Palantir Technologies Inc. PLTR 0.00%↑ grabbed (BIG) headlines (in fact, it made the cover of Time magazine back in early February) for its shadowy work employing its know-how to help The Ukraine military with targeting information as part of that country’s war with Russia.

Indeed, Time reporter Vera Bergengruen penned the report– which featured the cover story headline: “The First AI War – Palantir and Other Tech Giants Are Building the Future of Battle in Ukraine.”

“Named after the mystical seeing stones in The Lord of the Rings, Palantir sells the same aura of omniscience,” Bergengruen wrote. “Seeded in part by an investment from the CIA’s venture-capital arm, it built its business providing data-analytics software” to government agencies dealing with immigration, law enforcement, the military and more.

No surprise then that Palantir is viewed as a proverbial “government contractor” — albeit one with some super-cool (and super-secret) artificial-intelligence (AI) technology. Palantir-watchers likely doubled-down on that “defense contractor” view just a few weeks ago when the U.S. Department of Defense revealed a five-year, $480 million pact with the company for something called “Maven” — a battlefield-intelligence project that, again, will include include target-the-enemy capabilities.

But I’ve been watching Palantir, too. Closely. And I’m seeing some intriguing developments on the commercial side of the aisle for the company that was co-founded by famed venture capitalist Peter Thiel.

One example: Recent reports say that Palantir has pitched advertising agencies about the potential for its year-old AI Platform known as AIP. Morning Brew said the pitches included “wide-ranging use cases and applications” of AIP for tasks including “pricing and inventory planning,” “programmatic sales,” and “campaign optimization.”

The company also unveiled a multi-year strategic partnership with Parexel, a so-called “clinical research organization” (CRO) that helps drug developers herd a candidate therapy through clinical trials.

The objective of the Palantir/Parexel collaboration: Using AIP and machine learning to accelerate biopharmaceutical clinical trials — which could lead to drugs that are developed faster, at a lower cost and with no sacrifice in safety or efficiency.

As a guy who’s spent years following biotech — first as a reporter and then as a stock picker and analyst — I’m both fascinated and illuminated by the potential of what’s being talked about here.

The fact is that Palantir is making real progress in its commercial push. Tyson Foods Inc. TSN 0.00%↑ has used company technology to improve its trucking operations. United Airlines Holdings Inc. UAL 0.00%↑ linked up in a “strategic partnership” to help the airline better manage its data. AIP has found commercial fans at companies like ExxonMobil Corp. XOM 0.00%↑, General Mills Inc. GIS 0.00%↑, Molson Coors Beverage Co. TAP 0.00%↑, Hertz Global Holdings Inc. HTZ 0.00%↑ and more.

So what is Palantir offering?

Well, in the pitches it’s making to clients, the company describes itself as a builder of “leading software platforms for data-driven operations and decision-making.”

In other words (and we’re intentionally oversimplifying this), faster-and-better-decision-making aided by a quicker, more-thorough harvesting of all available data — in a way that’s highly predictive.

After analysts expressed commercial-growth fears earlier this year, it looks like there’s buy-in from Wall Street. On Monday, after Argus Research analyst Joseph Bonner put a “Buy” rating on the stock — with a $29 price target — shares surged 6%. Bonner’s message: Palantir’s commercial business is a “future growth driver;” and the company “has been dramatically improving its profitability and cash flow over the past year”

To Bonner’s point, commercial revenue climbed 40% last quarter to $150 million.

The Denver-based company also said it expects $661 million for the year from its U.S. commercial business, up 45% from last year and higher than its previous projection of 40% growth.

“We anticipate that our U.S. commercial business, which accounted for 24% of our revenue last quarter, will remain one of the most significant drivers of our growth in the near term.” CEO Alexander Karp, Q1 2024 Shareholder Letter

Karp’s company also revised its total revenue guidance from between $2.652 billion and $2.668 billion to $2.677 billion and $2.689 billion.

I’m watching all of this carefully — to make sure it’s a stock for Wealth Builders like us.

Now, let me share a few things happening around Stock Picker’s Corner (SPC).

🔊The Catch-Up With The Coal Trader

Well-informed Wealth Builders tend to have a visceral response to coal.

And that’s understandable.

Because, well, it’s coal.

Most retail investors hear that word and immediately think:

It’s literally a dying “smokestack” industry — to be avoided.

It faces the longest of odds — thanks to tougher regulations, mine depletion and the move toward so-called “clean” energy initiatives like EVs, wind-and-solar power, and the whole “net-zero energy” push.

But thanks to the Econ 101 investment case we’re seeing in commodities — where long-term supplies will fall short of surging demand — coal is a potential special-situation wealth-builder (as we’ve seen with silver).

That’s why I’ve been chatting with my good friend Matt Warder — the new helmsman at The Coal Trader.

You’ll see in our chat that all coal wasn’t created equal — and that a certain type of coal is a critical ingredient in the push to maintain and modernize our nation’s infrastructure.

Matt also shares some intel on the publicly-traded coal firms he’s watching the closest.

(For SPC Premium members, there’s an extended version of this interview available here, which includes the one coal stock Matt believes can double in price in the next three years. )

💻Hackers Put the Brakes on America’s Car Sales

On May 24, I told you folks that the U.S. Environmental Protection Agency (EPA) ordered U.S. water utilities to take immediate action to protect America’s drinking water from cyberattacks.

It didn’t take long for a new round of cyberattacks to make the news, but this time, U.S. car dealers were the targets.

CDK Global, an auto sales software and management company, was hacked on Tuesday, preventing roughly 15,000 car dealerships from making sales. General Motors Co. GM 0.00%↑, for example, relies on CDK’s systems.

CDK shut down its systems as it investigated the attack but suffered another “cyber incident” on Wednesday.

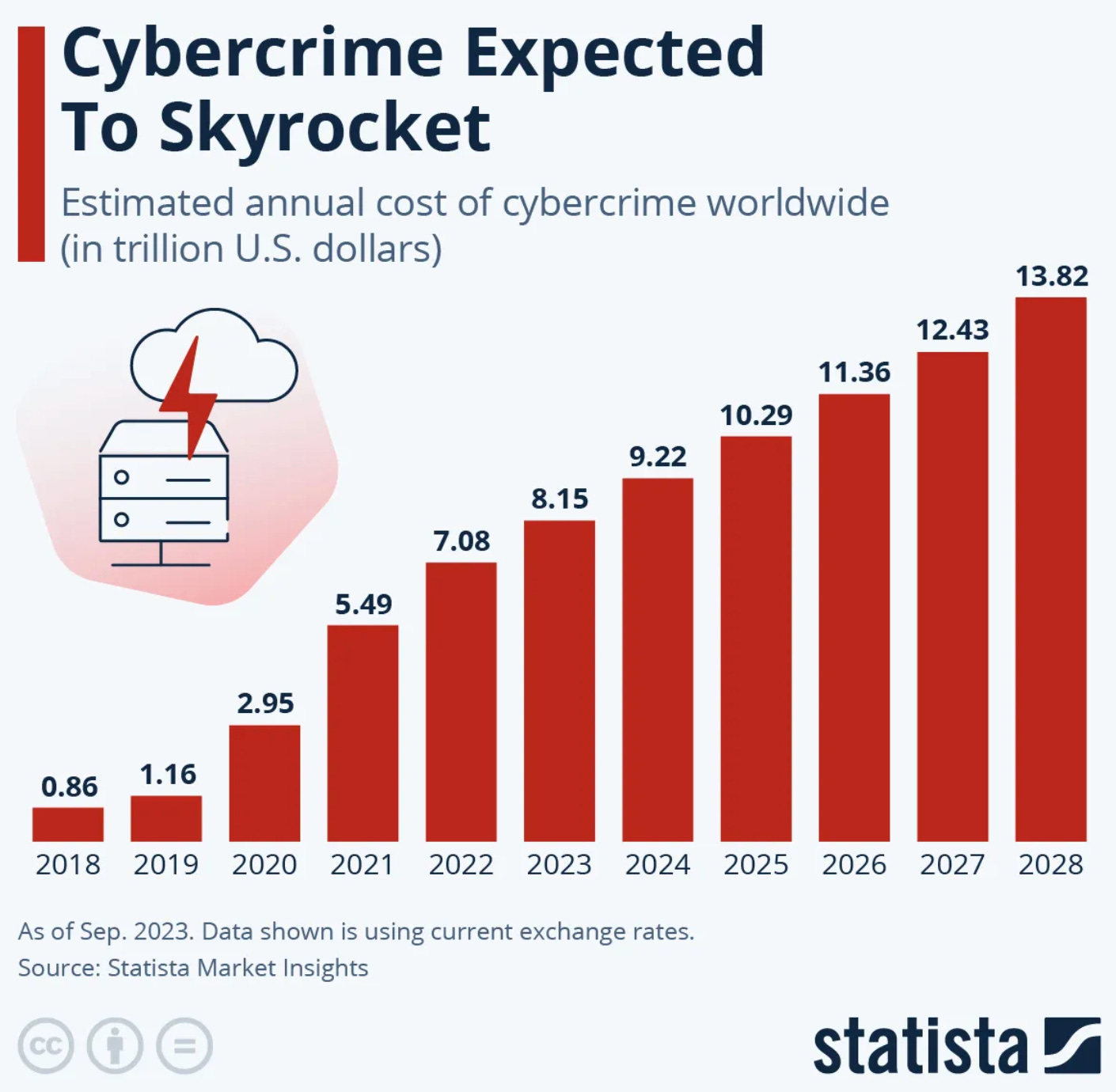

These types of attacks are only going to increase, as the expected cost of cybercrime will explode 50% over the next four years from $9.22 trillion to $13.82 trillion.

With these attacks, cybersecurity services will see a new urgency — a storyline Wealth Builders should watch and capitalize on.

For a research starting point, consider the First Trust NASDAQ Cybersecurity ETF CIBR 0.00%↑.

As a stock picker, you’ll always make more money by owning an individual stock over an ETF. But if you want to start with a foundational move, CIBR gives you broad exposure to some of the biggest names in cybersecurity software providers, as well as the equipment manufacturers needed to keep that software up and running 24/7, 365.

Investors are getting it: Over the past year, CIBR shares are up 22%.

Still, that will be just a glimpse of what’s to come: As cybercrime and state-backed cyberattacks escalate, the need for protection will be even greater.