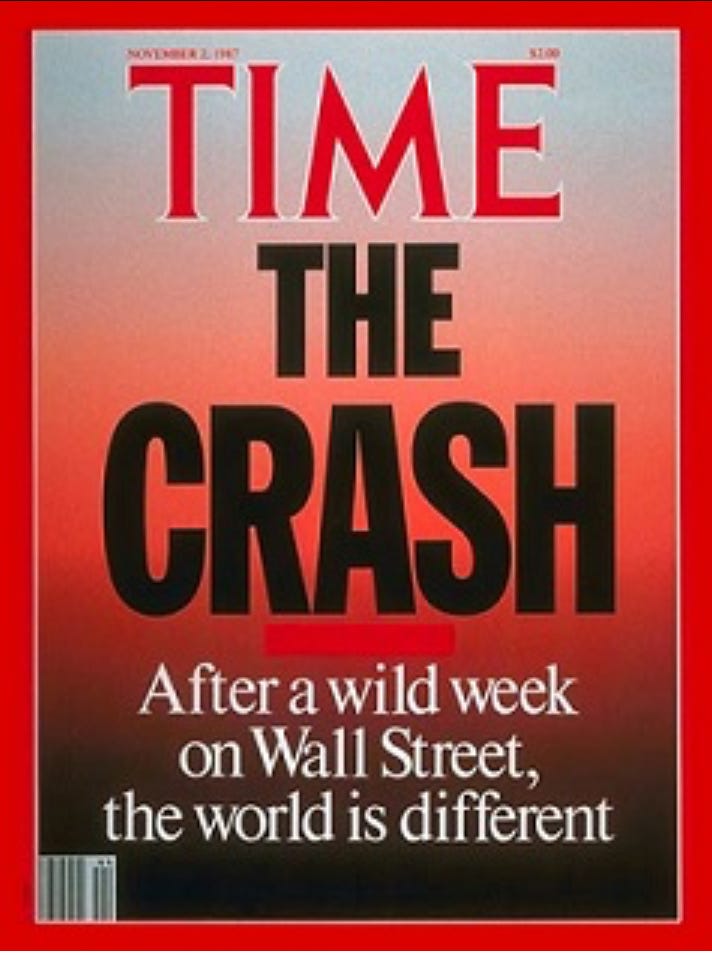

Monday’s $1.3 trillion stock-market sell-off was barely over before some big-name pros were likening it to “Black Monday” — the Oct. 19, 1987 crash that hammered the Dow Jones Industrial Average by a record 22.6%.

I’m talking about pros like Ed Yardeni, who heads a Wall Street research firm bearing his name. Back in October 1987, Yardeni was an economist with the late, great E.F. Hutton. And he told a Bloomberg reporter that Monday’s pounding teleported him back to that darker Monday 37 years ago.

“This situation is very reminiscent of 1987,” Yardeni told Bloomberg. We witnessed a crash in the stock market — which essentially occurred in just one day — and the assumption was that we were either in a recession or about to enter one. However, that didn’t happen. The crash had more to do with the internal dynamics of the market rather than the broader economy.”

His “connection” made a connection with me.

In October 1987, I was three years out of Penn State and three years into my career as a newspaper reporter. In those days, journalism was both a calling and a curse: I loved the work at my home county weekly, but the “salary” was a miuscle $150 a week, meaning my take-home was less than $110.

Gas was about a buck a gallon when I’d graduated. And I was driving about 50,000 miles a year, meaning a lot of what I earned was going into the gas tank (and out the exhaust) of the four-year-old Ford Mustang I’d scrounged enough to buy when I started my job.

So while “buying stocks” — or taking any kind of risk, really — seemed out of the question, my reporter instincts told me something was “off” and that I needed to dig deeper into this crash … for personal reasons.

After several weeks of digging, I remember thinking: “If markets are supposed to be so ‘efficient,’ how can stocks be worth ‘X ‘one day and ‘X minus 22.6%’ the next?”

That made zero sense to me. And I finally concluded that the real “risk” here was the risk of not acting — and missing the wealth window the stock market had literally handed to investors like me.

So I sought out a broker. And I bought my first stock — a beaten-down utility called Southern Co. SO 0.00%↑, whose post-crash dividend yield (if I remember correctly) was a massive 12%.

Nearly 40 years later — after a half-dozen job changes, several moves, a self-financed MBA, a new house, getting married and starting a family — I still own some of those Southern Co. shares.

And I still have all the lessons I learned … call it a dividend that I’m still collecting.

You see, it was the “Crash of ’87” that supercharged my interest in the stock market.

And it was the Crash of ’87 that forged my “Contrarian View” of the stock market: It taught me to “flip the script” — to think for myself … to avoid emotional decisions … and to look for those “inflection points” where out-of-whack prices, market-wide fear and knee-jerk assessments separate the Wealth Builders from the Wealth Killers.

Indeed, if you’re a Wealth Builder and hold your focus, stay on plan and maybe even add to your holdings, these moments of pain for the masses can set you up for years of profits to come.

And the whipsawing we’ve seen this week may have handed us the rarest gift of all: A reminder to keep all these things in mind … and a warning that there’s more rough moments to come.

In Those Days …

Having lived through (and invested through) the Crash of ’87, I understand why investment pros and the financial media are drawing these “then-and-now” comparisons.

In 1987, like today, stocks had enjoyed a hot run …. leading up to the respective sell-offs.

They nicknamed that era the “Go-Go 80s” for a reason: From 1982 to 1986, U.S. stocks soared 117%. In 1987, from January to August alone, stocks zoomed another 44%. Then came the October sell-off that was capped by that record 22.6% Dow plunge on Black Monday.

Back then, it was junk bonds, sketchy trading and leveraged buyouts that fueled that speculative backdrop. In pop culture, movies like Trading Places (1983) and Wall Street (1987) book-ended the October crash. Greed was good. Capitalism was revered. When E.F. Hutton talked … people listened. And Merrill Lynch was still “bullish on America” — albeit an America that had become a provider of hamburgers and financial services to the world.

Today we’re on another hot run — but this time it’s been Big Tech, the Magnificent Seven and artificial intelligence (AI) that’s been the fuel for the surge.

There are also “then-and-now” U.S. competitiveness concerns.

Today we’re worried about China.

Back then, it was Japan. Most Americans were terrified of a Japanese takeover of the entire U.S. economy — hence the popular mantra: “When the Japanese stock market sneezes, Wall Street catches a cold.”

(Watch the Sean Connery/Wesley Snipes flick Rising Sun — based on Michael Crichton best-seller of the same name — and you’ll see what I’m talking about.)

Down in Washington — both then and now — our leaders were maneuvering to keep advanced U.S. technology out of “unfriendly” foreign hands. And “unfair trade” was a concern on both sides of the political aisle.

I could go on, but you get the idea.

Forged in Fear

We obviously don’t know how the “this time” story will end. But the conclusion of the “back then” tale is a real shocker.

Although the 1987 Black Monday crash had most folks thinking even uglier days would come — and that the U.S. economy would probably tip into recession — the record plunge would turn out to be merely a “blip” on the trading tape: When 1987 ended that New Year’s Eve, the Dow was actually up 2% for the year.

But with that kind of price action, the juice isn’t worth the squeeze: Whipsawing like that can scar you for good.

Just ask Jack Alblin, currently the chief investment officer at Cresset Capital, a private wealth manager. In 2017 — on the 30th anniversary of the ’87 Crash — Ablin told USA Today that Black Monday really hit him hard.

As he told the newspaper, he was 28, and was trading mortgage-backed bonds for Constitution Capital — a Boston firm that (like the afore-mentioned E.F. Hutton) no longer exists.

"I felt a complete sense of helplessness,” he told USA Today. “I had a front-row seat at a trading desk. I was determined never to feel like that again. It shaped my view of investing forever … on the train to work the next day, my colleagues and I were talking business. And random people were coming up to us, and we were reassuring complete strangers that everything would be OK."

I experienced the same thing. When folks discovered I was a reporter (even though I was just getting interested in business news), they figured I must “know something” and sought reassurance, too.

Like Albin, I was changed by the Crash of ‘87. Or maybe I should say I was “forged” by it.

What I learned back then, still know now and want to keep sharing with you folks here is that — in the long run — moments that seem “black” to others don’t have to matter to you.

If you “flip the script,” they’re actually opportunities.

And next time here, I’ll show you why.

I’ll share three tips — and three stocks — that could help you “flip the scrip” … and stay on that Wealth Builder path. I’ll talk about some of our best storylines — including some that are molding our Model Portfolio. And I’ll share what we’re watching for … next.

See you then;

P.S. In last week’s story about Palantir, I promised you folks another defense-stocks story — focusing on Lockheed Martin Corp. LMT 0.00%↑. I’ll bring that to you very soon — the New Cold War storyline is huge — but I thought this follow-up on Monday’s nasty day was more timely.