Back in early November, as a family birthday “treat” (mine), my wife RK and son Joey took me to one of my favorite Baltimore spots: The B&O Railroad Museum.

My grandfather, William Patalon Sr., was a machinist for the Lehigh Valley Railroad operating out of Coxton Yard in Duryea, Penna. I still have lots of shovels, tools and manuals stamped with “LVRR.”

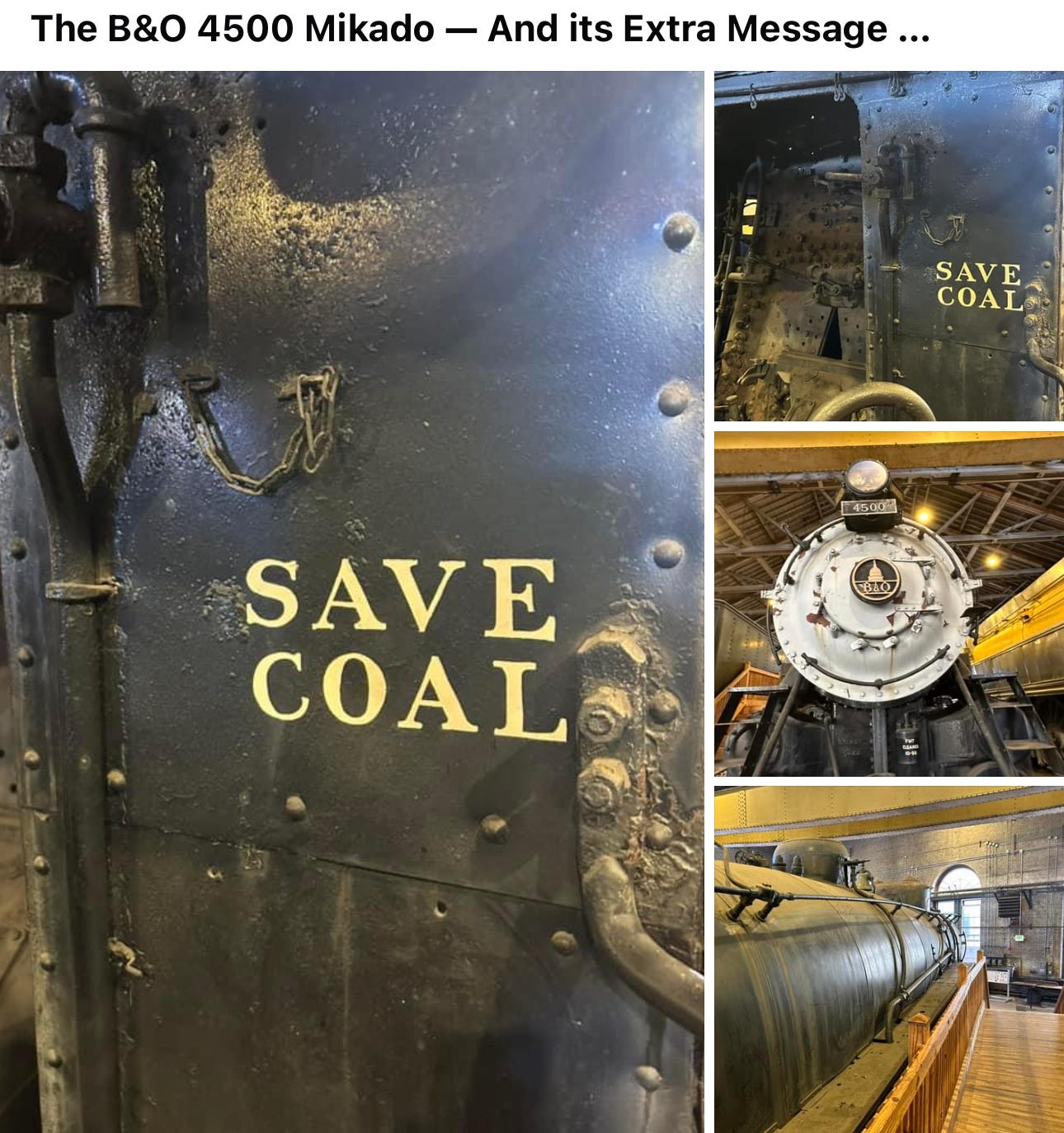

So I love trains — especially old ones, like the B&O No. 4500 “Mikado” — a 2-8-2 steam locomotive built in 1918 by the famed Baldwin Locomotive Works near Philadelphia that the museum has on display in its North Car Shop.

As we strolled along the raised wooden walkway that’s on the Mikado’s right side, two words – stenciled in white — jumped out from the back of the locomotive’s black-painted cab: “Save Coal.”

I guess it’s appropriate to see that message stenciled on a steam engine of World War I vintage — that operated until its retirement in August 1957.

Over the years … and through the decades … the “experts” have repeatedly written epitaphs for the “Black Diamond” — coal.

And coal keeps surviving.

As a source of energy (in terms of thermal coal). And as a key element in steel production (as metallurgical or “met” coal).

The push for green energy … the focus on renewables … initiatives like the Paris Accord … and worries about extreme weather … would all seem to represent a death knell for fossil fuels – and especially coal.

But that hasn’t happened.

Instead, coal has gained new life — as part of what my good friend and coal expert Matt Warder refers to as part of “a reasonable energy transition.”

Matt — publisher of The Coal Trader here on Substack and probably the best independent coal analyst on the planet — says the coal is enjoying its “Next Act.”

Matt, his Coal Trader colleague Joe Aldina and I are also collaborating on a special report on coal — one that we’ll share here on Stock Picker’s Corner (SPC) with all of you once it’s finished.

But my birthday-weekend sojourn to the B&O Museum — and those “Save Coal” words harkening back to my distant family past — inspired me to ask Matt for a short, interim update on coal.

Here it is …

WPIII (Q): Matt, why has coal been such a controversial commodity in recent years?And why – in your opinion – are some of those more-extreme “negative” (anti-coal) stances unwarranted? I guess … taking a cue from my anecdote … why do we need to “Save Coal?”

MW (A): Well, Bill, when it comes to – as you say – “saving coal,” there are really two reasons here.

The first is that – despite the progress made in the renewable-energy space – we still require baseload energy generation.

And there are really only four ways to achieve that:

Nuclear — which is the only true zero-carbon option we have today.

Or some combination of coal or natural gas or diesel.

Those, folks, are your options.

Of all of those, coal is the easiest to consistently obtain and is the easiest to transport and store.

Natural gas — actually, LNG — is the most challenging, thanks to its requirements for compression training … and some places plain old don’t have gas.

But it’s easy to handle coal.

So if we’re talking power-generation, coal will be part of the mix until grid-level battery-storage gets here — in scale — which probably won’t happen for 50 years.

On the steel side, we’ll still need it because the world cannot recycle its way to growth.

The fact is — and you know this from your years as a reporter covering Bethlehem Steel in Baltimore — there are only two ways to make steel … out of iron ore … or from steel that’s already been steel.

WPIII (Q): So … scrap steel?

MW (A): That’s right.

That we should emphasize recycling steel … it’s a no brainer. So for producers that use that process … go get it … go for it.

But for the auto industry, we require high-quality steel for the safety standards automakers maintain. So you need that high-quality steel for autos … or if you want to build tanks … or line an LNG vessel.

For those pursuits — and for other specialty areas — you’ve got to have virgin steel. And you’ll only get that through virgin production. And the only effective method of producing virgin steel is with iron ore and coke made from coking coal.

You can use hydrogen as a reductant, but we don’t have the hydrogen infrastructure. Not to mention the fact that water and molten metal don’t mix well, which means you have a problem in using hydrogen.

You’re better off just using coke and then mitigating carbon emissions in some other fashion … in a more-cost-effective way.

The other part of this is that steel-carbon emissions only coming from the coke-making process are about 8% of the global total, so you can spend lots of money and not make a real dent in the carbon-emissions issue.

Power generation or vehicle transportation represent a much bigger chunk of carbon emissions.

So what I’m really saying here is that coal will remain part of our lives for some time to come.

Virgin steel still uses coking coal.

And energy grids are destined to use coal longer that was thought in the first place.

So why do we need to “save coal?” Because we still kinda need it.

THE GLOBAL VIEW

WPIII (Q): Give us a thumbnail on two stories:

The first the “need” for coal in steel vs energy …

The second … differentiate coal demand/need in the United States and the West vs. China, Asia, India or other markets in the rest of the world …

MW (A): Well, coal demand in the U.S. is flat to declining … it’s probably not going to grow too much … might grow just a bit with the AI data center build-out trend — which I know you have written a lot about at SPC.

It might grow a bit if Nippon Steel Corp. is allowed to take over U.S. Steel – a widely misunderstood storyline here in America. But if it does grow, it won’t grow by much.

WPIII (Q): And there’s an important “takeaway” from this … isn’t there.

MW (A): There is, Bill. The reality is that — from a demand perspective — that need for coal isn’t going to go down as much as the government wants it to … that’s a newly accepted maxim.

So, to your point, we need to “Save Coal.”

The other thing is … we need to keep producing here … as the rest of the world’s demand continues to grow.

If China needs to build base-load power plants … we’re looking at some combination of nuclear and coal … what they have internally and what they’ll need from the seaboard market.

China over-produces steel.

But India’s need for it will keep growing. So as China declines, India’s steel production is going to rise. The two will offset each other (in terms of the net effect on met-coal demand), which means steel production stays similar or grows slightly.

On the power demand side … if a country gets wealthier, power demand will rise. India’s grid is multi-pronged — thanks to nuclear, coal and [natural] gas.

Coastal plants are more than likely coal-fired. More energy per unit of consumption … strong demand for coal that they don’t have domestically.

So demand is growing on the seaboard/import side.

China is agnostic in terms of the quality of coal it uses. It can ramp up production to meet its needs. But some places need high-quality coal.

So it’ll do some imports, as well.

Europe and the United States will be flat to declining …

India is growing.

China’s problem is brown consumption a bit … on the thermal side … declining on the met side.

So I guess where I’m going here is that folks need to change how they perceive coal: It’s not a question of whether it’s good or bad … we just need it and that’s a fact.

I believe there’s a “reasonable energy transition” that’s attainable.

I really do.

Perhaps we discover a force-multiplier [for slashing carbon emissions] in later years.

But we’ll have to take it step by step.

Step one is try to prove gridscale battery storage technology is attainable, but we’re not there yet.

We need to agree on a format; battery chemistries are different for different parts of the world.

And this isn’t just something you can snap your fingers and attain.

It’ll take a lot of work over a long period of time … meaning it won’t happen fast.

But progress can be made over the next 15 to 20 years.

WPIII (Q): With a lot of commodities … there’s a long-term “supply deficit” in sight … do we have the same with coal? What does that mean?

MW (A): Yes … we’re not financing any new operations – in terms of digging new mines. And we’re seeing a little bit of consolidation … Peabody Coal just bought Anglo American’s met coal assets.

But nobody’s going to be bringing on big, new mines. Certainly not for thermal coal.

So another big supply crunch is looming in coal because we’re not investing in new operations.

And it’s dirty to burn coal in a coal-fired plant, but it’s really dirty to burn diesel. If we can’t keep coal plans online and provide more coal and deplete oil reserves faster, that creates a whole new set of problems.

WELCOME TO THE AI CONUNDRUM

WPIII (Q): And … the first of my final two questions …

First … let’s talk Artificial Intelligence — AI — which is THE hottest topic right now. On a geopolitical (macro) scale … we’re talking about the future competitive advantage of countries … of economies.

Here in America, from a national standpoint, I think most folks understand that AI will continue to evolve; it’s an economic and technological inevitability.

But on a local scale — as illustrated by this image I shot in Maryland — there’s controversy because of the “development” demands from AI.

Massive data-center projects are needed. And those data centers will need massive amounts of power. The placement of the data centers … the additions to the power grids … and the power plants themselves … are already escalating controversy. Folks are protesting the placement and impact potential of that development.

Where do they put those data centers? The power lines? The power plants? What fuel do those plants use? We’re seeing old plants being refired … or plants that were destined for shutdown are now getting new life.

Does coal factor into AI … with met coal? Perhaps in the construction of all those data centers … and the transmission lines that’ll be needed to bring power to them?

OR … with thermal coal … helping bridge the looming “energy gap” so many experts are forecasting?

MW (A): It does … it does play a part on the power generation side. We may see new power plants get built — paired with carbon capture — or we may not.

We may also see coal plants that were destined for retirement remain online for much longer.

WPIII (Q): As we’ve seen with utility-in-the-making Hallador Energy Co. (HNRG), a stock that’s more than doubled since we recommended it to SPC subscribers.

MW (A): That’s correct.

And we’ll also see restarts of old ones … we’re talking with two companies interested in raising money to go buy one.

WPIII (Q): And … final question … if we continue to “Save Coal” today … when does coal “age out” of our power and construction ecosystems?

MW (A): I don’t know that it does … yet.

It’s really hard for me to look down the road 10 years and say “here’s what happens.”

All these things take time - even looking out 50 years to 100 years and saying, “Coal is not going to be part of that picture,” is hard.

There’s no way to tell what new technologies will come along.

When we DO make the breakthroughs that replace diesel and coal in the supply chain – and do so in a cost-effective way – that’s when we’ll be able to take coal out of our infrastructure. When we can do that … at economies of scale … it’ll be amazing to see what snaps into place. But it’s gonna take breakthrough technology to make it happen … and that will be tough to time.

Some experts believe it’ll take AI to solve this. But that’s the “choke point” of it all – since we must have the energy to do the AI processing we’ll need to figure that out.

So that’s why we need to “Save Coal.”

WPIII (Q): Thanks, Matt.

You can follow Matt and Joe Aldina at The Coal Trader.

You can find Matt on the social-media artist formerly known as Twitter here.

And SPC Premium subscribers can see Matt’s top coal stock here.

Fun Holiday Tip: If you happen to be in the Baltimore area over the holidays, DEFINTELY check out the B&O Railroad Museum. Christmas and trains go together like peanut butter and jelly … or macaroni and cheese. The museum has a great collection … and offers some cool holiday events. For more information, take a look here. And tell them that Bill from SPC sent you.

Super cool mention by @Takzku ... which we appreciated ..

https://substack.com/@takzku

https://substack.com/@takzku/note/c-81015706?utm_source=notes-share-action&r=3ftiph