Real estate is in my DNA.

Thanks to my family’s rental properties, I’ve been immersed in the industry since I was 17. I’ve assisted with repairs, cleaned rentals and helped my dad research commercial properties in a “boots-on-the-ground” education that stands at seven years and counting.

I owe this opportunity to my grandparents.

Originally from Serbia, my Dad’s parents moved to Canada and worked factory jobs before moving again – arriving in South Florida in the early ‘80s. From 1983 to 1998, they opened and operated their own motel on A1A in Fort Lauderdale, a city known for its beaches that attract tourists and snowbirds alike.

They handled everything— maintenance, cleaning, and bookkeeping. They also bought their home there in 1983 and built a duplex on the property two years later, which was the start of a slow transition to residential rentals. My grandparents finally sold the motel in 1998 and bought another duplex afterwards.

My father became a lawyer and dabbled in stock picking when he was younger.

In the early 2000s, he invested in Blackberry Ltd (BB), but watched as the smart phone pioneer’s dominance – and its stock price – eroded after Apple Inc. released the innovative iPhone. He invested in Disney in the ‘90s, but after a string of blockbuster failures, skidding attendance at its theme parks and the problem-plagued ABC acquisition, the kingdom seemed to have misplaced its legendary “magic” – so he dumped the stock for a loss.

My dad didn’t like the volatility (the whipsawing price action) he experienced with stocks. He found that real estate investing lined up better with his emotional makeup and played more to his strengths as a lawyer, especially because of his family background and his own experience with title insurance, closings, and more. Embracing the wisdom of Warren Buffett, my dad repeatedly told me he chose real estate because you “make money while you sleep.”

Despite my family’s deep real estate roots, I never expected to travel that same path. Finance intimidated me – which is why I never took an economics or business course in high school or college. I didn’t lack intelligence, but I lacked the confidence that I felt I needed to excel in those kinds of courses.

After high school, I pursued a bachelor’s degree in English literature and focused on children’s literature in the late-nineteenth century.

As graduation approached, I seriously considered a career in academia, and I planned to take a gap year to apply to doctoral programs. The COVID-19 Pandemic changed my perspective, and my plans. I realized that I didn’t want to commit to one profession or one field of study for the rest of my life. So I did a 180 and decided to earn an MBA.

The MBA appealed to me because it was the only post-graduate degree that provided an eclectic curriculum at a high level. In an unexpected fashion, my favorite classes, Crowdfunding and Fintech, whisked me back to my English literature days, because we did case studies, researched special topics, and wrote our own reports.

While I studied accounting, finance, and marketing, I related what I was learning in the classroom to the real estate business my family had worked so hard to build.

A Blueprint for Personal Growth

There’s a Chinese proverb: “Wealth does not pass three generations.” The first generation builds wealth, the second generation preserves it, and the third generation loses it.

I don’t want to be that “third generation” that squandered the enterprise my family had created. I didn’t want to mismanage the assets that my parents and grandparents would be leaving to my sisters and me. My dad has watched many times as people inherit property from their parents and immediately cashed out.

That’s why I decided to learn the family business, creating my own curriculum by taking over as property manager. That decision pushed me out of my comfort zone – but in the best way possible. That stretch — from 22 to 24 — was pivotal in developing my confidence and teaching me to trust in my abilities.

Up to age 21, I felt most at home with the academic world. But I also realized that there was no real personal growth there. Understanding your strengths is great. But sometimes you find yourself having to pull from your weaknesses to build new strengths.

Property management forced me to try new things; even areas I didn’t know much about or downright didn’t enjoy. For instance, I realized I relied too heavily on the convenience of text and email. It kept people at arm’s length, and in order to get things done, I had to get over my hesitancy of picking up the phone, especially when dealing with maintenance and insurance companies.

Everything shifted when I adopted a mindset of calm confidence. I told myself that the problem at hand could be resolved if I was patient. And I discovered that the stress I used to experience faded away.

With the “old me,” people drama threw me for a loop. Managers (the intermediaries between landlords and tenants) are often the harbingers of bad news.

One time, I gave tenants on a month-to-month lease a 15-day notice. They were disruptive, arguing late at night and damaging our property. When I served the notice, they cried, accused me of heartlessness, and screamed at me over the phone. I hated being viewed as the bad guy and was frustrated they couldn’t grasp one simple fact: They were just bad tenants.

They went behind my back and begged my grandparents to let them stay. We gave them several months to find a place and move out – but they didn’t, and were evicted. They trashed the apartment on their way out, and I allowed their behavior to steal my peace of mind.

But I learned from that, too. I realized you can’t control how other people react. But you can choose how to handle the situation.

I won’t let moments like that bother me again.

After my MBA, I leveled up my game in the real estate field by earning my sales associate license. As a property manager, I was already doing things for the landlords that a real estate agent might do – such as showing properties and marketing them. So I figured I should just make it official, gain access to the MLS, and earn the agent’s commission, especially if my family decides to sell one investment property and buy a different one.

Getting my license also exposed me to other parts of the real estate business that I may want to explore in the future.

Some of my friends were surprised.

A former classmate said, “I always thought you would be a professor or something. You were always so intelligent and intellectually curious.”

She’s right. Partly.

Real estate isn’t my absolute end game. But the combination of business and writing gives me the opportunity and freedom to exercise my innate intellectual curiosity. My family, which already had “landlord” and “lawyer” on its roster, has now added a real estate agent to its roster. It’s also gained a dedicated writer and businesswoman.

And my natural curiosity, from my MBA experience to my current work in real estate, led me to an interest in real estate investment trusts — or REITs, for short.

REITs 101

Owning real property as an investment isn’t always a realistic option for the retail investor; especially with how much mortgage rates have surged since 2022.

Real estate investing — even for passive income — requires money, time and effort that demands more of an active role. REITs, however, make real estate investing accessible to anyone with a brokerage account.

Investing in REITs gives you an income stream from real estate without headache tenants, late-night phone calls about repair disasters, or property taxes and soaring insurance costs.

REITs also come in different flavors with specialties that include residential, commercial, and industrial properties. There also are mortgage REITs, natural-resource REITs, and different “flavors” of technology REITs.

That’s the beauty of REITs.

They let you make money on projects that you find fascinating but probably couldn’t finance yourself. And once you’re invested, they can offer true income thanks to the Internal Revenue Service (IRS) requirement that REITs must pay out at least 90% of their taxable income as dividends to shareholders.

That brings me back to my father’s favorite thing about real estate investing: You collect money while you sleep.

To be sure, REITs have drawbacks.

As a REIT investor, you’re also at the mercy of management’s decisions, the influences of the overall stock market and the macro economy, shifts in interest rates, and other “wild cards” that arise from time to time. And all those factors influence the REIT company’s growth, its share price, and the amount available for payout.

Those dividends they pay out are also taxed as ordinary income.

But there are lots of benefits when a REIT is chosen with care and lines up with your overall investing goals.

And I’m going to share three opportunities in REITs to help you get started with your investing research.

Specifically, artificial intelligence (AI)-connected REITs.

Connecting the Investable Dots

At Stock Picker’s Corner (SPC), the core belief is that if you find the best storylines, you’ll find the best stocks.

And one of the top storylines is the AI Era and the data centers needed to make the AI Era run.

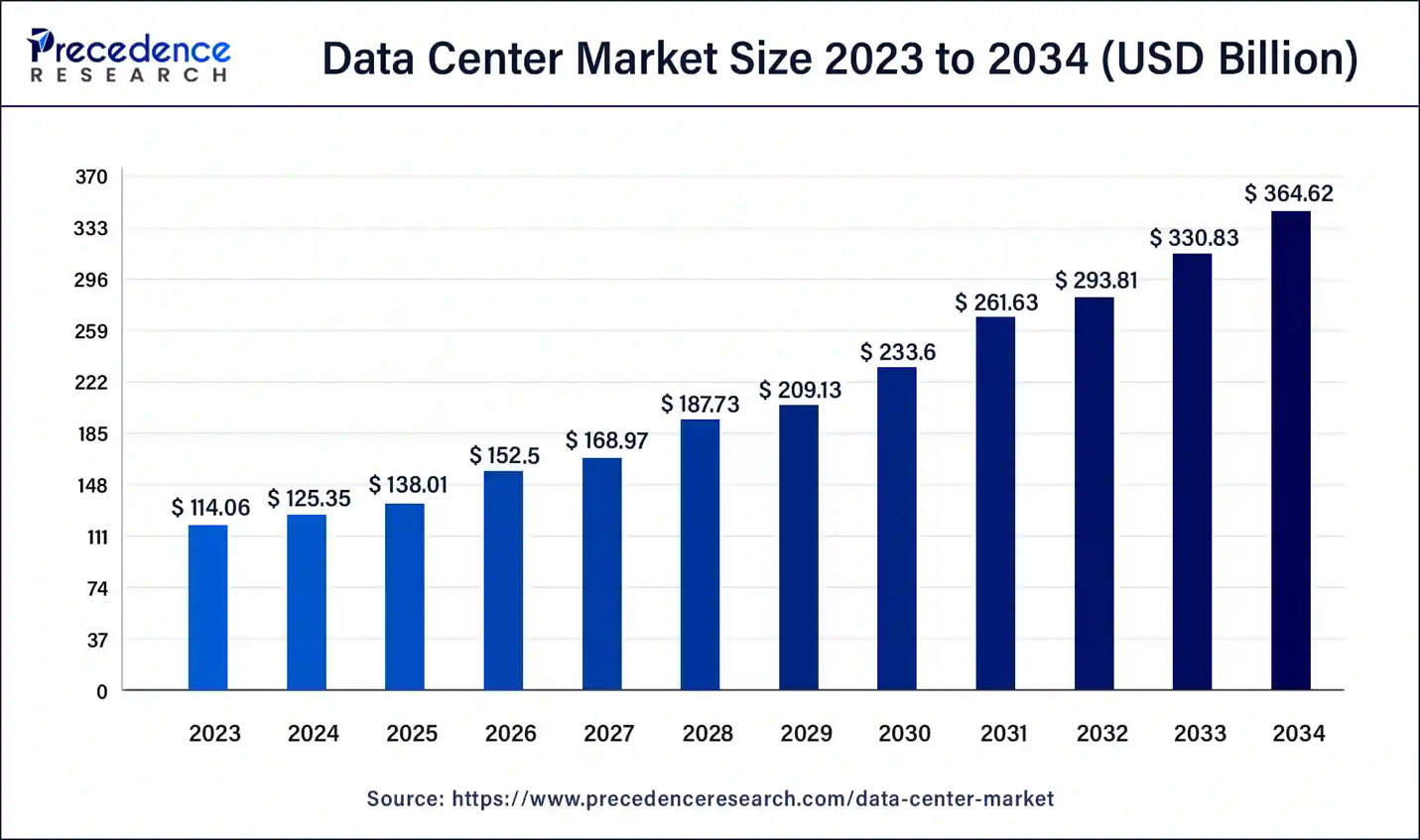

Precedence Research forecasts the global data center market value will expand in value from $125 billion in 2024 to $364 billion in 2034 for a compound annual growth rate (CAGR) of 11.39% over the next 10 years.

Just like infrastructure REITs may lease cell towers to telecom companies, data-center REITs provide their tenants with a place to install and operate networking equipment in a controlled, secure environment.

REIT No. 1: Digital Realty (DLR)

Price as of Publication: $180.10

One-Year Earnings Growth Projection: 98.09%

Five-Year Dividend Yield Average: 3.47%

Digital Realty boasts 300 facilities spread across six continents, allowing companies to:

Rent servers and computer hardware.

Connect between different networks and cloud providers.

And operate hybrid operations through cloud services integrated with on-premise infrastructure.

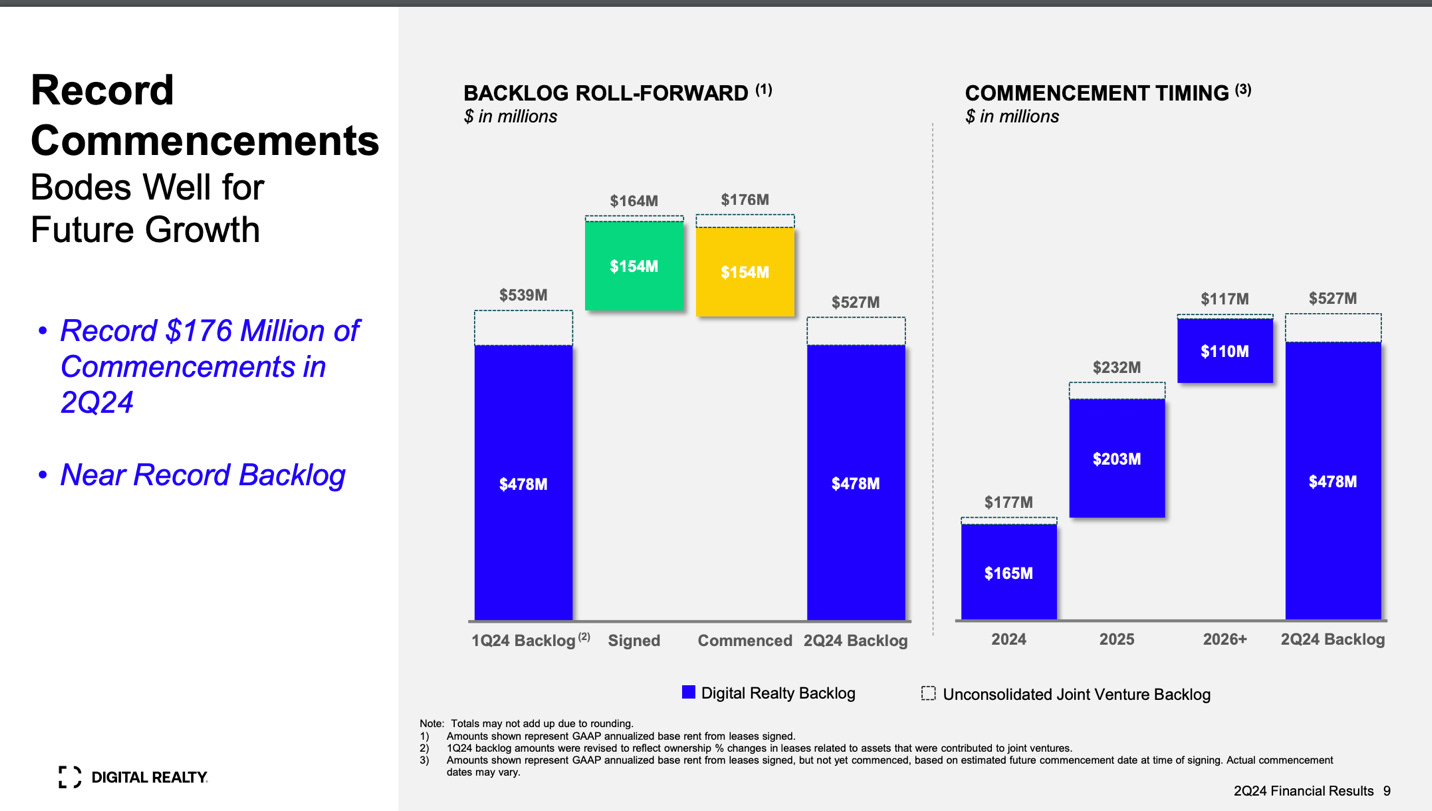

The value of Digital’s services is clear in the AI Era, with 13% data center revenue growth in the second quarter and recorded a record $176 million worth of new leases.

Because of Digital Realty’s involvement in data centers, this is an opportunity that offers both stock-price appreciation and income generation in the form of dividend payouts.

Shares of DLR have jumped 31% over the last year, while the company also pays out $4.88 per share in dividends — a yield of 2.71%.

REIT No. 2: Equinix Inc. (EQIX)

Price as of Publication: $919.89

One-Year Earnings Growth Projection: 10.89%

Five-Year Dividend Yield Average: 1.68%

At year-end 2023, Equinix offered the most global interconnections — private and physical connections between businesses — through 264 data centers across 33 countries.

It offers customers access to over 2,000 network services, over 3,000 cloud and IT services, over 450 content and digital media services, and over 4,800 enterprises, according to Insider Monkey.

Just looking at the stock price alone hovering around $900, it may seem “expensive.”

But you’re also paying for quality, as Equinix’s ecosystem is larger than its next 10 closest competitors combined. Ir has 86 consecutive quarters of top-line growth (the longest streak of any S&P 500 company). And its roster of customers included such big-league names as Amazon.com Inc. (AMZN), AT&T Inc. (T), and Apple Inc. (AAPL).

You can also buy fractional shares of Equinix, which means that you don’t have to buy full shares at $900 each; you can target the dollar amounts you want to invest at each juncture, working your way up to full-share positions.

Equinix shares are up 12.87% over the last year. It offers a dividend payout of $17.04 for a yield of 1.85%

That brings us to our final REIT.

REIT No. 3: American Tower (AMT)

Price as of Publication: $190.07

One-Year Earnings Growth Projection: 35.70%

Five-Year Dividend Yield Average: 2.45%

American Towers owns 24,000 communication towers, as well as data centers.

In 2021, it acquired CoreSite Realty, which added 25 data centers (now 28) to its portfolio.

This asset mix means American Tower is making money from data centers and from data transmission and processing.

American Tower is also positioned to benefit from the increasing mobile data needs because of the Internet of Things (IOT).

Shares are down 9% over the last year, and American Tower pays out a dividend of $6.48% (a 3.4% yield).

Key Takeaways

Today, we looked at Digital Realty, Equinix, and American Tower.

With real estate investing, the idea is earning money while you sleep, and you earn income through REIT investing in the form of dividend payouts. But because of the AI Era and the increasing demand for data centers, these REITs also offer the potential for capital gains.

If you’re seeking a higher yield, consider American Tower.

If you’re seeking stock-price appreciation, based on an earnings growth rate of 98% this year, Digital Realty would be the best candidate on the list.

I hope you’ve found this REIT overview helpful, and I look forward to diving into more real estate topics and sharing my ideas and research with you.