In last Monday’s issue of Stock Picker’s Corner (SPC), I told you folks why I’m writing on Substack.

The “headline” … Substack is Happening … Substack is Cool.

But what we in financial publishing refer to as “The Why” is that Substack is the perfect platform to do meaningful work, to present the lessons I’ve learned in my stock-picking career (lessons you won’t find in any book) and to have my “stuff” transform investors from Wealth Killers into Wealth Builders.

In response to that issue, Linda from Substack, the Partnerships Lead for Finance Content, shared a warm note, welcoming SPC to the Substack world.

I’m humbled. And grateful. And inspired … to keep doing great work — for you folks.

And as I’ve thought about Linda’s note over the last few days … I realized something else. That note is a “proof point.” It shows why Substack is special. Where else does a high-level person like Linda reach out … welcome a guy like me … and, in essence, help me by essentially telling the “Substack-sphere” that:

“Hey Everybody: I want to tell you about a new addition to the Substack Community. He’s a veteran newsletter guy … is well-known, has a good rep and wants to make a difference here.”

I’m good at sensing change … at major shifts. And the one we’re seeing now is the “major shift” from traditional newsletters to “platforms” like this one. And of all the platforms my team looked at as a home for SPC, we concluded that Substack was the hands-down winner.

In the months since our launch, we’ve seen how right we were: That “New Era of Substack” gives me a great new forum to work in.

But the real benefits will be to you - the reader.

As a guy who has cared deeply about his audience for the last 40 years — first as a reporter focused on everyday readers and then as a financial writer focused on everyday investors — I can just focus on “The Work” here.

Emotions — including, most of all, empathy for all of you — have a place in our work. Linda and her colleagues show that Substack understands that — indeed, actually nurtures it — so I can publish directly to you and for you.

From the growth we’re seeing and the notes we’re getting, you all like and appreciate what we’re delivering and developing — and I want to thank you for being here with us.

Speaking of which, let me share a little bit about what’s happening around the SPC universe.

✅ Special-Situation Investing

Most folks think about special-situation investments in a traditional sense … such things as M&A, buybacks and spinoffs. You’ll often hear Wall Streeters or academics refer to this as “financial engineering.”

Another type of special-situation play to look for is “event-driven” special-situation investing.

One example is investing in a company targeted by “activist” investors.

During my 40-year career (and counting), I’ve found some great special-situation plays.

✅(I recently published one such special-situation investment for SPC Premium members that shows a potential return between 173% and and 255% in the next six years.)

Another example — which we’re covering and writing about extensively right now — is in commodities.

Commodities like silver and copper.

The “trigger” here is a growing supply/demand imbalance. The Silver Institute, the trade group that serves as the industry’s voice, forecasts in its 2024 installment of its “World Silver Survey” that the silver “deficit” will surge to 17% this year – the fourth year in a row for a shortfall.

For copper, New York City-based S&P Global believes supply may not keep up with demand as early as next year.

Supply not meeting demand is “Econ 101” stuff — an easy-to-understand recipe for a price spike that’s a special-situation opportunity for Wealth Builders. I mean, it lines up perfectly with our core belief: Find the best storylines and you’ll find the best stocks.

The commodities shortfall is a great storyline. It’s being fed by multiple “triggers.” Once you understand that story, you can usually just drill down to find the best opportunities.

But commodities is a bit of a different animal. A bit outside of the mainstream experience for lots of retail investors — and not quite as simple as more “conventional” investments like stocks, ETFs and the like. That makes it a bit riskier — or, at least, less-intuitive — to zero in on.

The antidote is SPC, where my “Platinum Rolodex” allows me to bring the experts in these fields to you.

My interview with Peter Krauth, editor of Silver Stock Investor — where he shares his 2024 forecast and what could be some record-setting prices for silver over the next few years — is available to all SPC readers here. I’ve also been following up with Peter and his newest colleague about the outlook for gold and silver in the back half of this year. So stay tuned for more details.

And in my interview with Danny Brody, CEO of ORO Capital — where he gave us the “Copper 101” view of what’s driving the copper supply/demand imbalance — you folks got a behind-the-scenes look at a copper project he signed a letter of intent to acquire. You also got four copper stocks to consider as part of your own commodities-investing research. Danny’s back with a follow up on his recently-launched Substack, The Net Worth Club, where he breaks down a prediction from hedge fund manager Pierre Andurand, a former Goldman Sachs Group Inc. GS 0.00%↑ trader who now runs the $1.3 billion Commodities Discretionary Enhanced Fund. Andurand says copper prices could reach $40,000 per ton in the next few years (a 4X climb from where they are today), and Danny shows why this prediction has some legs to stand on.

💵Higher Prices for Forever

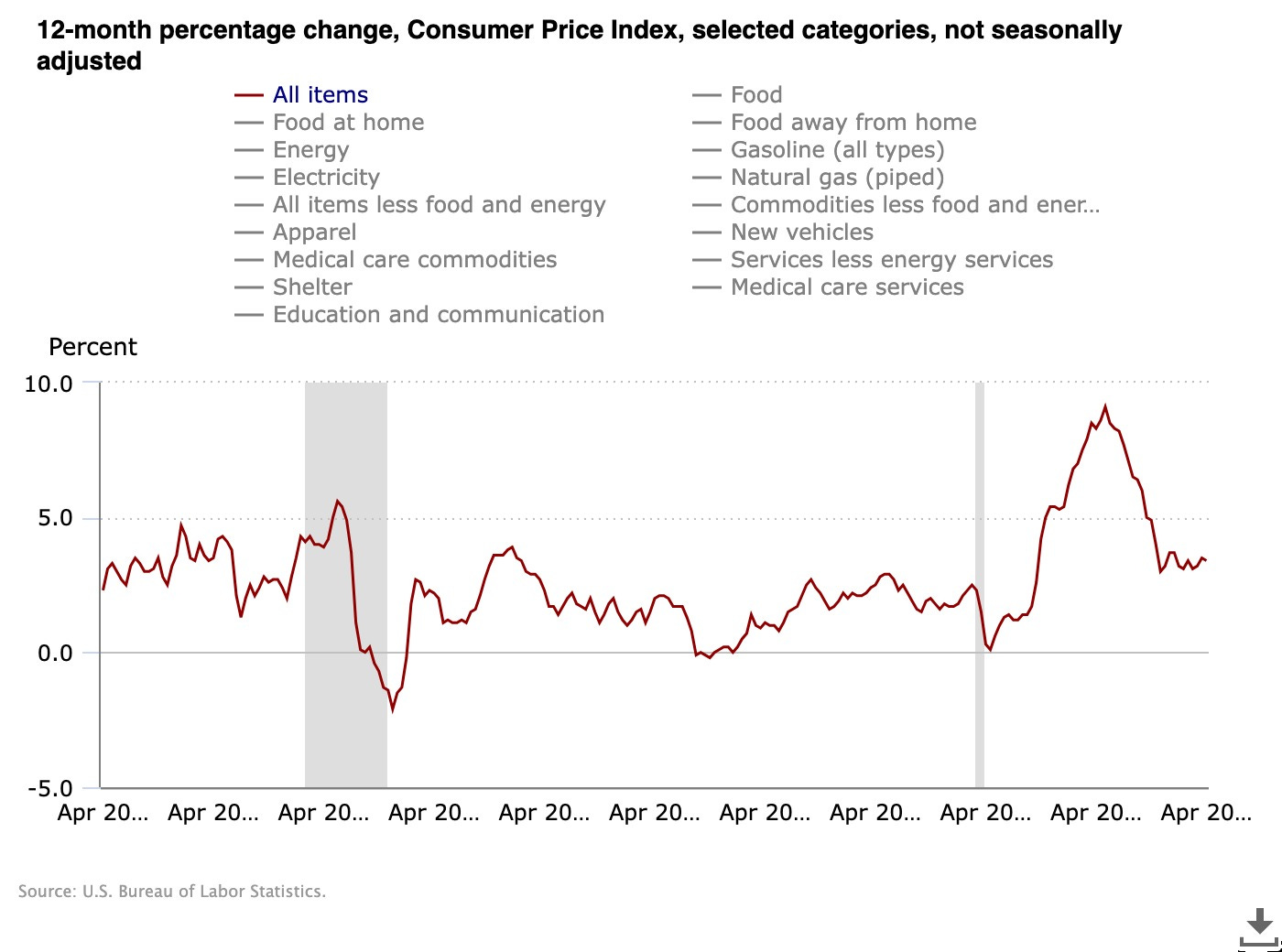

Mid-2027 - that’s when the Federal Reserve Bank of Cleveland expects inflation to reach the central bank’s 2% target.

That’s why, despite the numbers saying inflation is “cooling,” there’s a disconnect between the reported numbers being trotted out and how people are feeling. Call it “The Great Disconnect.” The economy is decent. But consumers are angry, even scared, and feel like those reports are all … Malarkey (my Dad’s preferred synonym for “BS”).

Why the disconnect? Why does the White House, our congressional reps, the academics and other “experts” keep getting it wrong?”

Simple - they just don’t get it.

They focus on “reports” … “statistics” … and numbers. But the economy (like the “stock market”) isn’t numbers — it’s people. People who remember what prices were four, six and eight years ago. And people who feel like they can’t afford to cover their groceries, take a furry friend to the vet, fix their car or truck, or renew their car insurance.

People who feel like they’re falling behind.

Those feelings are expressed in the Expectations Index (consumers’ short-term outlook for income, business and labor market conditions) from the global nonprofit think tank The Confidence Board.

The index rose to 74.6 in May from a horrendous 68.8 in April. But anything below 80 signals the potential for a recession within a year. And that index has been below 80 for four months in a row.

Higher prices are here to stay. And that’s creating something I’m referring to as the “Income Imperative.”

An imperative to keep your “Golden Years” truly golden — so you aren’t forced out of retirement and back into the work force because your dollars aren’t going as far as they used to.

An imperative so that you aren’t incurring the higher risks that you get when “chasing” the higher returns promised by “income products” (or “income strategies” like options), without really understanding how they work.

And an imperative because you can’t stuff your cash into the usual “income” investments — money markets, CDs, bonds or other interest-bearing investments — without considering such crucial elements of “context” like taxes, the inflation rate or interest-rate trends.

I cover all of that, as well as share an income-opportunity offering a 13% yield, here.

Before You Go

Today’s issue of SPC is free to everyone.

If you’ve enjoyed what you’ve been reading and would like access to our Model Portfolio, Dossiers, Farm Team, and SPC Premium Issues, feel free to learn more here.

For current SPC Premium members, you can access the Model Portfolio page here and any issues you may have missed here.