While Markets Tank, This One Stock Is Surging

And here's your plan to win today, tomorrow and for years to come ...

I spent time at a little get-together this past weekend and — not surprisingly — the newly gloomy outlook for the American economy and the skidding stock market had everyone talking.

One person — an acquaintance who knows what I do for a living — was literally wringing their hands as they asked: “What will the stock market do next?”

A second — a family member — was actually smiling as she told me: “I’m freeing up some cash … so I can buy.” (I’ve trained her well.)

That’s the stock market in microcosm …

And I get it.

U.S. stocks are getting slaughtered. A plunging Bitcoin is now down below $80,000. U.S. President Donald Trump is dismissing business-owner pleas for “more clarity” on his tariff strategy. The turmoil over the Elon Musk-led Department of Government Efficiency (DOGE) — and Musk himself — is continuing and is actually escalating. American consumers are feeling the squeeze, are feeling dour — and their worry could transition into outright fear.

In short, for most investors and consumers, there are tougher days to come.

More uncertainty. More pain.

But you aren’t most investors.

You’re part of the Stock Picker’s Corner (SPC) family …

And our strategy — indeed, our very mindset — was crafted to help you win.

In the face of all this turmoil, let’s do a “Cliff Note’s” review of our strategy.

Then I’ll give you one stock you can buy — today — to capitalize on the opportunities we see right now. And for the long haul …

The goal: To put you in the “Win” column — and keep you there — long term.

Let’s start with the strategy …

BUILD WEALTH — WHILE OTHERS TOSS IT AWAY

There are really three parts to the SPC belief system.

Part One: As an investor, you’re either a Wealth Builder, or a Wealth Killer — and there’s no in-between.

Wealth Builders invest. Wealth Killers speculate.

Wealth Builders buy stocks and other assets. Wealth Killers trade options — and “take flyers” on penny stocks and other risky assets.

Wealth Builders are independent thinkers: They have a plan — and they have the courage to stick with it. Wealth Killers are pack animals: They feel better losing as a group than they do winning independently.

Wealth Builders employ logic, analysis and a personal vision — and resist emotional, knee-jerk moves. Wealth Killers succumb to emotion: They chase stocks, buy high and sell low — and give in to “FOMO” … “Fear Of Missing Out.”

Of those two folks who talked with me at the gathering — the family member has the winning strategy … the handwringer is destined to lose.

Part Two: There’s another piece of the strategy — an important one — where we believe that: “If you find the best storylines, you’ll find the best stocks.”

As part of our “long-game” approach, we identify powerful narratives — storylines that offer substantive growth and that’ll last for years — and then find the companies (and stocks) that are best-poised to benefit.

That creates wealth.

In our paid SPC Premium publication, we’ve created a “Farm Team” as a de facto “Watch List” of stocks we’re analyzing, but haven’t moved on, yet. And a “Model Portfolio” — complete with Premium Research Dossiers — of the stocks we’ve spotlighted … for you.

Part Three: As Wealth Builders, we “Accumulate” our way to victory. After we find storylines we like — and identify the companies and assets best-positioned to win — we take a unique approach to wealth creation. Knowing that we’re playing the long game, we establish a “foundational” (starter) position — and then add to that stake on pullbacks or as we get more cash. Since we’re looking to hold most of our investments for three, five, seven years or longer, this “Accumulate” strategy makes for the best fit.

Here's another reason this gives you an advantage. Investors have a “binary” view of the market. Stocks are either a “Buy” … or a “Sell” — with nothing in between. That’s a view that’s driven by emotion. It’s wrongheaded. And it usually means “The Crowd” is out of step — buying high and selling low, instead of the other (correct) way around.

The Accumulate strategy puts you on an independent path.

Bonus “Boosters:” We do a few other things, too: We augment this with “Special Situation” strategy — stocks poised to benefit from unique “Triggers.” We’re talking about spinoffs, financial-engineering plays, possible takeover targets and other special catalysts. I’ve dubbed this portfolio “The Super 10” — because there are 10 super-cool stocks in it. These investments — by nature — are meant to be shorter-duration investments than our Model Portfolio stocks. Indeed, though we launched this in September, we’ve already cashed out two for big profits (and replaced them with two more companies — including this “Call Option on Quantum Computing”).

There’s your blueprint for navigating this stock-market mess:

Be a Wealth Builder, not a Wealth Killer: Invest, don’t trade. Look long-term.

Find the Best Storylines – and the Best Stocks: We do that here for you.

While Others Panic, You “Accumulate:” Be an independent thinker, and use pullbacks, corrections or crashes to buy stocks you like for the long haul, or to add to positions you already hold.

And ID “Special Situations:” Market pullbacks hand these to you “on sale.”

So let’s talk “opportunity” — starting with a rare “Two-Fer,” a stock that we already liked for the long haul … and that’ll be supercharged by this pullback. In fact, it’s going up right now — just as we told you it would.

OWN THE CASINO

I’m building a new “Watch List” for our readers.

As this uncertainty continues — and the chaos escalates — I’ll bring those directly to you …

And I’ll start with a company whose stock you need to own now … and that you should look to accumulate starting today.

The reason: It’s that rare “Two-Fer” stock, one that:

Is Benefiting From the Uncertainty We’re Seeing Right Now — which is why its shares are surging as most other stocks are skidding.

And is Poised to Benefit From Powerful Long-Term Storylines — which is right in the “SPC Wheelhouse.”

In short, it’s the rarest of opportunities: A company whose shares are poised to benefit from short-term — and long-term — “Triggers.”

Best of all for those who followed along: I told you folks this would happen …

The one company that transforms everyone else’s panic into profits for you is CBOE Global Markets Inc. CBOE 0.00%↑, an operator of financial exchanges, which includes the Chicago Board Options Exchange. It provides data analytics, trading tools and the technology for trading options, futures and other financial products. And it’s one of the largest clearinghouses for options trading.

That’s great for us in the near term. You see, we’ve been saying for months that as uncertainty climbs, trading would, too.

Especially options trading …

That’s happened … and (like that old rock-n-roll tune), CBOE is the leader of the pack.

Just take a look …

The Standard & Poor’s 500 is off 8.7% from its Feb. 19 all-time high. The Nasdaq Composite is down nearly 14%.

Some context: A 10% drop is considered a “correction.” A 20% decline qualifies as a “bear market.”

So far this year — against that backdrop — CBOE shares are up more than 12%. Given the S&P’s decline, you’re talking about a relative gain of more than 20%.

Here’s another fascinating factoid: CBOE has risen in all 10 of the biggest down days for the S&P since last July, Barron’s reported Monday.

WHY CBOE HAS LEGS

Though others are reporting it now, we’ve been telling you to expect this — and to own this stock —since we launched SPC a year ago.

That’s all great stuff.

And it’s just in the near-term.

Even better: The long-term outlook is equally intriguing.

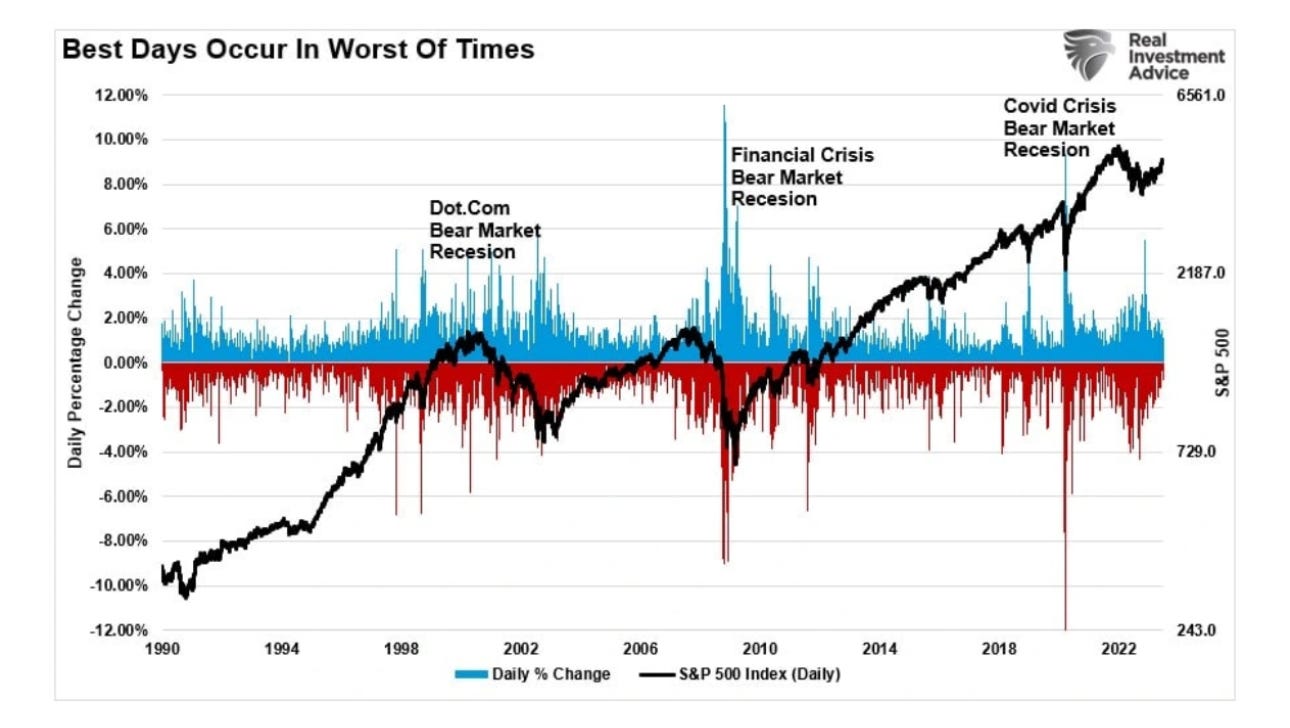

As I believe we’ve demonstrated, “timing the market” — going “all in” and “all out” at different times — is a loser proposition for retail investors. (And I intentionally meant “loser” — though it’s also “losing.”)

Even with the best intentions, the moves are almost never based on a system — and are almost always driven by emotion.

But that’s exactly what’s happening. A kind of “DraftKings Betting Mentality” has infected the retail-investing market.

And the explosion in options trading has made it even worse.

The Intercontinental Exchange ICE 0.00%↑ reported a 26% year-over-year surge in average daily options volume in 2023 — thanks to the easy access to trading platforms and zero-commission trading. Retail investors accounted for 45% of options trading volume — and researchers say regular investors are increasingly trading speculative options, as opposed to speculative hedging.

Not that those folks are doing all that well: An MIT Sloan study found that retail investors lost more than $2 billion in options premiums from 2019 to 2021 — the result of inexperience, lousy timing and high-risk (or no real) strategies.

So if a gambling mindset has infected the financial markets, why not own a piece of the casino …

CBOE is that casino.

Through the fees it collects, it effectively takes a slice of every wager.

And if trading will keep growing, those fees will grow, too.

Over the next five years, the securities-exchanges market — so companies like ICE, Nasdaq Inc. NDAQ 0.00%↑, CME Group Inc. CME 0.00%↑ and CBOE — are projected to grow at a compound-annual growth rate (CAGR) of 12.1%, reaching $49.6 billion, says researcher Technavio.

During that same period, CBOE’s earnings CAGR is a projected 13.4%. At that rate, CBOE’s earnings would double in about 5.4 years. And since stock prices tend to follow earnings, CBOE could be a double-your-money stock play in a fairly short time frame.

Other “Triggers” could accelerate that. The reason: CBOE is:

Expanding its reach globally, across asset classes and technologies.

Looking to benefit from round-the-clock trading.

Has boosted its dividend for 13 straight years — meaning its $2.52-a-share payout (1.18%) is likely to grow.

Will keep buying back shares — including the $680 million left under a current repurchase program.

And could benefit from consolidation — either by purchasing a rival, or as a takeover play itself. (I actually hope the latter doesn’t come true: This is a stock we want to accumulate for years.)

Be a Wealth Builder.

And CBOE is a stock that can get you started. Put it on your “Accumulate List.”

I’ll be back with more.

See you next time …