The Rise and Fall ... and Rise (Again) ... of Quantum Computing Stocks

Near-term, it's rollercoaster. But long-term, it's an opportunity ...

Back on Dec. 10, Alphabet Inc. (GOOGL) announced a quantum computing breakthrough — its highly touted Willow quantum chip took a mere five minutes to solve a problem that would take the world’s very best supercomputer 10 septillion years to run through.

“Mr. Market” liked what it heard.

Alphabet’s shares have edged up 7.5% higher since the announcement. And it’s a company that Chief Stock Picker Bill Patalon just shared yesterday as one he’s eyeing to own for the long haul.

But Alphabet hasn’t even been the major beneficiary of its own breakthrough.

The revelation ignited what we’ve (tongue-in-cheek) nicknamed “The Great Quantum Computing Frenzy” — an epic rise … and fall … and rise again of three quantum-computing companies that have become the main cast of this whipsawing wave:

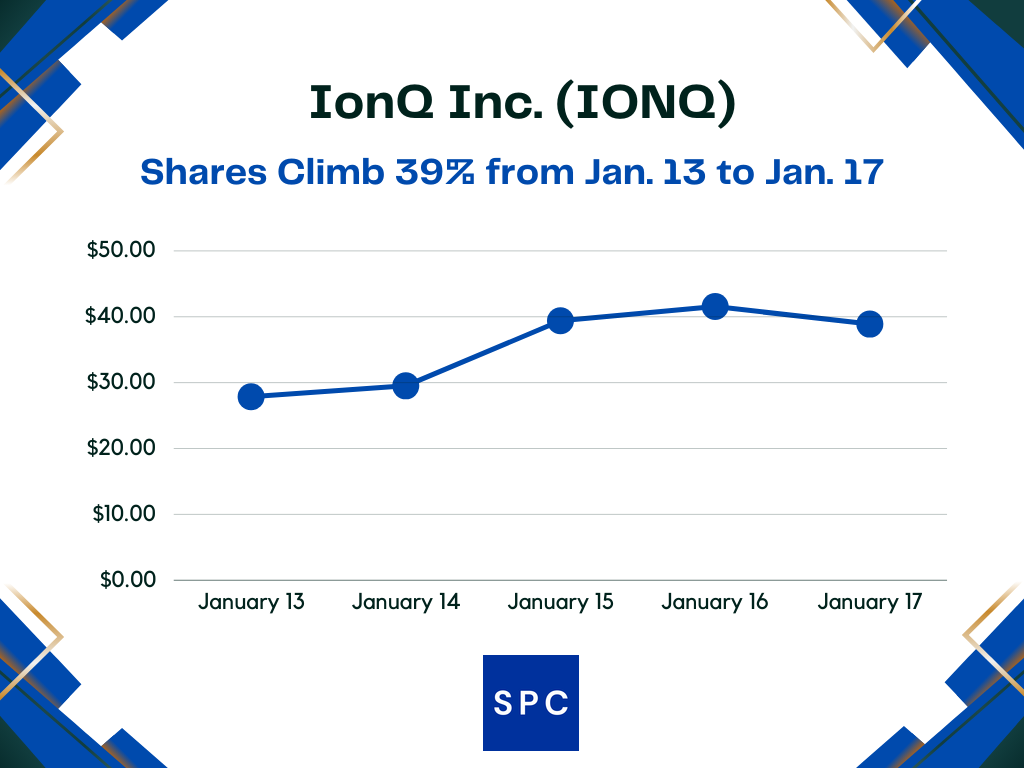

IonQ Inc. (IONQ): Based near our own hometown headquarters here in Maryland, IonQ develops quantum computers and software and counts Big Tech players like Alphabet, Amazon.com Inc. (AMZN), and Microsoft Corp. (MSFT) as customers. IONQ shares jumped 49% from Dec. 9 to Jan. 6.

D-Wave Quantum Inc. (QBTS): Launched in Canada 26 years ago and now based in Palo Alto, D-Wave’s quantum-computing know-how targets critical, real-world problems like drug discovery and supply-chain management. D-Wave has collaboraed with Lockheed Martin Corp. (LMT) and NASA to advance quantum computing research and applications. D-Wave shares rocketed 119% higher during that same time frame.

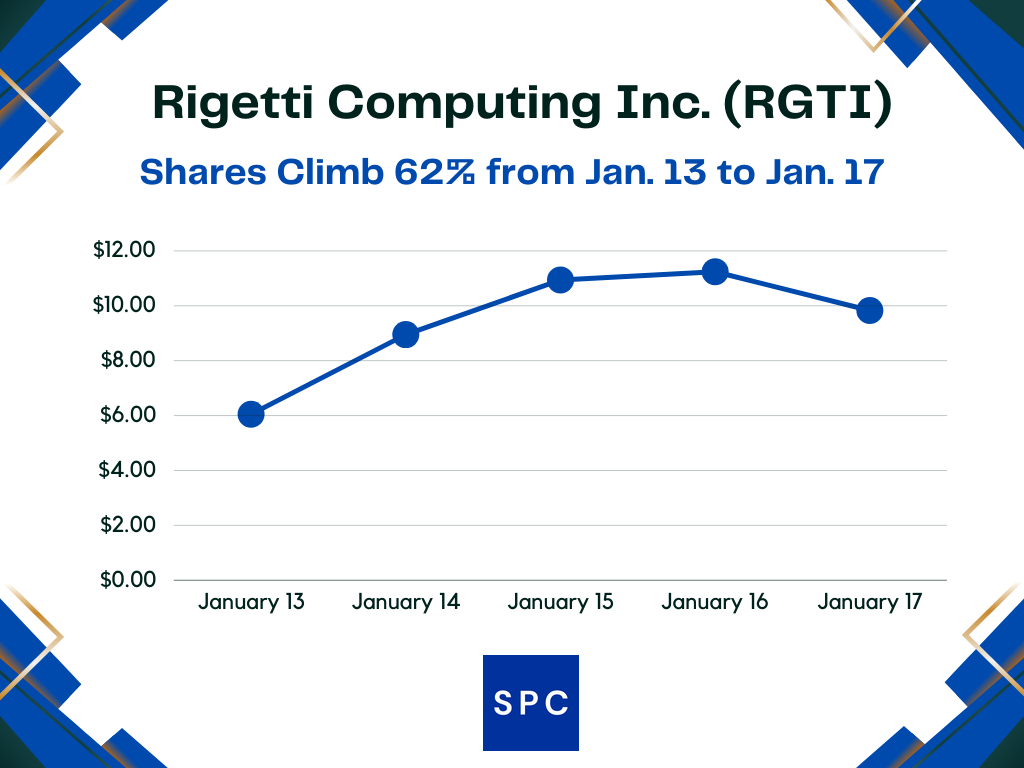

And Rigetti Computing Inc. (RGTI), which designs and builds quantum computers and allows customer access to quantum computing through the cloud. Just a few minutes up the road from D-Wave, the Berkley-based Rigetti was the biggest winner of the three: Its shares zoomed an eye-popping 336%.

When stocks jump that much in such a compressed stretch, you need to take a step back and ask: ‘What’s really happening here?”

That’s why I put together this timeline of the “Quantum Computing Craze.”

Plus, I’ll share the Stock Picker’s Corner (SPC) playbook to make sure you stay a Wealth Builder and avoid becoming a Wealth Killer.

Jan. 8: Huang Douses the Flames

On the heels of that euphoric run-up, Nvidia Corp. (NVDA) CEO Jensen Huang appeared during its financial analyst day at the Consumer Electronics Show (CES) in Las Vegas.

During his talk, Huang — an exec who’s viewed as one of Big Tech’s most-revered figures — told the audience that “very useful” quantum computers are still decades away.

If the Willow revelation fanned the flames of bullishness for quantum computing, Huang’s dismissiveness doused them … hammering the shares of IonQ, D-Wave, and Rigetti. The higher they soared after the Willow breakthrough, the steeper they dropped after the CES “downer.”

But there was still another chapter to this tale …

Jan. 14: Microsoft Reignites the Rally

This was the day that Microsoft announced its "Quantum Ready" program.

This initiative urged businesses to prepare for the advent of reliable quantum computing.

And just like that, IonQ, D-Wave, and Rigetti rebounded, with IonQ and Rigetti clawing back most of what they lost the prior few trading days:

And as I was writing this, there was already another “mini rise” as Rigetti shares shot up 42% on the day (Jan. 21) thanks to B. Riley analyst Craig Ellis boosting his target price on the stock from $4 to $8.50.

D-Wave shares were up 19% and IonQ shares are up 16.5%.

The Real Takeaway

Quantum computing has very applications.

Volkswagen (VWAGY) data scientists and big data experts worked with data from 10,000 public taxis in Beijing, successfully showing they could optimize traffic flow in the mega-metropolis using a quantum computer, according to the German automaker.

And the Boston Consultant Group created a use-case list that shows billions — and in some cases hundreds of billions — in potential:

There are tangible opportunities forming.

But just as online shopping, smartphones, and a lot of the tech promises of the late 1990s took longer-than expected to gain traction (something we demonstrated in this recent SPC Premium report), speculation can sprint ahead of reality in the near term.

Longer term, these companies could become stalwarts. Or they could end up as buyout plays, which is a kind of “proof point” that their technology is real, useful, and scalable. But a whole lot of people still recently “picked the wrong day” to hit the buy button, ended up out of step with this whipsawing trading pattern, and ultimately bought high and sold low because they made a knee-jerk decision to invest.

Remember: If you’re a Wealth Builder, you’re taking a longer view. That means you have time and should take time before making a move. Educate yourself to fully understand the storyline you’re investing in, the market it feeds into, and the companies best positioned to benefit.

You don’t even have to travel far: Substack is one of the best investing resources you’ll find. And there are two nice reports worth checking out from some of our Substack neighbors:

The Quantum Leap: The Quantum Computing Elevator Pitch

Quantum World Detangled: The Quantum Computing Opportunity is NOW (but not in the stock market)

If you like the quantum computing story but feel like the stocks are too volatile … or you want to learn more before investing … there are “focused” exchange-traded funds (ETFs), which give you a less-volatile way to make that initial move.

One example is the Defiance Quantum ETF (QTUM), which is a portfolio of quantum computing related stocks. The holdings include “quantum computers or computing chips, superconducting materials, applications built on quantum computers, embedded artificial intelligence chips, or software specializing in the perception, collection, visualization, or management of big data.”

But it’s also a source for stock ideas; in essence, it can also serve as a kind of “personal watch list” for a starting point for more research.

The ETF’s Top 10 holdings include a few of the companies already mentioned, plus a few you may be hearing about for the first time:

And don’t be afraid to “think big” — like with the Magnificent 7 and how Bill likes Alphabet.

Smaller winners will emerge along the way, but companies like Microsoft and Alphabet own a trailblazing track record of innovation, turning groundbreaking ideas into everyday products and services. They have enough capital to build or buy the technology of the future … as well as handle any missteps and setbacks along the way.

Take care,

Disclaimer: The information published in Stock Picker’s Corner, also abbreviated at times as “SPC,” isn’t personalized financial advice or a specific investment recommendation and should not be interpreted as such. The content produced is intended for informational purposes only. The writers and team members of Stock Picker’s Corner are not investment advisors or financial planners, and you should consult your own professional before making any investment decisions. There is inherent risk involved with investing and financial decisions, and any investment decisions you make are solely your own decisions. Market outlooks, estimates, or projections should not be construed as actual events that may occur. While stats and figures are believed to be as accurate as possible from public information available at the time of publishing, the writers and team members of this publication do not make any warranties regarding the information’s accuracy. Neither the writers, team members, or affiliates accept any liability for any direct or indirect losses from the information contained herein. Team members, contractors, and guest contributors may own assets and stocks mentioned in Stock Picker’s Corner. By using this site or associated social media accounts, you are indicating your consent to our terms of use, and this disclaimer. All content published by Stock Picker’s Corner is copyrighted