Peter Lynch, the legendary mutual fund manager and author of the best-seller “One Up On Wall Street,” was a huge proponent of “story stocks.”

And with good reason: Good stories made it easier to understand a company’s business – and to determine whether its stock will be a winner or loser.

Writing about Lynch in the AAII Journal, Maria Crawford Scott noted that: “The more familiar you are with a company, and the better you understand its business and competitive environment, the better your chances of finding a good ‘story’ that will actually come true.”

As Scott said, Lynch made that stock picking process even easier: He identified six general “story” categories that most companies could fit into:

Stalwarts: Big firms – often with well-known brands – that could grow at 10% or slightly better a year. If you get ‘em cheap, you can hold them for a couple of years – before rotating into a better opportunity.

Cyclicals: Ventures like carmakers, steel firms and other manufacturers whose fortunes ebb and flow like (and with) the broader economy. Investing in cyclicals requires sound timing, since the shares can sell off – and sell off hard – when downturns threaten.

Asset Plays: Companies where “hidden value” exists. Unlocking that value demands timing and expertise.

Turnarounds: Firms whose shares have been hammered by bad news, bad management or underlying business changes (Lynch dubbed these “no growers”). Better times (and better results) often demand ruthless new game plans – including layoffs, breakups and management-team makeovers.

Slow Growers: Big, ponderous firms whose days of lickety-split growth are in the rearview mirror. A slow growers tries to offset the “mature” nature of its business by managing for cash flow and paying nice dividends. But the total return wasn’t enough to make them a Lynch favorite.

Fast Growers: Aggressive, innovative players growing profits at 25% (or more) a year ... for years and years in a row. These are “franchises” in the making — new brands and investments that stand as “ground floor wealth opportunities” for folks who spot them early. Lynch loved these stocks. And they accounted for a hefty slice of the biggest wins he posted.

In this research report, we’re spotlighting one of those Lynchian-Fast-Grower-type stocks we’ve uncovered here at Stock Picker’s Corner (SPC).

And that stock is Wingstop Inc. WING 0.00%↑.

Lone Star State Meets Buffalo

The Lone Star State city of Garland is known as the “Cowboy Hat Capital of Texas.” It’s also the 1994 birthplace of Wingstop, a small restaurant that serves up buffalo-style chicken wings.

Fast-forward nearly three decades — to 2023 — and we find that Wingstop has tacked an additional 1,999 locations onto that first one. That includes 29 in my neck of the woods here in Maryland.

At first blush, this seems like “just another chicken-wing place” — hardly a unique idea.

And when it comes to wings, I like to think I’ve got a discriminating view: Heck, I spent nearly a decade working in Upstate New York, the actual birthplace of the Buffalo-style chicken wing.

That “invention” took place in 1964 — at Buffalo’s Anchor Bar. Here 60 years later, you’ll find scores of imitators. And I mean ... scores.

You’ve got eatery chains like Buffalo Wild Wings, Hooter’s and Applebee’s – and probably your favorite hometown pizza joint – where you can have the bar-food delights brought right to your table (probably with pitchers of beer). And the do-it-yourselfers reading this can buy fresh wings in the meat section of your favorite supermarket, or your local deli – then experiment at home with your own “secret formula” sauces.

The “time-challenged” folks perusing this can even buy the (admittedly inferior) frozen versions ...

That brings us back to Wingstop ... and Peter Lynch.

Wings Meet Tech

Operating in a “crowded” market isn’t necessarily a fatal flaw for a company — as long as it can set itself apart from the crowd.

And Wingstop has done exactly that.

In a recent Barron’s “Streetwise Podcast,” Amy Zhang, executive vice president of New York investment manager Alger Group Holdings, described Wingstop as “a technology company that sells chicken wings” — as opposed to a copycat wing restaurant.

That “technology” is Wingstop’s superpower — and is why that company has delivered 34.86% in revenue growth in the 12 months that ended Sept. 30, 2023.

In the podcast, Zhang focused on the hefty percentage of digital transactions that drive Wingstop’s business.

Zhang wasn’t talking about in-restaurant guests. Or wing orders that hungry customers called in for pickup. She’s talking about orders placed online.

And those orders face two potential constraints:

The number of delivery drivers available.

And the delivery radius.

If your favorite eating spot is 30 minutes away, you’re looking at a roundtrip time of more than an hour to fetch that order and get back home.

But if that restaurant offers delivery to your area, it only takes a few clicks on your smartphone or computer to bring hot wings to your doorstep.

Digital transactions also nurture repeat buying, since the restaurant can create and easily track reward offers and send you coupons. And it can use your previous purchases to make suggestions and encourage new buying.

Wingstop currently uses restaurant-tech firm Olo Inc. (OLO) to power its digital transactions. But the chicken-wing firm has invested $50 million of its own cash since 2020 to develop its own technology for online ordering. And that Olo partnership ends here in the 2024 first quarter, meaning Wingstop will soon debut its proprietary platform — preliminarily nicknamed “MyWingstop.”

Wingstop is also dabbling in artificial intelligence (AI), launching an AI-based voice ordering system in May 2023. The voice system is supposed to streamline orders and help with upsells.

Some companies without a clear AI connection throw the word around to try and capture investors’ attention, but Wingstop’s AI foray can boost efficiency, save costs and increase sales.

The Digital Edge

To give you a better understanding of the “Fast Grower” opportunity Wingstop represents, let’s compare that up-and-comer to an existing digital player that Lynch would probably now hit with the “Stalwart” label.

I’m talking about McDonald’s Corp. (MCD).

While not a perfect “apples-to-apples” comparison (Wingstop is kinda “fast casual” and Mickey D’s is “fast food”), these two offer intriguing parallels.

Granted, McDonald’s has larger seating areas, faster turnaround times, more locations, has way more menu items and is more of a “food-on-the-go" player than Wingstop.

But look at this.

In the 2023 third quarter, McDonald’s said 40% of its transactions were digital. The following Yahoo! Finance headline even characterized it as a “boom:”

But that “boom” label may have been a better descriptor for Wingstop.

During the same quarter as McDonald’s 40% “boom in digital sales,” Wingstop said 66.9% of its orders came from computers, tablets and smartphones.

These digital transactions not only let Wingstop reach more people – they also keep those folks coming back thanks to rewards, coupons, ease of ordering, and suggestions based on previous orders.

Visit Wingstop.com, and you’ll see this online ordering in action.

If you’ve ordered wings online, you’ve probably been constrained by pre-set quantities — ordering in sets of five, 10, etc.

But with Wingstop’s online setup, you aren’t restricted to those multiples of five ... you can select three wings, use your “lucky number” of seven, or pick, say, 23, to feed the folks at your “friendly” weekly poker game.

In the example below, see you can order three wings with Maple Siracha sauce, six Spicy Korean, and 11 Garlic Parmesan:

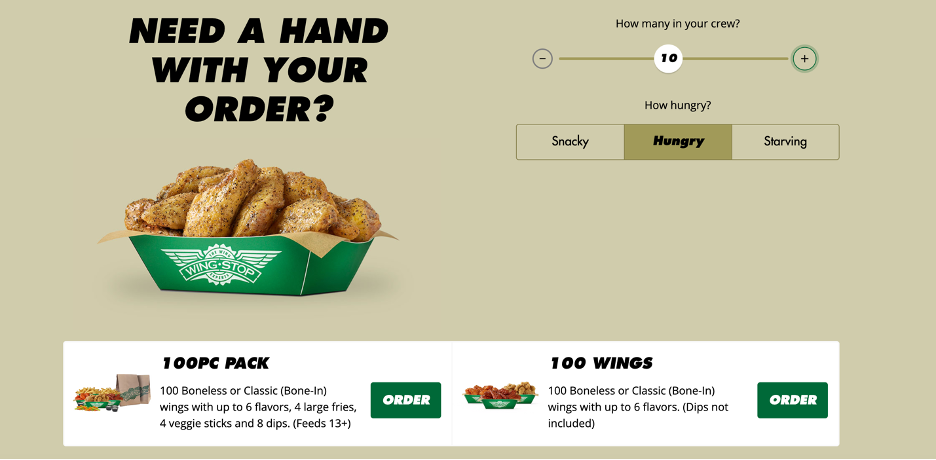

The ordering experience is beyond easy — and it doesn’t end there: Wingstop has something else up its sleeve for online orders — something it calls the “Wing Calculator.”

It seems gimmicky at first, but it’s pure genius in its simplicity.

If you’re not a big wing eater — but you’re hosting a cookout, or a party for the Super Bowl or Daytona 500 — just plug in how many guests you have and how hungry they are and it’ll give you tailored suggestions that you can turn into an actual order:

It’s one thing to show these cool features. But it’s another to prove that they work.

And they do.

In August 2022, the company unveiled a chicken sandwich, expecting to sell a million in a month.

It sold out of its entire supply in six days.

Today that chicken sandwich is a Wingstop menu staple.

That affair of the “Great Chicken Sandwich Sell-Out” conveys a crucial lesson: No matter how strong Wingstop’s technology may be, it wouldn’t matter if no one likes the food.

Indeed, the food-and-beverage publication Tasting Table proclaimed Wingstop the winner in its 2022 ranking of 13 chains serving chicken wings.

Weaknesses and Threats

Anytime you’re looking to invest real money, you first need to do your homework. So a “strategic analysis” is a must-do exercise.

And we’re partial to the so-called “SWOT Analysis” — which looks at strengths, weaknesses, opportunities and threats.

One of the weaknesses, at least according to some reviews I saw, is that Wingstop receives medicore reviews —not for its food ... but for its service.

Especially with in-person ordering.

Out of seven locations in our area here in Maryland, the highest rating I saw was a 3.9 out of five, with two as low as 2.6.

In comparison, out of the first seven Buffalo Wild Wings locations that popped up near me, the top rating was a 4 and the two lowest tied at 3.1.

Some of the Wingstop reviewers groused about long wait times for in-person ordering — meaning they ended up with cold wings.

I grant you … we’re looking at a small sample size … and a single (concentrated) geographic area … which means you have to be careful. And our experience was good when members of our team ordered online. But we need to watch Wingstop’s digital push — to make sure dining-in folks aren’t being shortchanged.

Franchising is also another potential weakness or threat, as I saw someone say they loved Wingstop wings, but didn’t like a specific location because of its perceived lackluster service.

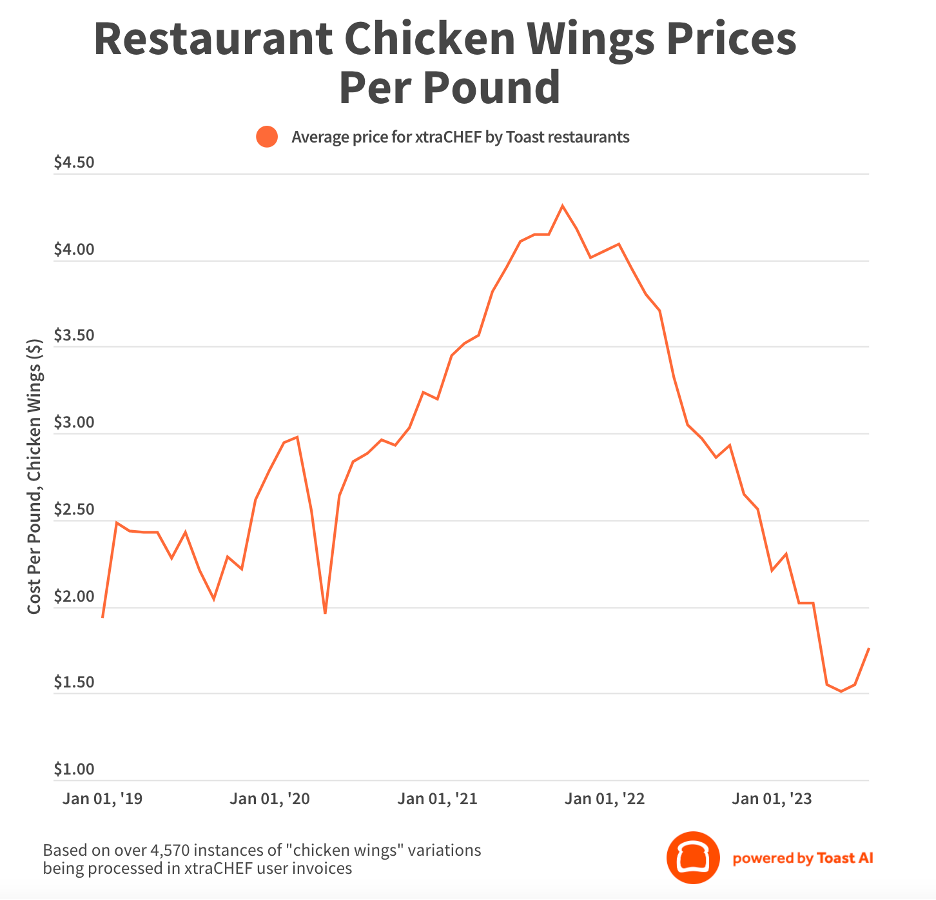

In addition, while Wingstop may be a “technology stock in disguise,” chicken is the company’s “key ingredient.” And that means a spike in costs, issues with poultry quality or bottlenecked supply chains are potential “threats” that can surface at any time.

The price restaurants paid for a pound of chicken wings jumped to $4.31 in October 2021, with the four-year average before that coming in at $2.91.

Costs shot down to roughly $2 by March 2023. But this shows you how quickly restaurant costs can nearly double. That’s a particular threat for a company like Wingstop that has a narrow product offering.

Looking Ahead

Even with digital transactions, Wingstop needs physical locations — its own, with franchises or co-locations inside “partner” operations — to cook the wings folks are ordering.

With roughly 2,000 locations, the company plans (no set date) to increase its store count by 250% to 7,000.

That’s a Peter Lynch Growth Equation: More locations + more customers = more revenue.

As a “growth story,” Wingstop could be worth owning on its own. But there’s a potential “bonus” aspect to it that could elevate its allure even more.

Wingstop could be a takeover target for a restaurant firm looking to add heft.

For any suitor seeking a deal, Wingstop could serve up a double win.

First, the wing business is profitable, with net income of $52.9 million on revenue of $2.7 billion in 2022.

Second, Wingstop’s technology could be used in other businesses.

That technology could beef up digital transactions for other brands and cut the need to use outside vendors (saving money in addition to boosting revenue and efficiency).

Recap

Wingstop is tapping into online transactions for sales growth, with its own technology platform debuting in the second quarter.

Online ordering could prompt customers to order more often — thanks to personalization and easily repeatable orders.

The company will launch MyWingstop in the second quarter.

And Wingstop plans to increase its locations by 250% — from 2,000 now to 7,000 in the future.

The Bottom Line

Wingstop is viewed as “just a wing company”right now — serving up a growth “story” for folks who understand the underlying technology magnifier and the upside offered by the firm’s expansion plans.

After all, if the company reaches that goal of having 7,000 locations, you’re talking about a 250% increase from what the company is doing today.

It’s a Lynchian Formula for stocks, and a Stock Picker’s Corner (SPC) formula for wealth.