Investment pros refer to it as “Top Down Investing.”

We think of it as the “storyline approach.” And we believe if you find the best storylines you’ll find the best stocks.

Here at Stock Picker’s Corner (SPC), one of those “best stories” is the AI Era.

And one of the “best stocks” — one of the biggest AI beneficiaries — is Apple Inc. AAPL 0.00%↑.

Apple’s “gateway” into AI is through its phones, and there just so happens to be an iPhone event slated for Monday where we’ll get to see all of this in action.

But there’s more to the iPhone rollout story than just AI. According to a recent Bloomberg analysis, we’re talking about a “Next-Level” plot addition to the Apple storyline:

Here are the most important details from that Bloomberg report:

The iPhone 16 will be packed with some powerful AI features. Siri will gain new muscle. And there’s a writing tool called “Rewrite” that may cause a lot of Grammarly account cancellations. Wedbush Securities analyst Dan Ives used a new variation of that magical phrase — “upgrade cycle” — when he talked about the “AI-driven upgrade cycle” for the 300 million iPhones that haven’t been upgraded in over four years.

And yet, folks in “dead zones” still might not rush to upgrade. Dead-zone phones struggle with network connections; towers are too far away or signals are obstructed.

Fixing those dead zones by building new cell towers will take time — and could trigger the ire of neighborhoods that don’t want their skylines altered by one of those fake steel trees. The solution: Satellites. Apple works with satellite provider Globalstar Inc. GSAT 0.00%↑, which has 24 satellites in orbit and is expected to add 17 more in 2025 as part of its coverage-boosting strategy. It’s a formula: The better the coverage you have, the more likely you are to upgrade.

“As for Apple, both satellites and AI are positive – as is anything that drives hardware sales,” Barron’s associate editor Al Root concluded in his report.

He’s right.

Apple already has that “gateway” into AI with its iPhones. If it can throw in better connectivity and more features, that can funnel more customers into that vaunted ecosystem.

But after reading this report, it felt like this just wasn’t an Apple story … that there may be a broader opportunity to explore.

Chief Stock Picker Bill Patalon likes to say the greater the number of intersecting storylines, the bigger the potential back-end bang. So the more I dove into satellites, the more I saw an intersection between the AI Era and the New Cold War.

Here are three key takeaways I found:

The global mobile satellite services market size is still relatively small. It was valued at $5.6 billion in 2023 and is expected to reach $9.5 billion by 2031 for a meager compound annual growth rate (CAGR) of 6.9%. In 2023, CCS Insight had a more bullish forecast that the satellite smartphone services market would reach $18 billion by 2027. Still relatively small, but this all may turn out to be conservative, as the AI Era can supercharge the need to get more satellites into space, which will help to easily exceed market forecasts.

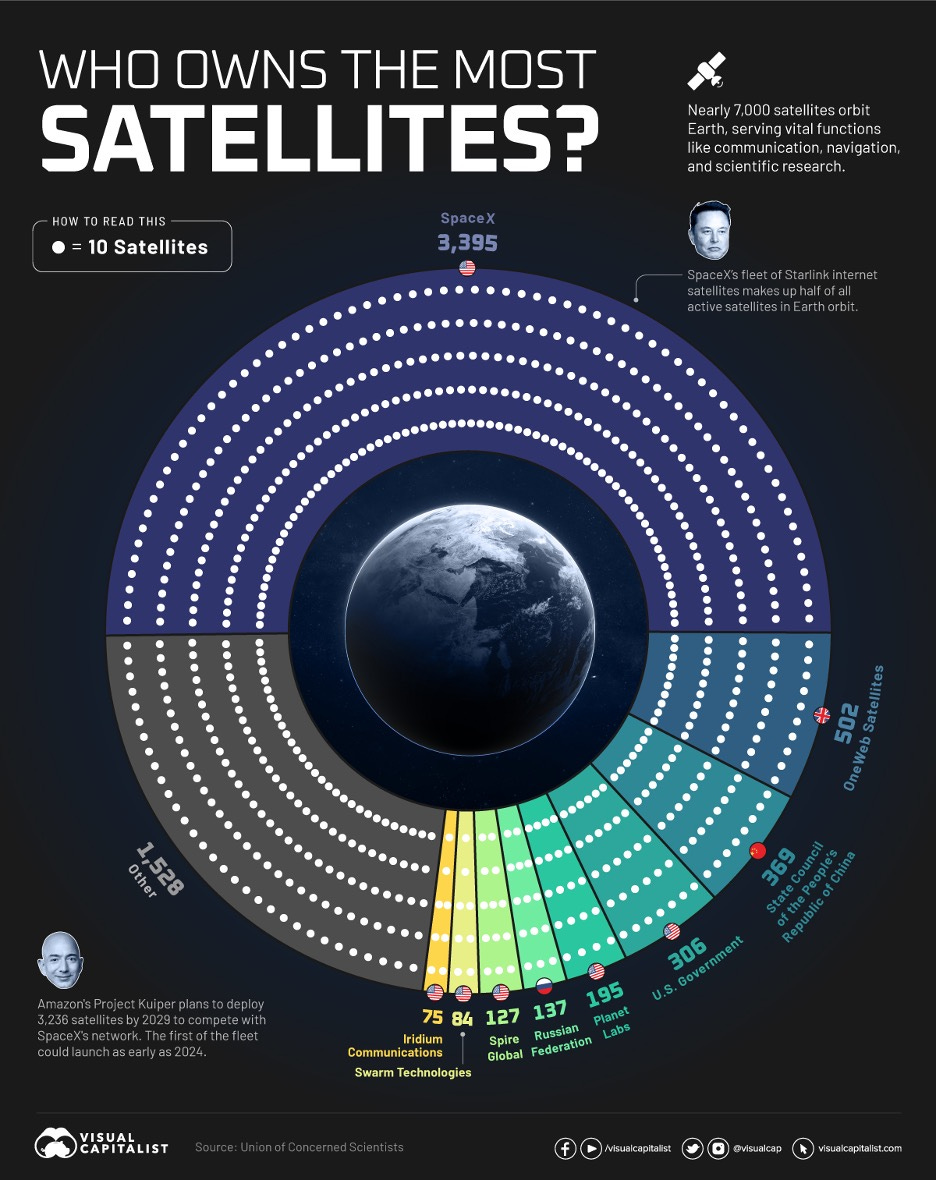

The global internet satellite market is bigger. In addition to smartphone satellites, internet satellites are also important in the AI Era. This was a market valued at $5.6 billion in 2023 — just like the mobile satellite services market — but is forecasted to reach $58.1 billion by 2032, for a much more impressive CAGR of 33.90%. Although a private company, Elon Musk’s Space-X satellite operator Starlink had the largest fleet of satellites in orbit in 2023 and now has nearly doubled that total with over 6,000. These satellites provide internet connectivity so things like John Deere tractors can autonomously navigate corn fields and self-driving cars “see” what’s in front of them on roadways.

Finally, for the New Cold War storyline, on Aug. 6, China launched 18 satellites as a part of a 14,000-launch plan to beam broadband internet into homes and rival Space-X. “The launch comes as China ramps up its commercial space sector as part of Bejing’s broader bid to cement its place as a dominant power in outer space,” CNN Senior China Writer Simone McCarthy wrote in an Aug. 9 report. And the think tank The Australian Strategic Policy Institute believes other countries using China’s satellites for broadband access could be pressured into censoring content that’s critical of China. So satellites are not only a “connectivity” issue to help power the AI Era … they’re a matter of national security. We were already on top of that story.

This is not an exhaustive list of all the players in the satellite market, but these are five of the more interesting opportunities I came across as a good research starting point that we’ll be diving into more in the weeks and months ahead.

The list includes:

Iridium Communications Inc. IRDM 0.00%↑

Viasat Inc. VSAT 0.00%↑

EchoStar Corp. SATS 0.00%↑

Gilat Satellite Networks Ltd. GILT 0.00%↑

Globalstar Inc. GSAT 0.00%↑

As big as this sounds, don’t ignore the near-term story that led me to all this research in the first place: On Monday, Apple is expected to unveil four new iPhone 16 series, two new Apple Watches, and some new AirPods.

And don’t forget about AI …

Monday’s Cupertino gathering will also include the rollout of the “Apple Intelligence” platform.

We’ll see you back here tomorrow for our weekend issue with more on Nvidia Corp. NVDA 0.00%↑.

Take care,