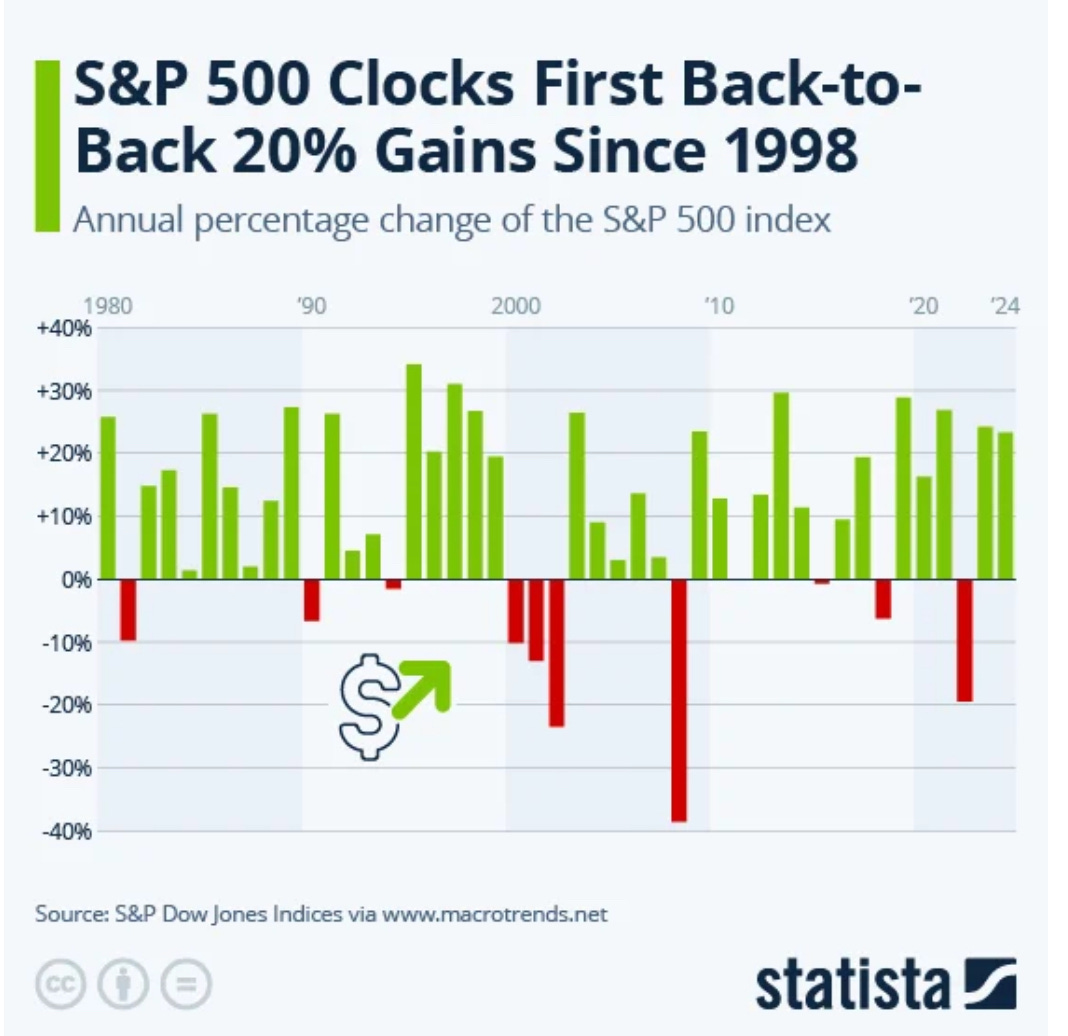

We don’t know what will happen this year. But that’s why we play the long game – and also use the “Accumulate” strategy, where we use cash windfalls, or pullbacks to buy more of the stocks we like. It’s why we invest. And it’s why we avoid the Wealth Killer effects of trading. And it’s why we search out “real” income; investments that put cash in our pockets after backing out taxes, general market rates and the eroding effects of inflation. The S&P 500 generated a total return of 26.3% in 2023 and 25% last year — although analysts worry that 2024’s windfalls were driven by some huge winners. The last time stocks had back-to-back 20% gains was in 1998:

The bailout of Long-Term Capital Management and a 1998 U.S. Federal Reserve rate reversal (both triggered by the Asian Contagion) added a tailwind that helped stocks along — but that three-year run was followed by the Dot-Com implosion. This time around, we’ll turn any volatility and trading tendencies to our advantage by investing in CBOE Global Markets Inc. (CBOE) — a stock we dig long-term. For real income, check out Annaly Capital Management Inc. (NLY), a New York-based mortgage REIT that’s got a track record of being well-managed. And use that “Accumulate” strategy — keeping the faith on good companies riding multi-year storylines.

No. 3: “Special Situations” and the “Stock Picker’s Market”

All that uncertainty tells us a couple things: First, it’ll be a “stock picker’s market” – meaning it’s not a “buy-the-index” year; second, playing the long game will smooth out the volatility and risk (and actually magnify profits thanks to our buy-on-pullbacks mindset); third, the stocks you pick can include “special situations” — companies whose shares are poised to benefit from unique catalysts or circumstances. One great example – covered extensively this past year — is Natural Resource Partners LP (NRP), a commodities royalty play focusing on coal. As we’ve outlined here in recent months, NRP achieved its special-situation status because it’s poised to use its cash flow to slash debt – after which it’ll be able to enrich shareholders through stock buybacks or a new dividend plan. I also still like “utility-in-the-making” Hallador Energy Inc. (HNRG), a “transformation play” that I talked about last summer at less than $6 a share. It’s been as high as $14 and is back down around $11.60, with the consensus one-year target at $15 … underscoring the power potential of that “Accumulate” strategy.

No. 4: Dealmaking and the “Private Equity Tidal Wave”

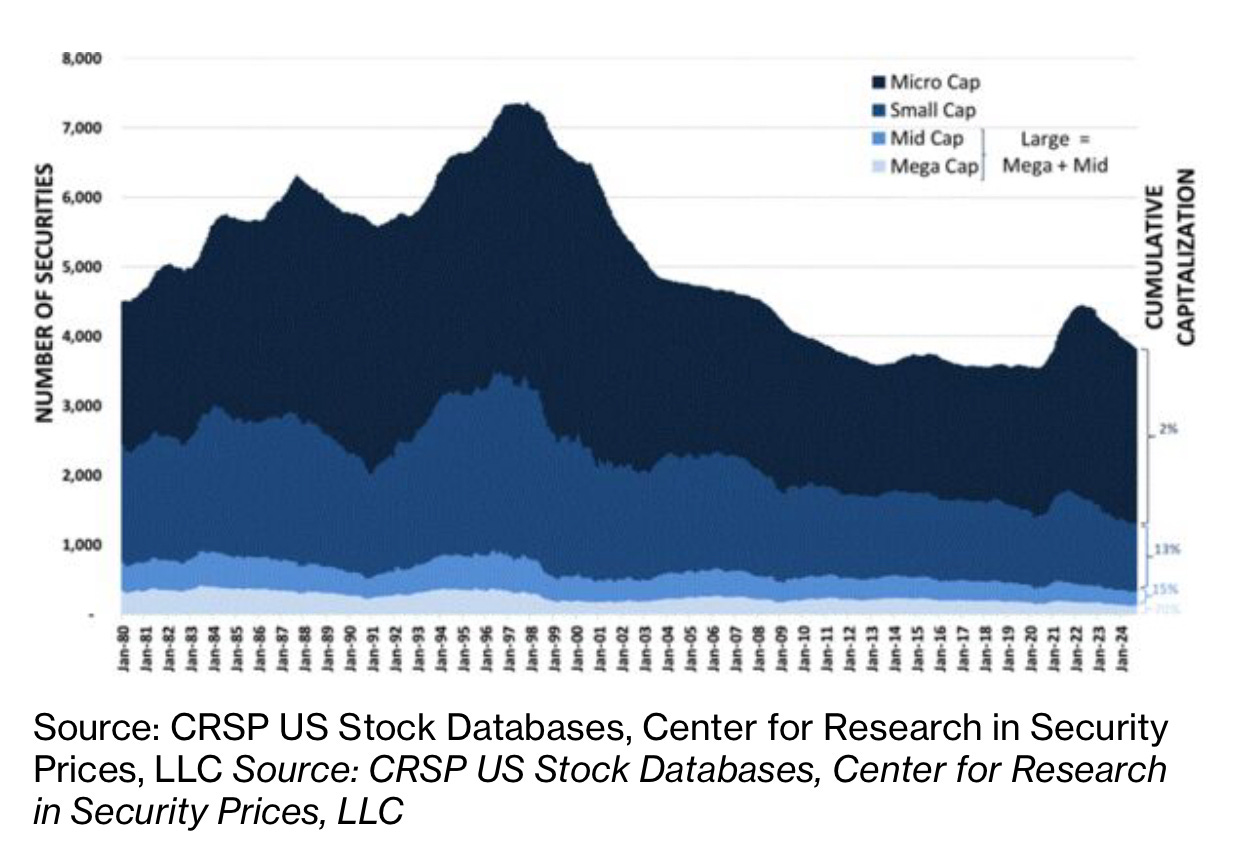

The $8.2 trillion private-equity (PE) business is “big-footing” just about everything on the planet. Pro sports, your kids’ sports, finance, data centers and more. Dealmaking means the number of public companies available to invest in keeps falling. And that trend is being supercharged by the fact that startups are staying private longer. Take Elon Musk’s company SpaceX: It’s privately held, but its recent market value was estimated at $350 billion — which Bloomberg says would rank it in the Top 25 in the S&P 500. Pitchbook just reported there are 1,400 “unicorns” — private companies with valuations of $1 billion or more. And there are more than 57,000 so-called “late-stage” firms — the ones most likely to go public. Deregulation is what I’d expect from a Republican White House — a reality that should rev up dealmaking in both the public and private markets. So we’re going to do here what we did in the trading realm: We’ll focus on the dealmaking beneficiaries — specifically Blackstone Inc. (BX). Founded in 1985 and based right on Park Avenue in New York City, Blackstone is a monster with $1 trillion in assets under management (AUM) — which makes it the world’s largest manager of “alternative” assets. It’s a company that I’ve followed for years. And its leaders are super smart: They keep finding new ways to make money (as in “windfall” returns). Blackstone scored big on distressed housing coming out of the Great Financial Crisis. And it’s now a big-time player in data centers and an emerging player in sports franchises.

No. 5: The “Broadening of AI”

AI is traveling a course a lot like the Internet – which burst onto the scene, captured investor ardor, zoomed in its initial phase where the focus was on “pure-play” firms and broadened out to become a mainstream technology – one that “enabled” all sorts of cool new businesses, and even entire new industries. That early stage grew way overheated, fueled by lots of “bubble companies” that had no real revenue or purpose. While folks will debate the valuations, we’ve not seen that same broadly irrational extreme with AI. Next we’ll see that “Broadening of AI.” Here you can continue to look at the foundational technologies – like chipmaker Broadcom Inc. (AVGO). But I also like some of the beneficiaries – including payments heavyweight Mastercard Inc. (MA) and cloud-software leader Salesforce Inc. (CRM). Mastercard is using AI for fraud detection, payment security, streamlined transactions, risk management, customer support and more. Back in September, the credit-card giant spent $2.65 billion to buy Recorded Future Inc., a threat-intelligence venture that uses AI to ID “compromised” cards. Salesforce is known for its “customer-relationship-management (CRM) technology and for its ownership of Slack, which it grabbed for $28 billion back in 2021. Salesforce’s cloud-based software touches every part of a company’s operation and is being supercharged by the company’s AI-enhanced “Agentforce” platform.

No. 6: Quantum Computing

Then there’s quantum computing – which has been promised for years but is finally demonstrating tangible progress. Quantum computing is next-level stuff: It’s not “binary,” and uses “qubits” (not zeros or ones) to solve problems at speeds today’s computers could never approach. But it’s the potential for linking those data-processing speeds with AI that’s got folks feeling stoked. You’re talking about a whole new realm, since AI models will learn and operate much, much faster. One obvious play — a company we already like as a “special-situation” rebound stock (see how these storylines intersect?) — is Alphabet/Google (GOOGL), a stock that’s been under pressure because of federal monopoly worries, including a U.S. Justice Department push to break the company into pieces. Last month, Google introduced a new, 105-qubit quantum chip called Willow. Not only is Willow speedy, it also demonstrated big gains in “error correction” — a key to building really big (and practical) quantum machines.

There you have it: Six great storylines to follow — and 11 stocks to research for yourself. We have other storylines we are following. — which is why you’ll want to stay tuned here in 2025 as we update them … as well as the companies we’ve identified here.

And if you want to be a full-fledged member of the SPC family, consider an SPC Premium membership. Join us and you get immediate access to the “Super 10 Portfolio of Special-Situation Stocks.”

You’ll also get access to our "Model Portfolio” of 18 stock and asset plays for Wealth Builders — and we give our members research Dossiers on each opportunity.

We also maintain something we refer to as the “Farm Team” — kind of a souped-up “watch list” of stocks and other asset plays that we’re considering as additions to our main portfolio or as special-situation opportunities.

And tune in next week: The Money Show invited me to contribute two “Best Ideas” to their 2025 Expert’s Panel.

That list gets released Monday.

See you next time;