The REAL Winner of the Paul/Tyson Fight ... Could Be You

You can make this move — before other investors catch on ...

When Jake Paul faced off against Mike Tyson Friday night, I wasn’t one of the 85,000 Netflix Inc. NFLX 0.00%↑ customers who reported buffering screens and delays.

I didn’t report it … but I did suffer through it: To reload the stream — and get back to the fight — I had to exit the app multiple times.

Given all the effort, I would’ve been better served to wait until the next morning for this two-minute highlight clip:

When Netflix streams the Christmas afternoon showdown between my Baltimore Ravens and the Houston Texans (with Beyonce performing at halftime), we’ll see if buffering still has Netflix “on the ropes.”

But as “storyline guys” here at Stock Picker’s Corner (SPC), we’re always looking to bring you the “real story.” And this Barron’s report — “The Netflix Tyson-Paul Fight Was Embarrassing. This Is the Metric That Counts” — bottom-lined last week’s streaming “experiment” in a meaningful way.

Says reporter Adam Clark: “With 60 million households tuning in to watch, Netflix is still likely to view the event as a success. Advertisers will want to see an improvement on the technical side for future live events but audience size remains the key metric.

Tyson took home an estimated $20 million …

Paul an even-greater $40 million …

But the real winner of the night was the sports biz, which once again demonstrated its massive drawing magic.

Despite the glitches and the complaints, 60,000 people still tuned in to watch the fight. That’s why streamers like Netflix, Amazon.com Inc. AMZN 0.00%↑, Alphabet Inc. GOOGL 0.00%↑ and Apple Inc. AAPL 0.00%↑ are elbow-jabbing one another for streaming-event rights.

And those rights aren’t cheap:

Netflix has a 10-year deal valued at $5 billion to stream World Wrestling Entertainment (WWE).

Amazon is shelling out $1 billion per year from 2023 to 2033 to bring us Thursday Night Football.

Alphabet-owned YouTube is paying $2 billion a year to stream NFL Sunday Ticket.

And Apple’s streaming service, Apple+, signed a $600 million pact for Friday Night Baseball.

According to the India-based Business Research Co., the global professional sports market is expected to grow from $484 billion in 2023 to $651 billion by 2028, which is a one-third increase in a tiny five-year span.

I’m sharing these stats for a reason: Many folks have no idea you can invest directly into professional sports teams … or even the sports ownership groups themselves.

But we do, and it’s been one of our favorite storylines of the year.

So today, I wanted to share a sports stock most investors may not be familiar with …

Madison Square Garden Sports Corp. MSGS 0.00%↑

Madison Square Sports spun off its entertainment division — Madison Square Entertainment Corp. MSGE 0.00%↑ — back in 2020 to focus on its sports assets: the New York Nicks, New York Rangers, and two development teams.

And the NBA and NHL business is booming.

Forbes said the 2023-2024 NBA season featured record attendance and record sponsorship, producing $13 billion in revenue. But that revenue for this new season could see “another double-digit-percentage jump.”

Hockey isn’t doing so bad, either.

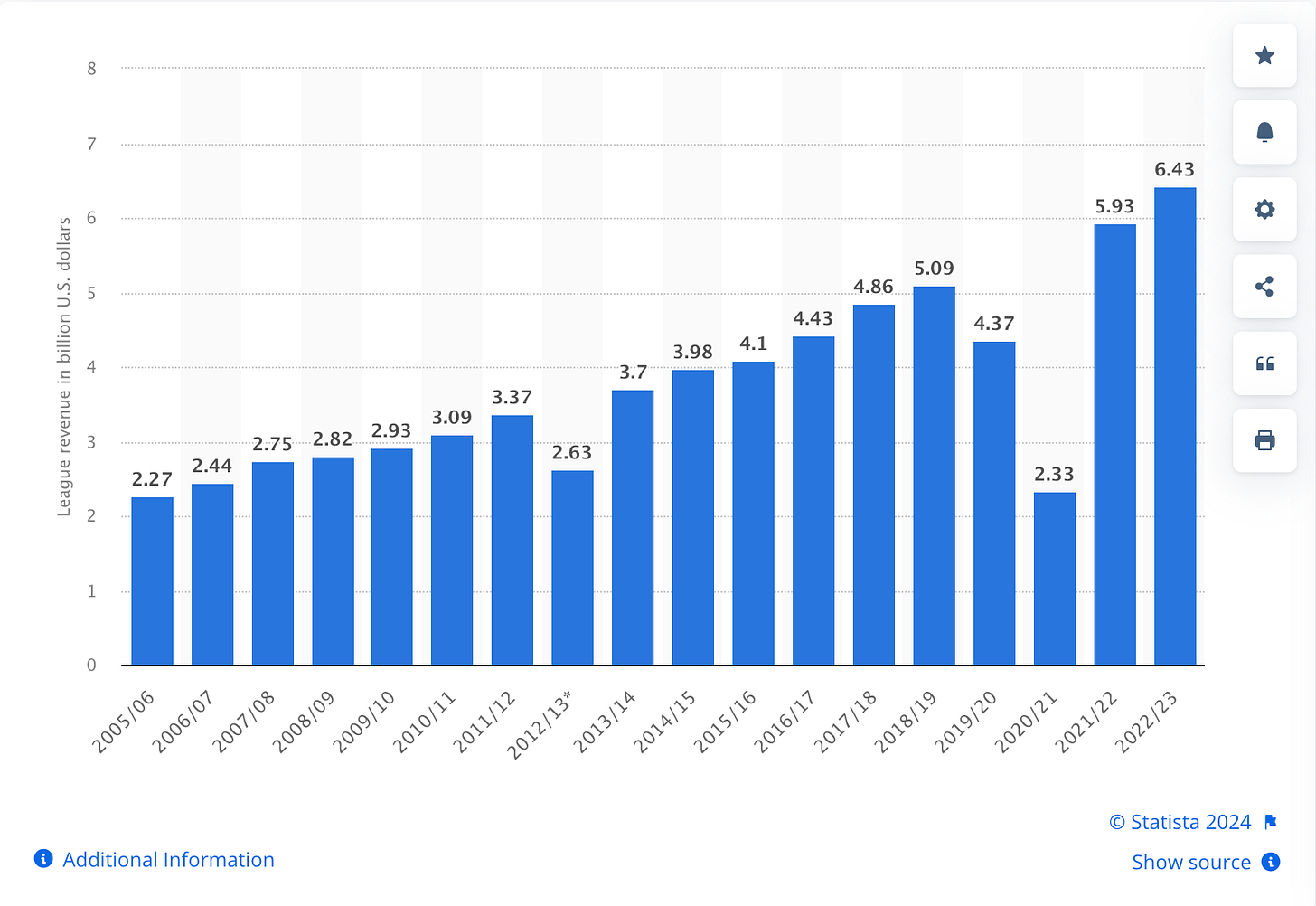

As you can see in the Statista chart below, after a few down years because of COVID-19 limiting live events, revenue for the NHL is on a continuous march higher.

And from the company’s fiscal 2025 first-quarter report, you can see folks keep shelling out cash for the teams they love:

The average ticket renewal rate for the Rangers and Knicks was 97% for the 2024-2025 season.

Revenue increased 24% to $53.3 million.

And the operating loss totaled $8.3 million, which decreased by 44% from the same time last year.

Operating at a loss isn’t great, but Madison Square Garden Sports hauled in record revenue of $1 billion in 2024, and the management team is optimistic about the long-term outlook.

Looking ahead to the next year, analysts expect massive revenue growth of 143.14%, and Chief Stock Picker Bill Patalon says that higher stock prices tend to follow revenue growth higher.

Final Thoughts

Even as inflation has made wallets feel lighter over the last few years, the record revenue from sports leagues says folks are clearly willing to keep paying for the entertainment.

That’s why private equity is rushing in on leagues like the NFL, which Bill covered - as well as a few ways to profit - for SPC Premium members in September.

Over the next few years, Nasdaq Inc. NDAQ 0.00%↑ CEO Adena Friedman expects the action to heat up further.

“I think you’re going to see teams in multiple sports being public,” Friedman told Barron’s. “You’re going to see changes in the structures of these leagues and organizations so it unlocks more value and brings more professional people into the mix.

We’ll keep watching this so you can stay ahead of the curve.

Take care,