There's an AI Agent In Your Future — Here's How to Invest Today

This one company has staked itself to an early lead ...

In the early 1990s — unless you were using a “friendly” service like Prodigy or CompuServe — an internet search was like a trip deep into the Amazon jungle … lost without a map, a compass, or any idea where you are.

Early innovations like Gopher, Archie, and Jughead gave searchers some help. Then British computer scientist Tim Berners-Lee created the user-friendly World Wide Web (WWW), a crucial juncture in how folks accessed online content.

Innovations like WebCrawler, Yahoo!, Locos, and AltaVista were incremental next steps.

But it was Google using advanced algorithms and indexing that in 1998 cleared a path through that “jungle,” leading us directly where we wanted to go with hyper-relevant results. That turned Google into a verb (“I’ll Google that.”) like Xerox. And when you’ve created a product that turns into a verb, you know you’ve really arrived.

By November 2022, Google owned 84% of the desktop search engine market.

But November 2022 proved to be another crucial juncture for internet searches thanks to ChatGPT from OpenAI.

Similar to Google, you can ask ChatGPT a question. But the answers feel more personalized, interactive, and engaging. It can also remember previous interactions, offering responses that are more personalized in a format that feels almost like an ongoing conversation.

ChatGPT outshined Google in another way, too: While Google search leads you to answers, ChatGPT goes even further by offering task automation, like coding and drafting emails.

Now Google’s popular search engine is feeling the squeeze.

Google’s desktop search engine market share over the last 10 years, which stood as high as 91% in November 2018, fell under 80% in January as people shift to the AI-powered Bing from Microsoft Corp. (MSFT), chatbots, social media, and other services.

But even that is already getting disrupted with a new evolution of search and task automation: AI Agents. Google improved search relevance, and ChatGPT provided more personalization and automation around productivity tasks. But, for retail consumers, AI Agents will be a true “digital assistant.”

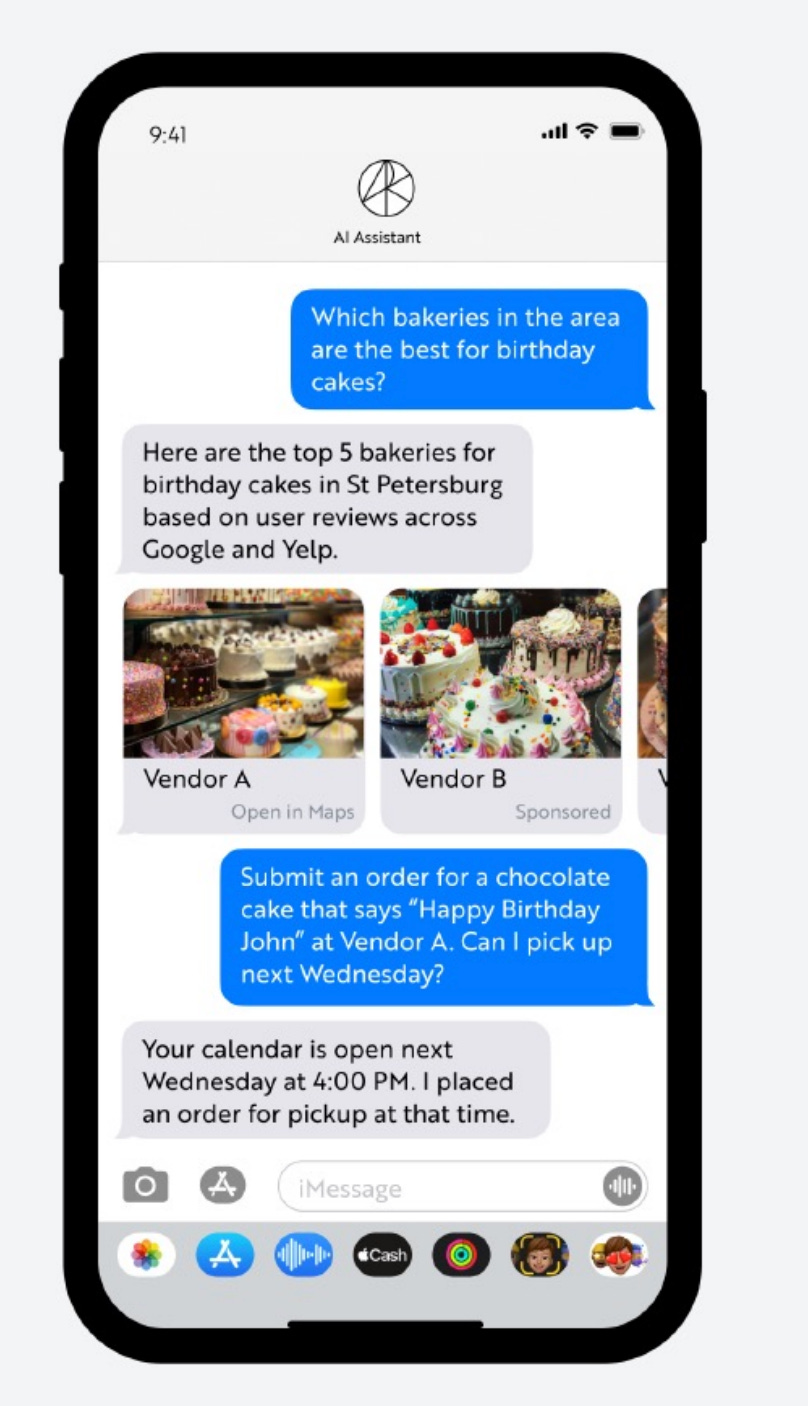

From Ark Invest’s 2025 “Big Idea” presentation, we can see it in action:

So from a simple query — “Which local bakeries offer the best birthday cakes” — the AI Agent:

Found the best bakeries in the area by review.

Showed the top five options.

And placed a customized order for the individual based on their schedule availability.

That’s a time-saver for sure. But we’re just scratching the surface here: This technology has far-reaching capabilities that can significantly enhance our daily lives way beyond just finding and ordering a birthday cake.

Such advances will lead to the ability of a self-driving car to detect the need for preventative maintenance, schedule an appointment, drive itself to the appointment, and pay the bill … without you having to leave your house … or even pick up your phone.

It means real-time health monitoring where an agent manages your medication schedules and books your doctor appointments.

And it’ll mean an advanced “early warning system” for earthquakes and tornadoes through advanced pattern recognition and data analysis, resulting in early evacuations and countless saved lives.

As futuristic as some of this sounds, market value projections tell us this tech will be mainstream before we know it.

🤖The AI Agent Outlook … And What to Do

We’re still in the early innings of AI Agents, as the research company MarketsAndMarkets says it was just a $5.1 billion market last year. But, by 2030, that value is expected to jump to $47.1 billion. In a six-year span, that’s a compound annual growth rate (CAGR) of 44.8%.

The 2030 forecast from Market.Us comes in slightly lower at $46.58 billion, but its outlook extends out to 2033, which sees the AI Agent market valued at $139.12 billion.

Over a 10-year span (2023-2033), that’s a 43.8% CAGR.

You have slightly different projections and timeframes but the same conclusion that this will be a booming market.

So here's what you do about it …

One of the companies Chief Stock Picker Bill Patalon is reviewing for inclusion in our SPC Premium Model Portfolio is Salesforce Inc. (CRM).

Businesses tap into Salesforce “Agentforce” to handle customer service questions and resolve issues, freeing up human workers for larger and more meaningful tasks.

AI Agents through Salesforce can also:

✅Engage with sales leads and schedule appointments.

✅Help with shipping and ordering through providing tracking information, handling returns, and issuing refunds.

✅Provide pricing and product specifications.

✅And resolve system and software issues.

Outside of Salesforce, one of our Substack neighbors, Antonio Linares, of Investment Ideas by Antonio, has a very thorough and well-researched analysis on one of the benefactors from AI Agents you may have never heard of before: Okta Inc. OKTA 0.00%↑ .

As a little bit of background …

Okata was founded as a digital identity and access management company in 2009. In October, it rolled out a new product to “help developers and organizations secure identity in GenAI applications, through secure identity standards and a seamless developer experience.”

This new product will “enable app builders to protect against AI-specific security risks, integrate GenAI agents into their products faster, and deliver AI-powered experiences for their customers.”

Getting back to Antonio’s report, he says the proliferation of AI agents will likely unlock exponential growth for the San Francisco-based company, positioning it as a foundational platform of the AI economy.

Make sure to check it out below.

That’s it for today.

Take care,