The American Retirement Challenge: How Far Can You Get With $1 Million?

And here's the SPC Plan to help deliver that "American Dream" ..

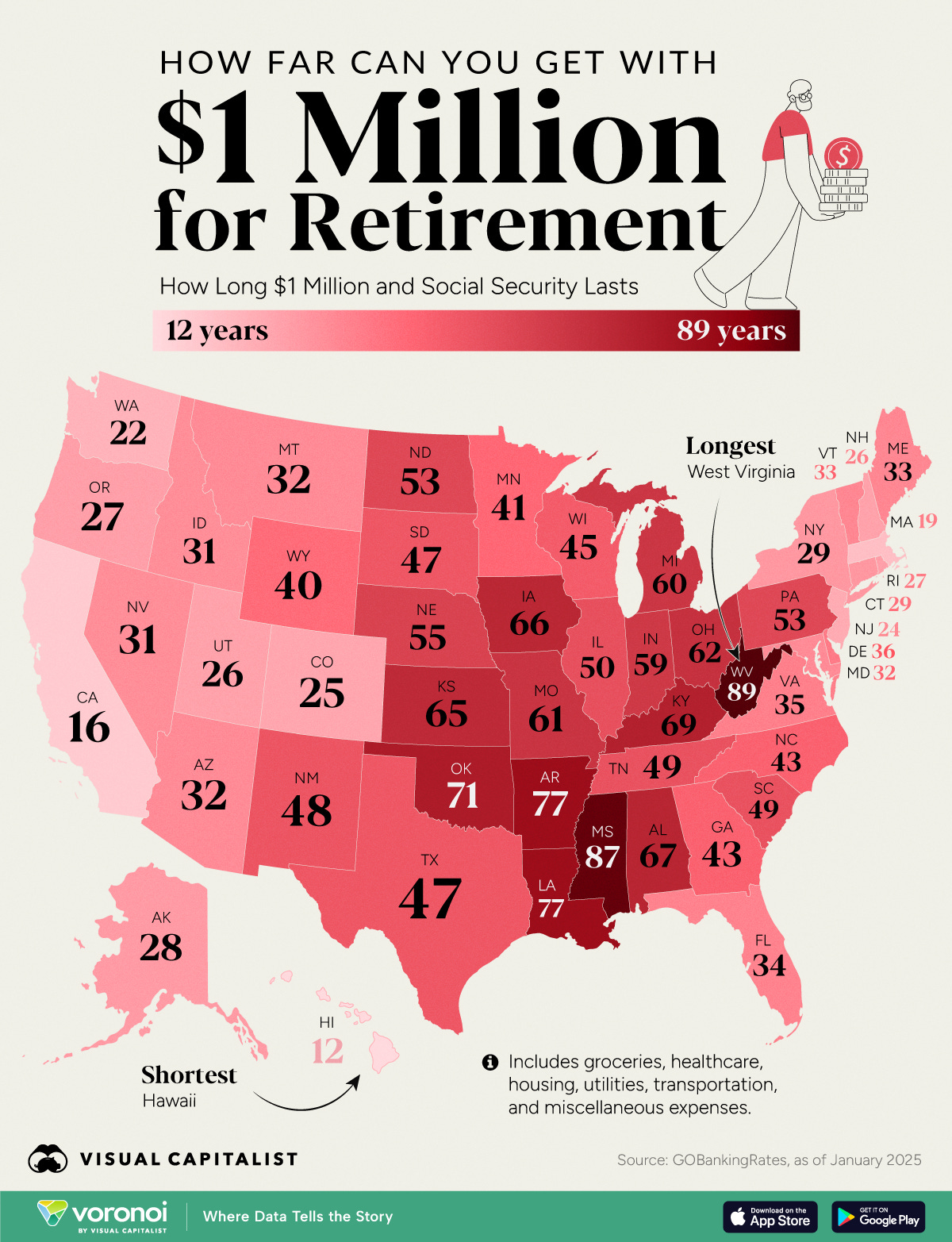

There’s a new study that looks at how long $1 million lasts in retirement — and says it all depends on where in the United States you retire to.

That retirement continuum ranges from a low of 12 years in Hawaii to highs of 87 years in Mississippi and 89 years in West Virginia, says the newly released study by GOBankingRates.com.

That’s one heck of a range.

Go figure …

Or … maybe … as the old maxim tells us: “Figures lie … and liars figure.”

In April 2024 — so almost exactly a year ago at this time — a study found that this same $1 million would last as little as 10 years in Hawaii to as long as 23 years in Hawaii.

The group that did last year’s study: GOBankingRates.com — the same personal finance site that did the grand new study.

That’s a huge disparity in a single year’s time, and the numbers went the wrong way: With inflation, surging uncertainty and growing risk, retirement affordability should get worse — not better.

SO YOU WANT TO BE A MILLIONAIRE

Look, I’m not actually challenging the researchers. My guess is the underlying figures they used this year were dramatically different from last year’s.

Besides, it’s kind of a moot point, isn’t it?

I mean … most Americans don’t have a million dollars.

According to research by financial-services player Credit Karma, nearly 30% of folks aged 59 or older have nothing saved for retirement.

Nothing.

The same study found that Baby Boomers have median retirement savings of just $120,000.

Going by the numbers in this year’s study, that’s only a year-and-a-half in Hawaii and a mere 11 years in West Virginia.

That’s probably why Americans believe they need $1.8 million for retirement, says broker Charles Schwab Corp. SCHW 0.00%↑.

That, too, falls short of the mark: While there are more millionaire households in America today than ever before, that million bucks doesn’t go as far as it used to.

Just look …

As you read this, there are about 23.7 million millionaire households here in America.

That’s up from 23.2 million last year.

And 9.63 million in 2014.

One final point of reference: In 1997, the year after the best-seller “The Millionaire Next Door” made its debut, approximately 5.3 million American households had a net worth of $1 million or more.

To have the million-dollar equivalent from 1997 here in 2025, you’d need about $2 million.

That’s right: That “Millionaire” status ain’t want it used to be.

In fact, as I detailed in a recent Stock Picker’s Corner (SPC) report, $1 million won’t buy that “American Dream.” Nor will that $1.8 million most Americans believe will buy a great retirement.

In reality, $10 million is the “New $1 million.” And the “Single-Digit Millionaire” no longer gets it done.

But this plan — detailed a few months back in one of the best-read reports we’ve shared since launching SPC — will get you started

Check it out … let me know what you think.

See you next time;