The "Cybersecurity Gunslinger" That Hooked Up With Amazon and Nvidia

Watch it "get the drop" on the "internet armies" of our foes ...

In a story here last week, we told you that Moscow just launched a nuclear-equipped spacecraft that’s designed to blast U.S. spy satellites out of orbit.

We also told you about a U.S. Environmental Protection Agency (EPA) alert that hackers were targeting drinking water utilities across America.

Welcome to the New Cold War – where new battlelines are being drawn in outer space and cyberspace.

Here at Stock Picker’s Corner (SPC), we follow the big storylines. And the biggest opportunities.

And the New Cold War is both.

It’s a table-setter … and a catalyzer that’ll keep shaping the world around us for the decade to come – and probably longer.

In that satellite-killer report we shared Friday, we dimensionalized the opportunity. And we promised we’d circle back with a company that stands to benefit.

Today I’m keeping that promise, with a cybersecurity “gunslinger” whose allies include Nvidia Corp. NVDA 0.00%↑ — and a bottom line that’s projected to grow at better than 20% a year for each of the next five years.

That’s the difference between investing … and wealth.

A gunslinger in the New Cold War. That’s a stocks story you just gotta love.

Flinty Plotlines

I grew up during the “First Cold War.” So I know that if the New Cold War is a story, there are subplots that will drive it. Subplots like:

The Return of Old Foes: Russia and China served as the Evil Empire foils to America and its Western Allies in Cold War I. They’re back and (as those TV promos say) “badder than ever.”

Some New Cast Members: A potentially fully nuclear North Korea wasn’t in the OG Cold War – but it figures to be in the sequel. Pyongyang leader Kim Jong Un likes to make splashes around important events and holidays (at my last newsletter, I wrote about his threat to incinerate America while most of us were sitting down for Easter dinner). Take the “over” on him making major noise with nuke and/or missile tests as close to the November presidential election as possible. In the meantime, new “stateless” foes have emerged, too.

Keep-Up-With-The-Joneses Spending: Yeah, I know I said it wasn’t just a money story. But money will help drive the subplots. Take China. While the proposed U.S. defense budget for next year increases only 1%, Beijing has been aggressively growing its military budget. It’s up 7.2% for 2024 – which follows increases of 7.2% in 2023, 7.1% in 2022, 6.8% in 2021, 6.6% in 2020 and 7.5% in 2019, government reports say. (And some experts claim Beijing understates those figures.) Beijing has boosted defense spending for 28 years in a row. And the budget in 2022 was 63% higher than in 2013, says the Stockholm International Peace Research Institute (SIPRI) think tank.And, as the following projection shows, global military spending will continue that march – from its record $2.24 trillion in 2022 to nearly $3.3 trillion by the end of the decade, SIPRI says.

Deglobalization: Decades of pushing to integrate world markets are being reversed – undone – as flintiness escalates. That move back toward “trading blocs” has consequences – and creates opportunities. Here in the United States, we’re seeing “onshoring” of manufacturing, which will be highly bullish for America’s semiconductor industry.

All New Acronyms: The military loves creating acronyms – especially weapons systems. And we’ll have new ones to learn – like AI, DEW (directed energy weapons), HGV (hypersonic glide vehicles), A2/AD (anti-access/aerial/denial), UAV (unmanned aerial vehicle), UUV (unmanned underwater vehicle) and C5ISR (command, control, communications, cyber, intelligence, surveillance and reconnaissance). These are some of the new technologies, and new weapons systems, that will command the battlefields of the future. We’re already watching “The First AI War.” And some of those other new battlefields will be in cyberspace – and outer space.

And Those All-New Battlefields: As we told you late last week, the new battlegrounds include cyberspace … and outer space. And that creates all sorts of new targets: Our adversaries are putting “bullseyes” on satellites, critical infrastructure like electrical grids and water systems, corporate information systems, and such personally sensitive things as your medical-records. New targets demand new defense systems. And for Wealth Builders like us … that also creates new opportunities – including one I’m going to show you today.

Meet the “Internet Army”

Go back through history and study the rise and fall of so-called “great civilizations” – or what we’d refer to in the simplified-label mindset of today as the true “superpowers” … and their challengers. And ask: What defined them?

Well, certainly the size, growth rate and wealth of their economies. More wealth can equal greater influence.

Then consider their militaries. How big. How advanced. Defensive or offensive. A coastal or “blue-water” navy. And, in recent decades, conventional or nuclear capabilities.

These days, there’s still another “variable” to consider: Does it have a “cyber army?” Cyberweapons – like nukes – are part of the modern, military “calculus.”

Since 2005, 34 countries are suspected of sponsoring cyber operations, says the Council on Foreign Relations. China, Russia, Iran and North Korea sponsored 77% of all suspected actions. In 2019, there were 76 operations – most of them cyber espionage.

But cyberweapons can be used in other ways, too. The United States has used malware to slow the nuclear-weapons programs of Iran and North Korea. Russia has demonstrated their use as advance weapons — a “digital beachhead bombardment” the precedes actual attack.

In January 2022, for instance, ahead of its invasion of The Ukraine, Russia took down more than a dozen of the target country’s government websites.

Beijing, for instance, has used its cyber army both to snag the designs of the West’s top new weapons systems — jet fighters, helicopters, missiles and more. And it’s engaged in industrial espionage – using its cyber army to get U.S. technology, which it hands over to its companies to boost the China economy’s global competitiveness.

And when it comes to state-sponsored cyberattacks, nobody’s “off limits.” As we told you several months ago, two major law-enforcement agencies — the Royal Canadian Mounted Police (RCMP) and the U.S. Justice Department (DOJ) — reported cyberattacks of their own. The DOJ was open in blaming China-sponsored players for its attack.

Those reports surfaced right after UnitedHealth Group Inc. UNH 0.00%↑ — and its subsidiary Change Healthcare — were hammered by a cyberattack that really hit home for the American consumer. Change Healthcare handles the payments and processes prescriptions across the country. And this ransomware assault by BlackCat ALPHV made it impossible for thousands of American customers to get their prescriptions filled.

Just this week, published reports revealed that Change Healthcare paid a $22 million Bitcoin ransom – only to have BlackCat “go dark” … and not get its data back.

Increasing the challenge, the stakes and the messiness of it all is the emergence of the so-called “hacktivist” — hackers like Anonymous allegedly working for political and social change (and personal gain, too). The boundary between hacktivists and state-sponsored hackers is blurry at best.

Add in the unvarnished military and intelligence-based cyber-attackers and it’s clear there’s plenty to worry about in the years to come.

When Crime Becomes a Growth Business

It’s a mess — an expensive mess. One that’s almost impossible to accurately quantify today — or to predict what comes next.

Still, it’s worth a try – if only to understand the magnitude and growth of what we face.

And to identify potential beneficiaries.

After all, if there’s a problem, someone will be tasked to fix it. And the larger the problem, the greater the windfall potential for the players involved.

Cybercrime, cyberespionage and cyberwarfare are major subplots of the New Cold War – one of the biggest Wealth Builder storylines we’re following. And you know our mantra: If you find the best storylines, you’ll find the best stocks.

Let’s look at cybercrime – which includes stolen money, intellectual-property theft, data destruction, lost productivity, reputational harm and the “fix-it” actions that follow.

According to brand-new report from Statista Market Insights, the global cost will surge from $9.22 trillion this year to $13.82 trillion in 2028.

One reality of modern life is that we are numbed by big numbers.

And these are huge.

If the projected $9.2 trillion in losses for this year were a country, it would rank as the No. 3 economy in the world – behind only the United States ($28.78 trillion) and China ($18.54 trillion). In fact, it would be roughly double the world’s No. 3 and No. 4 economies (Germany: $4.73 trillion x 2 = $9.46 trillion; and Japan: $4.11 trillion x 2 = $8.22 trillion).

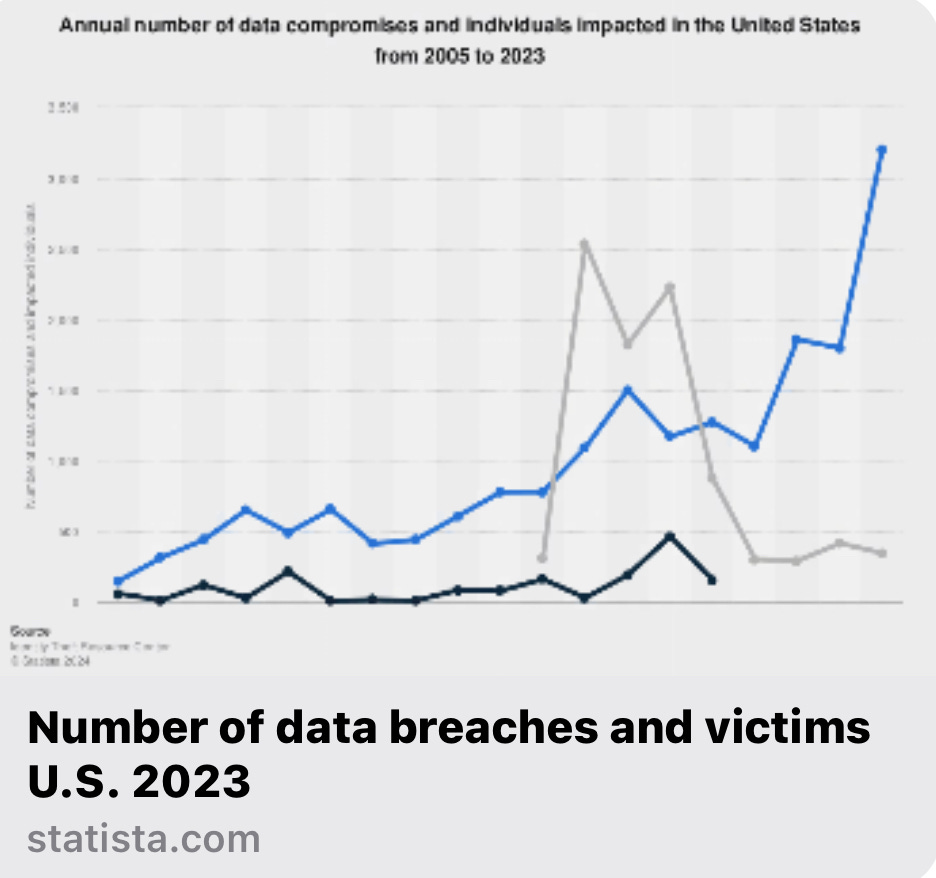

Last year, there were 3,205 data compromises in the United States alone. But more than 353 million were affected by data compromises – including data breaches, leakage and unauthorized exposure where sensitive data was accessed by someone who was an unauthorized “threat actor.”

Partnerships + Profit Growth = Power

One major trend when it comes to so-called “cyber solutions” is increased collaboration between the Pentagon and private cybersecurity contractors – a roster that includes Lockheed Martin Corp. LMT 0.00%↑, Northrop Grumman Corp. NOC 0.00%↑, Palantir Technologies PLTR 0.00%↑, BAE Systems and Leidos Corp. LDOS 0.00%↑ — as well as the privately held Booz Allen Hamilton.

And CrowdStrike Holdings Inc. CRWD 0.00%↑.

The mantra of the Austin, Tex.-based CrowdStrike is “stop breaches, drive business.” More than 20,000 organizations use the company’s technology. And it does work for the Pentagon.

In the last few months, CrowdStrike announced partnership deals with chip heavyweight Nvidia Corp. NVDA 0.00%↑ and Amazon.com AMZN 0.00%↑.

In the strategic collaboration with Nvidia, CrowdStrike said it’s combining its own Falcon data platform with the chipmaker’s AI software.

“Cybersecurity is inherently a data problem — the more data that enterprises can process, the more events they can detect and address,” said Nvidia CEO Jensen Huang. “Pairing NVIDIA accelerated computing and generative AI with CrowdStrike cybersecurity can give enterprises unprecedented visibility into threats to help them better protect their businesses.”

With Amazon, the partnership focuses on Amazon Web Services (AWS), the commerce company’s $90 billion cloud business. In what was described only as an expanded “strategic partnership,” Amazon said it dropped other security products in favor of CrowdStrike’s cyberthreat-protection technology.

The current 12-month target prices range as high as $435 a share. Based on CrowdStrike’s current trading price of about $352, we’re talking about a one-year upside

But as you folks know, we don’t look at stocks as “trades” or as intermediate-term “profit opportunities.”

We look to build wealth. Over multi-year stretches.

The company has beat earnings forecasts – delivered “upside surprises” – in each of the last four quarters.

But it’s what comes next that matters.

Current forecasts call for the company to grow earnings at an average annual rate of 29.5% in each of the next five years – more than double the 11.27% estimates for the Standard & Poor’s 500.

And we know that cybersecurity is a “growth business.”

Especially for a New Cold War gunslinger.

See you next time.

If cyberspace is one of the new battlegrounds we're seeing here in the New Cold War, AI is one of the technologies that'll help define it.

Some observers have dubbed the Russia/Ukraine War as the "First AI War."

Here's our attempt to give the everyday investor a simple overview on what to watch for.

https://open.substack.com/pub/stockpickerscorner/p/its-the-first-ai-war-and-its-silently?r=3ftiph&utm_campaign=post&utm_medium=web