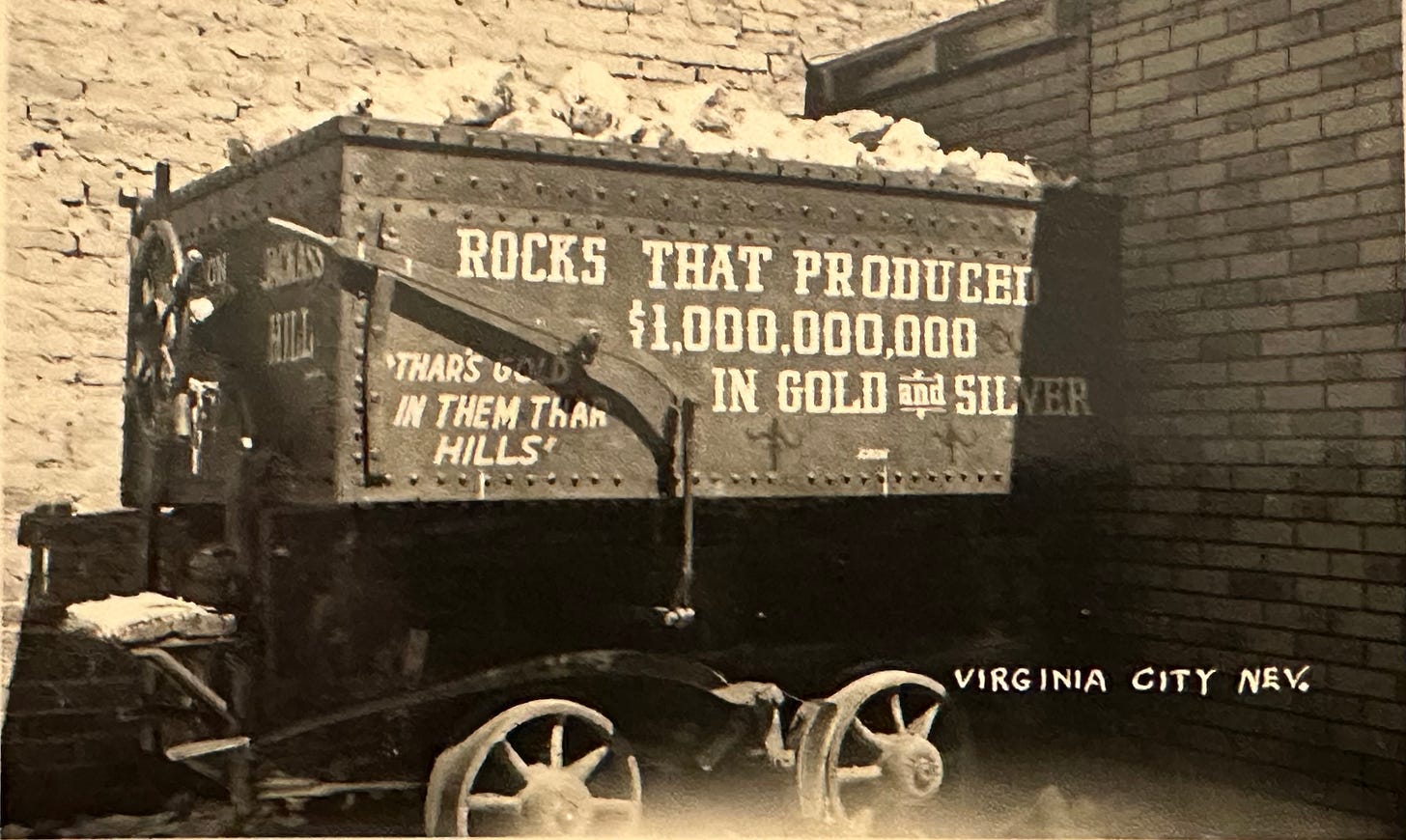

Old postcard from my collection … probably the Comstock Lode, the first major silver ore discovery in America. Named for miner Henry Comstock, the vein was found under the eastern slope of Mt. Davidson in Virginia City, Nev., circa 1859.

In an interview that led to my March 6 Stock Picker’s Corner (SPC) report, “Silver's Surge: $30 Soon ... $300 By 2030?,” Silver Stock Investor (SSI) Editor Peter Krauth told me that silver would hit $30 an ounce sometime in 2024 – and eventually go higher (even much higher) from there.

I’d picked Peter for that interview for a bunch of reasons.

First, although I’m a fervent believer that stocks are the best Wealth Builder investment you’ll ever find, I’m always on the lookout for “special-situation investments.” I’ve always held some silver in my personal portfolio. But as I launched SPC, I saw the special situation opportunity offered by the “other precious metal.”

And Peter is my silver expert of choice. We’ve been industry colleagues for 20 years – and through that became friends. He’s a tenacious researcher, a superb writer, a straight-shooter and a truly good guy – just the kind of person you like to collaborate with.

I watched Peter launch and build his silver-investing franchise SSI – an investment publication focused exclusively on the “common man’s precious metal.”

And that possible $300 upside was a scenario he detailed in his 2022 book The Great Silver Bull.

And believe me, I sure am glad I did that interview.

At the time we published our report, silver was trading at about $23.87. It soared (that’s a fair descriptor) to a 52-week high of $32.51 an ounce on May 19 – for a 36% surge in just 74 days.

There are different ways to measure this. But to give you some context, that’s roughly equal to a 177% gain over a full year.

Silver has since dropped back to $30.54.

So I knew it was time to circle back and speak with Peter: He says silver is, well, taking a bit of a breather — call it a consolidation respite — before heading higher.